Hi investors,

In today's edition we discuss:

- Bitcoin trades at all-time-high after breaking $20k USD

- Bitcoin On-chain Indicators Primer

- Pandemic Villain: Robinhood

- The Fraying of the US Global Currency Reserve System

... and other bits and bytes

Bitcoin Trades above $20k USD for the First time in its History.

Three years ago almost to this day Bitcoin was making headlines after trading above $19k for a brief moment.

What followed was a brutal 2-year bear market which tested the convictions of many believers but had the immense benefit of purging the space of most speculators and ICO sh*tcoiners.

Today, Bitcoin is trading at $20,722 USD. The price is firmly at all time high levels and we've officially broken out of that cup and handle pattern to resume price discovery.

If you indulge me, I'd like to kick off this edition of the newsletter with a celebratory meme:

With this out of the way, let's proceed.

How high will Bitcoin go?

Well, no one knows for sure but the market sure looks primed for more upside in 2021. Let me offer some mental models to help you think about were we are in this cycle.

Here's what we know.

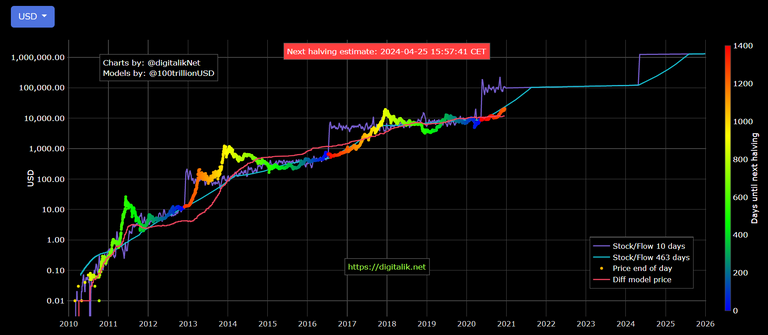

First, The established narrative in today’s market is that Bitcoin cycles align with halving cycles (4-year cycles at the end of which the block rewards gets "halved"). Taking PlanB's famous Stock-to-Flow model as reference, we can see that the market has shown an historical propensity to top roughly halfway through its halving cycles.

The last halving happened back in May 2020 and the next halving is "scheduled" for the end of April 2024 (give or take). So we're still early in this cycle.

Source: Bitcoin Stock to Flow Model live chart

Second, since we're in uncharted territory, I believe that the price will resume its discovery around psychological and technical levels.

If I had to bet, I'd say that $29k USD will be an important level of profit taking because it's close to a round number (30k) and to the "magic" 1.618 Fib retracement level (I am being both sarcastic and realistic here).

You can also bet that the more retail is drawn into the market, the more important these psychological levels will become for predicting price swings.

I happened to be around during the 2017 bull run and TA proved a pretty decent tool for timing the market (see below).

That being said, I strongly discourage you from playing the trading game.

Bitcoin is a long term investment play. In this market you win by developing strong convictions about the asset and having low-time preference when it comes to taking profit.

In other word, Bitcoin is an asset you should treat like a long term play. Buy it, secure it, forget it and take a look at it in 1-2 halving cycles (4 to 8 years).

