For most of the last year, Russia's currency, the ruble, has fared better than expected. Having collapsed to a historic low of 140 ruble per dollar in the immediate aftermath of the invasion, it then recovered to a high of 56 per dollar in April before stabilizing at about 60 per ruble for most of the last year. However, in the past few months the ruble has started steadily declining falling to 70 ruble per dollar in February then 80 in April before reaching an eight year low of nearly 95 per dollar this week after Wagner's attempted coup. So in this article, we're going to have a look at what's happened to the ruble recently, why it's declined, and what this might mean for both Russia's economy and the war in Ukraine.

Before we get into its recent decline let's start with a bit of context. When sanctions were first introduced in Russia in the immediate aftermath of Putin's invasion of Ukraine many analysts expected them to cripple the Russian economy. After all, these sanctions were unprecedented. They included freezing Russian central bank assets, expelling a shot of Russian banks from Swift and individual sanctions on Russian elite and even Putin himself. In the first few weeks, Russia's economy looked precariously close to collapse. The Russian Central Bank was forced to more than double interest rates. Russia closed its stock market indefinitely and Russia's currency the ruble collapsed to an all time low of 140 per dollar. However unfortunately for the West the Russian economy and the ruble actually fared better than expected. That's not to say they did well according to official data the Russian economy still shrunk by over 2 % last year and that number should be taken with a pinch of salt and will have been deceptively inflated by military spending.

Nonetheless, the Russian economy clearly didn't collapse as some Western politicians expected it to and the ruble actually seemed to have recovered. By April of last year it had returned to its prewar level of 70 ruble per dollar, and it actually hit a five year high in early July peaking at about 57 ruble per dollar. The ruble's apparent strength became one of Putin's favorite talking points which he claimed was proof of the futility of the West's sanctions. Now, as I mentioned at the time, this wasn't because people really wanted rubles. Rather it was because Russia's central bank had wisely hiked interest rates from 9.5 % to 20 %, making it more attractive to hold rubles but almost guaranteeing a recession in the real economy and because the Kremlin implemented stringent capital control s to bolster its currency including limiting who could trade rubles on official exchanges, banning foreign investors from selling their Russian investments and requiring exporters to convert 80 % of their foreign exchange reserves into rubble. This then essentially became 100 % when Russia started requiring European oil and gas importers to pay for their hydrocarbons in rubble.

The point I am making is that the rubble's appreciation last year was ultimately down to two things clever central banking and the massive demand for oil and gas which both peaked in the immediate aftermath of Putin's invasion. This provided Russia with copious amounts of foreign currency which they could then use to defend the ruble. However in the past few months or so the ruble has experienced a steady decline which accelerated late last month. By January, the ruble had returned from its high of about 56 per dollar to its prewar level of about 70 ruble per dollar. In the months since though the ruble has continued to decline reaching 80 ruble per dollar in April and then slipping to a new low of nearly 95 ruble per dollar this week. The ruble has become one of the worst performing currencies in 2023 slipping 21% in the past few months. As I see it there were at least three reasons for this decline.

