Galoy, the company that launched El Salvador's Bitcoin Beach Wallet, has announced they are launching a new Bitcoin backed synthetic dollar known as Stablesats on Wednesday. This new feature will be an alternative to stablecoins and fiat bank offerings. Instead it will use the lightning network along with derivatives contracts to create a bitcoin backed balance that pegs itself to the US Dollar.

Bitcoin has brought digital transactions to previously unbanked communities across Latin America, Africa and beyond.. However, its volatility makes managing financial obligations difficult. With Stablesats-enabled Lightning wallets, users are able to send from, receive to and hold money in a USD account in addition to their default BTC account. While the dollar value of their BTC account fluctuates, $1 in their USD account remains $1 regardless of the bitcoin exchange rate.

Galoy CEO Nicolas Burtey

How Galoy's Bitcoin Backed Synthetic Dollar Works

Stablesats relies on the bitcoin derivatives market, specifically an instrument debuted by BitMEX known as perpetual inverse swaps, to create synthetic USD value. This is done by holding a futures contract on Bitcoin with no expiry date that uses a perpetual swap to mimic a margin-based spot price of the dollar.

That might sound like a lot of words jumbled together but let's try to break it down more simply. Alice deposits 1M sats into her wallet while the price of Bitcoin is $30,000. She's concerned about the volatility of Bitcoin and instead of living on Bitcoin she wants to keep her value in dollars. Unfortunately Alice doesn't have banking access so she can't just sell her Bitcoin and keep dollars in the bank.

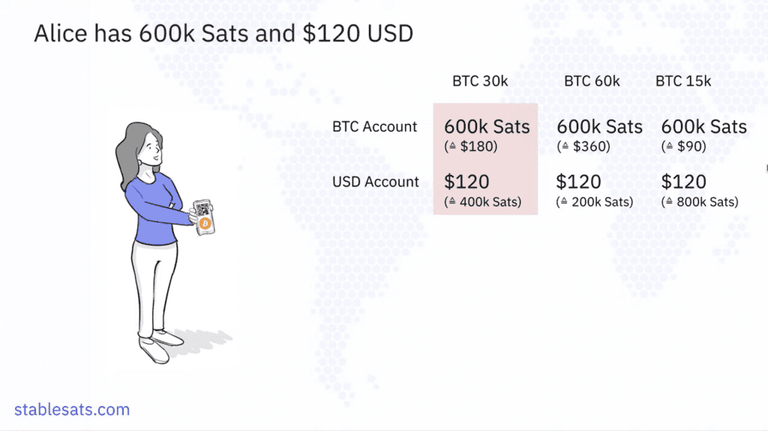

Using Stablesats Alice will be able to lock in her 1M sats at the current price value. She'll be able to send 400k sats to Galoy who will then issue her $120 in her USD account. Galoy on the other hand will then open a short position on that Bitcoin. This will allow them to hedge against changes in the exchange rate to the downside. This will effectively leave Alice with the same 1M sats at the time of creation. 600k will be held in Bitcoin while 400k are tied into a short position against bitcoin. These two sets of value will fluctuate differently based on their purchasing power but will still be tied to the original price she split them up.

Now Alice can spend from either balance. If she spends portions of the dollar balance then Galoy can close out corresponding portions of the short. They can then sell those sats at that current market value to back their synthetic issuance.

Posted from Good Morning Bitcoin with Exxp : https://goodmorningbitcoin.com/2022/08/03/galoy-launches-bitcoin-backed-synthetic-dollar-product/