Hi investors, the bull is back in the crypto markets

Today we're looking at the latest Bitcoin rally and we plunge deeper into the potential risks of crypto custody by banks.

Let's dive in,

Bitcoin.

BTC is trading at $11,668 USD at the time of writing, we're up +19.29% since last week trading on increasing spot volumes.

The total market cap has finally popped above the previous Ytd ATH level, perhaps signaling that new money is finally coming into the space after 8 solid months of accumulation.

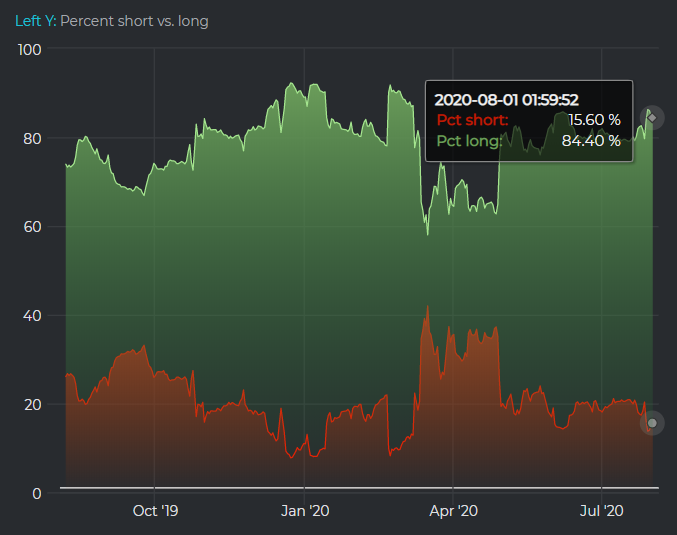

Market sentiment is extremely bullish as reflected by a sharp increase in long bets on futures markets

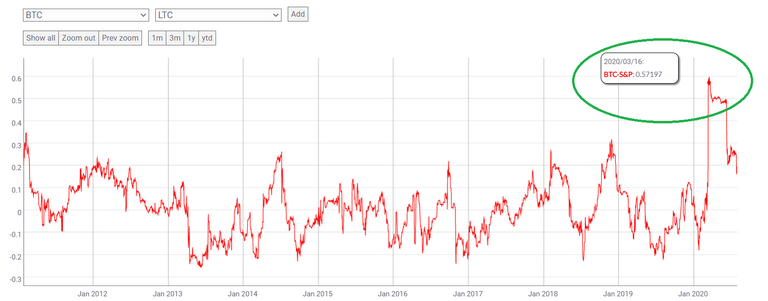

On the macro level, Bitcoin's correlation to the S&P500 has sharply decreased since all time high levels were reached mid-march 2020:

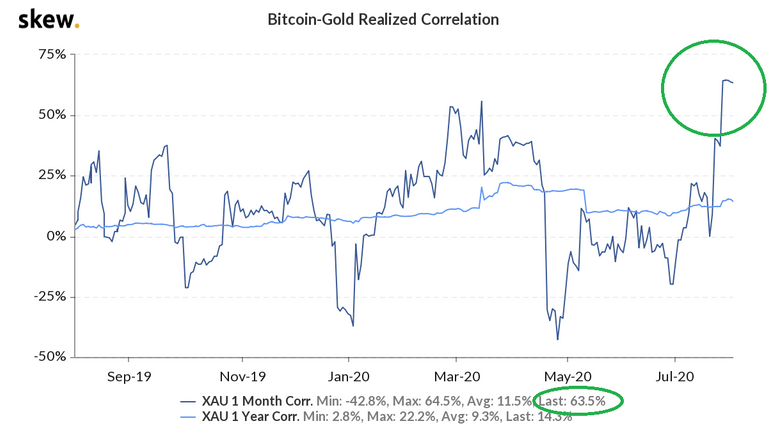

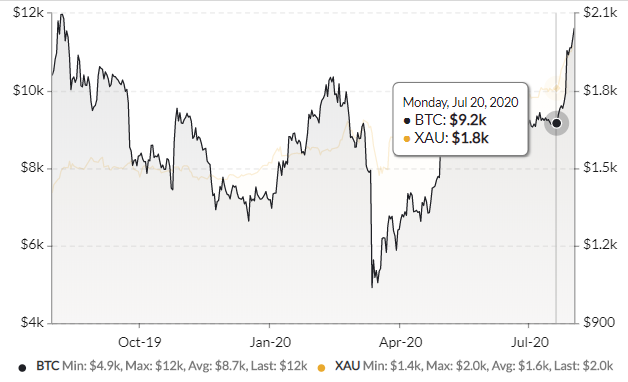

Interestingly we're seeing Bitcoin reach ATH correlation to gold YtD:

While it's too soon to declare BTC a safe haven asset, **positive correlation to gold more closely aligns Bitcoin's price action to its fundamental value proposition as digital gold or, in the words of Fidelity's Ria Bhutoria, as an aspirational store of value.