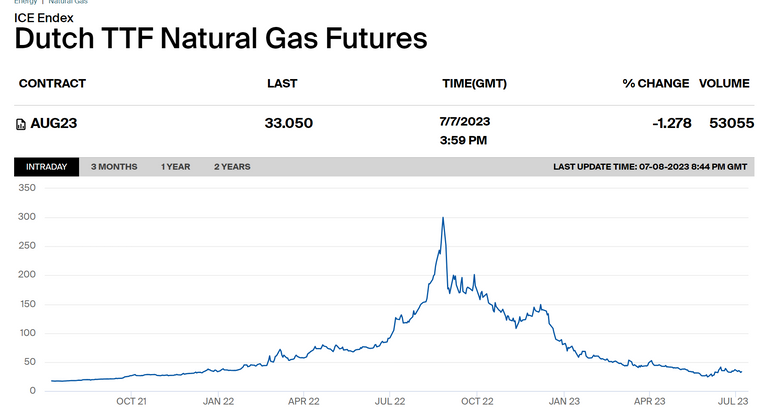

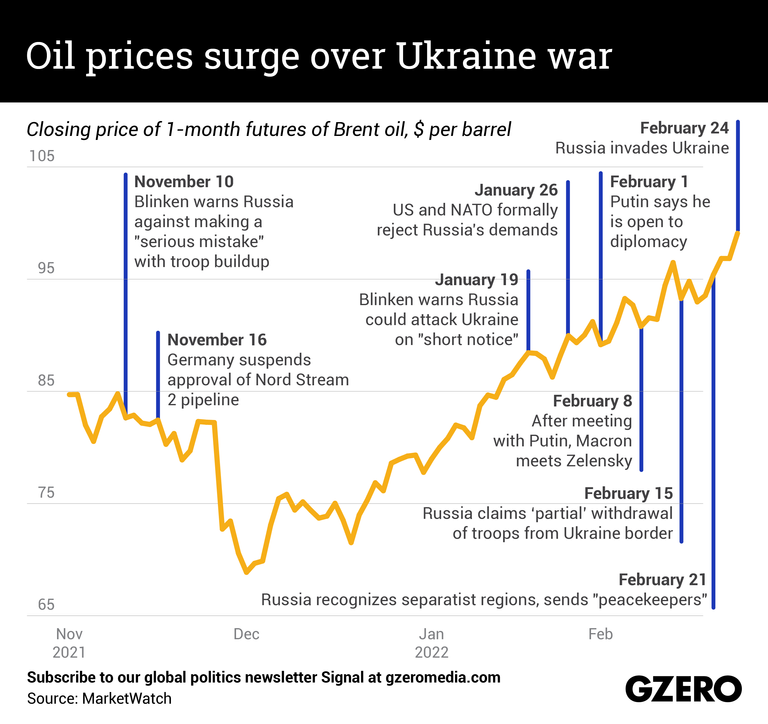

First, the waning impact of Russia's clever monetary policies. The measures that the central bank implemented at the beginning of this year were only ever going to be temporary. Capital controls became less effective over time as people and businesses find ways around them and Russia's central bank has cut rates from 21 % to %7,5 which will have had some effect on the ruble. Second the drop in global hydrocarbon prices. As I mentioned earlier one of the main reasons Russia was able to defend the ruble last year was because it was raking in so much money from its oil and gas exports. In the months following Putin's invasion European gas prices skyrocketed from their prewar average of about €20 per megawatt hour to over €70 in March, before reaching an all time peak of over €300 in late August. Similarly oil prices jumped from about $80 per barrel at the start of the year to an eight year high of about $120 per barrel in the days after Putin's invasion and stayed above $100 for the next few months. However in the past few months, oil and gas prices have declined. European gas futures are now trading at around €35 per megawatt hour which is above the prewar average but well below what it was last year. And oil is trading at about $75 per barrel. Russia is also selling its oil at roughly 20% discount at the moment in part because of the G7's oil price cap introduced late last year. Obviously this drop in oil and gas prices means less hydrocarbon revenues for the Kremlin which means less foreign currency reserves to prop up the ruble.

Third, Wagner's attempted coup. The ruble has been steadily declining since January, but the rate of decline really accelerated after the Wagner Group's attempted coup. The day before Wagner's coup, the ruble was trading at around 81 ruble to the dollar but the day after it was already down to about 85 and it then rapidly slipped to a 15 month low of 94.5 ruble to the dollar in the early hours of Thursday morning. Clearly Russia's domestic political crisis has spooked the market and pushed down the ruble. So what does all this mean? Well, it's obviously not good news for the Kremlin. While it's unlikely to have a critical impact on Russia's war effort, given that Russia produces most of its arms domestically and has significant reserves saved up for exactly this purpose, a weaker currency does still mean less purchasing power which will make funding Russia's war in Ukraine a bit more difficult. It also runs the risk of stoking inflation which has only just started to come down in Russia and it's another nail in the coffin for the much hyped idea of a Brics currency, which Putin seems particularly keen on at the moment.

Sources:

- https://www.bloomberg.com/news/articles/2023-07-05/mutiny-aftermath-jolts-ruble-as-43-5-billion-outflow-takes-toll#xj4y7vzkg

- https://www.bloomberg.com/news/articles/2023-07-05/mutiny-aftermath-jolts-ruble-as-43-5-billion-outflow-takes-toll#xj4y7vzkg

- https://www.theice.com/products/27996665/Dutch-TTF-Gas-Futures/data?marketId=5586285&span=3

- https://www.statista.com/statistics/276323/monthly-inflation-rate-in-russia/

- https://tradingeconomics.com/commodity/brent-crude-oil

- https://www.gzeromedia.com/the-graphic-truth-oil-prices-surge-over-ukraine-war

- https://www.nytimes.com/2022/02/28/business/russia-sanctions-central-bank-ruble.html

- https://www.ft.com/content/5742c586-e786-4466-b29e-5d96827f45ef

Reblogged! Thank you for the extensive research

Just wait until the sanctions hit..

That's going to take years however it's absolutely going to kill the entire economy of Russia. Personally I think that the world should refuse to remove sanctions until Russia completely disarms all of its nuclear weapons and pledges to only use nuclear power for peace.

The entire world is getting tired of the constant threats of nuclear annihilation.

But honestly enough the Russian ruble is never been worth a lot anyway so the failure of this fiat currency isn't really going to affect the rest of the world much anyway...

It might make baah cry a lot though.