Hi investors, what a week it has been in crypto!

In this edition we'll recap the latest in Bitcoin, Ethereum and Bitcoin on Ethereum. I will share my thoughts on Modern Monetary Theory (MMT) and we'll touch on the latest ETH Twitter drama.

This is going to be a fun one.

Let's dive in!

Bitcoin.

Bitcoin is looking very bullish. BTC is trading on spot at $11,775 USD at the time of writing. We're down 0.43% since last week against the USD (up 62.95% YtD) and 18% against gold.

Source : XE

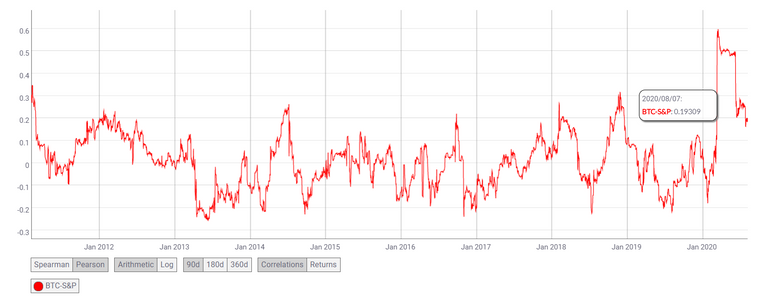

After reaching ATH around March, BTC's correlation to the stock market is trending back down to 0 which is definitely a relief.

I believe the spike in positive correlation was initially due to general de-risking across crypto and equity markets at the onset of the COVID crisis. Correlation then persisted as US day traders started risking their PPP checks in crypto and the stock market.

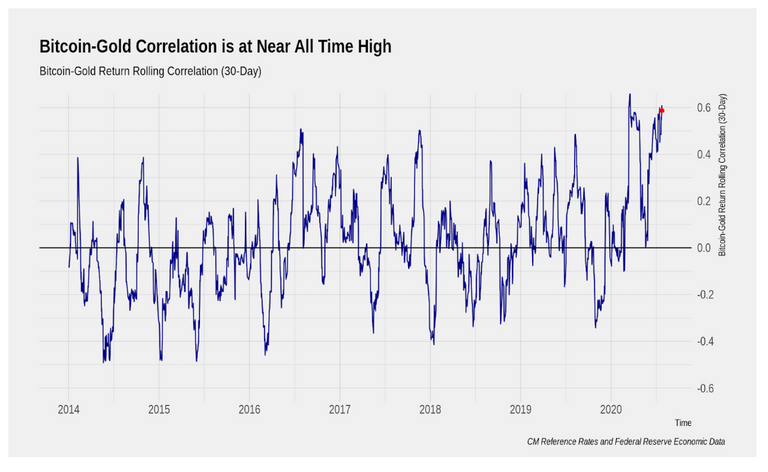

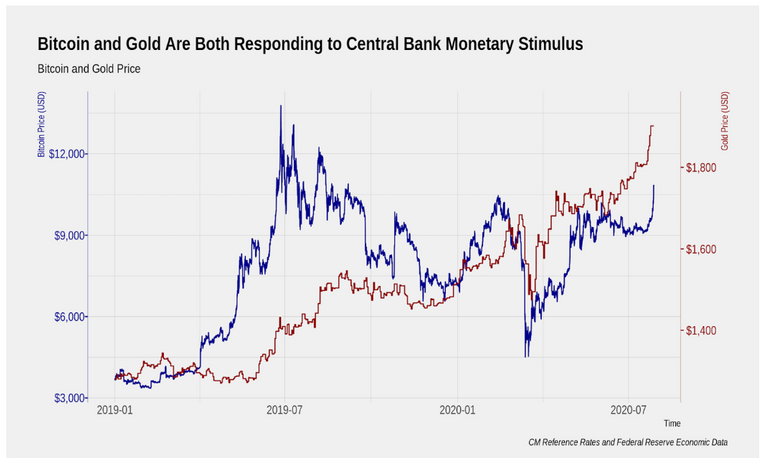

As CoinMetrics pointed out in the latest issue of their State of the Network newsletter, Bitcoin is now de-coupling from equity to near ATH correlation with gold. This is a happy development which strengthens the digital gold narrative and the role of Bitcoin as a macro-hedge.

