Hi investors,

Today we look back on the year 2020 and we look forward on what 2021 might bring.

DISCLAIMER: This content is not financial advice and only represents my personal opinions.

Always do your own research.

The Trades.

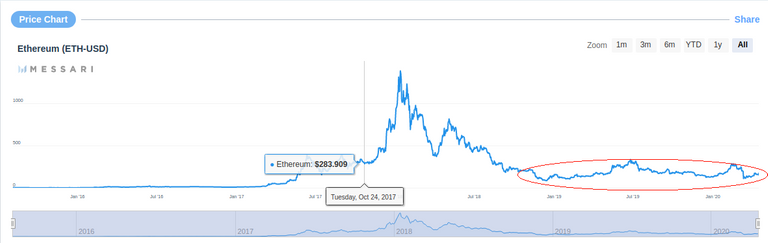

Back in April 2020, I kicked off the blog with a fundamental analysis of Ethereum native ETH currency.

The post was titled Ethereum Growth Makes Case for ETH Investment and it articulated a simple concept:

With regards to fundamentals, the price of ETH looks quite undervalued compared to the global health of the Ethereum network.

ETH was trading at $170 USD then and we noticed that the technicals seemed to indicate an accumulation pattern while key fundamental indicators (active addresses, value transferred, community headcount, number of dApp users) were experiencing rapid growth.

We concluded that the market was underpricing ETH.

Today the asset is trading at $734 USD, 430% up from its April value.

The second asset we've always been bullish on is of course Bitcoin.

In a July 2020 post titled Crypto Portfolio Strategy for the next Bullrun we shared the following chart:

We noted the following:

[We]'re currently in a quiet accumulation phase that is setting up the stage for the next crypto bull market.

Bitcoin was trading at $9,216 USD then. Today it is changing hands at an eye-melting $26,883 USD (290% gain) and many bullish catalysts have happened along the way.

Overall, it's been a very good year to be involved in crypto.

But as 2020 is fading into the fog of history, I'd like to take a moment to reflect not only on the year that's passer but also on what I've learned in the past 4 years of being involved in the crypto space.

So let's do this.

On Investment Strategy.

The first takeaway is that TA is a useful tool to spot market peaks and bottoms provided that the time frame is long enough (multi-years) and that the fundamentals are also sound.

The second takeaway is that patience and long-term investing is better rewarded than short-terms strategy like day-trading which will only make you poorer and stressed.

Convictions win the game.

Fundamentally, crypto is a mental game you win by developing strong convictions about the assets you hold. Strong convictions help with navigating the volatility and creating good investing habits like buying dips and prudent capital allocation.

How do you develop strong convictions you ask?

Learn as much and as often as you can about the asset you're investing in. Find the most intelligent minds in the industry and listen to what they have to say about the projects you're bullish on.

There is no shortcuts here, invest the time and thou shall be rewarded.

Don't trade (unless you're a professional).

Understand that unless you're a professional trader aided by bots and a solid team of analysts, crypto trading (especially day trading) will likely ruin you over the long run.

And I mean ruin in the general sense here.

Crypto markets are extremely volatile and soon the volatility will start to affect not only your portfolio performance but also your psychological well-being.

Watch out for these signs:

- you can't help checking the price of crypto every 10 minutes

- you start loosing sleep and you sometimes wake up in the middle of the night to feverishly place trades

- placing a trade triggers a dopamine rush

- you start thinking about crypto all the time and you frequently catch yourself doing math in your head

- people close to you start noticing that you look stressed and agitated

- although you frequently lose money, you think you can beat the market and consider dropping everything to become a day-trader

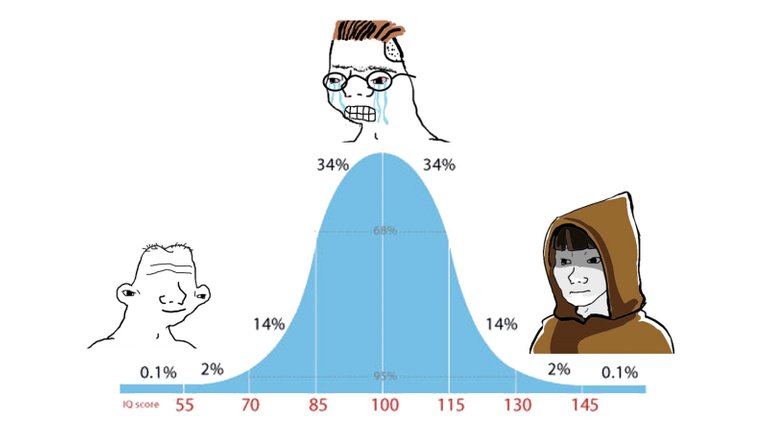

Newbs often start their crypto journey as traders because they lack the conviction to become investors and get easily hooked on moon juice. Trading crypto is pure dopamine, the highs are stratospheric and the lows are hellacious.

