Stablecoins are one of the most essential parts of the crypto ecosystem. They are used to hedge against big losses and to earn interest as well as being used as a store of value. Since national currencies are under certain regulations, it is not possible for any project to get approval to trade cryptocurrencies with national currency pairs.

Aside from their distinctive use cases, there are lots of coins that are called stable coins. However, while choosing a stable coin to use, what should be considered? According to my observations, for many people, it does not really matter and for some, the transaction fee is a critical point while using them.

Tether

When someone says stablecoins, the first one that everyone knows is, of course, Tether. Tether tokens were issued on 06.10.2014 on the Bitcoin blockchain. When it first appeared, the name of the coin was "Realcoin". It can be said that Tether is the ancestor of all the newborn stablecoins. Yet, how reliable is Tether?

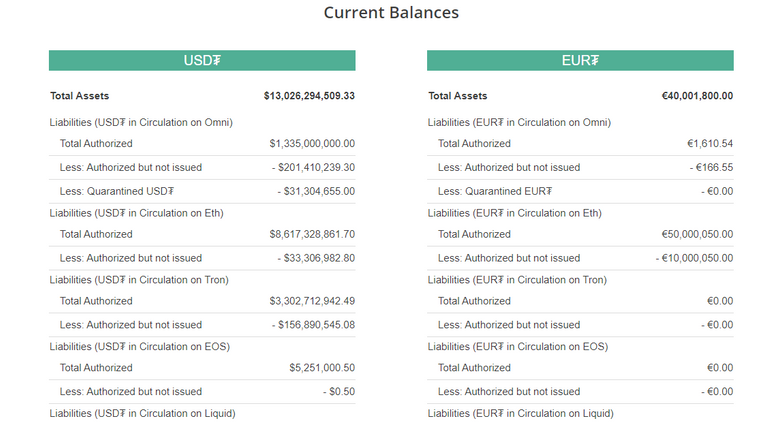

For this query, we have some sources to check: Transparency

The value of the reserves is updated at least once a day. Even though it's transparency, Tether went down to $0.90 because of the manipulation claims directed to Bitfinex exchange. In reality, for each 1 Tether coin, there must be $1 in the bank account of the company. However, it was declared by the Tether Limited that the stablecoin is backed %74 by cash dollar according to the Bloomberg news

One way or another, Tether is the top 3 coin in the whole crypto market whereas by far leading the Stablecoins market. I have Tether coins in my portfolio but am I comfortable for possessing them? Well, not actually. The reason why I am holding is because of its mass-adaption. Many short-scale local exchanges only accept Tether as a stablecoin.

✓ Mass Adoption

✓ Transparency

X Bad History

X Centralized

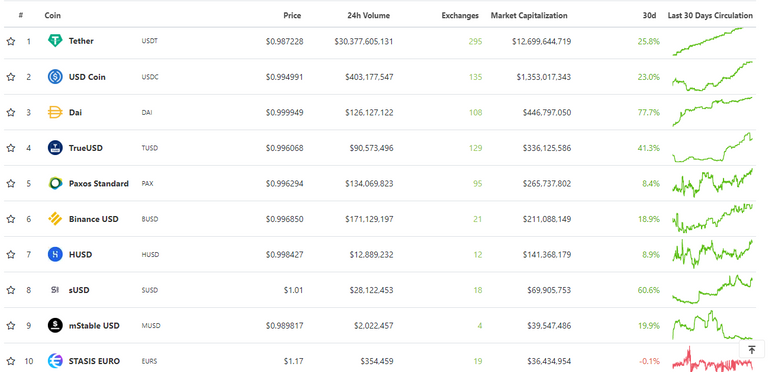

Following Tether, USD Coin has the second position in the stablecoins ranking according to their market capitalization.

USD Coin

USD Coin is also supplied by a company. However, the story is kind of different from Tether.

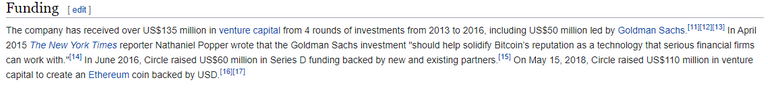

Circle is the company behind USDC Coin. What makes this company such famous is that the company was funded by Goldman Sachs...

In light of the post by Wikipedia, the company received US$50 million worth of capital from a very well known global investment bank.

Even though the coin is still under the control of a minority, I am not concerned about the fate of my USD Coins as much as I did about my Tether coins. Like Tether, they share monthly reports to prove their transparency.

Your USD Coins ---> Backed by Goldman Sachs? 🤔 Wait a minute... Is it possible? In the crypto ecosystem, nothing is impossible.

It is not a surprising fact to see that global banks are investing or "funding" the companies that are working on Blockchain-based products or services. Moreover, the giants do not want to use their own names while there are no regulatory protections for their brand name. However, the big brothers are with us 😎

✓ Mass Adoption

✓ Transparency

✓✓ Funded by a Goldman Sachs

X Centralized

DAI

DAI has nothing mutual with neither Tether nor USD Coin but for its stability.

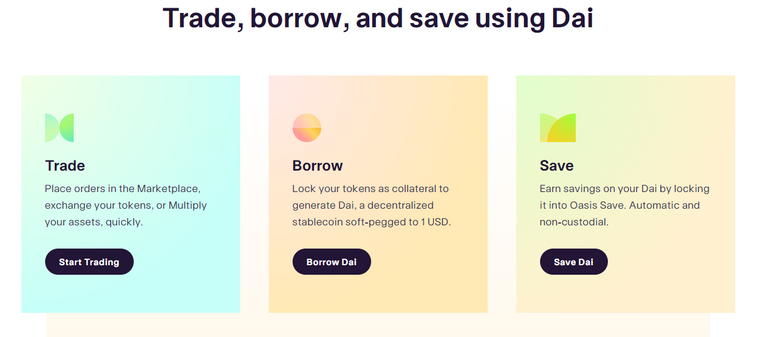

Dai coins are generated by you 🙃 If you do not know the process, let me summarize. by using Oasis.app you lock your digital currencies as collateral to generate DAI. Currently, you can use 12 types of coins as collateral. (I hope in the near future we will have wHive as a new one)

DAI is the best example of "from people to people" among the stablecoins. With De-Fi Mania, the number of people using DAI as stablecoin has increased drastically.

✓ Mass Adoption (Less than the former ones)

✓ Transparency

✓ Generated by people

✓ Entirely Decentralized

As a crypto enthusiast, I love DAI. Yet, I'm not satisfied with the existing mass-adoption of the project. I hope the project is used by millions when they need to possess stablecoins.

TL; DR

Tether ---> Accepted all around the world but the company has not a good reputation.

USD Coin ---> supplied by the company Circle which is invested by Goldman Sachs. However, it mismatches with our decentralization phenomenon.

DAI ---> Decentralized; generated by people but still needs more listing and adoption.

Depending on your preference, we have 3 unique stablecoins.

Which one do you use and what is the rationale behind?

Do you use another stablecoin? Why?

Please enrich the post with your precious ideas.

Thanks for reading.

@tipu curate

Upvoted 👌 (Mana: 0/5)

#POSH

Twitter

Your current Rank (65) in the battle Arena of Holybread has granted you an Upvote of 30%