Source: CoinMetrics

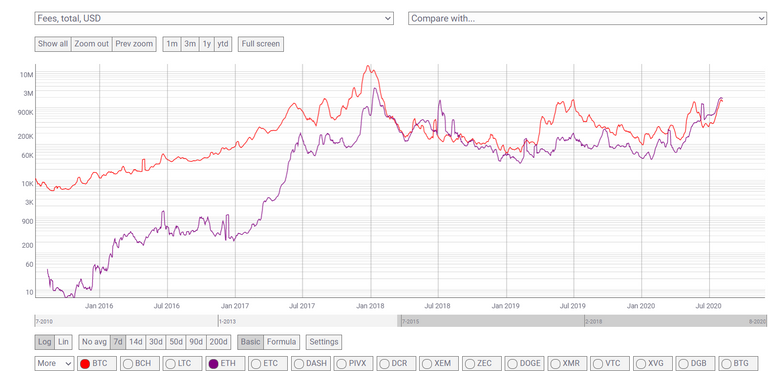

This bull market is also injecting some life into Bitcoin's block space market which has started making higher lows again but is comparatively losing momentum against Ethereum's (purple line).

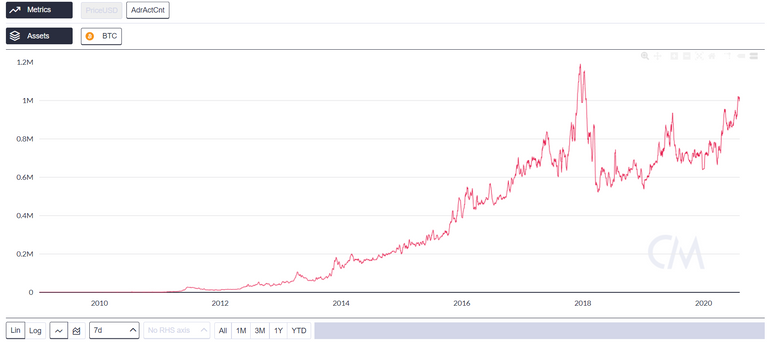

This higher demand for block space is driving up the creation of new UTXO (Bitcoin addresses) which is now nearing ATH levels.

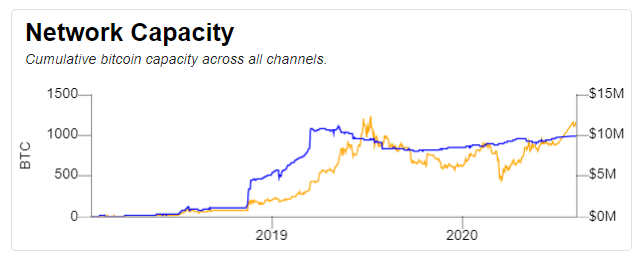

On point of concern is the stagnation of L2 DeFi solutions on Bitcoin. With DeFi on Ethereum sucking up all the liquidity and attention, Bitcoin's Lightning Network is comparatively vegetating as per total Bitcoin locked in (blue line). Current value is floating around 990 Bitcoins which is roughly equivalent to 0.005% of BTC supply.

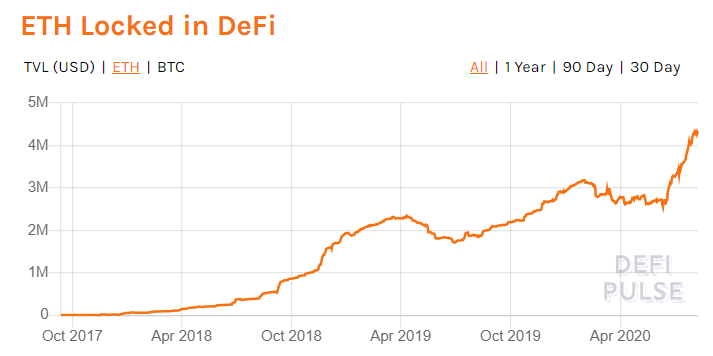

Compare that with roughly 3.8% of the total supply of ETH locked into DeFi (Ethereum) protocols:

