With fast technological advancements, cryptocurrency and blockchain technology is finding mass adoption slowly. It is very clear that digital assets like Bitcoin, Ether are going to drive market growth in the coming years too. Post pandemic, the global economy has been shaken and fiat money is getting devaluated day by day. Institutional interest has pushed Bitcoin price to the moon and the cascade effect is visible on other cryptocurrencies. We can obviously say that the cryptocurrency market has decoupled from the traditional markets like stocks and precious metals. This is a really interesting phenomenon in the modern economic era. Yes, the market is ruled by the bulls now and novice traders are investing emotionally and loading up shitcoins. Trading can be profitable in this kind of market situation but the market dynamics change rapidly. The price volatility of cryptocurrency is very high and even a pro trader books losses in the market due to error of judgement. It is a fact that hodlers gain and they’ve gained historically. But how to hodl? Decentralized finance or DeFi is offering different types of platforms where you can deposit your crypto assets and earn but the security of the smart contracts is often questionable. The hacking of DeFi platforms has become regular news in this industry. Considering everything, it is really a decent idea to deposit your assets to a trusted custodian for earning passive income while you hodl. Let’s try to understand a few popular options.

BlockFi

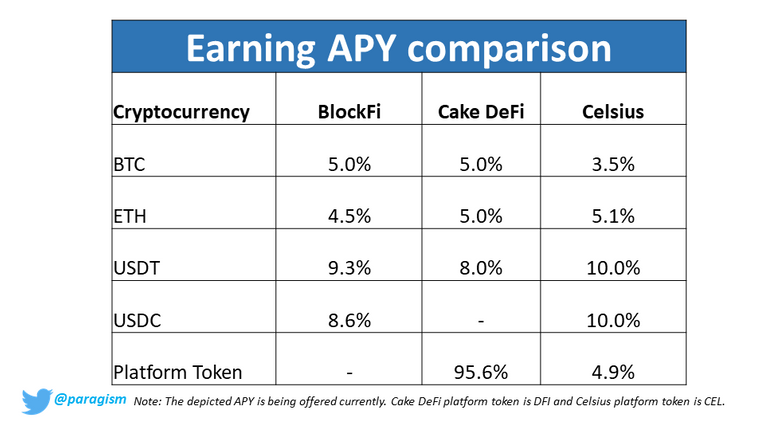

BlockFi is a popular platform that allows you to earn up to 9.3% annually on your cryptocurrencies. BlockFi, founded in 2017, is based in Jersey City, New Jersey. The company raised $158.7 million up to Series C fundraising. Very big investors like Consensys, Coinbase Ventures and Winklevoss Capital are backing BlockFi. You can avail of the service of the platform through their mobile app or website. Presently BlockFi supports quite a lot of crypto assets. The compound interest is paid at the beginning of the month. BlockFi currently offers 1 free cryptocurrency withdrawal and 1 free stablecoin withdrawal per month. The swap feature is also cool as you can swap your cryptocurrency to another. If you use this referral link to sign up and deposit $100 or more into the BlockFi Interest Account (BIA), you will earn $10 in BTC. KYC is needed.

Pros: Great security, the backing of big names, 1 free withdrawal per month. No lock-up

Cons: High swap fee, APY reduces if you are a micro or mini whale (only 2% APY if you hold > 0.5 BTC or >15 ETH)

CakeDefi

Cakedefi, registered in Singapore, has the core service in its Lapis lending products. The platform was launched almost one year back with the vision of providing lending and borrowing service and pooled master node. The company is distributed across the globe with footprints in several big cities like Tel Aviv, New Jersey and London. The platform supports many digital assets now. You are able to enter with any crypto amount of your choosing. Once you decide on your entry amount, your crypto will be locked in option contracts for the next 4 weeks. After the 4 weeks period of the batch, you will have the option to auto-compound into the next batch. You can also withdraw only your proceeds, or your entire principal + returns to your account. Lapis does not charge fees from users. The Freezer feature allows you to earn even better APY. KYC is needed. You can stake DeFichain(DFI), the native platform token, on the platform with 95.6% APY and DASH with 5.3% APY The rewards are paid every 12-24 hours. You get $20 worth of DFI when you sign up and make a deposit of $50 or more. You can use this referral link, you get an extra $10 i.e., a total 30$!

Pros: Easy to use interface, great referral scheme, APY not related to deposit amount, also offering liquidity mining, juicy joining bonus

Cons: Relatively new platform, lock up for Lapis products

Celsius

Celsius is a financial services platform by Celsius Network for cryptocurrency users. Celsius Network is a project which completed their token sale in March 2018 and survived the ICO crash. The company has offices in Tel Aviv, New Jersey and London. It connects crypto asset holders with borrowers and helps to earn interest on the crypto assets or get a loan against them. It acts as your bank savings account. Penalties and bank-style fees don’t exist. There are no other hidden fees too. The app acts as your wallet too. You can simply hold assets there and earn interest. The interest is paid weekly basis. KYC is needed. You can use this referral link when signing up and earn $40 in BTC with your first transfer of $400 or more.

Pros: No lock-up, rapidly expanding business, reputation, regular promos

Cons: Customer service has been an issue with the growing userbase

Mining and staking were the only ways of earning passive income with cryptocurrencies some years back. We’ve novel solutions nowadays. While DeFi is giving us the opportunity to be our own bank, we can also use bank-like infrastructure to earn passive income from our digital assets. There is no harm to put some money on such platforms if you want to earn while you sleep. Please note that before doing any kind of investment, you should do thorough research so that you can select the platform according to your risk appetite.

Your current Rank (68) in the battle Arena of Holybread has granted you an Upvote of 77%

nice post, thanks for sharing. Even the world of DeFi is about to become as infinite as that of cryptocurrencies

Thank you very much

Very interesting post. I don't trust BlockFi very much, they seem kind of shady. CakeDeFi is something I'm not willing to try just yet. These DeFi protocols are new and only time will tell how safe they are. Celsius is a platform I trust. They have proven to be reliable for almost 3 years now. 😎

Okay. I have used all. Better to not put it into one basket maybe. :)