Is DeFi going mainstream? Or is it just limited to a particular set of users?

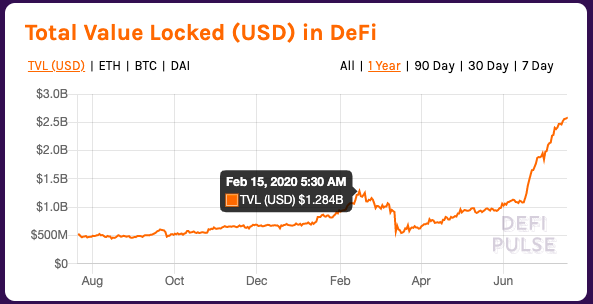

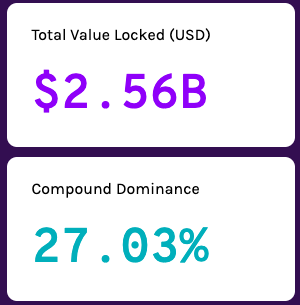

The value of USD locked in DeFi has tripled since April this year. Meaning users have shown trust and demonstrated that DeFi serves a real-world use case. Every new DeFi platform is witnessing a steady rise in the amount of USD locked in their platform. Some major platforms like Compound or Uniswap are experiencing parabolic growth. The total amount of USD locked in DeFi is currently just a bit north of $2.5 Billion with Compound leading all other platforms with a dominance of 27%.

Although these statistics paints a very strong picture for DeFi. But all is not how it seems, as it often is. When it comes to the number of unique users responsible for this humongous amount of USD locked in DeFi, the statistics fail to show the same tremendous growth in the number of users as is in the case of TVL (Total Value Locked) in the Decentralized Finance sector. As per the latest study/report released by Codefi user growth has not been nearly as impressive as TVL.

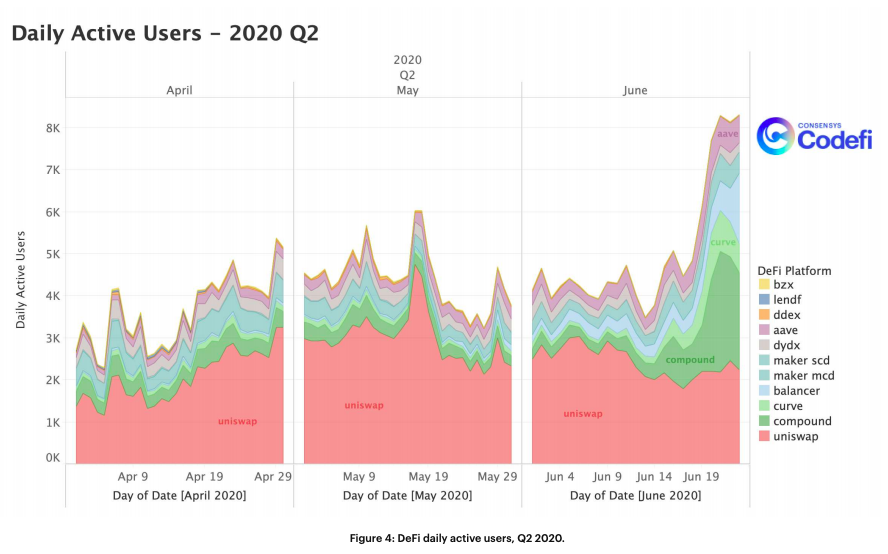

The report states that in Q2 2020, around 79,648 addresses were taking part in DeFi platforms with a sudden rise seen during mid-June.

June 21st was the busiest day of the quarter with respect to daily active users, with 6,333 active users on Ethereum DeFi. Compound alone accounted for 2,877 (45.4%) of those users.

Note that June-18 is listed as the date COMP was listed on major exchanges. Thus this sudden rise in users around mid-June can be attributed to the FOMO created by COMP token as it launched at a price that was not expected even by the Compound team. The graph shows exactly around 19-20th June we witnessed a sharp rise in users.

We now understand that the FOMO made users interested in COMP resulting in the spike of user growth. Another important thing to note is that these are not unique users as most of these users are the same who were interacting with other DeFi Platforms who in FOMO of COMP joined the Compound platform.

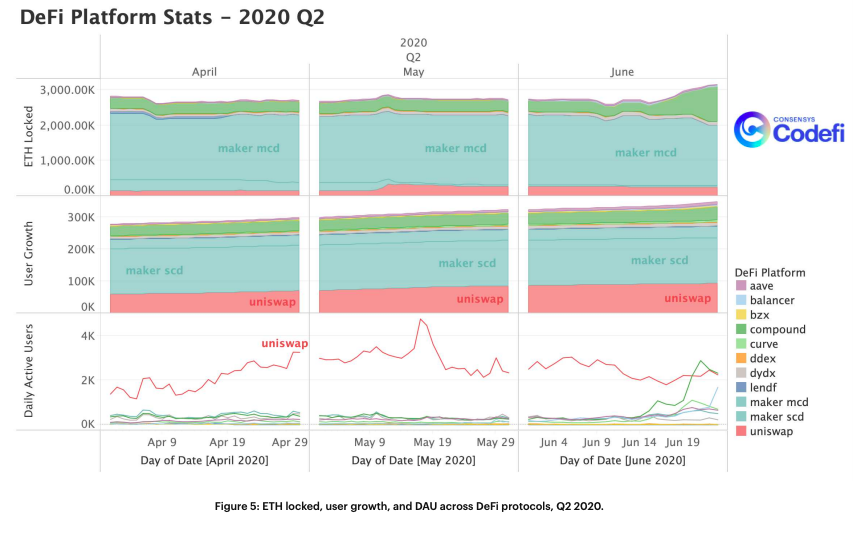

The above graph shows ETH locked, User growth. And you can see how even though ETH locked has seen great increase especially in the Compound platform but the user growth is still nowhere close to capturing the same increase.

With respect to ETH locked and DAU, COMP caused Compound to suddenly capture an outsized portion of the market when compared to previous ratios. User growth, however, did not experience the same sudden deviation from previous trends (figure 5). In fact, if we looked just at user growth in Q2 2020, we might presume nothing significant had happened in the past few months. User growth increased steadily and each protocol appears to have gained new users at the same rate and within the same ratio as they had the entire quarter.

So, even though money is being poured left and right into DeFi but user growth is not at all increasing accordingly. The reason being only a few sets of users who were already interacting with DeFi protocols are now jumping to other platforms and investing more there. Thus more and more money is coming from the same set of users. What's increasing is the number of users interacting with multiple platforms.

DeFi is the next bull catalyst for crypto imo

They building the ground that will become the norm in a few years for the mainstream.

Agreed.