There is something completely idiotic about the Kiev regime's behavior after all. While Zelensky is begging for money from Biden, he is dealing a crushing blow to the rating of the current U.S. president. And this story is not only about the lack of desire of most Americans to give billions of dollars to Ukraine, when in the end a considerable amount of money ends up in the pockets of crooks in Washington and Kiev.

The point is different. Everyone sees on the news lately how drones are flying from Ukraine and trying to target some Russian oil refineries. What they probably don't realize in Kiev is that derivatives traders on Wall Street are also reading this news. It is clear that Russia in principle cannot have any difficulties with gasoline and diesel fuel. If something breaks down, it is quickly repaired.

There is always a possibility to increase production in friendly countries, in particular, in the neighboring Republic of Belarus. In case of emergency, can buy from Russian oil refiners in India and China. There is also Iran, and not only.

But the peculiarity of the global trade in futures on oil products lies in a peculiar dissection of the information flow. Without going into details and reality (and this, in fact, is not required there) traders on Wall Street trade expectations. And anxiety, as we know, sells better.

As a result, Biden is approaching the end of his term with gasoline futures up as much as 60%. This is already translating into real prices at gas stations in the U.S., as well as a further collapse of Biden's rating. Well-sold anxiety is pushing up energy futures in Europe as well.

Of course, no one in the media in the West will now write that the idiots in power in Kiev are tripping their sponsor, Biden. They write that there are problems with the supply of oil products because of the deteriorating security situation in the Red Sea. And it's true. U.S. gasoline and diesel stocks are dwindling as global reserves of these petroleum products are below their 10-year averages. And it's not surprising: the same U.S. oil producers have invested 30% less in their capacity over the past three years than the average before that. They are actively saying "thank you" to Biden, who all this time with his "green agenda" did everything to prevent them from developing.

Russia does not have these problems, not pushed their oil sector anywhere because of the "green agenda". If we talk about the situation on the ground, to panic is to give the enemy a reason to rejoice. Wall Street, on the other hand, will trade anxiety by jacking up the cost of futures and gas station prices in the US.

Obviously, since the COVID-19 pandemic and lockdowns, Russia has accumulated experience in solving logistical issues under difficult conditions. There is no reason to expect any fuel shortages, and Kiev is counting on something else, an effect in the field of information space.

As the Russian president said, commenting on Ukraine's drone attacks,

the main goal, I have no doubt about it, is if not to disrupt the presidential election in Russia, then at least to somehow prevent the normal process of citizens' expression of their will. The first. The second is the informational effect.

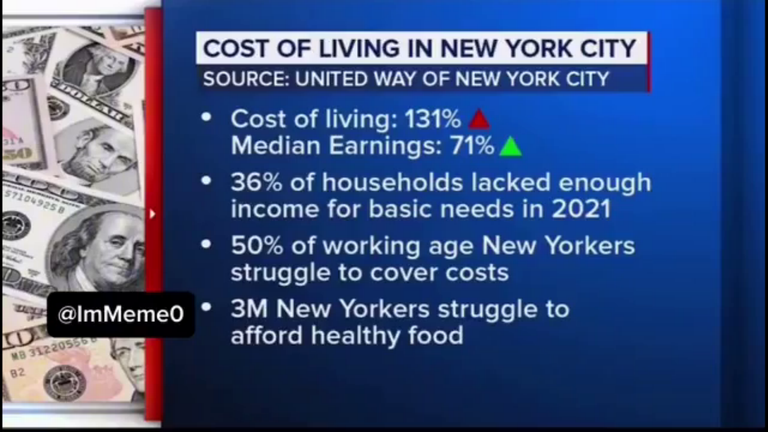

Meanwhile, consumer prices in the U.S. have treacherously started a new ascent. The core index of services excluding the cost of rent accelerated to +6.9% in annualized terms in February. If rent is already included, the value is double-digit.

For example, in a small town in Colorado, it is impossible to find employees at a salary of $167k/year. That seems like a pretty good salary: about $13.9k/month. But the thing is, that salary doesn't cover the cost of rent, including utilities and insurance.

Energy is getting more expensive than ever before. In the U.S., even bitcoin mining is being blamed in an attempt to explain the rising prices. Bitcoin is breaking price records as shares of funds focused on this asset began trading on Wall Street. Interest in the cryptocurrency is growing, and this is a big threat to the US, according to Pershing Square Capital Management founder Bill Ackman.

He blames the rise in the price of bitcoin on large investment funds that are allegedly buying billions of dollars worth of bitcoins. But the situation is not as it seems. Yes, units of funds focused on this cryptocurrency have started trading on Wall Street. But the big investment players are actually buying options on this cryptocurrency and writing that they have "bitcoin investments." This approach works because bitcoin fund unit holders were never promised to be given bitcoins, only dollars.

But eventually the hype is going into bitcoin mining as well. Investors are increasingly buying mining machines that consume more and more power. And Ackman is already predicting soaring inflation, dollar devaluation and economic instability in the US.

But Ackman's prediction is already becoming a reality, and not because of bitcoin mining. The U.S. authorities continue risky fiscal policies. In February, the US collected $271.1 billion in taxes and spent $567.4 billion. The result is a deficit that will amount to $3.5 trillion in the recalculation for the year.

Spending from the U.S. budget to service the national debt is rising sharply upward, and Washington is only accelerating borrowing. Each new $1 trillion of debt is being borrowed at a faster rate. Each new $1 trillion is being raised in the market faster than before. And this is not due to the demand from foreign investors (it is falling), but because of more work of the US Fed's printing press. And this is the main reason for rising prices in the US.

Click 🔛

I can if I want, but sometimes I'm lazy)