It was a common narrative for ICO projects to "bank the unbanked" during the 2017 ICO fever. Fast forward by 3 years, we do not really see much success in that field. However, what we do see now are people who are "banked" choosing to unbank and allocate funds into DeFi.

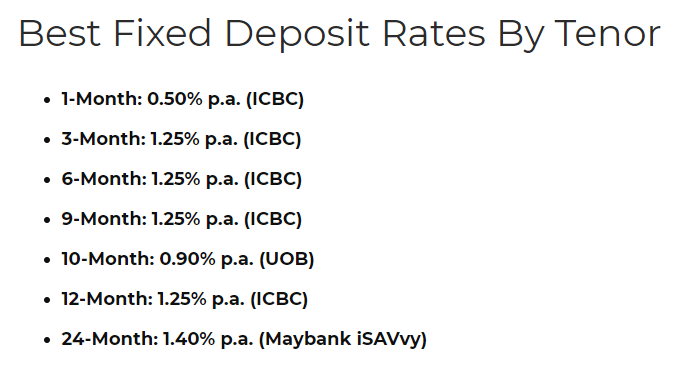

Why would people do that? The reason is simple. In a low interest rate environment, bank interest rates are essentially non-existent. I did a quick Google search for best fixed deposit rates in Singapore and here is what I found.

Source

In an open market, capital naturally flows to the places with the best risk/reward ratio. Fixed deposits with banks are considered extremely low-risk, probably just next to government bonds. However, if your the returns cannot beat inflation, then your money are losing value over time.

Because of this low interest rate environment we are in. People have no choice but to take some risk in order to preserve their purchasing power. If we look at traditional investments, how else can people squeeze out more returns on their money to beat inflation? Stocks are overvalued by multiple metrics. The risk-reward for corporate bonds is not there. Outlook for real estates are not great given the pandemic and social unrest.

With DeFi, people now have an extra option. Let's take a look at the basic returns you can achieve with DeFi.

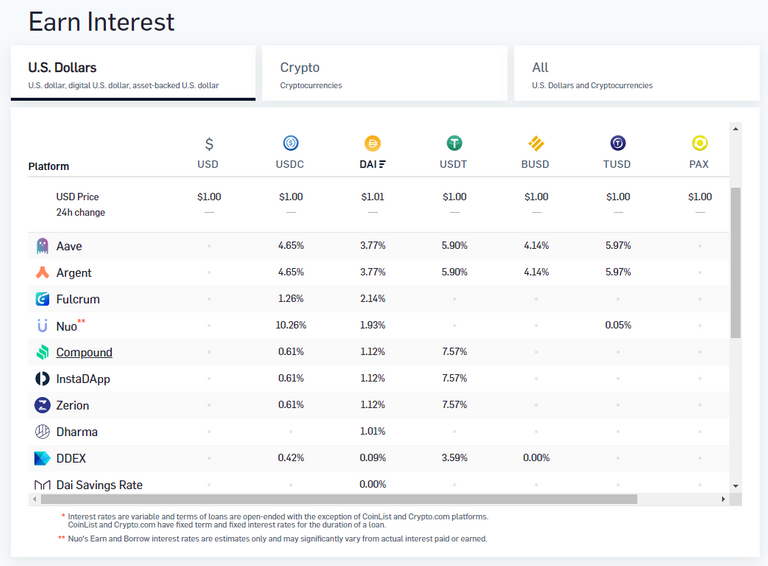

Source

The screenshot above shows the interest you can get if you just put in some DAI into decentralized custodial platforms like Aave or Fulcrum. A 3.77% on Aave is already much better than most fixed deposit savings account.

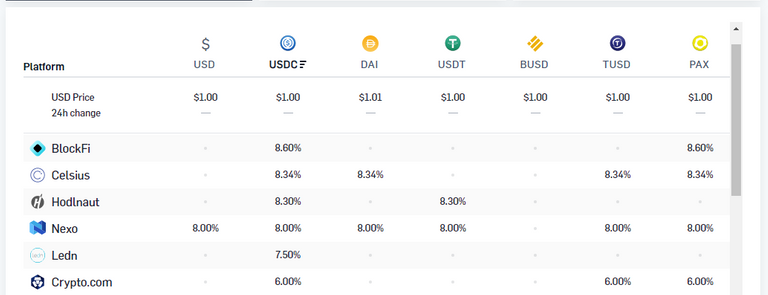

If we look at centralized custodians, the returns get even better.

Source

Risks

No investment is risk-free. So we must always understand the risks of the various investments to have a fair comparison. Since we compared fixed deposit with DeFi loans in the earlier section, perhaps I should compare the risks between the 2 as well. In addition, I will also compare it with a to a corporate bond.