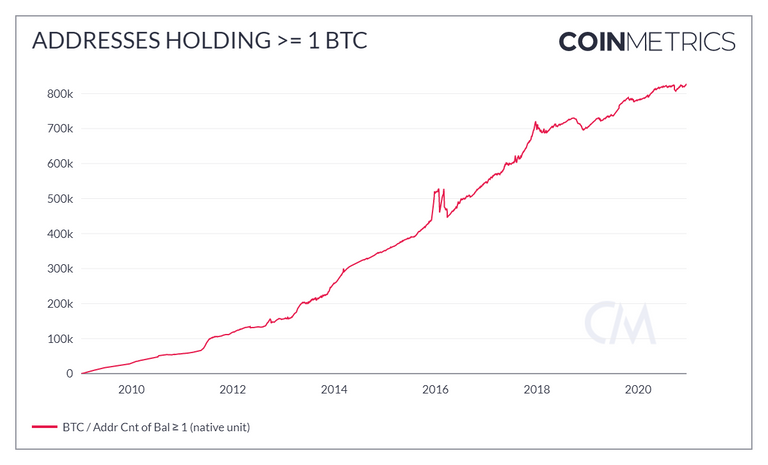

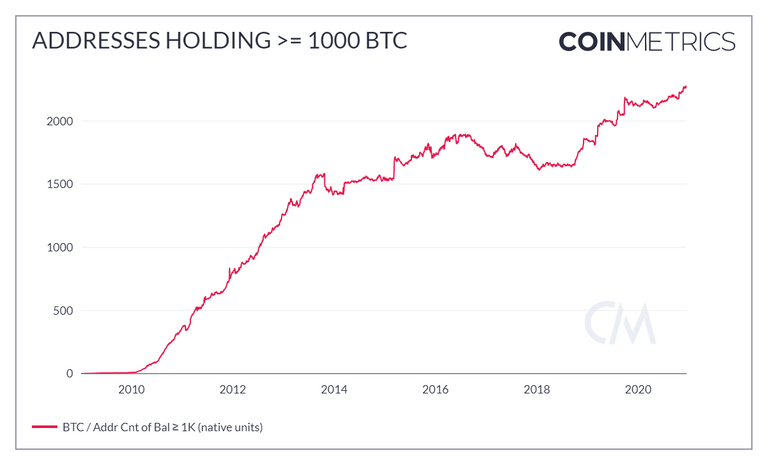

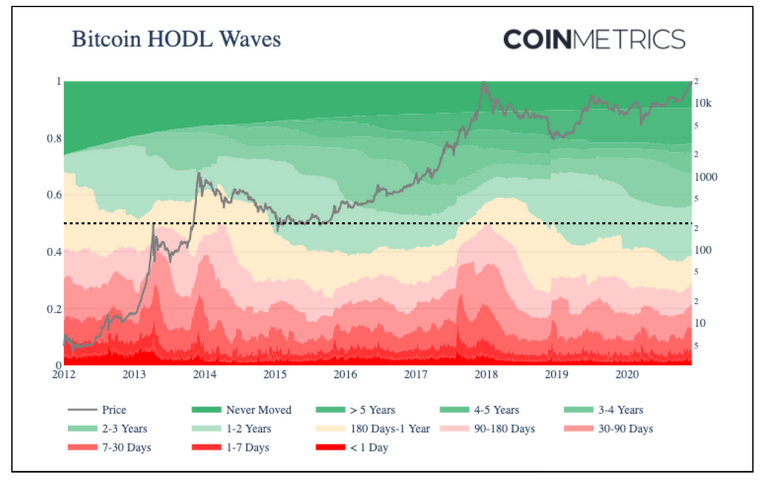

Third, we know that holding is at an all time high. The number of addresses containing >1 BTC and >1000 BTC are both at record levels:

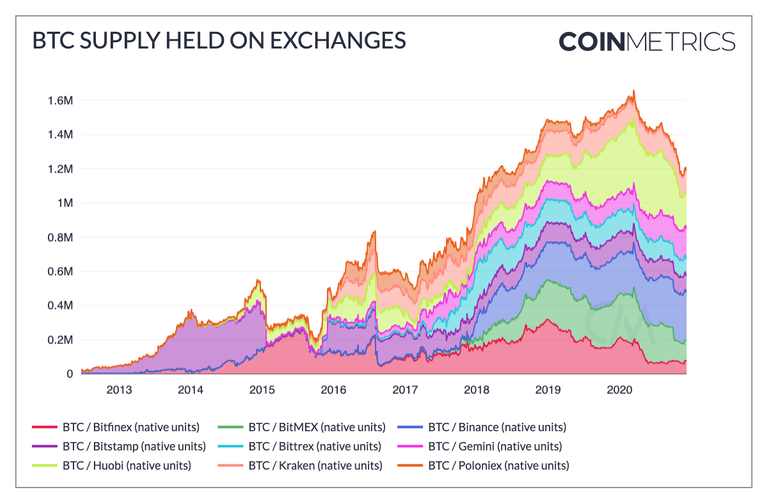

Meanwhile, the amount of Bitcoin on exchanges has been steadily decreasing:

Basically, the Bitcoin market is thinning.

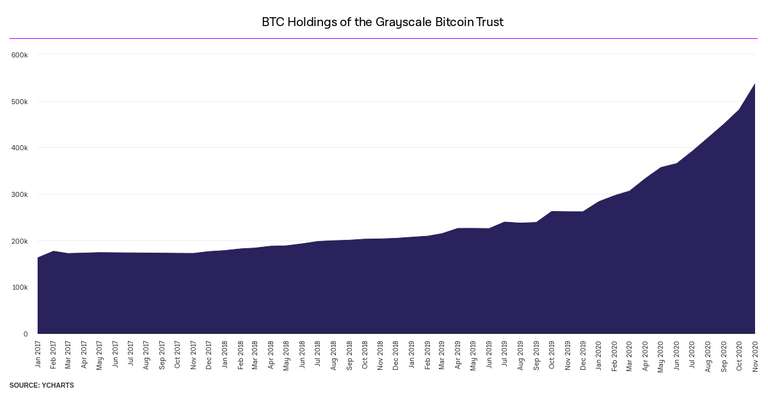

We're seeing a "supply shock" play out as both the amount of Bitcoin available to trade with is decreasing while the (halved) block supply is being gobbled up by Grayscale's Bitcoin Trust and a plethora of institutional players latest of which Ruffer Investment and MassMutual.

