The indicator of the Bitcoin Hash Rate is marking us if we compare it with the Hash Ribbons

What is the Indador Hash Ribbons?

The Hash Ribbon indicator has reflected the mining capitulations that have occurred in Bitcoin indicating good Bitcoin purchase points

Today we will compare this indicator with the Bitcoin hash rate has regressed and it could already be marking a possible mining capitulation in the coming days. Why?

Let's see

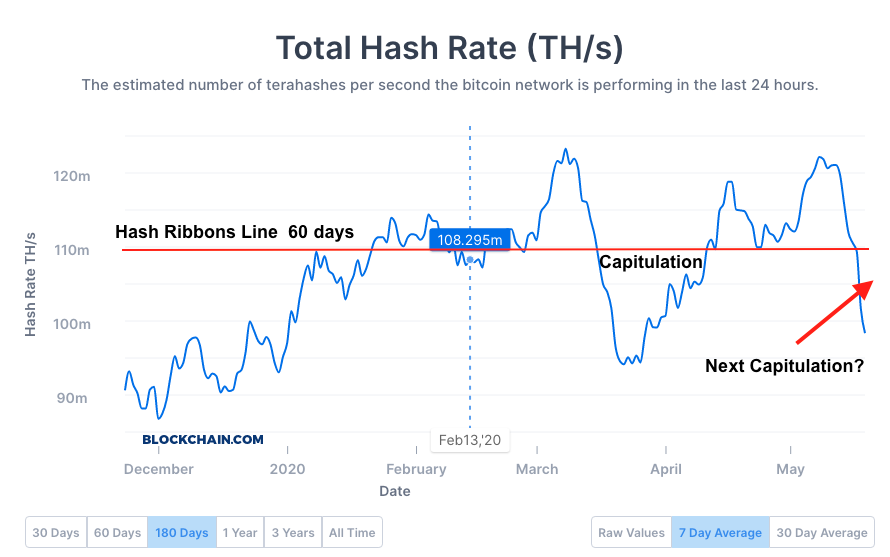

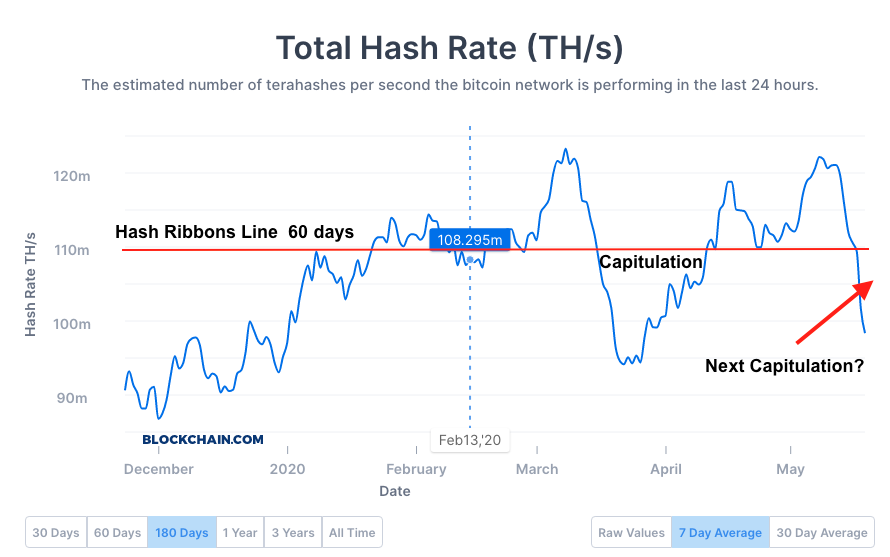

graphic source: https://www.blockchain.com/en/charts/hash-rate

Before starting it took me several hours to do this whole post, so please like it with your vote. Thank you.

A little knowledge before

After the Negative Difficulty Adjustment, there have been drops in the price of Bitcoin in the history of Bitcoin.

As we saw in the previous post, the generally negative adjustments in the difficulty of bitcoin have caused a drop in the price of bitcoin in the following days. Why? We must first see that the difficulty of Bitcoin

Bitcoin difficulty

Bitcoin’s difficulty is designed to adjust every 2016 blocks - or approximately every two weeks. This adjustment is based on changes in the network’s hashrate, and occurs regularly in an attempt to ensure that the network continues to solve new blocks at a rate of one every 10 minutes.

If the hashrate during the past two weeks has gone up, the difficulty will go up as well, making mining more challenging. If the hashrate has dropped, the difficulty level will decrease, making blocks easier to solve.

When there are significant negative changes in network difficulty, it indicates that the bearish cycle may be about to start

Why does the bearish cycle occur as a result of a decrease in hash difficulty?

This was analyzed in the previous post I leave you the link

Bitcoin (BTC / USD) Price correction? - ONE DAY - Difficulty adjustment

Graphics source:https://btc.com/stats/diff

Current situation

As we see in the graph, the decrease in the hash was -6% was relevant, it could indicate the beginning of a new post-halving mining capitulation

Let's see the Hash Rate Graph

Price corrections are not immediate, sometimes occurring days after a significant decrease in the hash

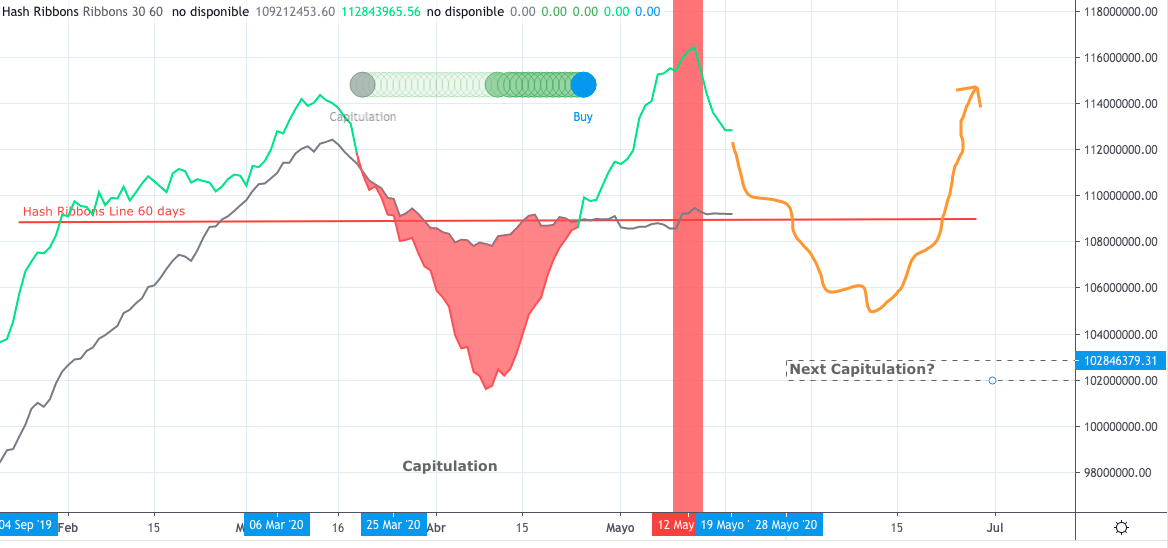

Hash Ribons chart

If we compare the graphs we have to take into account

The Hash Ribons Graph are average lines of the hash rate of the 30 and 60 days, which means that they reflect the movement after it occurs.

The hash rate graph is on a weekly average

If we compare the graphs at levels of 108HR Th / s, which is the value of the 60-day average line of Hash Ribons, we see that the graph of the hash rate is already marking the future mining capitulation that if stable prices should remain in the next days or weeks depending on the value of Bitcoin.

Bitcoin price could go back and anticipate mining capitulation or rise and avoid it

What you think?

Remember to give your post a vote, Always support good content. Thanks

Follow me it costs you nothing and you get a Healing Reward with Your Vote

Leave your comment or your vote. Your opinion and participation is important

Protect your assets use Stop loss

The alcoins market is very dependent on the price of Bitcoin, when Bitcoins goes up the alcoins go up more, but also in the other sense, so I suggest that you periodically review a Bitcoin and use stop loss and move it when they are already in profit. Do not let a profit become a loss.

We will continue monitoring

To be attentive

Protect your Investments

If the analysis helped you, give your vote with some hive, thanks !!

Lately I have noticed that there is no good analysis on hive, everything takes time, I ask that as you read them leave your vote, it is a way to encourage you to continue making more reports, thanks.