While the jury is still out on the causes of the spike. The data suggests that it could be the result of profound concerns around the status of the dollar as global reserve currency.

The dollar has been continuously losing in value since mid-May 2020:

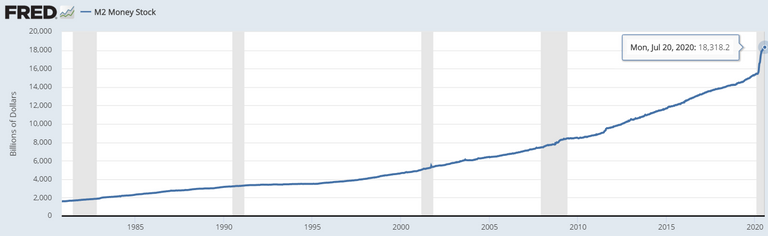

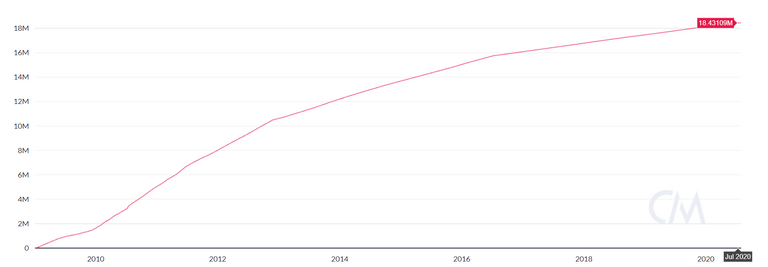

Meanwhile the USD monetary base (M2) has exploded, gaining almost 3 trillion units in the last 5 months alone:

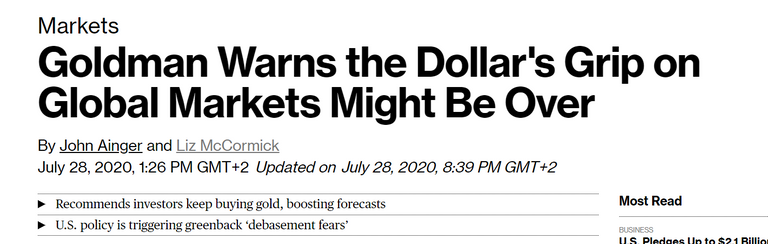

In the face of this unprecedented level of money issuance, Bloomberg published an article in July 20 relaying Goldman Sachs' fears that the US might be at risk of losing its "grip on global markets" and urging investors to stock up on gold.

Soon after we saw gold and Bitcoin take off in concert

One cannot but think of Paul Tudor Jones now-famous May 2020 Market Outlook in which he laid out the case for BTC as a hedge against the negative consequences of a "great monetary inflation" induced by successive rounds of QE.

In the letter Jones pointed out that:

"Monetary expansion alone is not sufficient to generate inflation. The context is very important too"

Here again the context seems to vindicate Jones' Bitcoin bet. Political instability in the US combined with stoked tensions with China and a global sense that the world is heading toward "deglobalisation" have all merged into a grim macro-background, leading to a rush to safety into scarce assets like gold and Bitcoin.

Bitcoin however, seems particularly well positioned to benefit from these new market dynamics.

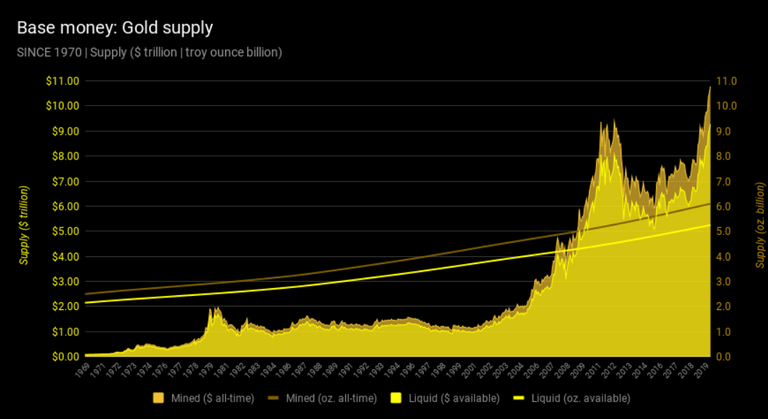

First, unlike gold the supply of Bitcoin is inelastic. Its flow cannot adjust to increasing demand because of its hard monetary policy. This leads to exaggerated upward volatility in times of high demand.

