The pandemic lockdowns had massively destructive impacts on the economy, supply chains, and more. I think we are all aware of this. The very dumb policies pushed by governments to pay people to stay home, and to even pay people that didn't stay home with money that the government doesn't have is one of the first major seeds that caused the huge spikes in inflation. Yet they kept doubling down and sending money (they don't have) places which can only increase inflation more.

I know people that get excited about minimum wage, and "free" stuff from the government have no idea how inflation and economies work. They obviously don't understand the long term ramifications of those actions. If they did they would not be cheering for them, protesting for them, etc. They would be saying "No!"

The government cannot give you anything for free. They can steal it from you. Perhaps in the guise of taxes which they like you to think is voluntary yet we know if you didn't pay them they'd seize your property, throw you in jail, and if you resist kill you. It isn't the same as you choosing to voluntarily crowd fund solutions you want to support. The other means they use is to print more fiat money. They don't have money. They'll simply print more. That is actually worse than the taxes.

That is FAR worse than the taxes. Taxes you can plan around. You know how much they are likely going to take. You can set some money aside to deal with it.

The results of their monetary printing though introduce a permanent taxation that you can't very accurately plan for. We call that inflation.

If today I can buy 100 bottles of water with $100. Then inflation kicks in at 6%. That means things will eventually adjust to cost 6% more. Now my $100 can only buy 94 bottles of water. 6 bottles of water of purchasing power was stolen. If you are thinking "So what?" then you need to stop thinking short term. That is permanent. It happens each year. It happens inevitably anytime the government prints more money without first removing the same amount from circulation. It happens when the government offers you "free" or "guaranteed" (aka government backed) things.

Yet it is worse than that...

Your retirement fund sounds good right? Let's say you have $100,000 in retirement set aside. Let's say that can purchase 100,000 bottles of water.

Let's say that retirement increases by 5% per year which would be pretty good.

A year later you have $105,000 in retirement. The number is going up! That's good. Right? Nope.

Now if the inflation is going up 6% (it's actually been worse than that lately) then you could effectively purchase 99,056 bottles of water with that now larger number. That means your purchasing power of your retirement funds actually decreased by over 900 bottles in that same year.

The insidious thing about inflation is people don't truly seem to understand it. They see their savings accounts increasing and look at it like a scoreboard. Yet the reality is unless your savings is increasing faster than inflation your savings is actually being robbed.

The only things that protect from inflation are purchasing things that increase in value as inflation increases. Things that retain their value.

Yet the "politicians", oligarchs, and dictators simply will introduce new taxes so they can demand some of that gain in value. You may have actually just remained the same in relation to inflation but they will call it a gain and will tax it.

Theft...

Inflation is the worst.

Taxation that is not truly voluntary is not much better it's just easier to predict.

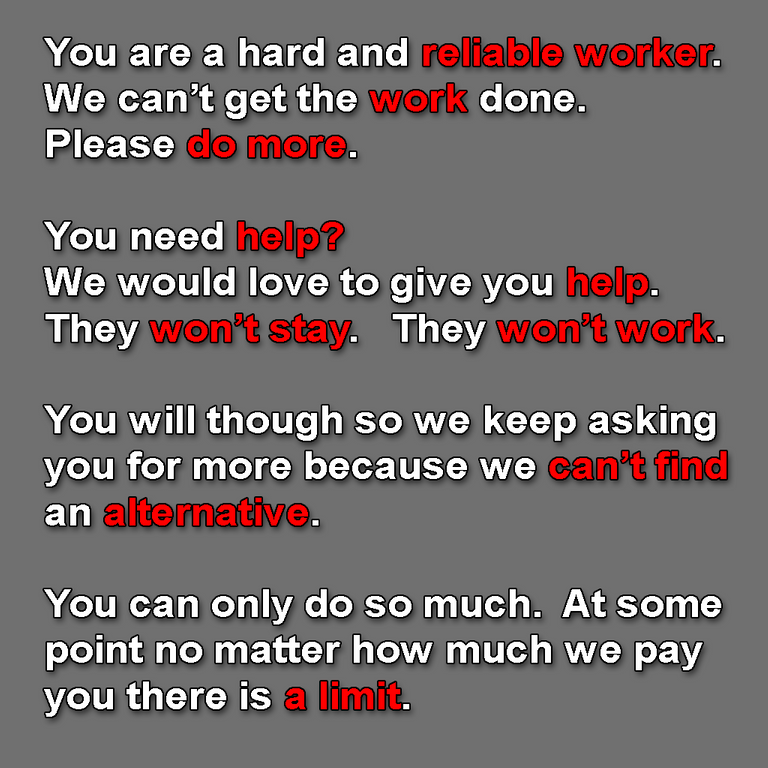

Now the challenge today post lockdown is to find people willing to work. Even if the wage is pretty good it is still a challenge.

Those with good work effort that show up and work hard will find themselves increasingly piled on as they are expected to pick up the slack of the Post-Lockdown employees.

It seems to be a problem all over the place.

You'd think with the influx of illegal immigrants that there would be no jobs. There are a lot of jobs, just not people that actually will work them.

Furthermore, wages increase. Yet perhaps the people picking up the slack don't have their wages increased to reflect the extra work they are doing so eventually they leave.

This leaves businesses short on good workers, and also deprived of experience as the over burdened experienced workers leave to get better wages.

Inflation makes the demand for better wages become more a thing.

Wages increase.

Items / Services costs increase.

Inflation fueled not just by the printing of money but by the vicious cycle it began. Will our economy immolate itself?

EDIT: This year the company I work for finally got a 401K program. I had a window to sign up for it. I looked at the percentage of growth expected in various areas and decided not to do it. In my case it might have still been worth doing it as my company will match I think up to 5% of my wages. So if I put 5% into a 401K it actually would be 10%. That is 100% increase and does beat inflation.

The problem and why I ultimately opted not to is that the banks, the economy, and the world are in a state that putting the money out there that I'll EVENTUALLY be able to use seems not that safe. I am not much of a gambler. I figure I can keep my 5% and invest it into improving my property, and doing things like that and at least that is something I hopefully can count on.

It is a good thing that you explained a bit of how inflation steals from savings. However, just like the magic of compound interest, inflation magically compounds too. I realize that the math of compounding becomes complex, and that makes it difficult to express, but as inflation compounds over multiple years, that compounding really hits hard, and increases the rate of increase of theft, and people don't understand this.

Perhaps many people simply cannot understand it, and that's fine. As long as they understand the basic principle, that inflation steals from them the wealth they can save, they will oppose it, and that is what we can hope for, realistically.

Thanks!

They use the terms "cost/price" and "value" interchangably. They are not the same. A good example is gold. The value of gold is $35 (the gold standard). The cost is $2000. The $1965 difference is inflation, it reflects how many inflated dollars it takes to buy a $35 ounce of gold.

The aim is to crash the economy and these tactics are working brilliantly. But most people are way too stupid to grasp any of this.

It's all about the debt-based economy

Congratulations @dwinblood! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 62000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: