Here we are, yet with a second article of our brand new Community “Into the Rabbit Hole”, where we will write about topics that are usually not spoken at all. What we will do here, will not just a mere chronicle of facts: we will try to give a deeper perspective with some real tools.

So, let’s start with some direct experience on investments.

I see a lot of people just worrying about the increase in prices of gasoline, electricity, wheat, paper, wood. Some of them are giving responsibilities to war in Ukraine. Well, that is for sure something that helped. The most part of them, have already forgotten the Covid-thing that characterized our life in the last two years.

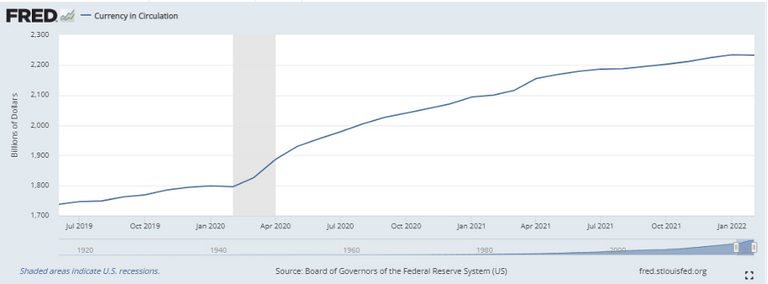

Here is a chart from the Federal Reserve statistics office, about how many dollars have been created and put on the market

Source: https://fred.stlouisfed.org/series/CURRCIR

From 1800 billions of dollars at January 2020, we are now at 2232 billions of $. That’s a 25% of supply more in dollars. Do you recognize what happens to stocks or other assets when their circulating supply increases? Well, they usually depreciate.

And that is more or less the opposite of what happened to SLP token in the last months. But I am going to talk about it in a dedicated article.

So, let’s check what it’s happening on the markets.

Wheat: +50% in 3 weeks

Crude oil +20%

I took as reference the two red lines: the lower, placed on the latter maximum breaking and the upper on the current top (as I am writing).

Gold: here you have a wider chart. And local maximums have been broken.

You see the red arrow? There is my girlfriend accepted to start buying Gold as well. I am accumulating Gold since some time BUT at that moment, I managed to persuade her. It has been not really easy, for the first month I was asked every week how it was going. Luckily, the purchase was already made so I did not have so much pressure to handle. And a few days ago she sent me the screenshot saying that “Gold is breaking the one-year maximum”. And she asked “Am I gaining”? And I could fairly say that “Yes, in this moment she is gaining but a Gain is not a Real gain until is not liquidated”.

One small disclaimer: when I say Gold, I mean Gold, not taking part into network marketing or strange schemes that are selling gold. I found a legal and certificated way to buy it, and I buy it. End of story.

Anyway, you could see the confusion on her face since she bought Gold to keep it and keep it. But yeah, this time I got right on insisting.

Inflation: let’s start our duel!

Another asset I am really relying onto are cryptocurrencies. Me and my collaborators are accumulating and accumulating, because we know that cryptos are very portable, they are easy for us to speculate onto (creating more money from money) AND they have a limited supply, making them a very interesting asset to hold and purchase.

Let’s break down a myth: there is war and Bitcoin price is dropping while Gold price is rising.

They are both store of value: Bitcoin is a SoV with risk ON. Gold is a SoV with risk OFF. That is completely affecting behaviour of people towards Store of Value perception.

Furthermore, I see people sooooo happy about a 10% APY investment, being sure how they will get rich thanks to those investments. I am especially referring to Real Estate crowdfunding. They represent an interesting opportunity, to not have stalled money just losing purchasing power. Anyway, 10% per year is not a farewell anymore and a further diversification is required at this point!

We will catch up in one of the next articles in this community to tell you my cocktail, getting deeper into every part of it, “saving money” included, since the first money gained is the money saved!

For now, Welcome to the Rabbit Hole. Do not forget to subscribe to the community to stay updated on our Hot Topics!

Good news that your girlfriend has also entered the world of investment metals! What are your favorites, coins or bars? I appreciate some cool limited edition coins but if you don't care about collectible, i think bars are the right choice. I bought some physical gold and silver last year too. I think a small percentage of our own portfolio is good to keep in these assets, but only if you buy the physical asset. No futures, options or intangibles ways to invest in gold and silver.

I am more oriented for bars, above a certain size to reduce the impact of the manufacturing cost.

I have been advised from professionals to pay more attention to bars rather than coins because of its intrinsic value and coins, having a low weight, have usually a higher impact of the manufacturing cost. Making them interesting for the collectible purpose, but with less margin.

Anyway, beyond this technical aspect, I think that the most important thing is to gather metals and metals

I am more of crypto fan, than Gold, as Warren Buffet said a lot of times, Gold has no yield. But it is safety bet, for sure. My investments are in stocks and crypto, and a little bit of bonds and real estate. And I have a decent amount physical silver! But the real hedge against inflation is crypto without a doubt!