Hi investors,

Today we're talking about Bitcoin, Ethereum and the Sushiswap disaster.

Let's dive in!

Bitcoin.

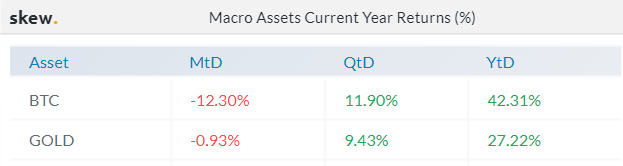

Bitcoin had a deep correction this week. BTC is trading at $10,198 against the USD at the time of writing. We're down 12% since last weekBold but still comfortably up 41.5% YTD.

BTC is still up against gold YtD by a good margin.

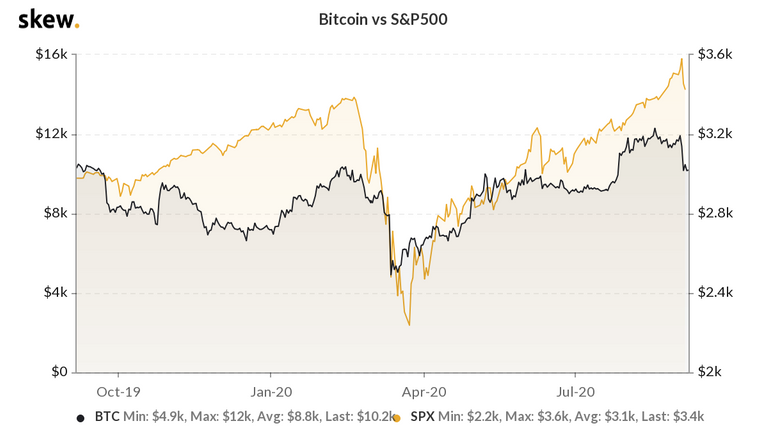

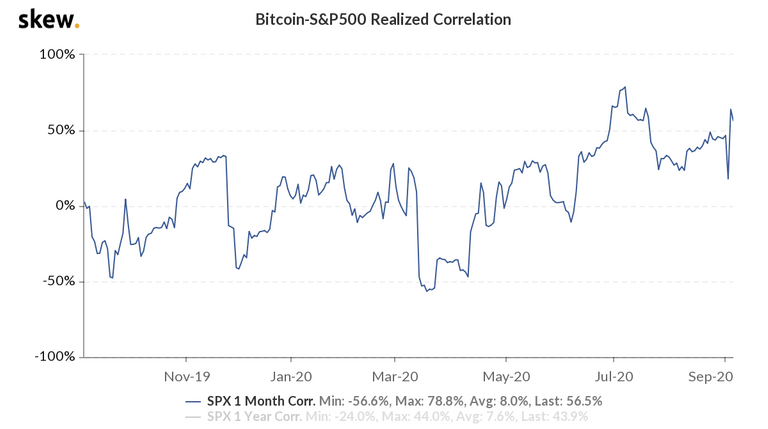

The drop seems highly correlated to a similar correction in the S&P500. BTC's positive correlation with stocks being close to all-time-high levels.

The drop prompted a lot of trader to seek refuge in stablecoins which have experienced a 25% growth in volume since the beginning of the weekend.

Source: https://www.stablecoinswar.com/

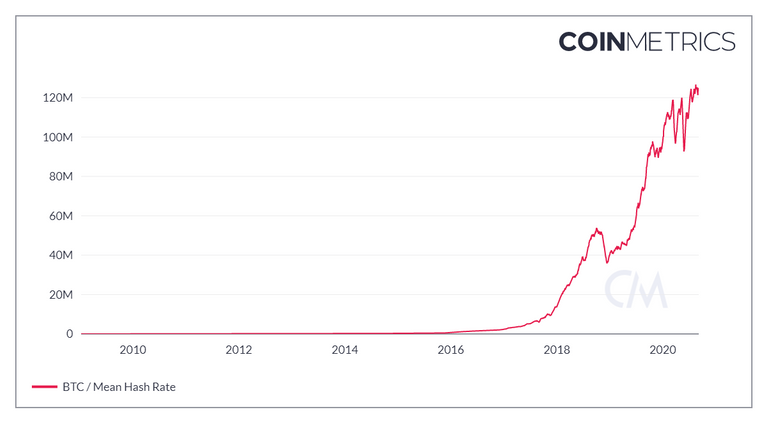

The drop doesn't seem to have had any effect on the Bitcoin network itself though. Hash rate is still at an all time high, reflecting miner bullishness in future prices.

To me this correction was well overdue. The market had been considerably overheating since the beginning of the summer. Plus, for what it's worth, Bitcoin has a track record of bad performance in September.

Maybe there's seasonality to Bitcoin trading, with the hotter months of summer leading to more risk-taking behaviors in traders. After all, we're all animals.

SushiSwap.

The DeFi space keeps getting weirder.

This week, two AMM (automated market makers) Uniswap and Sushiswap engaged into a fascinating liquidity war.