As they mature and learn about the space traders (unless they get completely rekt and rage quit) turn into holders. If this is your first bull market, chances are you'll go through these phases too, you'll taste the forbidden fruit and learn painful lessons. This is all part of the learning process.

This process generally takes a full market cycle to complete. Traders that make it from peak to trough eventually develop iron nerves, strong convictions and a general detachment to price action, Twitter noise and arcane TA charts.

This bring me to my next point.

Beware of Paid Online Trading School/Courses:

Beware of online trading schools that promise to teach you how to trade for a monthly/yearly fee.

Why you ask?

First of all, TA is complete bonkers most of the time and has near-zero predictive power when not coupled with fundamental analysis. Beside, markets are dynamic and a "bullish" pattern can very quickly start to look like a bearish pattern or the other way around.

Second, trading gurus fundamentally lack skin in the game. They profit from selling memberships to newbs, not from trading. As a result, they'll never show you their P&L balance (which is probably in the red) and have no incentive to take risks since they can always rely on a cushy monthly cash flow from their students.

Trading schools have fundamentally flawed incentive structures.

They suck, stay away.

Thoughts on the Crypto Community and its Beliefs.

Crypto is one of the most intellectually stimulating communities to be involved in right now. It's also thrillingly extreme.

The talent pool in crypto is incredible.

From sharp, intellectual figures (Nic Carter, Lyn Alden, Preston Pysh, Matt Walsh), everyday men (Peter McCormack), brilliant yet disturbing Robespierre-like characters (Pierre Rochard, Dan Held, Safedean Ammous) to complete morons (anyone who identify as part of the XRP Army, LINK Marines, etc). Crypto draws from all corners of the intellectual and political spectrum.

For best or for worst.

These factions wage 24/7 social media battles which result is an extreme balkanization between communities, a drift to extreme ideologies, disgust for anyone not part of the tribe and primitive online etiquette encapsulated by the brutal "Have Fun Staying Poor" meme.

It's on this digital battlefield that the crypto culture most shows its dark underbelly.

Crypto conflates financial success for truth and has a disturbing lack of respect for institutions while demanding that personal property be upheld at all cost. Some Bitcoin maximalists in particular advocate for some form of stateless utopia in which free-markets and brazen personal liberties are the main organizing principles for society.

The problem is that you can't bankrupt the State without putting monetary self-custody in great peril.

The rule of law is what safeguards order and makes self-custody... safe. Without the Sate, Bitcoiners would be prime targets for physical attacks and would have no choice but to resort to erect fortresses (citadels) to defend their property against thieves.

There is historical precedent for this state of lawlessness when the strongest ruled the land and property could only be established and preserved by force. The Middle Ages.

The irony is that the most extreme elements of the Bitcoin community might eventually become the most fervent supporter of order as a mean to safeguard their crypto wealth.

Self-custodians need personal safety and none provides safety like a functioning democratic state.

In the meantime, fringe Bitcoiners are working very hard to undermine the powers of the State.

There lies a contradiction.

The values we ascribe to democracy don't mesh well with a vision of the future where wealth is concentrated in the hands of large BTC holders, this is a recipe for violence and disaster.

To quote famous Gotham City philosopher Harvey Dent:

"You either die a hero, or you live long enough to see yourself become the villain.""

Hyper-bitcoinization is exactly a scenario where large holders of BTC see themselves become the bad guys. Their wealth will attract greed and anger and they'll become prime political targets for leftist ideologies that aims at redistributing poverty.

All this intellectual posturing for anarchy and state bankruptcy is all fun and games until an angry mob knocks on your door and demand you forfeit your coins or else...

If Bitcoin ever shoots up to 500k and creates a new breed of crypto rich, the Bitcoin community will need to retire the "Have Fun Staying Poor" attitude and show support to those that have been left behind during the wealth transfer.

Failure to do so would further divide some Western democratic societies which are already on the brink of social discord.

This is not the future we want for the Bitcoin revolution.

Anyways, these are my thoughts as we close 2020 and advance further into this new decade.

With that I wish you a Happy New Year 2021.

See you next weekend for more market insights.

Until then,

🦁

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: