Hi investors, it's been another eventful week in crypto. DeFi is gaining a lot of momentum while Bitcoin is quietly accumulating.

Let's dive in.

Bitcoin.

Bitcoin is trading at $9,385 USD at the time of writing and the price is going sideways on diminishing volumes which to me indicates that we might be about to see some volatility in the market (my guess is by the end of this month).

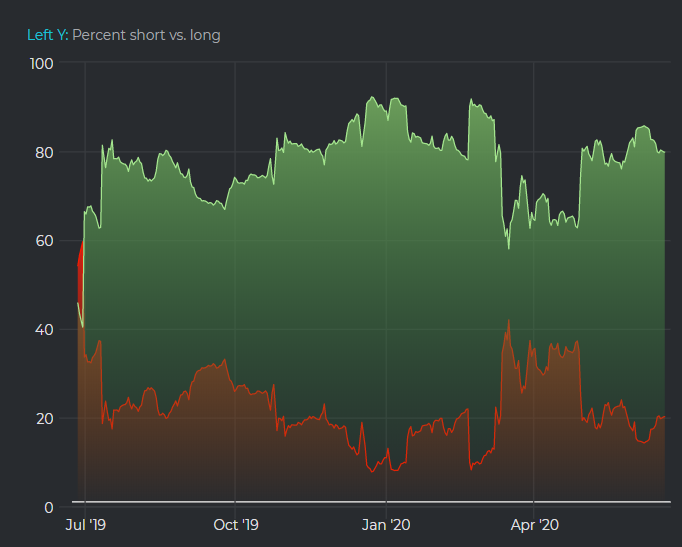

Market sentiment as reflected by the long/short ratio is still overwhelmingly bullish:

But in all honesty, that is no guarantee that BTC will take the bullish path over the coming months.

Bitcoin trades on market sentiment and macro factors and these are mostly unpredictable.

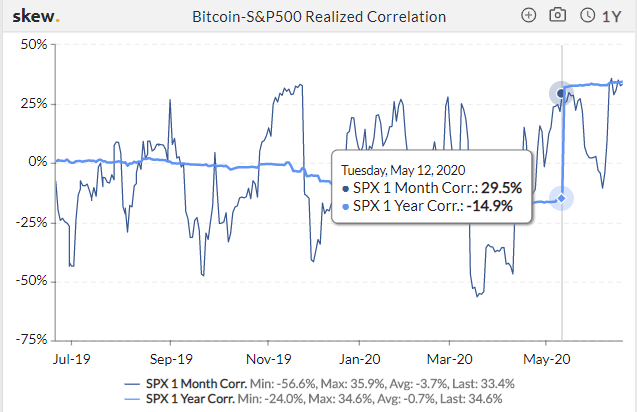

Interestingly though, the Bitcoin market has shown a lot of positive correlation with the S&P500 since the May 2020 halving.

As you can see by the flat shape of the curve, BTC isn't historically correlated with the S&P500 but has posted over 30% of positive correlation this past month.

I am not too sure what accounts for this correlation but my best guess is that the "Robinhood-driven" buy-the-dip rally in US stock markets has bled into the BTC market, adding to existing institutional demand and helping lift the price.

Apart from that interesting footnote, it's been a very quiet week in Bitcoin as most of the action has been happening in the Ethereum ecosystem.

Ethereum.

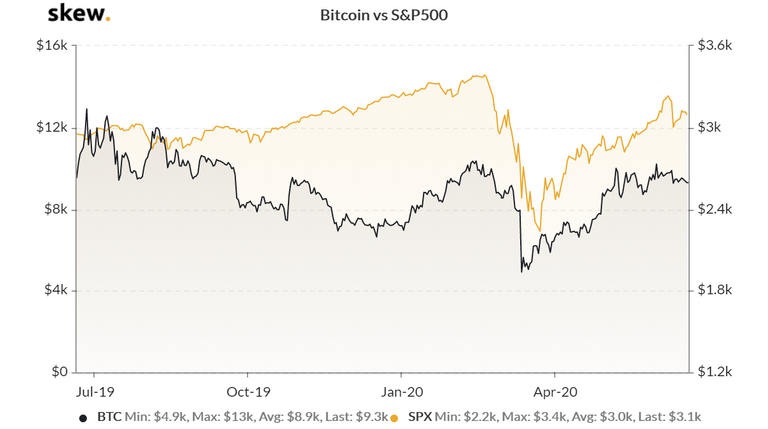

The real story here is not ETH, which has remained mostly flat...

