The decentralized Hive fund plays a major role in the Hive ecosystem. It is the backbone for the development and funding of the platform. A tool that provides a self-funding mechanism for the chain! Since the creation of the Hive chain its role has increased massively since there is no centralized entity that will keep developing. The community members are the ones making the development and the DHF is providing the funds.

The DHF has 22M HBD now. It holds a lot of HIVE as well but those are not available for use. Since the creation of the Hive blockchain in March 2020, the funds under management in the DHF have grown from under 1M HBD to more than 22M HBD at this moment.

Let’s take a look at the data.

Background generated with Midjurney

The account that holds the DHF funds is the @hive.fund. Only 1% of the HBD holdings in this account are available for daily payouts and funding. At the moment this budget is around 220k HBD per day. Projects can create proposals for funding and if they are voted out from the community, they will start receiving funds.

There is only one way funds can exit this account and that is for proposal who have been voted from the community to get the funds.

When it comes to funding the DHF, or how funds are added to the DHF there is more than one way.

Funds added to the DHF:

- 10% share of the inflation

- Ninja mined HIVE conversions to HBD

- @hbdstabilizer

- HBD and HIVE transfers to the DHF

- DHF as posts beneficiary

The core source of funding for the DHF is the inflation.

In recent history a few more significant sources for funding were added. The most significant would be the HIVE that was transferred from Steemit Inc and co to the DHF. At the time of the fork in March 2020, there was more than 83M HIVE put in the DHF. In October 2020, this HIVE was put in a slow conversion mode with 0.05% of it being converted to HBD daily, that will continue for multiple years. This is to avoid price shocks.

Another significant source of funds are the transfers to the DHF that are made by the @hbdstabilizer.

This account is receiving fundings for the purpose of stabilizing the HBD. It trades HBD or HIVE on the internal market to maintain the peg and then it sends the funds back to the DHF. Depending on the price of the HBD it sends back HBD or HIVE. When HIVE is sent to the DHF it is instantly converted to HBD at the feed price, making these funds available for use. The stabilizer sends and receive funds, but overall, it has been a net positive.

Let’s check the charts.

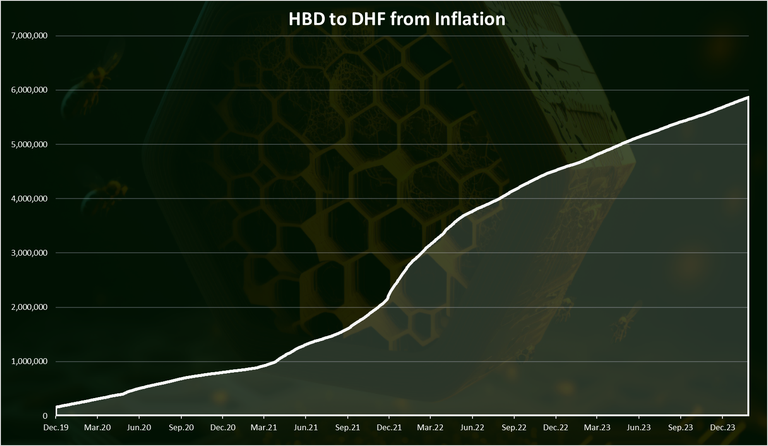

Funds from Inflation

As mentioned, 10% of the inflation goes to the DHF. Here is the chart.

The amount of HBD added in this way is correlated with the HIVE price. 10% in HBD is not the same when HIVE is 2$ or when it is 10 cents.

Almost 6M HBD was added in the DHF from the regular inflation. In 2023 alone there is around 1.2M HBD added in the DHF from inflation.

