COMP affecting the price of several tokens including BAT.

For a long time now, we have known that Bitcoin holds a strong influence on Alt-Coins. We have experienced most of the altcoins bleed whenever there is a sudden move in Bitcoin price, either to upwards or downwards. Except for a few alt-coins which remains strong due to news events, forks, halving, etc. For Example, the recent news and events had ADA pumping even though we saw Bitcoin struggling to break resistance and reverting to support every time it touches the resistance. But ADA holds while a lot of Alt-Coins bleed when Bitcoin fails to break the resistance resulting in losing $300-500 in one single move. Similarly, with BAT we actually saw BAT decoupling from Bitcoin and keep its bullish pace even though Bitcoin was decreasing in sudden and big moves.

Right now we are experiencing Bitcoin in a consolidation mode for months and that has seen explosive growth in Alt-Coins so much that we are enjoying the Alt-Coin season again which may end as soon as Bitcoin breaks downward or shoots to the moon. The last time we had this explosive growth with Alt-Coins was also the time when we saw Bitcoin in a consolidation mode for a long time.

Correlation- Bitcoin & Alt-Coins.

Let's take a look at the correlation during various time periods between Bitcoin & Altcoins. Considering the scale of -100% to 0 to +100% where -100% means the inverse of Bitcoin's trend, 0 means no correlation and +100% means in line with Bitcoin's trend.

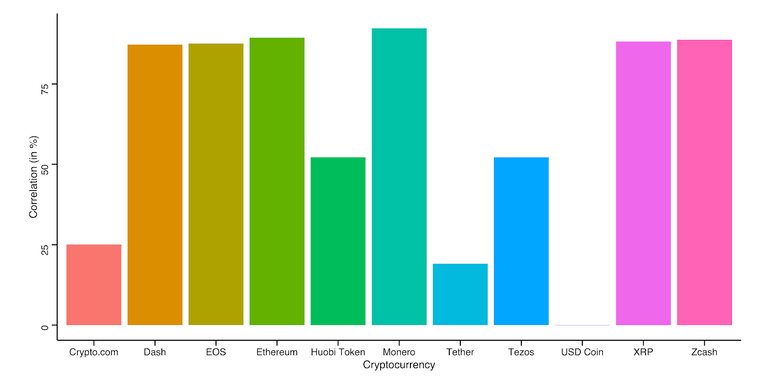

December 18- March 19

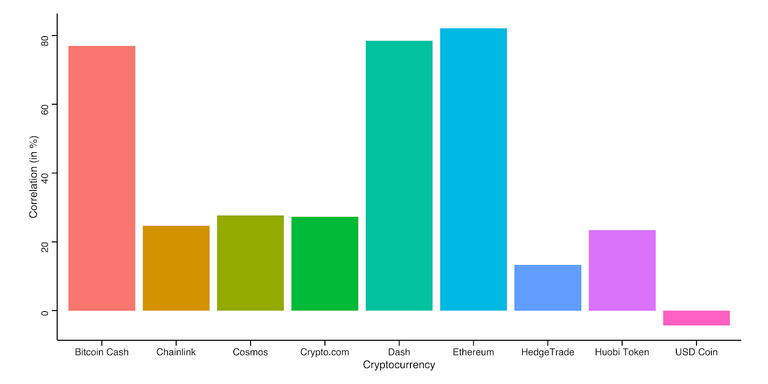

April- June 19

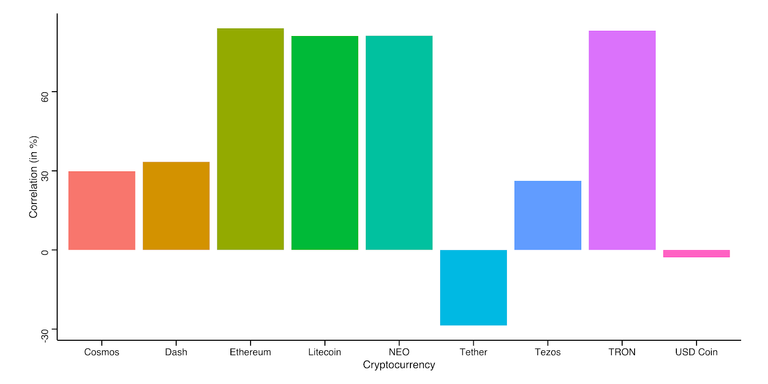

Jan 20- Feb 20

You can infer from the above graphs that stablecoins are the least correlated to bitcoin either when Bitcoin is bullish or when Altcoins are bullish.

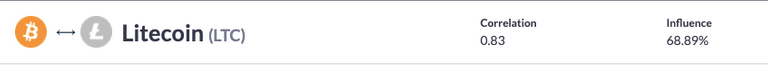

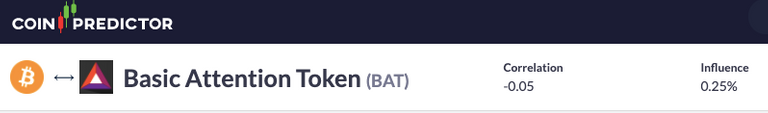

Coinpredictor analyses the past 100 days performance of bitcoin and altcoins and calculates the correlation between them. According to coinpredictor Bitcoin correlates highly with the top cryptocurrencies.

