Greetings friends!

It is often said that Warren Buffett, the renowned investor, once remarked that he pays less taxes than his secretary. I don’t know whether it was truly said by him or not, but it points towards a harsh reality of our economic system. This statement highlights the truth that the ultra-wealthy often pay a smaller percentage of their income in taxes compared to the average salaried persons. This isn't just a flaw in the system—it's a feature of a system deliberately designed to benefit the rich at the expense of the working class.

The wealthy have numerous legal ways to reduce their tax burden. Governments around the world provide them with almost free access to land, resources, and favorable loans to encourage the creation of businesses. In countries like India, tax holidays are often offered to attract industrialists. Once a factory or company is established, it enjoys various privileges, such as tax rebates on land purchases or leases, free or subsidized electricity, and other financial incentives.

For the average taxpayer, taxes are imposed on their gross income, meaning they must live on whatever remains after paying income tax and other direct taxes. After the leftover, they have to pay indirect taxes as well. In contrast, companies calculate their income only after deducting all business-related expenses. They also benefit from depreciation, which reduces their taxable income. When a salaried individual buys a car, they pay taxes on that purchase, but a company can claim depreciation on the same purchase, thereby lowering its tax liability. The system allows businesses to use the depreciation of assets to reduce their taxes—an advantage that ordinary wage earners can never enjoy.

If an individual takes out a loan to buy a car, he cannot claim a tax deduction based on the interest payments to reduce his taxable income. However, companies can deduct loan interest payments, further reducing their tax burden. Additionally, businesses typically secure loans at lower interest rates, while individuals face higher rates and harsher consequences if they default. In extreme cases, when large companies are unable to repay their loans, they often receive bailout packages. So the reality is: if you owe the bank 100,000 rupees, it’s your problem; if you owe the bank 1 billion rupees, it’s the bank’s problem.

The wealthy often conduct personal expenditures under the guise of business expenses. Hotel stays, travel, housing, and even foreign vacations are all often paid for by their companies, which then deduct these costs as business expenses to reduce their taxable income.

These are the legal methods used by the rich to minimize their taxes. But beyond that, there are countless ways in which they evade taxes, stepping into illegal territory. The rich influence governments, shape policies, and ensure that the system serves their interests. This is why you rarely see a billionaire topping the list of the highest taxpayers. Meanwhile, those with lower incomes are burdened by indirect taxes, even if they don't pay direct taxes.

The middle class, particularly salaried employees, bear the brunt of the tax burden. Between direct and indirect taxes, they may end up paying between 60-80% of their income in taxes. They work harder to increase their earnings, only to see much of that income diminished by heavy taxation. This dynamic traps the middle class in a rat race—they work relentlessly, unable to save much, so they work harder, pays more taxes and so on. This is the unfortunate reality of our global economic system. Despite of this, many middle class salaried person thinks that this is the best system in the world.

Thank you!

🎉 Upvoted 🎉

👏 Keep Up the good work on Hive ♦️ 👏

❤️ @bhattg suggested sagarkothari88 to upvote your post ❤️

Thank you so much! I am glad to receive an upvote from you.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @akdx, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.View or trade

BEER.Hey @akdx, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thank u @indiaunited and @bhattg

welcome

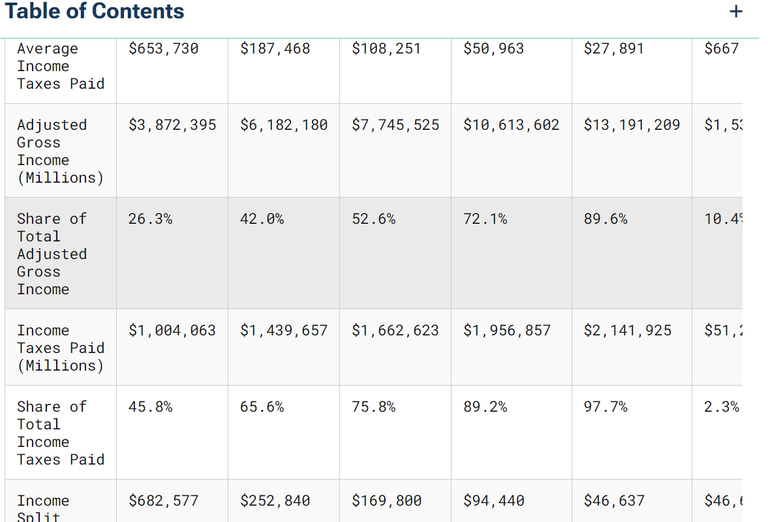

Info from taxfoundation.org would seem to contradict this, at least to some degree:

The average income tax rate in 2020 was 13.6 percent. The top 1 percent of taxpayers paid a 25.99 percent average rate, more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers.

The top 1 percent’s share of federal income taxes paid rose from 38.8 percent to 42.3 percent in 2023.

The top 50 percent of all taxpayers paid 97.7 percent of all federal individual income taxes, while the bottom 50 percent paid the remaining 2.3 percent.

Rich have various methods to save taxes. Top 1% rich have more than 50 percent of wealth in their hands but their contribution is still low compared to their wealth.

Their share is still lower than others.