Today I analyze the cost of mining bitcoin at current prices

Veamos

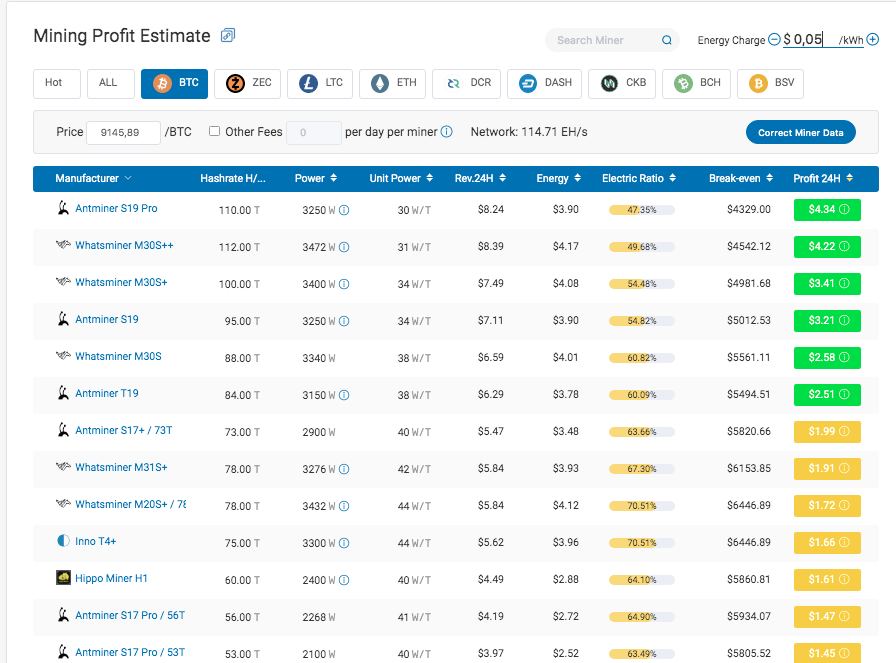

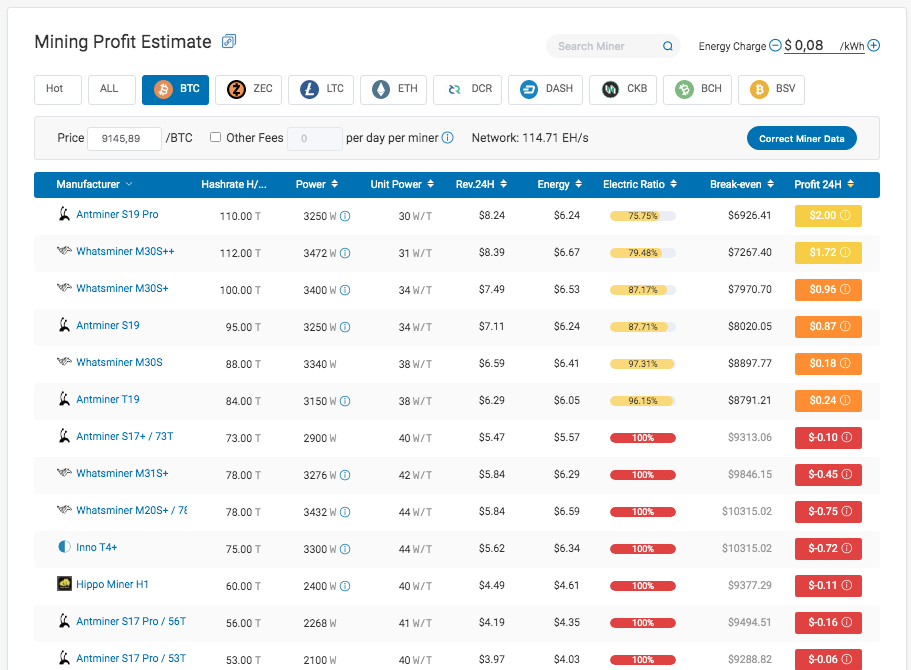

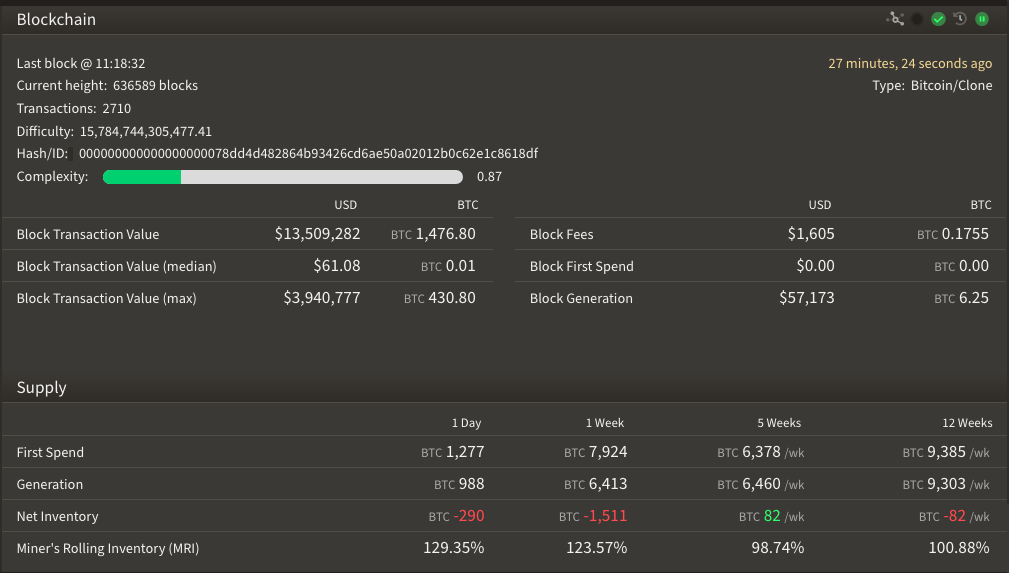

As we see on the page these are the costs of mining Bitcoin currently.

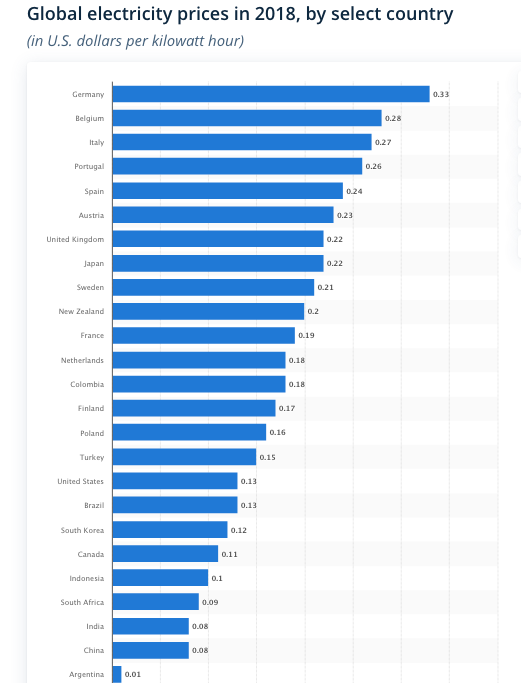

These are the electricity costs for the year 2018

Graphic 2018

Source: https://www.statista.com/statistics/263492/electricity-prices-in-selected-countries/

I have found this page with the update has 2019 but the values are the same or similar and describe more countries

Source: https://www.globalpetrolprices.com/electricity_prices/

The cost of electricity must be adjusted to an average. We have from $ 0.33 per kWs from Germany to $ 0.08 from China. We will take the value of China's electricity as it concentrates resources and low prices.

Mining team earnings page

Source: https://www.poolin.com/

If we adjust the price of KWs to the value of China $ 0.08, this is the profit per team. (At higher values more negative to mine Bitcoin, try to put higher values on the page)

There are provinces in China that in rainy seasons electricity can be obtained for $ 0.03, but in general they are for a few months, or until the rules change. So these values are for short periods.

source:

"Sichuan’s mountainous region, cheap electricity, access to competent workers, and naturally cool climate makes it a hotbed for Bitcoin and cryptocurrency miners. Branch offices of mining giants Bitmain and AntPool are located in the region, with others.