Coinpredictor has taken the scale of -1 to 0 to +1. Just as before, here -1 means inverse correlation, 0 means no correlation at all, and +1 means tight correlation or in trend with Bitcoin.

Correlation between Bitcoin and Altcoins can be a very lengthy topic and ultimately in the end we only find out that we cannot completely rely on correlation because certain crypto which acts accordingly to the Bitcoin trend in Bitcoin season does not correlate to Bitcoin during the Alt Season.

But this article is for COMP and the influence it has had on BAT these past few months.

Coinpredictor analyzed the past 100-day performance of Bitcoin and BAT and calculated the correlation to be a -0.05 meaning BAT actually performed inverse to Bitcoin over the past 100 days which is evident from its recent performance where Bitcoin saw consistent rejection and drops but our favorite crypto BAT experienced bullish behavior.

COMP has singlehandedly given a massive boost and generated a new sector within the Crypto community. If not generated then made it mainstream. It wouldn't be wrong to say that COMP has made De-Fi mainstream in the crypto community. Mainstream may be the wrong word seeing how the whole crypto ecosystem is nothing but niche but you understand what I am trying to say.

According to data from DeFi Pulse, the total value of the tokens currently locked within Compound is around $630 million, which is $100 million more than the amount locked within Maker, and $330 million more than the total value locked within Synthetix.

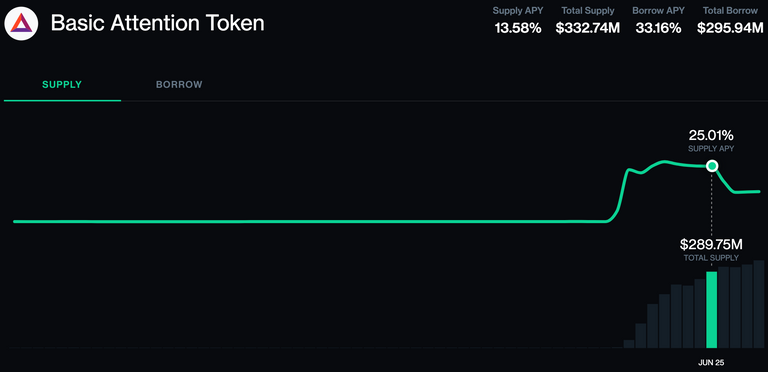

On the Compound platform, we all saw the huge interest BAT provided. People started supplying so much BAT that at one point 80% of BAT liquidity was on COMP. This risky situation was countered by Compound.finance by altering the distribution structure of COMP and thus reducing the BAT interest rates. I go about that in detail in this post.

First, it was USDT that was giving gains of 165% APY which was fixed by COMP in their proposals then it was BAT.

Along with this tons of people were supplying REP and ZRX to farm COMP as well. This farming led to the alteration of COMP distribution structure and BAT APY was also reduced just like USDT.

Look at how Compound holds influence on BAT prices in the below price chart.

Pay attention to the Basic Attention Token's price (green) on the price chart. As soon as the USDT patch is passed BAT starts its bull-run and rises from $0.20 to $0.29 whereas before yield farming BAT generally hovers around $0.19 to $0.25. Now that the COMP distribution is altered and the amount of COMP distributed to users no longer depends on supplying the asset with the highest interest, the price of BAT is decreasing consistently from its local high of $0.29 to now $0.246.

The graph also shows how REP and ZRX prices are influenced by COMP.

This influence of COMP on various other cryptos is termed as "The COMP Effect" by Santiment- the analysts behind this extensive research on COMP and its influence. You can refer to the highly descriptive and informational post by following this link.

Various developments are going on with the Compound platform and we will be hearing lots of them. I am also curious about how there is more supply of DAI on Compound than the actual supply of DAI. Probably the lenders are lending DAI, then borrowing more DAI and lending the same thus giving the perspective that the supply of DAI is more than what it actually is. But that's for another post and another time.

Quite interesting Effect this is. I will take my notes for some future cryptocurrency analysis

These are interesting information. I look forward to more cryptos decoupling from Bitcoin, especially Hive, I believe it will but with time. Or perhaps another fork will take us there....

As much as I will like to diversify my portfolio, increasing my stakes in Hive comes first!

Bitcoin is such a huge asset at this point that it affects all other crypto assets one way or the other. But I believe cryptos like HIVE, BAT which thrives on user engagement and provides a platform like Hive.Blog, Brave Browser has very good potential to achieve mass adoption. And we as users of these platforms can be the early investors who took the initiative to bring this change. Exciting times ahead for sure.

Very exciting. At least there will be one orca in Nigeria named Mistakili on hive in the future ,;)