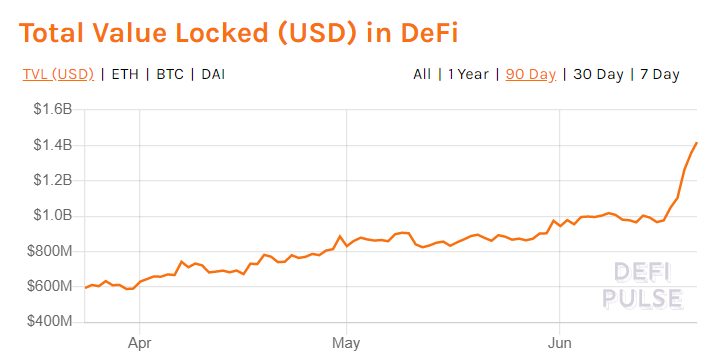

... but the monster increase of liquidity in DeFi...

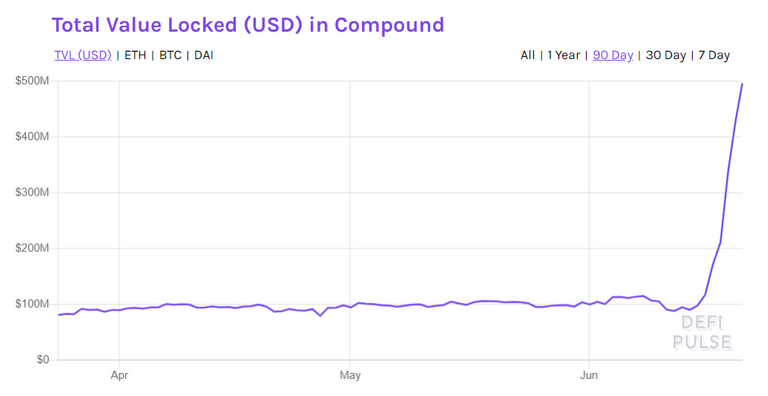

...most of which is accruing to the Compound protocol which saw its liquidity augment by around 500% this last week alone:

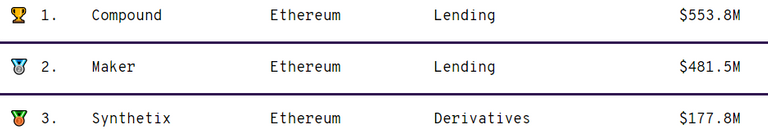

As a result, Compound has become DeFi's richest protocol ahead of MakerDAO and Synthetix:

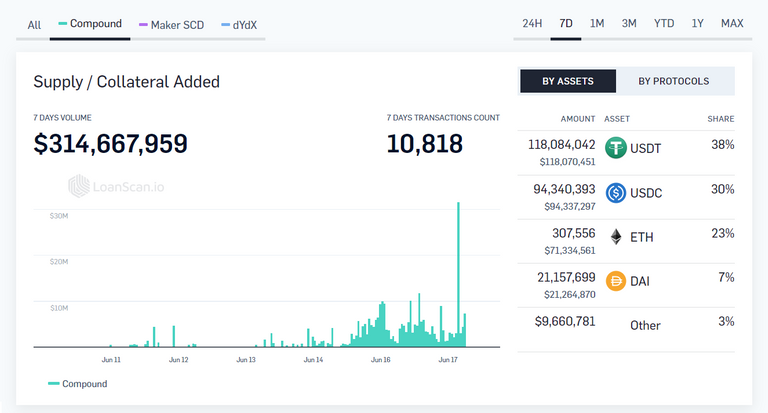

Most of Compound's fresh capital has come in the form of crypto-dollars (USDt and USDc):

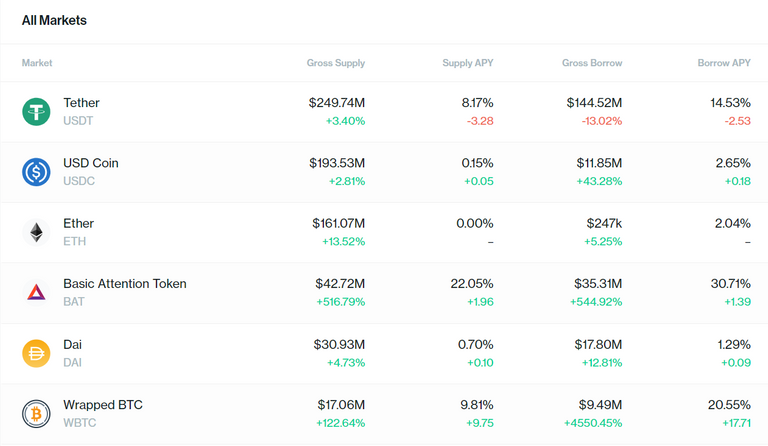

Tether and USDc now represent the two biggest liquidity pools on Compound ahead of ETH:

This is not surprising, lenders of crypto-dollars can earn generous yields on their deposit:

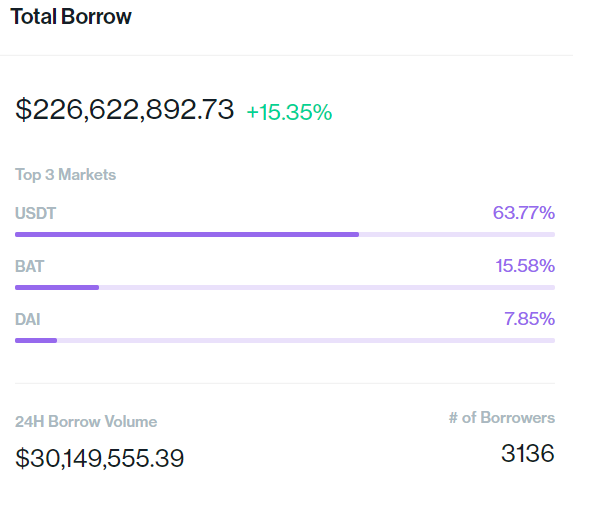

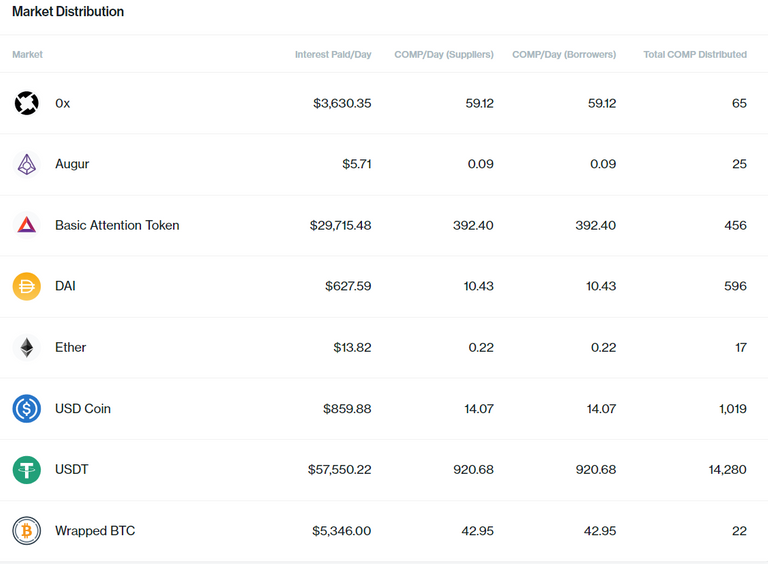

... this high cost for capital hasn't stopped traders to borrow massive amounts of USDt:

... to gain leverage in order to collect $COMP, the protocol's new governance token which can only be harvested by sending liquidity into the dApp.

You can see the current distribution of $COMP tokens per market below:

And here's a tutorial on how to get $COMP tokens if you feel so inclined:

https://www.youtube.com/watch?reload=9&v=WimKt5dEDS4

This positive feedback loop has been very efficient at attracting enormous amount of liquidity onto Compound but I wonder if this mechanism will help distribute the token fairly, more on that later as more data will become available.