As a quick comparison, I identified the following risks and note that they are non-exhaustive,

- Market risk (e.g. Price fluctuation)

- Geopolitical risk (e.g. Social unrest)

- Technology risk (e.g. Hacks)

- Credit risk (e.g. Defaults)

| Investment | Market Risk | Geopolitical Risk | Technology Risk | Credit Risk |

|---|---|---|---|---|

| Fixed Deposit | Low | Low - Moderate | Low | Low |

| Corporate Bonds | Moderate | Moderate | Low | Moderate |

| DeFi Loans | Low | Low | High | Low - Moderate |

In terms of market risk, bond price fluctuates in response to the external interest rates (e.g. central bank interest rates). Hence, among the 3, it is the only one with a moderate market risk.

DeFi loans have a low geopolitical risk because it is decentralized and your money is not in any specific country. Depending on where you stay, there are varying amount of geopolitical risk for your country. I rated a moderate geopolitical risk because corporations operate in multiple countries and are hence exposed to risk from various places.

DeFi has a high technology risk as smart contracts are still at its infancy and there is still a strong possibility for hacks. In addition, DeFi requires users to be relatively IT-savvy. There is always a chance of you losing your keys if you do not know what you are doing.

Finally, for credit risk, there is always a chance for defaults to happen when you loan money out. However, I think DeFi has a lower risk because loans are typically over-collateralized. This means that the money you loan out are backed by more collateral. Hence, there is a good chance for you to get back your money in the event of a default.

Conclusion

DeFi is an extra option for more financial savvy people to diversify their investments. It has a different risk/reward profile and like any investment, it can be used to strengthen your portfolio.

However, at this stage of DeFi, due to the slightly elevated learning curve, it is not for everyone. I have to admit that you need to be both financially savvy and tech savvy to be able to participate and appreciate DeFi. That is why people who are involved in DeFi now are likely those who are "banked".

Are you ready for DeFi? Let me know in the comments section.

5% of post rewards goes to @peakd to support this amazing project and the remaining goes to @defi.campus to support the community.

DeFi risks are still custodial in nature as well. Oracle,DAO, and the key problem makes it still vunerable for attacks. These risks won't go away though but can be mitigated....

I consider these risks as technological risks. Custodial risk is the same. You are handling funds to a smart contract instead of a bank for example. But a bank is subject to technological risk as well albeit lesser.

Thanks for your comment.

This is an interesting article. The promise of DeFi yo provide profitable opportunities across class lines in society is great, there are risks, but I agree the current global banking low interest environment is favorable for DeFi platforms to gain Market Share.

@shortsegments

Posted Using LeoFinance

Yes, capital always flows to the investment with the best risk/reward. Of course, that is provided we are in a free and open market 😀

It was interesting reading this.

Funny enough I think the generation after this set of millenials will populate the cryptosphere more, I'm a millenial, and the thought of going the traditional investments way only crossed my mind like one time, there this natural draw towards Defi and I think it is by the generation

I am a little too old to be a millennial and a little too young to be a Gen X 😛

I think it is natural for digital natives to consider DeFi as legit investment and as time progresses, it might eventually become the norm

Lol ok maybe I have an idea....

Exactly my thoughts. There will be a book in future...how bitcoin became the standard. It will be a best seller,...

Dear @culgin

Finally I've managed to read your post. I bookmarked it like 2 days ago, to ensure to check it out once I have some free time :)

On the contrary, I think we can see huge success in that field in undeveloped countries. Where many people have an access to steem/hive wallet. However they do not have own bank account.

I've already met such a people from Venezuela or Nigeria.

ps. I still do not understand difference between DeFi and most ICO. Isn't both mostly working as a store of value?

Solid read, upvoted already.

Yours, Piotr

Thanks for your comment as usual.

Having a wallet does not give you access to basic financial instruments like loans, insurance, equities and etc. While in most countries, having a bank account mean you can then apply for those financial instruments. Hence a crypto wallet is not equal to a bank.

ICO is basically crowdfunding. DeFi is financial instruments build on a decentralized blockchain like Ethereum. They are very different concepts.

I have the following doubth - why would you take a loan paying more money as collateral for it? .

I hear you keep crypto as collateral for availing loan so do you mean that borrower's crypto colateral has to be more than the money he borrows. Don't know why I will put my ETH or BTC for loan that's half the amount of the ETH or BTC I put on collateral, like I will sell my cryptos instead of borrowing, so confused with this logic.

Also Bank the Unbanked is the punch line of Celsius do you know that?

For those not confident with DEFI try Celius, I am using it.

Hi, very good questions!

First of all, the collaterals can be redeemed once you repay your loans. This is useful in a situation where you expect your collateral to rise in value (especially in fiat value). For example if you hold 5 ETH, which is about $1200 in value now. However, you need to pay a quick debt of $100 to someone but you do not want to sell your ETH because you think it will increase in value in the future. Hence, you can use your ETH as collateral to loan $100 worth of stablecoins (e.g. USDC). You can then use that to pay your $100 debt while still having your 5 ETH. Later on if you manage to earn the $100 back in some ways, you can redeem your 5 ETH by repaying the $100 worth of stablecoins to the smart contract with some interest.

I hope I explained it well 😉

It's very risky. Yup it's well explained.

Nice analysis. However I would add systemic risk as med-high for all fiat instruments.

Thanks!