Hi Steemians,

In our Category "Did you know?" we would like to share random interesting facts and figures about the financial markets in general. Stay tuned for frequent editions in this catogory, as well as the other categories and topics we are about to generate!

The first public Stock offering (IPO)

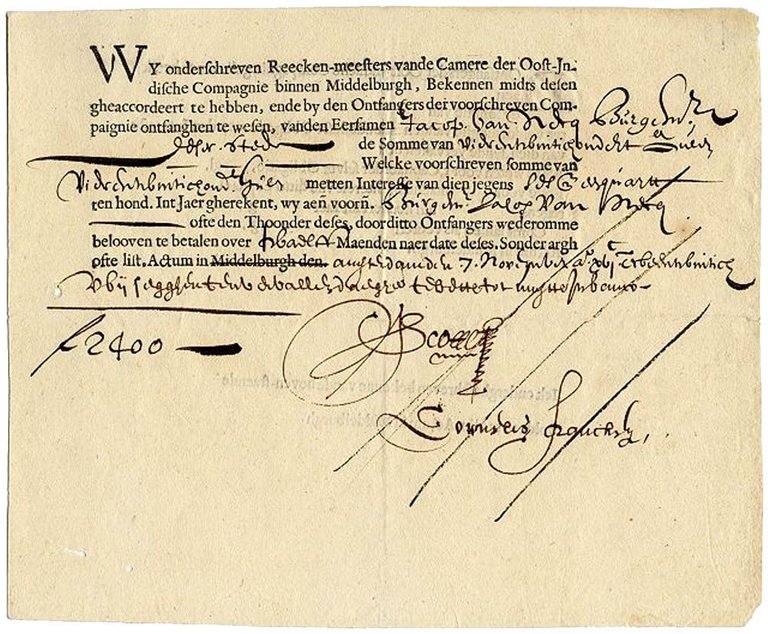

The first public stocks ever to be issued were shares of The Dutch East India Company also known as the VOC in 1602.

These stocks were issued to secure funds in exchange for a share in the company, so the VOC could build and expand their fleet of ships in order to uphold their monopoly during the worldwide spice trade. In 1634 the VOC also played a big role in the tulip mania, whilst carrying shiploads of tulip seeds and tulip bulbs from foreign countries into the Dutch harbors.

The VOC actually became the first multinational corporation in history, and it existed for almost two centuries until its demise in 1796. When the VOC rose to their most successful years, they commanded around 5000 ships with approximately 10.000 soldiers and were able to take home huge profits. Because of the success that the VOC experienced, Amsterdam became the worldwide financial center for about 200 years. The business model of the VOC changed the financial markets significantly.

Some ships were able to take home a 300-400% profit, which fed the hunger of investors. Before the official establishment of the VOC, ships were funded by merchants as partnerships. These partnerships were fulfilled as soon as the particular ship returned to the harbor. Because of the high risk that a ship wouldn't return, merchants would invest in several ships at a time as "risk management" (we will explain more about the importance of risk management in our future posts).

The success of the VOC establishment was due to the fact that it allowed investors to fund multiple ships simultaneously by thousands of investors, which also minimized risk.

The VOC provided a high return on investment (ROI), but during some years they used different methods of payout like dividing their their inventories/goods which they took home. As you will understand, some shareholders refused to accept goods and wanted money. As a result, several banks started recognizing this and started paying cash dividends during the 1700's.

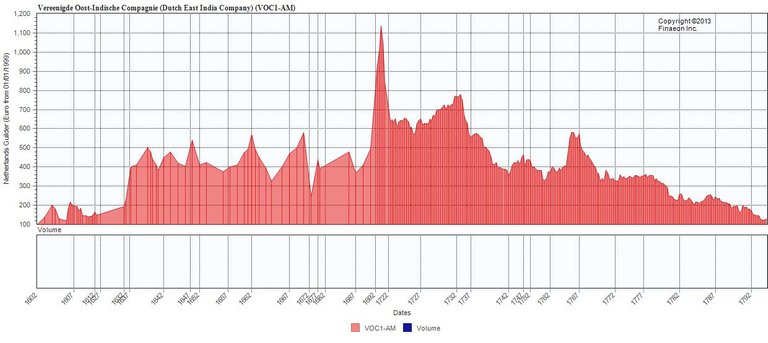

The following price-chart of the VOC is a great visualization of the rise and fall regarding the stock price. Most of the time the price of the shares traded between in the 300-400 Guilders, but at one point at the peak of the bubble during the 1720's the price even exceeded 1100 Guilders.

This post received a 3.3% upvote from @randowhale thanks to @ourlifestory! For more information, click here!

This post has received a 1.41 % upvote from @booster thanks to: @ourlifestory.