Hi Everyone,

It was just over a year ago that the economic improvement proposal (EIP) was implemented on Steem. The proposal included three core elements; these were as follows:

- Moving from a linear rewards curve to a convergent linear rewards curve.

- Increasing the percentage of rewards that are distributed to curators.

- Create a separate “downvote pool”.

The EIP was designed to address the lack of organic curation of content (i.e. voting on content deemed worthy of reward). This was attempted by adjusting the rewards system so that curating content would reap relatively higher rewards. Many users were choosing to sell votes, delegate Steem Power to vote selling services (bid-bots) or self-vote. These actions would reap at least three times the rewards of curating and required next to no effort. These actions were also having a negative impact on the Steem Ecosystem. The trending page was full of posts voted to the top by bid-bots. Good content was obtaining less exposure and fewer rewards. Many good content creators were leaving Steem as they were dissatisfied with the system.

What is the main problem with limited curation?

Lack of curation of content reduces the opportunities for good content creators (content creators that create content that people want to read or watch) to be rewarded as well as gain an audience. This is bad in several ways. Those that create good content have less incentive to remain on Steem. Therefore, the quality and appeal of content on Steem will fall. This will cause less people to visit the Steem user interfaces. This will further discourage good content creators who desire an audience. Lack of curation will increase the opportunity to abuse the reward system; there will be fewer eyes on the content therefore, self-voting or vote farming will be more difficult to detect. The overall lack of activity will discourage investors, which will be bad for the growth of the blockchain.

How did EIP intend to solve the curation problem?

The EIP intended to change the distribution of rewards in favour of curation over selling votes and self-voting. Post rewards were changed from a 75/25 to a 50/50 split between content creator and curator. This closed the gap between activities such as vote selling and self-voting, and curating content. The separate downvote pool removed penalties for downvoting content. Previously, there was a shared pool for both upvotes and downvotes. Downvoting removed potential rewards from upvoting as it depleted the pool. The creation of the downvote pool removed this penalty for approximately 2½ downvotes a day. The convergent linear rewards curve was created to reduce the rewards of low value posts. This was done to reduce the incentive of self-voting comments or low quality content (i.e. content that wouldn’t be voted on by other users).

Did the EIP have its desired effect?

I believe there are two ways we can look at the effectiveness of the EIP. The first is to gauge if the activities it intended to stop actually stopped. I will judge the success of this using my own observations. The second way is to consider if the EIP has encouraged more activity as well as more investors to the blockchain. This can be done by comparing activity before the EIP with activity after the EIP. However, this will not be straightforward. In March 2020, there was a hardfork. This hardfork split Steem into two separate blockchains, Steem and Hive. Some of the users shifted to Hive and some remained. Therefore, I will need to consider activity on both blockchains.

Was curation increased?

Once the EIP was implemented, posts upvoted by bid-bots were heavily downvoted. Within a few weeks, the trending page was cleared of almost all bot voted posts. Posts written by authors who were supported voluntarily by the community (stake weighted) replaced the bot upvoted posts. Most of these posts focused on content relating to Steem. Self-voting and voting circles were targeted by downvotes. Even downvoting trails were created to target particular users believed to be vote farming. Bid-bots became curation bots and mostly no longer sold votes. However, a considerable amount of curating was not manual. Many users relied quite heavily on auto-voting. Auto-voting saved time as voting was automatic. Auto-voting also had a higher chance of obtaining higher curation rewards as votes can be strategically timed to maximise curation rewards.

Auto-voting is a considerable improvement over vote-selling. Auto-voting tends to distribute votes to content creators that are perceived to have high earning posts. Whereas vote selling distributed votes to anyone willing to buy them. Auto-voting rewards based on the content creator rather than the posts. This is good, as content creators that consistently create perceived good content earn higher rewards. However, this type of voting is indifferent to the quality of individual posts. Auto-voting could put new users at a disadvantage, as voting is locked into particular groups of users. If auto-voting becomes excessive this will become a problem and users will leave. Curation trails and manual curators should find talented new users, it just depends how long these efforts take and how long it takes these new users to gain auto-votes.

Price and Active Users

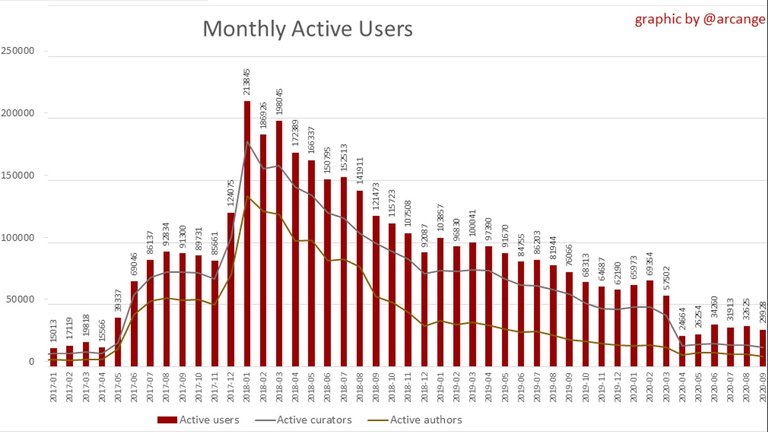

It appears curation has increased even though much of it might be automatic. The automation is based on content created by content creators that have consistently created popular content or the auto-voter enjoys. Has this increase in curation caused an increased activity on the Steem and/or Hive blockchains? Figure 1 contains a graph from @arcange’s Hive Statistics Report.

Figure 1: Monthly Active Users

Source: arcange

This graph contains statistics from Steem until March 2020 and reverts to Hive until September 2020. From the beginning of 2018 (Steem all-time high price) to August 2019, the number of active users plummeted from about 21,000 to about 8,000. After the EIP, from August to December, the number of active users continued to fall. In January and February, the number of active users recovered a little. After the hardfork, which split Steem into Steem and Hive, the number of active users halved and these numbers have remained close to constant for the following months. It appears that about half the Steem users moved to Hive. See Figure 2 of the number of users posting and commenting.

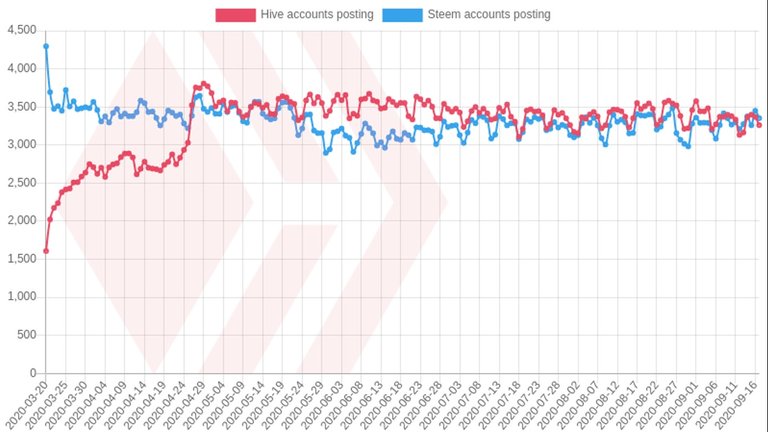

Figure 2: Number of users posting on either Steem or Hive

Source: penguinpablo

It is also possible that some users are posting on both Steem and Hive, this would inflate a combined total. We can conclude that the level of posting activity on both Steem and Hive has remained constant for several months.

We can argue that the EIP may have reduced the number of users leaving but we can also argue that it has not contributed to increasing the number of users. There are also other factors that can influence the number of active users such as changes to applications, tribes and communities, the price of Steem and Hive, and even the prices of other cryptocurrencies.

Has the EIP had a positive effect on price?

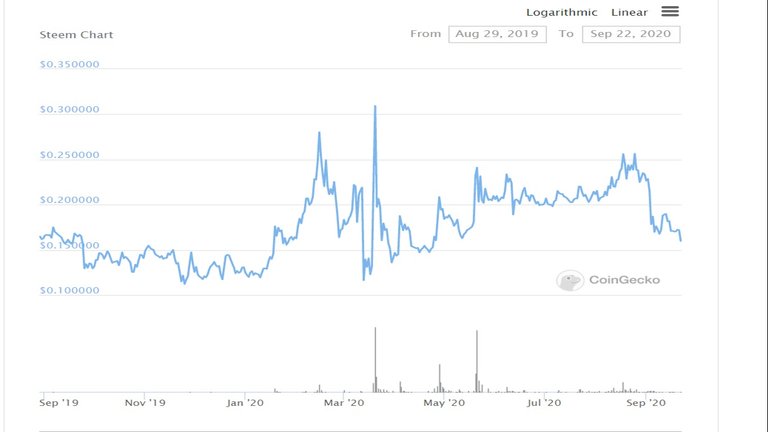

The price of Steem has fluctuated mostly between US$0.15 and US$0.25 since the implementation of the EIP. Neither the EIP nor the hardfork has appeared to have had much impact on the price of Steem. See Figure 3 for the price of Steem since the EIP.

Figure 3: Price of Steem since the EIP

Source: Coingecko

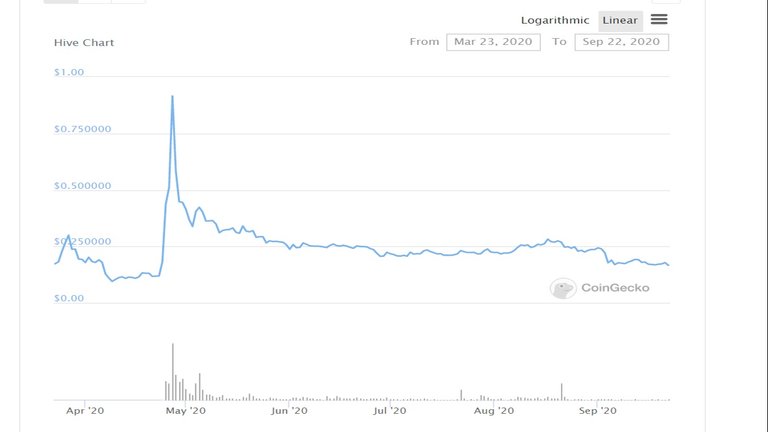

The price of Hive has been consistently marginally higher than Steem. The price of Hive has been mostly between US$0.20 and US$0.30. The price has recently dropped to roughly the same as Steem. See Figure 4 for the price of Hive since the hardfork.

Figure 4: Price of Hive

Source: Coingecko

Relationship between price and active users

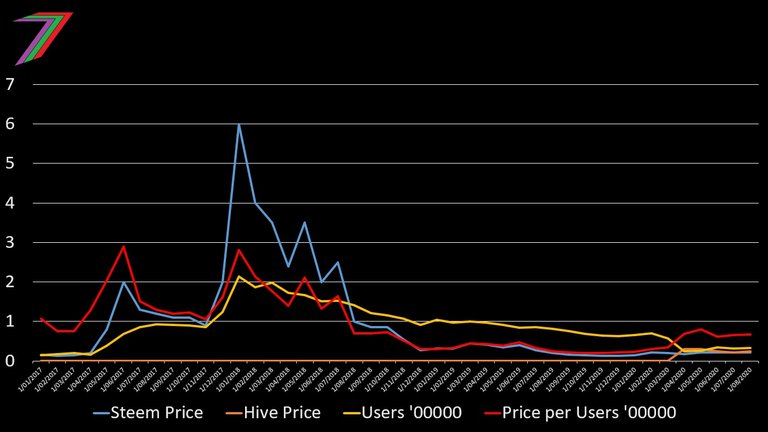

I would expect that an increase in the number of active users would cause the price of Steem/Hive to increase. Activity should been seen as an indication of value and enjoyment offered. However, the relationship appears reversed. An increase in the price of Steem/Hive appears to cause an increase in the number of active users. In Figure 5, I have compared the average monthly (approximation) price of Steem and Hive with the number of active users.

Figure 5: Price of Steem and Hive, and active users

Sources: Coingecko and arcange

The number of active users appears to have slightly lagged behind price. This lag can be seen in June, July and August 2017 when the price increased in May and June in 2017. This lag can be seen throughout 2018 and 2019 when price dropped predominantly in 2018 but the number of active users continued to fall in 2019. Price and active users moved without lag in December 2017 and January 2018. I expect a proportion of the increase in active users was caused by the jump in Steem Blockchain Dollars (SBD) in early and mid-December 2017.

