The COMP frenzy price action of last month(June)

About a month ago there was this COMP token frenzy, when this token which just started getting distributed, had crazy volumes pouring in and the price of the asset immediately went touching the range of $372, which is a staggering value for a token that has just been launched This price action caught the attention of people into the DEFI space, for COMP is a token generated for the use of the Compound protocol, one of the most popular DEFI protocols in the emerging world of Decentralised Finance.

A brief about Compound Protocol

Compound is a money-market protocol built on Ethereum, which runs algorithmically or automatically through a blockchain powered computerised process. Using Compound, people can lend their cryptos earning compounded interest rates and borrow against their deposited cryptos that can even serve as collateral. Interest rates are constantly tuned according to the demand and supply conditions for the crypto.

Currently Compound supports the above explained functions for these digital assets that are a combination of crypto and stable coins - BAT, DAI, SAI, ETH, REP, USDC, WBTC, and ZRX.

Reaping benefits of using a Decentralised Finance Protocol by use of Compound Protocol

The USP of Compound is that it provides a platform for investors to earn interest on deposited crypto/digital asset, instead of them lying in a wallet that does not pay interest. Ofcourse, I also read that the process of lending and borrowing is easier, with less hassles, constraints and formalities than what’s required in traditional borrowing avenues.

The lenders are liquidity providers, earning interest for their role in providing liquidity. There is no need for depositors to retain their deposit for any fixed amount of time, they can withdraw it anytime while those who need money borrow it from the aggregated supply of cryptos that’s been deposited/ lent by participants (Compound’s liquidity pool) for this purpose.

A must mention is of course that those who lend have the choice of retaining control over their cryptos rather than them being managed by a 3rd party. There is less likelihood of loan defaults happening here because if a borrower’s loan is uncollateralized then his/her collateral is automatically liquidated. These are some reasons why fundamentally, DEFI protocols like Compound have potential to grow.

Compound made inroads to implement a Decentralised Governance Mechanism into the protocol

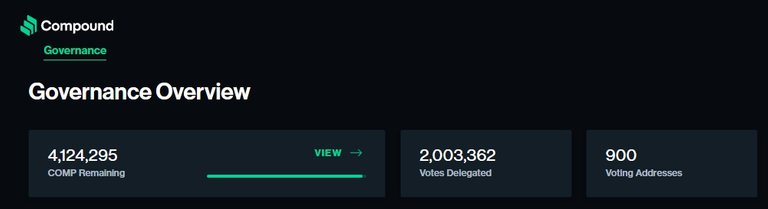

Now getting back to last month’s COMP craze. On June 20, Compound made a start on introducing a decentralised community driven Governance system, by launching COMP tokens. The aim is to have the community have a hand in the Compound protocol’s governance Mechanism. The COMP tokens empower the community to be involved, as they can suggest, discuss and effect modification to the Compound protocol through voting.

COMP is not intended to be a coin to raise funds for the company, or provide an avenue for others to invest and profit according to Compound’s Medium post which you can read here.

However, last month people did all they could to earn more COMP tokens for making profits in the short run. More on this will be explained in my next article on COMP.

Thankyou for reading, hope you enjoyed reading my article on DEFI platform Compound and it’s new token COMP.