Source: The Block

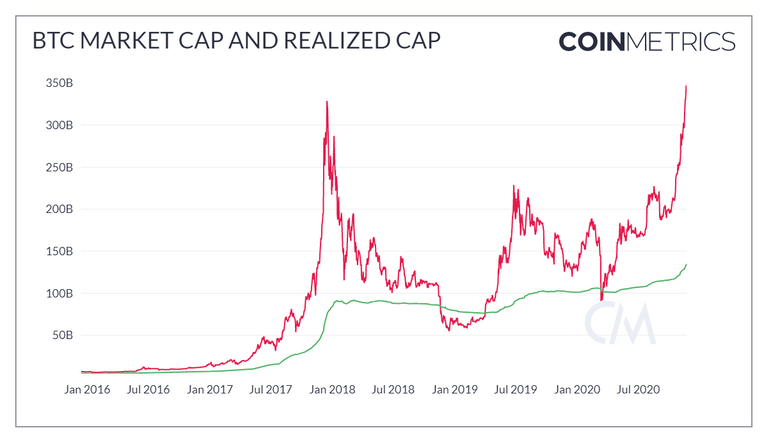

Next, we know that the ratio total market cap ($342 B) / aggregate cost basis ($134 B) is only around 2.6.

This means that your average Bitcoin holder is current somewhere around 160% in profit at the time of writing.

Finally, having spent a lot of time around the community, I can tell that there is a notable difference in mood between today and 2017. As far as I can tell, nobody is talking about taking serious profit just yet as all believe the bull run is only getting started.

To wrap it all up.

In a world where “risk-free“ assets offer 0 to negative yields, institutions have no choice but diversifying from bonds into assets further up the risk curve.

In this world, assets that have an asymmetric risk/reward, instant liquidity and provable scarcity like Bitcoin suddenly become very attractive.

The smart money has finally waken up to the fact that millennials would rather own gold than Bitcoin.

Hell, even legendary Bitcoin skeptic Ray Dalio recently flip-flopped on Bitcoin:

Most millennials are entering their 30's which, for most, will be the richest and most productive years of their lives. Millennial will start making real money and they ain't going to put it in gold, bonds or pumped-up fiat cash.

Couple that with the fact that Bitcoin has way more utility than gold, is completely auditable (unlike gold which can be faked) and functions like an unstoppable Swiss bank account in cyberspace, now you've got yourself all the ingredients for a mega-trend which could result into one of the most sudden transfer of wealth in recent history.

I also think that the involvement of famed Wall-Street names and finance institution giants like Blackrock, Fidelity, JPMorgan, Citi, Guggenheim et al. has obliterated the career risk for financial professional to seriously look at BTC and its implication within a diversified portfolio.

It’s going to be a helluva year 2021.

Bitcoin On-chain Indicators.

The folks over at CoinMetrics issued a primer on Bitcoin on-chain indicators.

I am a big fan and avid user of CoinMetrics myself. They've created one of the best suite of free tools for the community and freelance analysts like myself.

The report is free and a recommended read. You'll learn how to calculate and interpret the following metrics:

- Market Value To Realized Value (MVRV)

- Spent Output Profit Ratio (SOPR)

- Relative Unrealized Profit

- Market Cap To Thermocap (?!)

- HODL Waves

It's a well written paper, richly illustrated and completely free so you really have no excuse for not checking it out.

Source: The Bitcoin On-Chain Indicators Primer

Pandemic Villain: Robinhood.

Matt Taibbi wrote a great piece on next gen exchange Robinhood, its business model and how they've managed to hook an entire generation on gamified stock trading while making solid amounts of money selling their order flow to high-frequency firms.

It’s the perfect mousetrap, among other things because of its name. “That’s the other thing,” says Brewster. “They call it Robin Hood.” Instead of stealing from the rich and giving to the poor, the American version takes in the young and sells them to computer-powered hedge funds; this Robin Hood is the house that always wins. If there’s a more brilliant metaphor for capitalism in the Covid age, it’s hard to imagine.

It's a savage but entertaining read which you should contrast with this conversation with HF trader Tarun Chitra to hear the trader side of the story.

The Fraying of the US Global Currency Reserve System.

Lybn Alden is back with another monster article this time sharing her views around a weakening dollars and placing its decline in an historical context spanning all the way back to WW2.

It's a long read (it took me nearly 45 minutes to get to the end of it) but Lyn Alden is a brilliant analyst and a concise (I understand the irony here) writer which you should follow if you in-depth, rigorous and contextualized analysis.

I also suggests listening of this installment of The Breakdown if you want to hear her talk about QE and its (non) effect on inflation:

Bits and Bytes.

- Learn the Options Greeks (link)

- JP Morgan settles first repo transaction using JP Morgan Coin (link)

- Ex-UBS and current Merger and Inquisitions blogger Brian DeChesare on the year that passed and the year ahead (link)

... and this:

See you next weekend for more market insights.

Until then,

🦁

@tipu curate