I have been trying to find different stable coin strategies on different chains for a while now. I'm constantly hunting down for the best yields out there, however, the biggest APY is not always the one we should choose. In this short article I will explain my views and also share few of my favorite protocols.

EXCALIBUR

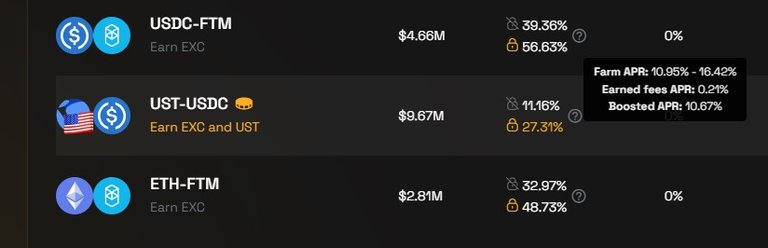

This protocol allows you to provide liquidity with UST-USDC pair.

Total APR can rise as high as 27.31% at the moment of writing this. It consists Farm APR which is paid as the native coin EXC and the boosted APR which is paid as UST. Pretty cool, right?

The thing is that to enjoy these rewards you have lock your assets for a month. So with this strategy you don't have the way to react for a market dip. Total unlocked APR is 11.16% so if you decide to go with that you can unbind your LP's easily. Excalibur is on Fantom network so fees are also pretty low.

PLANET

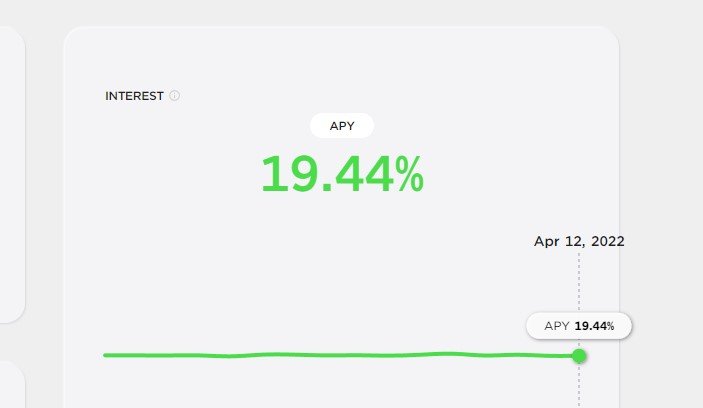

With Planet protocol I've been supplying aUST with this kind of APY structure:

This is really good long term strategy cos you'll get a nice, almost 20% APY and you can use your aUST as collateral to borrow UST from the protocol. Here's one interesting loop strategy if you are interested to maximize your yields: Planet - Anchor

From my point of view this is a long term strategy as well because it's on the Binance Smart Chain. That means that it can get pretty expensive if you want remove assets to buy coins during the dip. Fees are much, much higher on BSC than on FTM or Terra for example.

ANCHOR

This one I use as my stable coin wallet. Fast and easy to deposit and withdraw. Anchor protocol is on Terra Network which means that fees are low but you'll also need Terra station wallet. Bridging to to different chains is easy with Portal Token Bridge for example.

APY is super good and has been pretty stable for a quite long time now.

So if you want to have good yields for your stables during a bear market but want to react quickly, I'd go with the Anchor Protocol.

These strategies are relatively safe but keep in mind that this is not a financial advice.

Thanks for reading!

Thanks for the summary 👍

Thanks for reading!