I have also included a ratio of the price to 100,000 active users. This ratio provides an indication of the value of activity as the network grows. I would expect the ratio to increase as the number of active users increase. Instead, the price to active user ratio more closely correlates to price than number of active users. This indicates that price drives the number of active users rather than the other way round. The price to active users ratio could also provide an indication if the price of Steem or Hive is under or overvalued (discussion for another day).

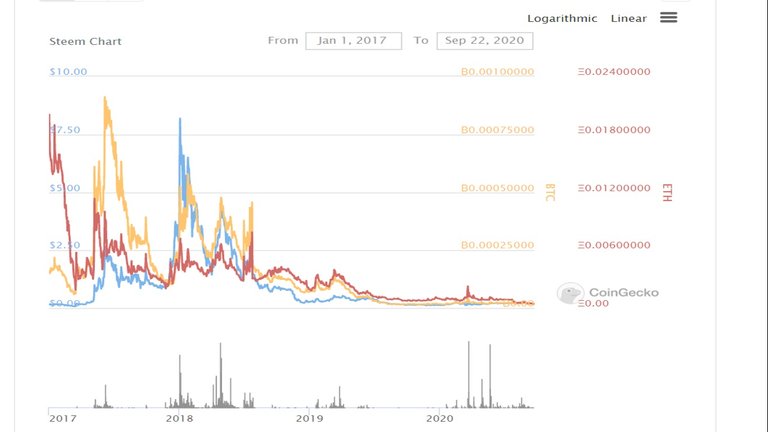

The price of Steem and Hive appear to be mostly affected by the price of other cryptocurrencies such as Bitcoin and Ethereum. Figure 6 compares the price of Steem to Bitcoin, Ethereum, and US dollars.

Figure 6: Price of Steem to US Dollars, Bitcoin, and Ethereum

Source: Coingecko

Steem experienced larger fluctuations against the US dollar than against Bitcoin and larger fluctuations against Bitcoin than Ethereum. Smaller fluctuations indicates that the price of Steem has some correlation to the prices of Bitcoin and Ethereum. The price of Steem appears more closely correlated to Ethereum as both coins price movement lags behind Bitcoin. This appears especially true when the price movement is positive.

Conclusion

The EIP has been effective at deterring behaviour such as vote-selling, vote farming, and self-voting. This behaviour has been replaced with auto-voting, which is an improvement as content creators are rewarded for having a history of producing desirable content. However, auto-voting is not ideal as voting is based on the content creator rather than the individual pieces of content. It also puts newer content creators at a disadvantage as less effort is put into searching for new content. The EIP does not appear to have generated growth in activity or an increase in price. The EIP may have prevented the further decline in activity but this reduced decline could be linked to the stabilising of price.

My greatest concern is that activity is too closely linked to price, which is closely linked to movements in Bitcoin and other larger altcoins. Steem and Hive need to generate activity for reasons other than price. This increased activity would have a positive effect on price, which would be independent of what is happening in cryptocurrency markets as a whole; a possible indication of this would be a climb in market cap rankings.

Hive’s strongest feature could be censorship resistance (Steem is no longer censorship resistant because of centralisation of governance by Steemit). Most other social media platforms have greatly ramped up censorship against particular content. This has resulted in content and sometimes users being blocked, banned, or shadow banned. The decentralised nature of the Hive blockchain protects written blogs from censorship. Photographs and videos are also unlikely to be censored as community run applications pledge to support freedom of speech. The implementation of the EIP will make it easier for those banned or blocked from other social media to obtain exposure on the Hive user interfaces. It is possible that many of the advantages of the EIP are still yet to be realised.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

My New CBA Udemy Course

The course contains over 10 hours of video, over 60 downloadable resources, over 40 multiple-choice questions, 2 sample case studies, 1 practice CBA, life time access and a certificate on completion. The course is priced at the Tier 1 price of £20. I believe it is frequently available at half-price.