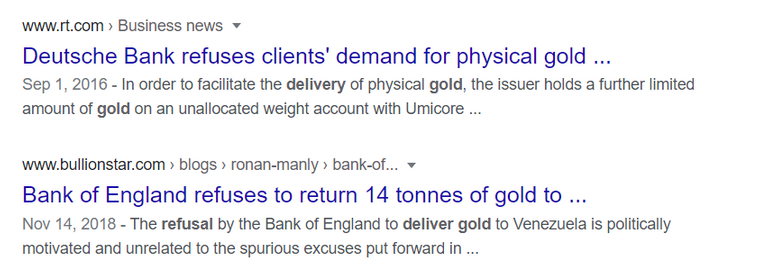

Second, Bitcoin is portable and designed with self-custody in mind ("not your keys, not your Bitcoin"). Portability is an attractive feature in a world where supply chains are contracting and we've seen multiple instances of banks refusing to deliver physical gold for politically motivated reasons.

Lastly, Bitcoin's auditability and permissionlessness make it the perfect neutral payment infrastructure in a world increasingly polluted by corrupted data and distrusts.

The current moment is thus ripe for Bitcoin to crash the world stage and rise to its potential of becoming a trustless store of value and public payment infrastructure for the world.

But the road to global adoption is fraught with dangers.

The Risks of Crypto Financialization.

We spoke last week about how allowing US bank to custody crypto was extremely bullish for the space and would open the floodgates to institutional involvement into crypto.

Today I would like to take a moment to echo Caitlin Long's concerns about letting traditional banking institutions hold crypto. These concerns were initially formulated in a very eloquent article by Long published by Forbes in 2018 around the time when the CBOE opened its physically delivered Bitcoin futures.

The risk described by Caitlin is not the threat of hacks (which can be greatly diminished thank to techniques like the omnibus model of custody) but the risk of letting custodial banks apply fractional-reserve banking to scarce crypto assets like BTC. This is also known as the risk of re-hypothecating crypto assets or simply the risk of financializing crypto assets.

Re-hypothecation basically consists in lending out assets you have custody of on a fractional-reserve basis to third parties in order to generate yield and reduce the opportunity cost of just having these assets sit idly on your balance sheet.

In traditional banking, this technique introduces great systemic risk because it creates situations where multiple parties will borrow the same asset and record it onto their balance sheet. These parties might then turn around and re-re-hypothecate the borrowed asset to more third-parties and so on so forth.

This financial technique exponentially increases the risk in the system and creates situations where nobody really knows who owns what and where asset defaults have cascading effects on multiple stakeholders.

For a real world example of that you can look up the Dole Food Stock scandal of 2013. Basically, there where "too many $DOLE shares" recorded on investors' balance sheets relative to the real number of shares as custodied by the DTC.

Fractional-reserve and re-hypothetication of custodied digital assets would be particularly damaging to crypto banking if they were to become the norm as they would undermine crypto's scarcity by creating a potentially infinite number of paper-claims and under-collateralized debt.

And in a way we're already seeing signs that this is happening

Last week, Coindesk broke the story that crypto-lender and custodian Celsius might have been issuing non-collateralized loans to its customers.

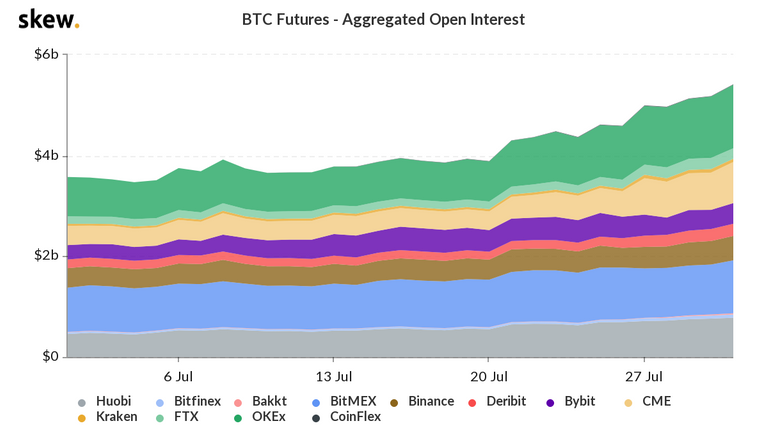

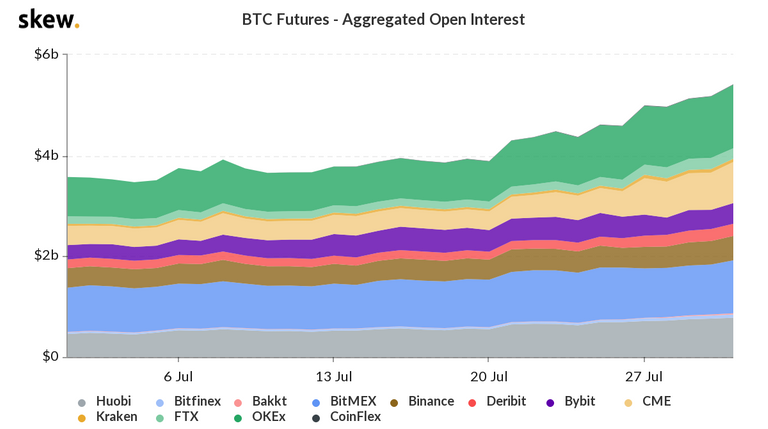

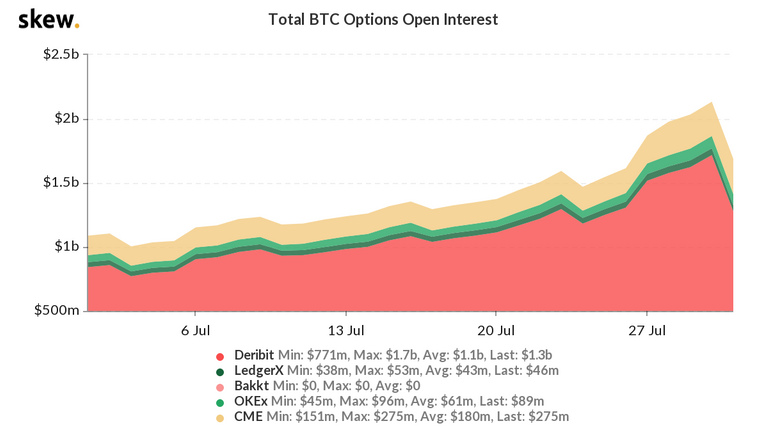

At the same time the size of crypto derivatives markets is steadily growing. Not only in CeFi (Centralized Finance)...

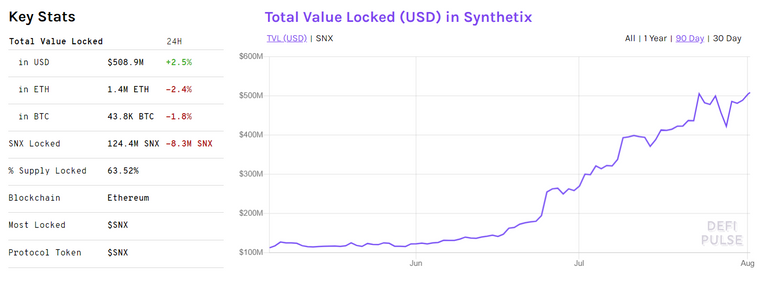

...but also in DeFi with protocols like Synthetix and decentralized lending protocol MakerDAO.

Though DeFi lending is currently over-collateralized (on MakerDAO, $1.5 dollar of ETH must be posted to create $1 of DAI), there is nothing guaranteeing that these collateralization levels won't come down in the future and introduce severe systemic risk into markets that have already proven to be extremely sensitive to the volatility of its collateral.

With traditional banks now entering the crypto custody fray we might see a push to apply the same old fractional-reserve practices to crypto assets and drown their scarcity under an increasing amount of paper-claims.

If anything, crypto assets' scarcity and custody risk is **the perfect catalyst to an explosion of fractional-reserve crypto banking **. As bank delegate custody more crypto assets to third-parties, it's likely these won't resist the temptation to re-hypothecate and financialize their crypto deposits, particularly for assets with long hodl-time horizon and no capital return (staking) like Bitcoin.

However, this time could be different.

Unlike traditional "paper assets" like stocks and bonds, crypto assets are ultimately controlled by consensual rules at the network level. In Bitcoin in particular, node operators have been known to be a powerful (if not the most powerful) form of government.

This opens some fascinating reflections around the future of crypto and the role node operators will have as check and balances to the banking system that will build "on top of these assets".

One can imagine a future where Bitcoin node operators will use the threat of forking the network if the mistakes of old are repeated or to ritualistically purge (clean-slate-style), the system from parasitic assets like derivatives every halving.

In such world, centralized crypto custodians will have to exert transparency via proof of reserve and adopt a culture of restraint or risk facing the wrath of users.

Exciting times ahead.

Worth your time:

- Is Financialization a Double-Edge Sword for Bitcoin an Cryptocurrencies? by Caitlin Long

- Metaverse Musing Ep 02: A Crucible Moment from Delphi Digital Podcast

- Su Zhu and Hasu talk to James Prestwich from the Uncommon Core podcast

See you next weekend for more market insights.

Until then,

🦊

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz: