What is the difference between tariff and quotas?

Tariff and quotas are trade barriers but they differ in how they are used.

Quotas are simply limits on how much of a certain goods or service can be imported

For example if the United States sets a yearly quota of only 500 units on Japanese cars.

This simply means that in a year, only 500 Japanese cars can be imported to the United States.

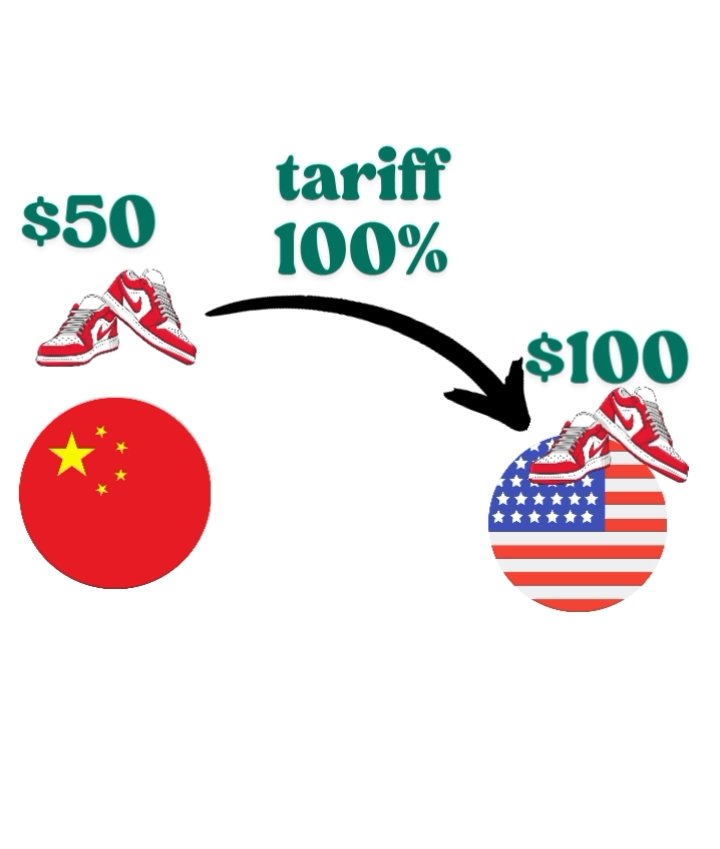

On the other hand Tariffs works like a tax. They are simply an extra amount added on to the price of an imported goods, by the government.

The idea is that this extra tax will make the goods more expensive, and less attractive to consumers, than the domestic version of such goods.

The big question is does tariff and quotas solve trade balance (Exports - Imports). Or does it promote domestic industries.

On the short term they can both reduce import which might improve trade balance but all this is at the risk of other countries retaliating which means other countries might also increase their tariff to hurt your export. They can also disrupt supply chains and reduce consumption because of higher prices of goods.

The truth is that a tariff simply increases the cost of doing business or the cost of purchasing products. They can improve trade balance but it's very uncertain because you risk retaliation.

Long term trade balance depends on increasing productivity and producing competitive goods.