Feel free to use and share my post or graphics, but please mention, @criptoar as the author. Otherwise, consider plagiarism and I will call you and advise my friends to do the same.

READ DISCLAIMER: this publication / analysis is only for general information purposes. I am not a professional trader and I will never be a financial advisor. The material in this publication does not constitute any trading advice of any kind. This is the way I see the paintings and what my ideas are.

Perform your own analysis before making an investment decision. Use money that you are willing to lose if you make an investment.

If you make exchanges or investments after reading this publication, it is entirely at your own risk. I am not responsible for any of your gains or losses. By reading this publication, you acknowledge and agree that you will never hold me liable for any of your profits or losses.

For your vote or comment, thank you

Or else Buy me a beer ! Ligthing Network

Vote for the post.

Always support good content.

Follow me it costs you nothing and you get a Healing Reward with Your Vote

I learned one valueable lesson from that incident. A hash rate decline signals an alarming security risk to the network itself. If hash rate goes down significantly, the price will surely follow the trail.

This link can help you

Bitcoin (BTC / USD) Price correction? - ONE DAY - Difficulty adjustment

Thank you for providing your comment.

Fully upvoted and reblogged.

Very good post and definitely something to look at.

You should look at this post to give your view : https://peakd.com/hive-126009/@vlemon/why-bitcoin-will-be-crowned-the-global-reserve-currency

Sincerely,

@hodlcommunity

I already commented your post promises to be interesting

It made me remember your post to a question I had the other day

They asked me what I thought about the price of Bitcoin in a post I made about adjusting the difficulty and the relationship with the price.

Link in case you are interested

It made me remember why inflation is everywhere.

Thought

They are positive and negative data that make an upward trend uncertain.

Congratulations @criptoar! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPHi mate, thank you for your work,

Just one observation here. Afaik the accepted narrative is that the mid-March drop was mostly triggered by large players liquidating their Bitcoin position during the COVID panic to hedge against the risk of an economic slowdown. Here, you seem to suggest that the dump was triggered by a hash rate event.

Why would miners decide to dump their coins 2 month before a bullish event like the halving, it doesn't make a lot of sense to me but I'll be happy to discuss that.

In the first mining capitulation of 2020 we saw as a first a drop in price and causes a Mining Capitulation

Now we are seeing that Halving by reducing profit causes another drop in the hash rate, (miners shutting down equipment due to decreased profits). That it will produce a new Mining Capitulation indicated by the Hash Riboons.

This is indicated by the decrease in the hash rate, if the price remains below $ 12,000 approx.

The indicator of the Capitulation Mining Hash Ribons which is an indicated that can indicate good points of purchase of Bitcoin works with average lines of 30 and 60 days of Hash rate and gives a date after the event. It does not give the best point of purchase as you can see in the graph.

Thanks for your comment

Oh gotcha, you're saying that the March drop in price triggered a "miners capitulation" and that a second "capitulation" is underway as a consequence of the halving until difficulty adjusts down.

So, we're about 5-ish days away from a difficulty adjustment down now and the price hasn't tanked, how would you explain that and do you think that a capitulation is still in the cards?

The Hash Ribbons indicator does not yet reflect the capitulation because it works with average lines of 30 and 60 days as I already mentioned. The middle lines are averages of values. Being averages they show a trend displaced in time

Thanks for your comment

Ok, so what % drop from current price would need to happen to make you feel like a difficulty-related capitulation has happened?

What I am trying to say is that it's already been 11 days since the halving and we haven't seen either:

1/ a significant drop in difficulty

2/ a significant drop in price

so I am wondering how your framework account from that and why you think a hash-rate related miner capitulation is more likely now (5 days before Bitcoin will automatically adjust difficulty down) than it was at the moment of the halving or before the halving.

Not trying to trick you here, just challenging your assumptions so we can get closer to the truth ;)

The hash rate has already decreased after halving look at the graph and how much can the price come down for this new mining capitulation, nobody knows, I do not make futurology.

For now the hash rate indicates that the Hash Ribbons would produce a new mining capitulation at these prices

the true price you will know after it happened

Yeah, there's been a decrease in hash-rate but it's really not that significant if you look at a longer time-frame, we're basically back to January 2020 levels

Plus we're up 7% in price since the halving and, again there will be a difficulty adjustment down in few days

so yeah, we'll see if it happens or not...