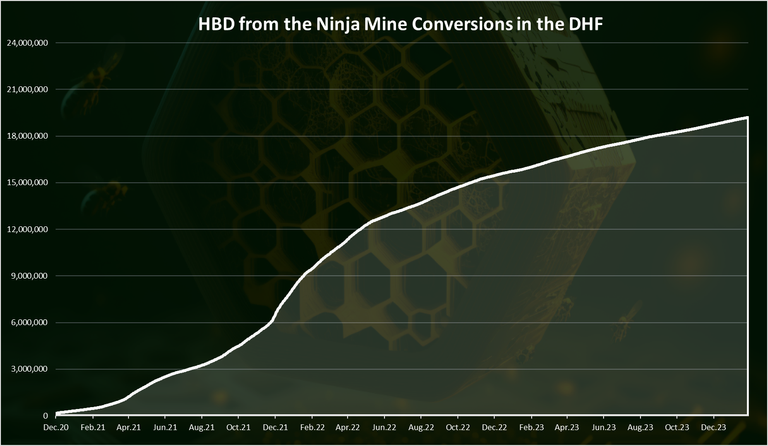

Funds from the Ninja Mined HIVE Conversions in the DHF

Here is the chart for the HBD added in this way.

This type of funding started at the end of October 2020. This is when the HF happened that enabled this. These conversions are also heavily dependent on the HIVE price.

A total of 19M HBD was added in the DHF from this source. In 2023 this number is at 3.2M.

This type of funds will slow down going forward as the amount of daily HIVE converted to HBD is going down. When the conversions started there was around 44k HIVE daily converted and now we are at 22k HIVE daily converted to HBD from the ninja mine. Meaning half from the start. Another significant factor is the price of HIVE. Nevertheless, these funds are limited, and after three years the conversions will end, and no more funds will added in this way.

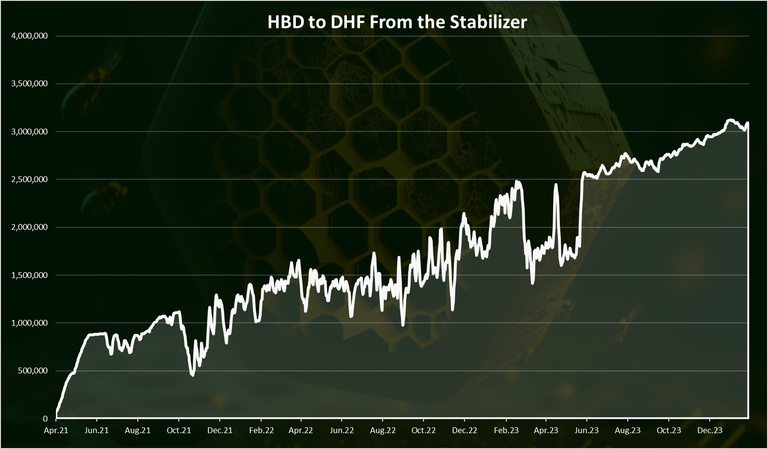

HBD Added to the DHF from the @hbdstabilizer

Here is the chart for the net HBD added in the DHF from the @hbdstabilizer.

As mentioned, the stabilizer receives HBD from the DHF, for the purpose of stabilizing the HBD peg.

If the HBD price is higher than 1$ then it will sell the HBD on the internal market. If the HBD price is lower than the peg, it will convert the HBD to HIVE and then buy HBD on the internal market.

If the price is at the peg, it will simply return the funds. It sends back funds to the DHF both, in HBD and HIVE. The HIVE that is sent back to the DHF is instantly converted to HBD in the DHF to be available for usage.

The chart above shows the net HBD added in the DHF from the stabilizer. More than 3M HBD is added in this way in the DHF.

We can notice there has been some volatility in the year, with funds going up and down but in the long run they keep on growing.

When there are spikes in the HBD price, it usually marks a period when more HBD is added in the DHF, and when there are drops in the HBD price, the stabilizer is using more funds and is taking funds out of the DHF.

Note that the stabilizer also receives funds from posts payouts as beneficiary and this has been a significant amount lately since a lot of the top stakeholders allocate there votes there.

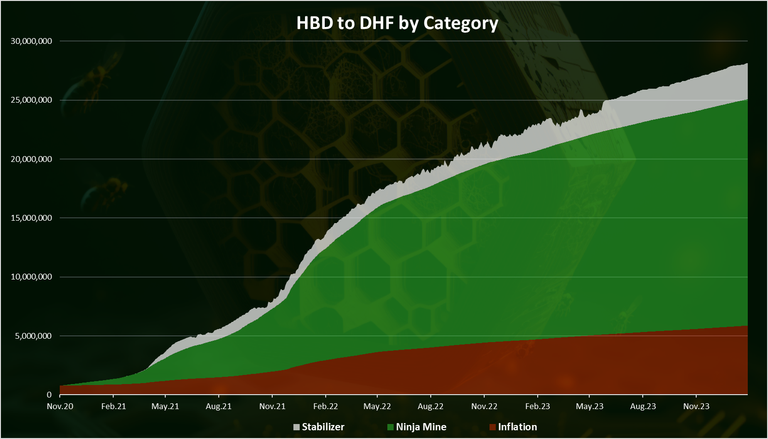

Cumulative HBD Added to the DHF

If we combine all the above, we get this.

From the chart above we can notice that the conversions from the ninja mined HIVE in the DHF are the main way for adding funds in the DHF.

A total of 19M HBD or 68% of all the funds in the DHF has been added in this way. The regular inflation is in the second spot with 5.9M (21%), and then the stabilizer with 3M (11%).

Payouts from the DHF

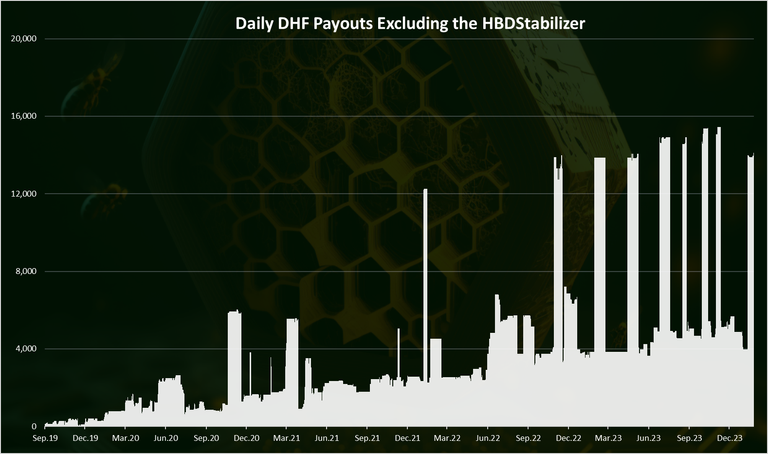

As mentioned, this is the only way HBD leaves the DHF. Here is the chart.

The chart above excludes the payouts to the @hbdstabilizer.

We can notice a few spikes in the payouts, usually when some project with heavy funding in a short period of time.

On average in the last period around 4k HBD has been paid daily to DHF workers. The spikes that we can see on the chart are usually when the @valueplan account has proposal. This account manages a multiple activities under its umbrella.

On a yearly basis the total payouts look like this:

| Year | HBD |

|---|---|

| 2020 | 616,784 |

| 2021 | 888,701 |

| 2022 | 1,775,947 |

| 2023 | 2,737,231 |

The funding to projects has reached an ATH in 2023 with 2.7M allocated. This might seem a lot, but it is still small numbers when compared to some other projects that have much larger development and marketing budgets.

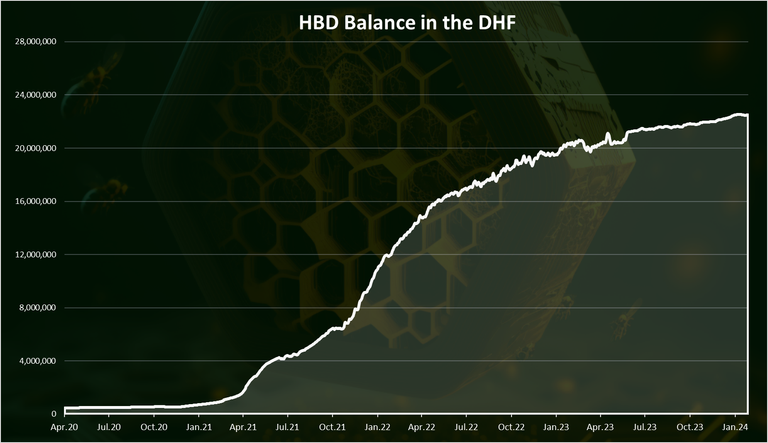

HBD Balance in the DHF

Here is the chart.

When we add the funds added and removed form the DHF we get the chart above.

More than 22M HBD in the DHF now.

We can see the sharp growth in the funds back in 2021 and 2022. This is mostly because of the ninja mine HIVE to HBD conversions in the DHF and the high HIVE prices at the time.

In 2023 this growth has slowed down as HIVE prices have dropped and payouts increased.

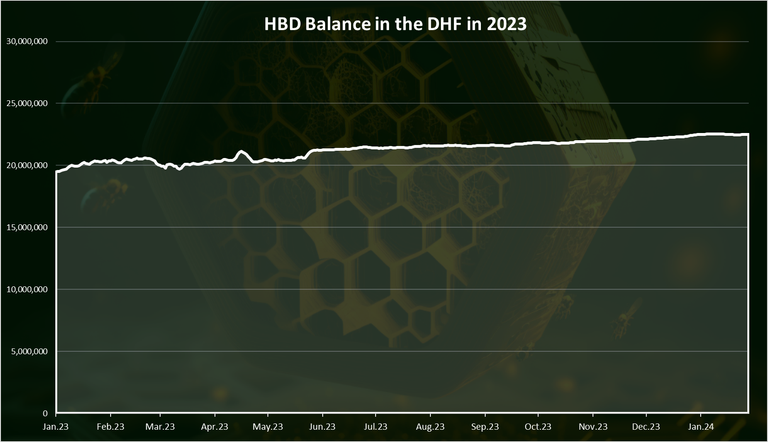

When we zoom in 2023 we get this:

The year started with 19.5M HDB in the DHF and now we are at 22.5M HBD.

Overall the DHF balanced has increased in 2023 for 3M, but at slower pace from the previous years. For example in 2022 there was almost 10M HBD added in the DHF.

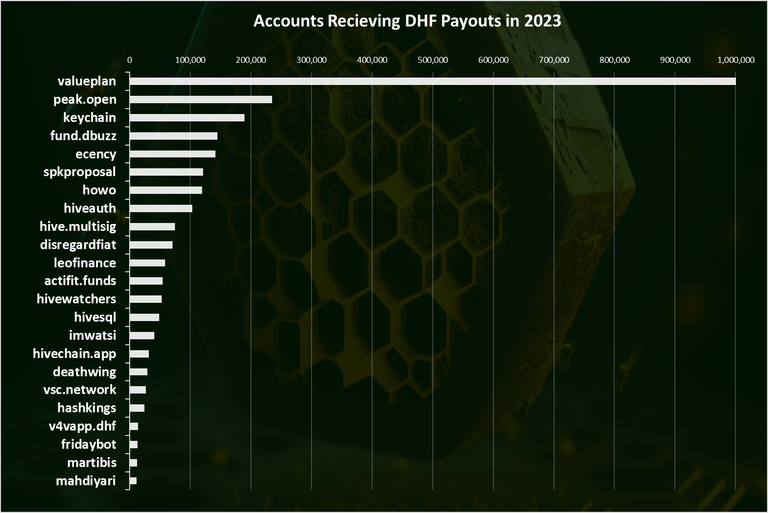

Accounts Receiving Funding from the DHF in 2023

A total of 25 accounts received funding from the DHF.