For context, Sushiswap is:

A [new] fork of Uniswap with a native token, SUSHI, that people can currently yield farm using other Ethereum-based tokens.

It's important to note that Sushiswap is not live yet. The SUSHI token is used as an incentive mechanism to reward liquidity staking into the protocol in anticipation of the launch.

SUSHI tokens can be acquired by staking Uniswap LP tokens into Sushiswap.

Uniswap LP tokens can be acquired by providing liquidity to pools of tokens in Uniswap (for example the REN/ETH pool). The idea is to incentivise token holders to pool their holding together into pools to facilitate trading on Uniswap.

To sum up in order to acquire SUSHI tokens, one must first provide liquidity to Uniswap, collect LP tokens rewards, then stake these tokens into SushiSwap to receive SUSHI tokens.

The incentive structure for acquiring Sushi goes like this:

With Uniswap, 0.3% of trading fees are distributed proportionately to each LP. It's fair and square -- you earn the pool's fees when you provide liquidity to it. However, when you stop, you lose all your income despite your contribution to the growth of the pool.

With SushiSwap, 0.25% goes directly to the LP, and another 0.05% goes to $SUSHI token holders. Because $SUSHI tokens can only be minted by supplying liquidity to SushiSwapSushi pools, each LP gets roughly the same 0.3% fees in the long run with better-aligned incentives.

At this point, staking Uniswap LP tokens into Sushiswap, doesn't affect the liquidity on Uniswap but the hope is that liquidity will flow from Uniswap to Sushiswap once the protocol is launched.

Some have compared Sushiswap to a "vampire" attack because its end-goal is to suck all the liquidity out of Uniswap.

The concept make sense, at least on paper. However, as as Anthony Sassano from the Daily Gwei pointed out in an August 31 article:

The real question is [...], does this liquidity migrate over to SushiSwap once the yield farming incentive ends?

This issue didn't seem to give pause to the market though. The project went immediately viral.

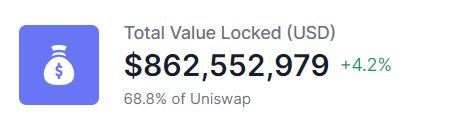

In just about two weeks SushiSwap attracted a tsunami of liquidity.

At one point, the daily volume on Sushiswap clocked higher than the volume on OG exchange Bitstamp and there's almost 1 billion of Uniswap LP tokens value locked into Sushiswap at the time of writing.

Source: https://sushi.zippo.io/

Meanwhile SUSHI tokens became the object of a speculative frenzy, experiencing a x10 appreciation in less than two weeks.

Source: https://www.coingecko.com/en/coins/sushi

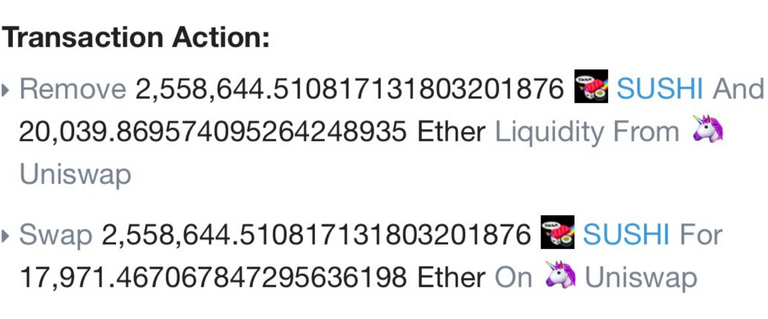

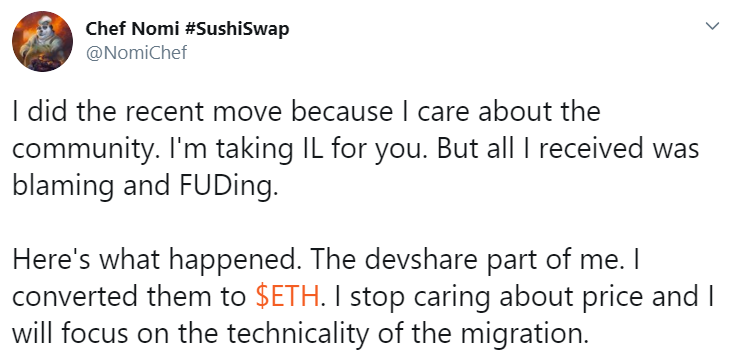

All seemed well in until the news came in yesterday that Chef Nomi, the anonymous founder behind the project, had withdrawn all of their SUSHI tokens and swapped them for over 6 million USD in ETH.

Chef Nomi and some in the DeFi community immediately took to Twitter to defend the move:

For most of Crypto Twitter though, Chef Nomi's actions immediately drew consternation and calls of scam.

Some compared the move to Charlie Lee (founder of Litecoin) dumping all his LTC at the peak of the crypto mania in 2017.

To me this is an imperfect comparison, Lee might have dumped at the top but, after dedicating over 6 years of his life to building the Litecoin community, his move was similar to that of a tech founder doing a successful exit.

The Sushiswap exit seems different.