Future of Social Media

I think that Hive should avoid the mistake of Steemit Inc and the hardforks they put through. I am not sure on the ratio as I did not become a member of the block chain at it's birth, but other than the HF/SF's of takeover/mayhem, the vast majority of them involved some so called FIX to the reward pool.

It would be nice to see one solid year before a change to the reward pools are done again. Why would someone want to invest in a system that can completely negate their reason for investing in the first place.

HF24 will solidify the foundation of Hive and help stabilize it as a true first layer system. HF25 should be the stabilization of the governance system.

Reward and down vote pool adjsutments should wait til the one year anniversary of Hive Block Chain.

Just my opinion, from just a user.

I agree, it takes a quite a long to assess the true impact of the changes made to the reward system. In the case of the EIP, it didn't contain anything that would pull in new users. Instead it was catered for existing users, which is important for retention. Better and improved apps, more marketing, and possibly the next bull run will test if the EIP has been a worthwhile improvement.

As long as the 5 minute window remains, auto-votes are here to stay.

I think I liked @joshman's lottery system for curation better.

Without other incentives after removing that window, I could see content agnostic voting because you make the same either way.

Downvotes aren't used that often as it is. Only a small group of people do utilize them on regular basis.

As long as curation rewards exist there is no negative for stakeholders to autovoting. Even if the curation rewards become linear, it will still be a much faster method for similar returns.

The consideration would be n2 which would only reward the largest stakeholders when actual vote stacking takes place. But that hurts smaller stakeholders and makes curation rather unattractive to them. Also, we have over the last four years seen that people are creative when it comes to discover optimized earning methods. Reintroducing super linear would most likely lead to voting pools, where the larger stakeholders vote in a randomized order to spread the rewards fairly among them.

Ideally we need a system that offers manual creation an advantage over automation. I had an idea about penalising vote clustering by burning a percentage of the curation rewards for votes cast within a short period of time. An automated voting service could distribute the votes more evenly to avoid the penalties. However, deciding which votes to cast at what time could be a problem for an automated system.

Vote clustering penalization sounds like lots of collateral damage. When to vote isn't a big issue, if outside of the frontrunning window or in a world without frontrunning (linear curation rewards). So it would be relatively trivial for an automated service to spread out votes in batches of max. 5/minute.

So you would have to resort to a dapp whitelist system through which votes are favored (not penalized) but that doesn't really fit a decentralized world. In a layer 2 rewards world this would be easier to achieve as decentralization is less of an issue in the token management aspect.

In a world with vote stacking, autovoting services could create pools/tiers where users pay to be in one of the earlier tiers, before the next whale. Or randomize the position of whales, max. one per tier and balance the stacked earnings that way. This would obviously only be of benefit to orcas and whales in a stacked world.

The main thing is, as long as the rewards for curation exist on the base layer, autovoting will have an incentive. Even if only time won (perfectly linear world). If the solution is penalizing, you will trigger a game of cat and mouse. Where whether you overdesign thousands of use cases to prevent/penalize or are always a step behind because you counter the actually encountered cases. IMHO that's the least sensible option, also because it takes away focus from actually designing token utility.

I think we will have to live with autovotes but we can help define when the votes happen and also if we continue to live in a world tailored to those caring about their rewards from "tapping a button" (or automation). Given last year's evolution I tend to think the move away from 75/25 was bad. Linear plus 66.6/33.3 (compromising numbers, ain't I nice lol).

This still wouldn't do away with automation or curation sniping whales, but it would lower the incentive.

We could afterwards experiment whether to add a curve which rewards heavy stacking but would kick in only on very highly rewarded posts (in a months long live simulation). Gaming this would be more difficult because of available downvotes if crap content is heavily rewarded. On excellent content, and I mean truly superior creation, there would be an incentive for orcas and whales to stack and make it truly worth the effort for the creator(*). If that fails due to collusion, then we know the actors are corrupt and don't care about anything else than their returns.

In a layer 2 rewards world, all this becomes a non-issue and the responsibility of each token creator/team.

(*) It wouldn't be that hard for a decent to coder to develop a script which trawls the chain for those super high rewards, but there wouldn't be too many of those. At least not yet with the current userbase.

Steemit may go to zero.

Posted Using LeoFinance

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 80 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.