https://www.usinflationcalculator.com/

https://www.usinflationcalculator.com/

GOVERNMENTS will use any CRISIS, whether "real" or "imagined" to erode INDIVIDUAL RIGHTS AND PERSONAL FREEDOMS.

Perhaps you're aware that when the "income tax" was expanded from a 1% tax on the top 1% of citizens in the united states, it was promised to be TEMPORARY ?

It was a TEMPORARY tax increase in order to address a CRISIS.

The history of income tax in America is an unusual one. The first federal income tax was created in 1861 during the Civil War as a mechanism to finance the war effort. In addition, Congress passed the Internal Revenue Act in 1862 which created the Bureau of Internal Revenue, a predecessor to the modern day IRS. The Bureau of Internal Revenue placed excise taxes on everything from tobacco to jewelry. Following the end of the Civil War, the income tax did not have substantial support and was repealed in 1872. **

On October 3, 1917, six months after the United States declared war on Germany and began its participation in the First World War, the U.S. Congress passes the War Revenue Act, increasing income taxes to unprecedented levels in order to raise more money for the war effort.

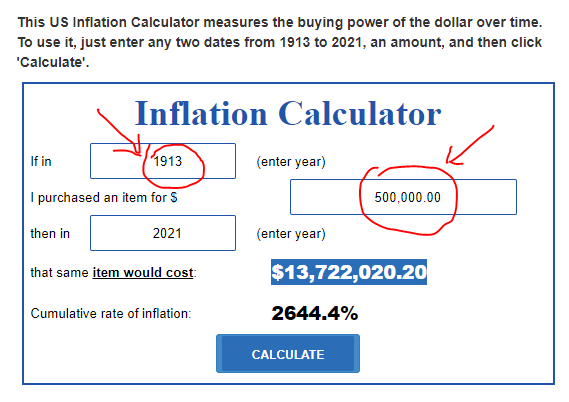

The 16th Amendment, which gave Congress the power to levy an income tax, became part of the Constitution in 1913; in October of that year, a new income tax law introduced a graduated tax system, with rates starting at 1 percent and rising to 7 percent for taxpayers with income above $500,000 ($13,722,020.20 in today's dollars, accounting for inflation). Though less than 1 percent of the population paid income tax at the time, the amendment marked an important shift, as before most citizens had carried on their economic affairs without government knowledge. In an attempt to assuage fears of excessive government intervention into private financial affairs, Congress added a clause in 1916 requiring that all information from tax returns be kept confidential. **

tag @oldoneeye