I seriously doubt that Chef Nomi, who is anonymous, will now put more than an half-assed effort into developing the project. Selling his coins completely eradicates his incentives to do so. I wouldn't be surprised if he "hands the project back to the community" (aka disappear into the night) after the launch of SushiSwap over the weekend (if the project ever goes live).

UPDATE: Chef Nomi has official left the Sushiswap project:

To me this whole affair is closer to what played out with Block-one. After bagging around 3 billion USD during their EOS ICO, the company squandered the money and only put half an effort to develop their chain. EOS is now a zombie project controlled by cartels.

The DeFi community is re-learning the lessons from 2017. Easy money doesn't create good incentives for a start-up unless its leadership is particularly strong and determined to support the project to the end.

I just don't sense the same level of commitment coming from "Chef Nomi", sorry chef!

Ethereum.

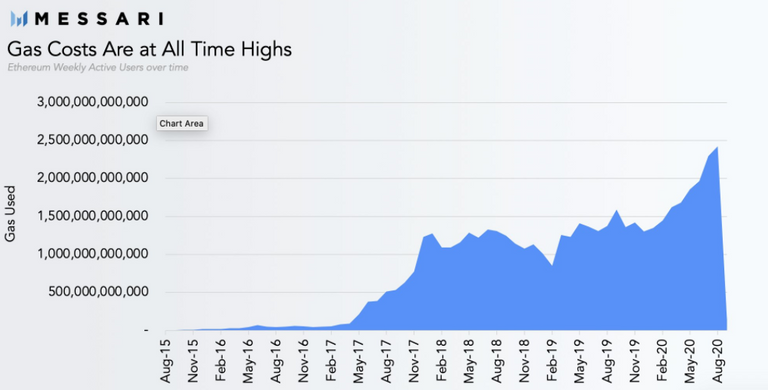

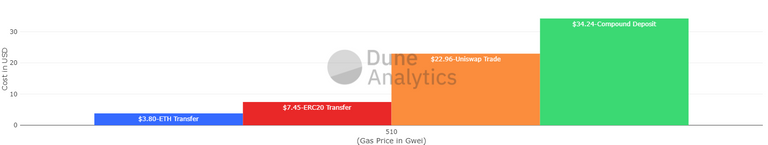

One collateral damage of this story has been an ATH explosion in gas prices on Ethereum.

In the last episode of On the Brink podcast, Nic Carter predicts that high transaction fees are pricing out retail traders which are likely to leave the market until gas prices return to less expensive levels.

Since professional traders need retail to make money in DeFi, these might also reduce their trading activity on DeFi. This might lead to a sharp drop in DeFi volumes and less demand for ETH which might depreciate in price as the market cools down.

This will bring back gas price to more organic levels. By that time, the market will have developed some new use-case that might attract retail and the cycle will repeat.

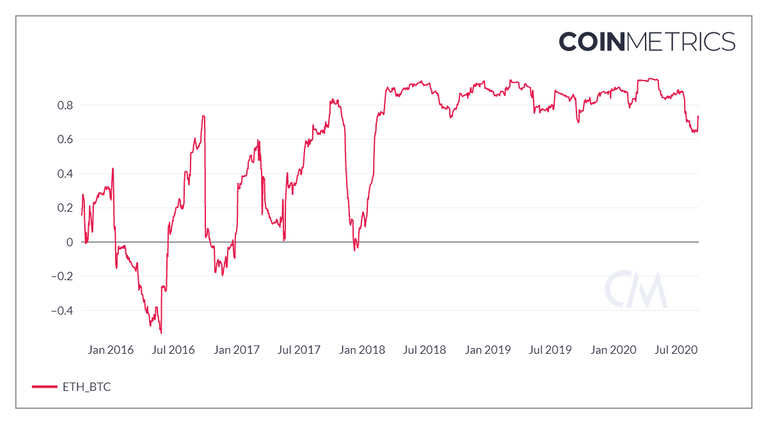

In a way, we might already be witnessing this prediction plays out. ETH has experienced a -19.24% weekly drop against the USD. However, one should keep in mind that ETH remains highly positively correlated to BTC, which also experienced a severe drop in price this week.

To me, the market is giving all the signs that we're about to enter a period of consolidation. The SUSHI craze (scam?) was the peak of an irrational bullishness driven by DeFi.

The market needed a correction and still need to purge itself from all these ridiculous food-meme-tokens that have been traded up on nothing but hype against unsuspecting retail.

Remember, pros need dumb money to make a buck. With gas price at an ATH price and scams like Sushiswap exposed, I wouldn't be surprised to see retail retreat on the side line for a bit until the next hype wave hits.

Make no mistake, this bull-run still has some juice in it but one needs to think ahead about what the next mania might be. I am ready to bet that NFT (crypto collectibles) might be ready to make a return. Derivatives trading on L2 Ethereum layers might also be the next thing that attracts retail.

Decentralized finance is a powerful concept and the train has already left the station.

Worth your time:

- The Trillion Dollar NFT Opportunity – Metaverse Musings Ep 04 from the Delphi Digital podcast

See you next weekend for more market insights.

Until then,

🦊🦊🦊🦊