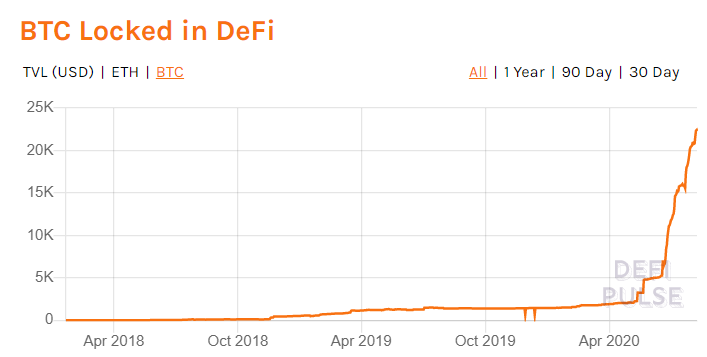

And 22.3k BTC being locked into DeFi (Ethereum):

The reason for this growth of course being the search for yield. For reference, WBTC (BitGo's custodial Wrapped BTC) currently offers over 3.5% APR on Compound.

Macro.

The macro story is that of the financialization of Bitcoin.

Derivatives markets are exploding in volume/value. In a Q2 report Digital Currency Group's Genesis subsidiary reported a staggering $400 million USD of derivatives volume (mainly options) traded since June.

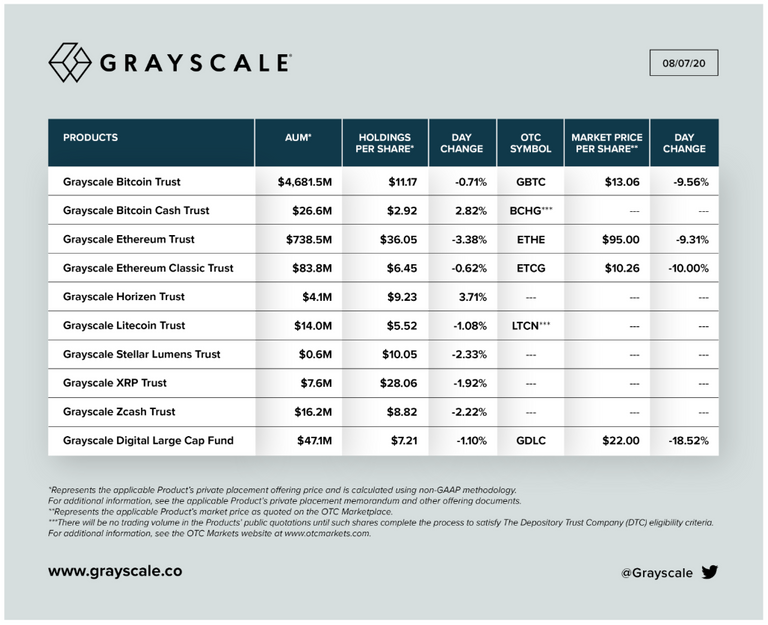

Furthermore, institutional interest for Bitcoin (and Ethereum) is soaring with Grayscale reporting a record 80% Q1 to Q2 capital increase into its investment products.

This comes on the heels of extremely bullish news from the US where chartered banks are now allowed to custody crypto assets (themselves or via sub-custodians) for their customers.

Although financialization will lead to risks of dilution and rehypothecation of crypto assets (which I explored last week ), it is also a great opportunity for Bitcoin to go mainstream and becoming the world's hedge against great monetary inflation.

