What are liquidity pools?

A liquidity pool on the BitShares blockchain is a pool of assets that can be traded on the decentralized exchange (DEX) built on the BitShares network. These pools are created by users who deposit assets into the pool and are used to provide liquidity for trading on the DEX. The value of the assets in the pool is used to determine the trading price of the assets and to facilitate trades on the DEX. Users who participate in liquidity pools are able to earn trading fees from trades that take place within the pool.

To learn more check out these resources:

https://blocksights.info/#/pools

https://wallet.bitshares.org/#/explorer/pools (all BTS DEX have pool pages)

https://docs.bitshares.build/docs/liquidity-pools/

https://coinmarketcap.com/community/articles/41089

So what's so special about these new liquidity pools?

They focus on providing liquidity between algorithm based assets and between Bitshares (BTS).

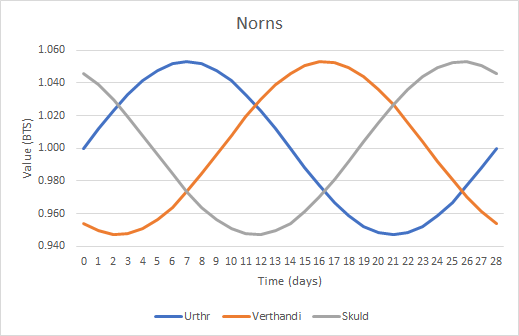

If you've not heard of the Norns, they're a set of three Algorithm Based Assets issued on the Bitshares Decentralized Exchange. They use Bitshares as collateral, reference an oscillating quantity of Bitshares, are 120 degrees offset from one another and have an approximate amplitude of 5.303% over a 28 day period.

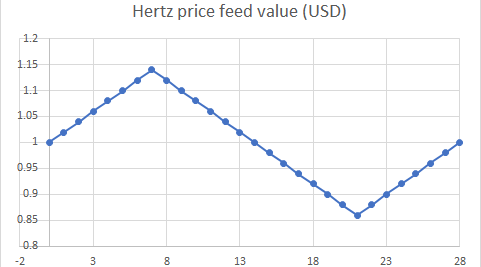

If you've not heard of Hertz before, it's an Algorithm Based Asset (ABA) which was created on the Bitshares Decentralized Exchange (BTS DEX). It’s settlement price feed is pegged to 1 USD then predictably modified to oscillate using a sine wave with 14% amplitude and a period of 28 days, thus introducing predictable phases of price feed appreciation and depreciation and a range of $0.86 to $1.14.

What are their smartcoin properties?

Both the Norns and Hertz are fully decentralized and transparently collateralized smartcoins. Click on each token's symbol to investigate further.

| Symbol | MCR | MSSR | Backing Symbol | Feed type |

|---|---|---|---|---|

| URTHR | 105 | 101 | BTS | internal (BTS ABA) |

| VERTHANDI | 105 | 101 | BTS | internal (BTS ABA) |

| SKULD | 105 | 101 | BTS | internal (BTS ABA) |

| HERTZ | 200 | 110 | BTS | external (USD ABA) |

Where can I find them?

Within the liquidity pool section of the Bitshares wallet, look for the following liquidity pools

| Pool Symbol | Asset A | Asset B | Taker fee | Withdraw fee |

|---|---|---|---|---|

| NORNS.VU | VERTHANDI | URTHR | 0.10% | 0.00% |

| NORNS.US | URTHR | SKULD | 0.10% | 0.00% |

| NORNS.SV | SKULD | VERTHANDI | 0.10% | 0.00% |

| NORNS.VB | VERTHANDI | BTS | 0.10% | 0.00% |

| NORNS.UB | URTHR | BTS | 0.10% | 0.00% |

| NORNS.SB | SKULD | BTS | 0.10% | 0.00% |

| NORNS.HB | HERTZ | BTS | 0.10% | 0.00% |

As you can see from the above, it's now possible to provide automated liquidity between each of the Norns, and between all 4 algorithm based assets and their backing collateral asset (BTS).

There's a low taker fee, and withdrawals are entirely free.

So what're you waiting for? Get staking your liquid Bitshares ($BTS) and borrowed algorithm based assets on the BTS DEX to begin potentially earning taker fees passively over time! 👍

Enjoy :)

Congratulations @nftea.gallery! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2250 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!