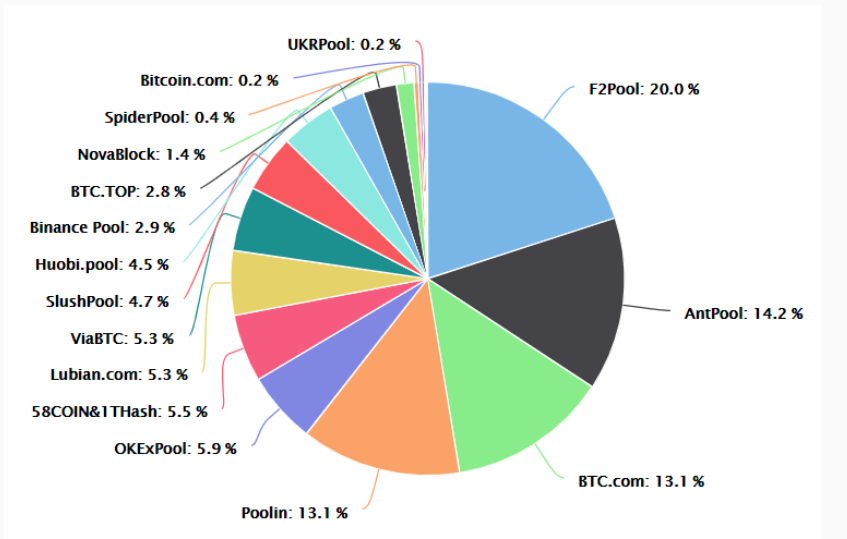

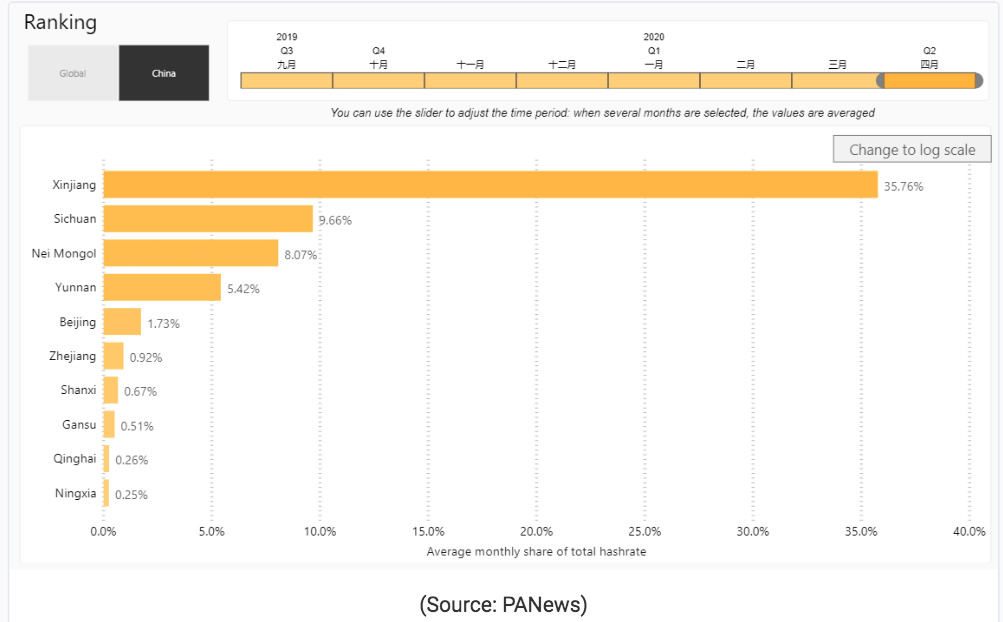

Interestingly, 9.66 percent of all Bitcoin hash rate is generated from the region, if the tweet is considered. A look at BTC.com’s mining page confirms the claim. Six of the top ten miners are located in China, with some presumably in Sichuan: "

"Data from China is notoriously difficult to get. Still, with the help of multiple reports, projections can help to predict what the new Sichuan directive could mean for Bitcoin.

PANews, an Asia-focussed blockchain research firm, cited the below in a tweet: "

"Xinjiang, in Northwest China, comes out on top. The province is a vast region of deserts and mountainous land and provides an optimal zone for miners. 35 percent of the Bitcoin hash rate seems to originate from the region.

Cities like Beijing and Zhejiang also make an appearance on the list. Electricity and labor are both expensive in the two regions, as reflected on their low overall hashrate share.

However, Sichuan’s omission won’t necessarily mean miners in the U.S. or Europe can now increase their share. Xinjiang, Mongolia, and Yunnan are plush with Sichuan-like conditions.

Technical know-how, low cost of labor, and sheer dominance in the mining space are all factors contributing to China’s prominence in the mining space, and may not be easily superseded.

Besides, the country is pushing for blockchain regulation, investment, research, and even infrastructure. This, presumably, means cryptocurrencies may be subject to similar regulation and state-backed policies.

Meanwhile, China continues to move ahead with its digital currency project, which as per a CryptoSlate analysis, might be bigger than previously imagined. "

part of source article: https://cryptoslate.com/ author:Shaurya Malwa

Today Bitcoin price

As we see in the Bitcoin chart at $ 9,145.89, there are few mining teams that are making a profit of $ 0.08 per KWs.

Bitcoin sale by miners

Massive Bitcoin sale by Miners

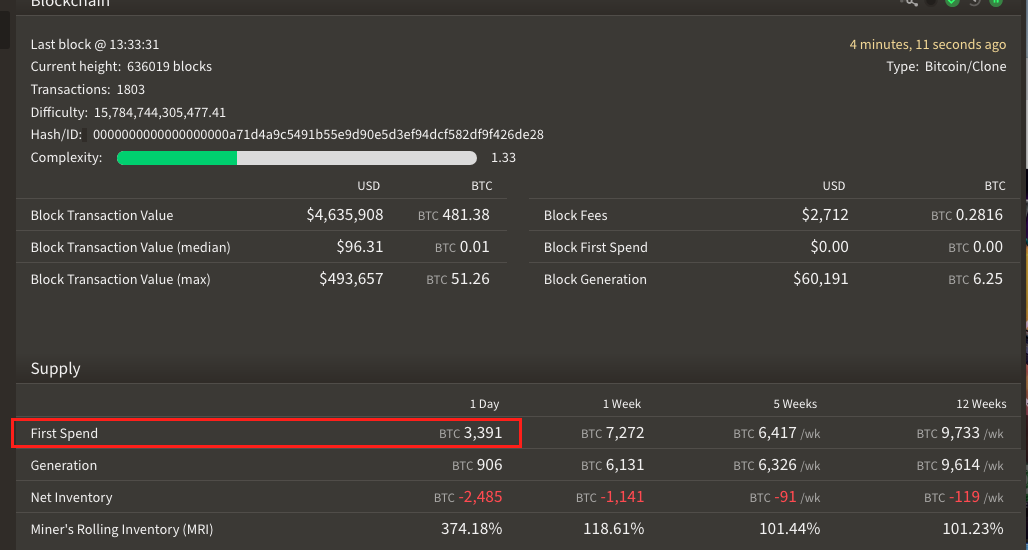

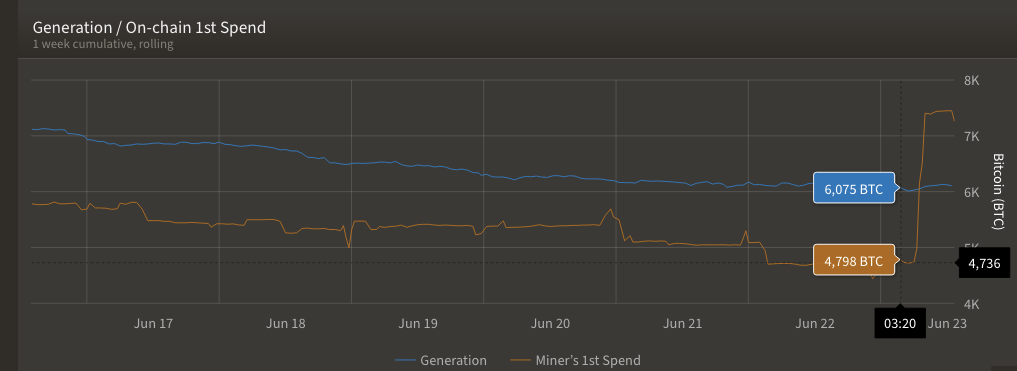

As we see few days ago they are selling 3391 bitcoin.

On average they were selling 4800 bitcoin weekly, so few days ago, they are selling 70% of the total that they sold in the previous week.

As we saw this week there were sales by the miners plus bitcoin of the 900 bitcoin that are normally mined per day

Why would the miners sell bitcoin at current prices if profits are minimal?

Today we see it again

I have only one answer.

We are in a mining war, where new mining investors are putting pressure on the other mining pools to give up on continuing to mine bitcoin.

Muy buen post de mineria de Bitcoin