Analysis.

The first big takeaway from the Compound story has been very well articulated by David Hoffman:

The second takeaway here is that neither ETH nor BTC (in the form of Wrapped BTC) are gaining a lot of momentum as collateral in DeFi.

In the case of BTC, I think this is largely due to the unfamiliarity of most BTC holders with Ethereum and reluctance to transact their coins on another chain.

For ETH though, this is a clear sign that crypto-dollars are a serious competitor to the native asset. For me, this has implication regarding the security of the Ethereum chain (which needs a strong ETH) and the viability of crypto-backed stablecoins like DAI.

Crypto-dollars are just too attractive an investment (via Compound) and too convenient for traders and I don't see this trend exhausting anytime soon.

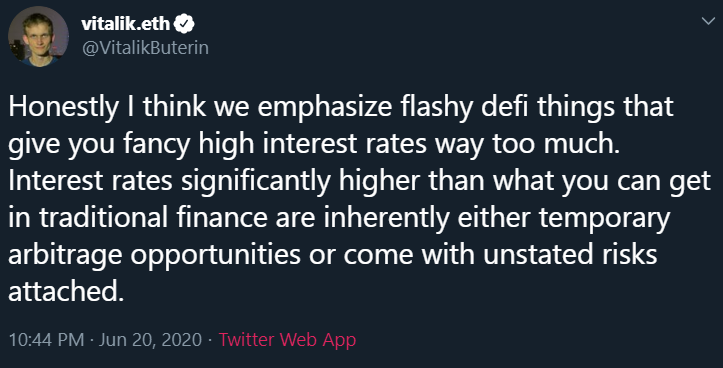

Vitalik is not convinced:

But crypto-dollars offer more than fancy interest rates. Price stability alone is an advantage when your goal is to build a global financial system where exchanges need to be quoted at a predictable value.

In the end, I find it quite ironic that crypto-dollars are finding product market fit via public block-chain infrastructure that was originally designed to provide a fiat-free alternative to the existing financial system.

I also think it's fair to wonder if the boom in crypto dollars could eventually threaten the position of BTC as the reserve asset for the crypto economy. It doesn't seem to be the case for now but it's certainly something to watch out for in the future.

🍒Cherry on the cake.

Former CFTC chairman Christopher Giancarlo said in a (Ripple-Labs-sponsored) piece of research that he doesn't believe XRP to be a security...

I am disappointed with you crypto Dad.

For the record, here's my honest opinion about XRP and Ripple:

Ripple doesn't have and has never had a sustainable business model.

Their SWIFT-like solution XRapid doesn't have product market-fit so Ripple's only steady source of cashflow is to either :

- dump XRP supply (60% of which belongs to Ripple) on unsophisticated (brainwashed?) retail investors (the infamous XRP army);

OR

- use XRP to

bribepersuade banks or companies like MoneyGram to 'partner' in a desperate PR attempts to pump the price of XRP... in order to dump more XRP onto retail.

Hell even Brad Garlinghouse, Ripple's CEO has admitted that Ripple wouldn't be profitable without selling XRP.

I am sure Ripple still has well garnished coffers from selling XRP during the 2017 hysteria but once their treasury runs dry they'll go down because the core of their business (software) is a failure and their XRP token doesn't have product market fit has we now have ample evidence that crypto-dollars like Tether are being used for remittances and medium of exchange.

Stay away from XRP folks.

Anyways...

That's it for this week's analysis, see you next weekend for more market insights.

Until then,

F0x

Hello there my friend !

What a great post: I do not even know where to start, you explained so well what is happening in the Defi markets and the threats opportunities rising from it.

I very much liked your take on Ripple and on USDT and the irony that it is becoming the main trading pair of this "FIAT free" revolution.... How ironic!

You deserve more attention as this is probably one of the best article I read this week. Reblogged.

I appreciate the kind words Mr.@vlemon,

Yeah quite ironic indeed, so much for getting rid of the USD, if anything public blockchains are the perfect rail to supply the global demand for dollars... jury's still out on how this will affect dApp platforms going forward

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!