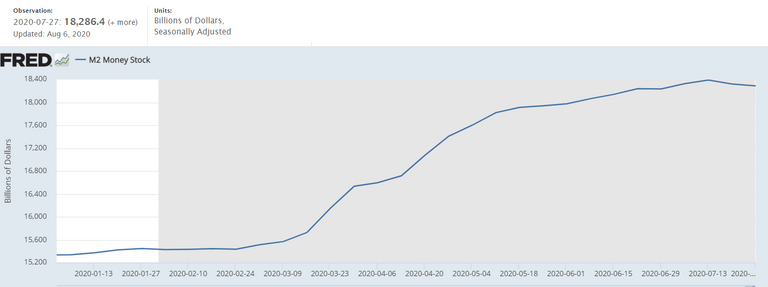

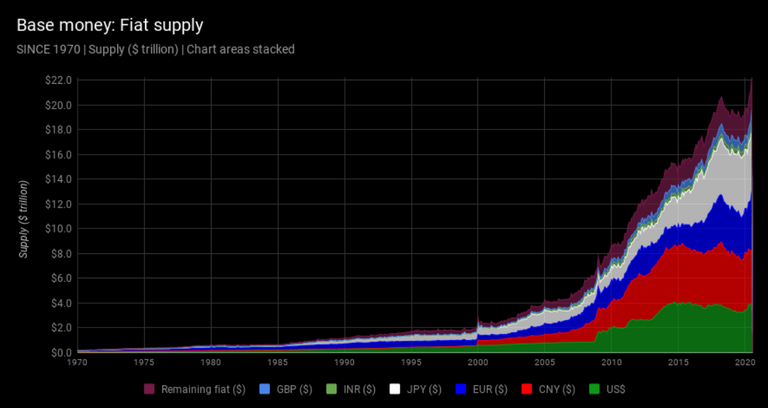

There are indeed serious reasons to be alarmed. The use of unconstrained money creation to steer the economy has gone mainstream in the mind of governments under the guise of Modern Monetary Theory (MMT).

In a very revealing (and NYT Best Seller!) book titled "The Deficit Myth", senior economist and government insider Stephanie Kelton vaunts the merits of QE as a tool for Central Banks to govern any economy.

In the book Kelton explains that, unlike your typical household, a sovereign government (in this case the US federal government) doesn't need to earn before it can spend. Hence, unconstrained monetary creation (QE) is justified as a way to reach optimal employment as long as inflation is kept under control.

The message of the book is clear. QE is now part of Central Banks' tool kit and these won't stop this monetary experiment unless obvious signs of currency devaluation and inflation start manifesting.

The system is quite perverse. It's a fact that we haven't yet seen majors signs of inflation (except in education) nor dollar devaluation. However QE strikes me as being uniquely conductive of political instability because it undermines the moral case for paying taxes and working to earn cash-denominate wages.

QE is nihilistic because it sends the message that your money, and thus your work, is worthless and can be conjured out of thin air while it hugely benefits those closest to the money spigot (the so-called Cantillon insiders).

Let's now look at Ethereum.

Ethereum.

ETH is looking very healthy. The asset is trading on spot at $390 USD at the time of writing and we're up +1.18% since last week and an eye-popping +199.48% YtD.

ETH continues gaining against BTC after double-bottoming in 2019:

Good news also came from the institutional side with Grayscale announcing that Grayscale Ethereum Trust has Filed a Form 10 with the SEC. This filing would narrow the window on the maturation of the Ethereum Investment Trust down to 6 months.

As Matt Walsh (Castle Island Venture) points out, being registered with the SEC will allow a broader range of institutional players to get exposure to Grayscale's ETH investment vehicle (since some institutions can only invest in SEC registered financial products) which is very bullish for the underlying asset (ETH).

Finally, this week saw an interesting debate on Twitter around the total supply of Ethereum.

In Bitcoin, auditing supply is trivial as it takes only a simple script that can be run against a node.

{

assert(!outputs.empty());

ss << hash;

ss << VARINT(outputs.begin()->second.nHeight * 2 + outputs.begin()->second.fCoinBase ? 1u : 0u);

stats.nTransactions++;

for (const auto& output : outputs) {

ss << VARINT(output.first + 1);

ss << output.second.out.scriptPubKey;

ss << VARINT_MODE(output.second.out.nValue, VarIntMode::NONNEGATIVE_SIGNED);

stats.nTransactionOutputs++;

stats.nTotalAmount += output.second.out.nValue;

stats.nBogoSize += GetBogoSize(output.second.out.scriptPubKey);

}

ss << VARINT(0u);

}

In Ethereum though the problem is apparently not as trivial as different methods of calculations can lead to discrepancies in reported total supply of ETH.

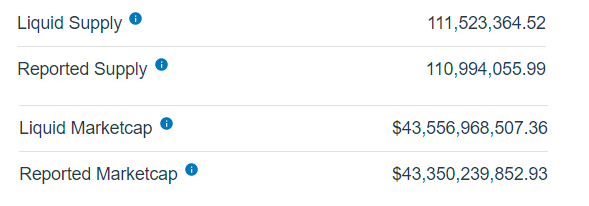

Supply as reported by Messari:

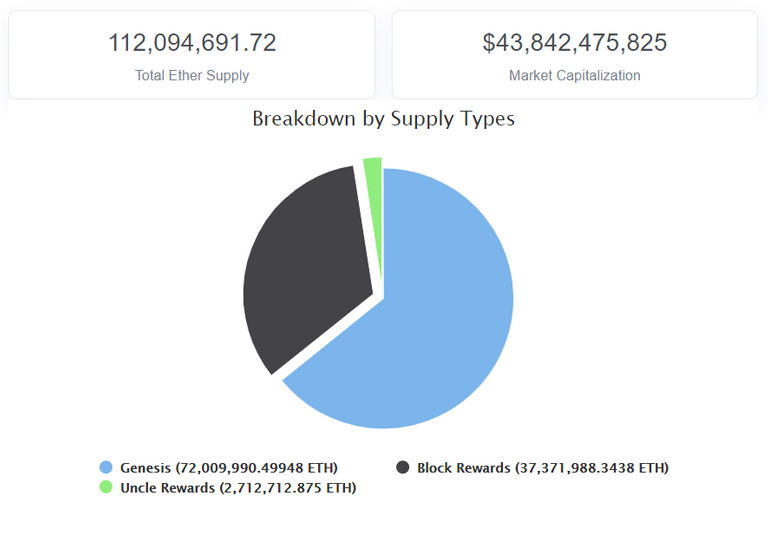

Supply as reported by Etherscan:

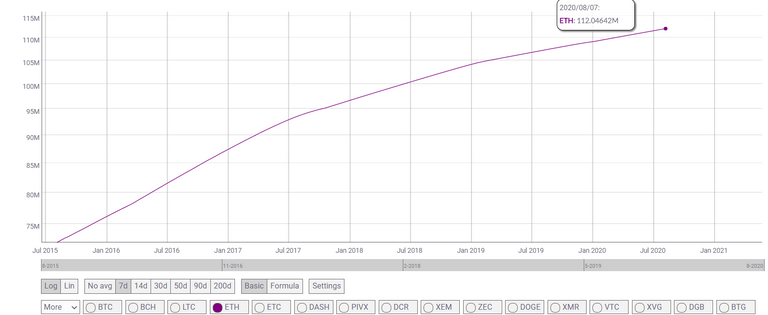

Supply as reported by CoinMetrics:

The delta is "small" but concerning for an asset whose value strongly lies in its scarcity.

The Ethereum community immediately mobilized to produce a script which produced a figure very close to Etherscan (delta: 3 ETH)

connect

WS Connected

start

(...)

Block 10590000 Cumulative block rewards:37313251.28125 uncle rewards:3055454.625

Block 10600000 Cumulative block rewards:37333290.53125 uncle rewards:3056596.125

Block 10610000 Cumulative block rewards:37353328.53125 uncle rewards:3057708.375

Genesis Supply: 72009990.5

Block rewards:37361706.21875

Uncle rewards:3058130.375

Total Supply: 112429827.09375 at block:10614181

For me the whole incident says less about Ethereum that it reveals a widening divide fueled by constant Twitter trolling between the two largest crypto communities that really should be united in the goal of creating a self-sovereign, trust-less financial systems.

Tribalism, it turns out, cannot be decentralized.

Worth your time:

- The History, Present and Future of Central Banks (feat. George Selgin) on the Breakdown Podcast

- The Anatomy of a Rally by Howard Marks

See you next weekend for more market insights.

Until then,

🦊

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Very interesting as usual !

It is crazy the number of Ponzi and pump and dump schemes that I am seeing at the moment.

It is on a roll and even if I paid less attention to DeFi than you need, all these compounding interests mean more tokens therefore inflation and they should lose value in the long term.

The use of this DeFi for real business / consumer purposes seem absent if you ask me. It is the ICO boom all over again...

Thanks for the kind words Mr.Lemon

Yeah could be an ICO 2.0, not sure yet, what I know for sure is that Ethereum better scale before the plebs comes back and start using DeFi

$LINK ? ;)

Haha you have seen all the $LINK trolls and fans ! They are going after me. Did you read Zeus Capital's report?

I've only skimmed through it but I think I got the gist, definitely not something I would invest in, particularly at this valuation... I am getting 2017 vibes here...

I think we are in a series and the final episode will be at the end of the year

Hi mate, thanks for stopping by :)

I am not entirely sure what you mean there...