Here is the chart, excluding the stabilizer.

The @valueplan is on the top for 2023 with 1M HBD, followed by @peak.open and @keychain.

Other known projects in the top as @ecency, @spkproposal, @howo etc.

From the beginning of the chain, back in March 2020, more than 50 accounts received some form of funding.

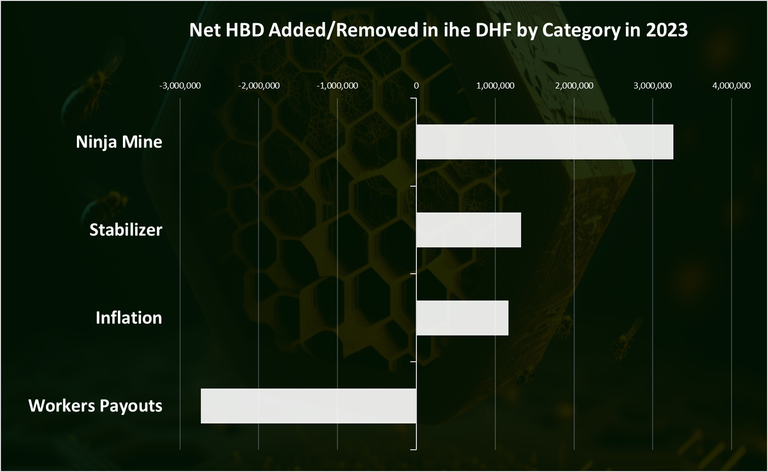

Summary for HBD Added and Removed in the DHF by Category in 2023

Here is the chart.

The Ninja mine conversions are on the top with 3.2M, the stabilizer comes at the second spot with 1.3M HBD and then the regular inflation has added 1.2M HBD in 2023. The payouts to DHF workers are at 2.7M and are negative on the chart. A net 3M HBD added in the DHF in 2023.

All the best

@dalz

Sad :-( I was expecting to see my return proposal's contribution to this pretty pile of funds ;-)

Lol ... here you go

Something that I wondered about the other day.

Do you know how to allocate automatic votes to comments?

I think hive.vote has options ... although I havent looked at it in a while ... other option is to follow the votes of the other top accounts voting ...

Tried that, seems that's not enough. Hive.vote doesn't have any option to vote comments or vote trailing comments.

shame that rewarding.app from @holger80 is no longer available. Are u there sir?

Ha ... I bet there was a comment option on hive.vote ... will look again once I'm on PC .... otherwise it should be a simple script to run this kindcof things

I like HBD. I think that one day I will buy a lot of HIVE for HBD.

Good luck!

I see you already have some... on a good way

Great article as usual, dalz.

I have one question that's somewhat related to it...

Do you happen to know why the receiver on the return proposal is steem.dao and not hive.fund? I thought the purpose of the return proposal was to capture all funds not taken by proposals with more votes and funnel it back into the DHF

Thanks!

It existed before the split from Steem. The consensus rules now automatically transfer anything from steem.dao to hive.fund (both are special system accounts governed by consensus rules).

That makes sense :)

Thanks for your reply

!ALIVE

@dalz! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ tuisada. (1/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

Thanks for sharing these insightful statistics about the Decentralised Hive Fund, and from what you wrote I can agree that it plays an important role in sustaining the ecosystem. Thanks for writing.

HBD makes a lot of sense

I also love the APR

It is not bad as long as I’m not trying to find a get rich quick scheme

Thank you for the valuable information presented in this article; now we know where the money went during the year 2023. Good job to everyone working hard to promote Hive and spread the word about this community-powered blockchain.

Thank you for this update it will be well appreciated

$WINE

Awesome post again. I am learning more and more about the Hive ecosystem from these. Seeing the amount of funds available, and it continuing to increase, I hope we can have more developers working on different projects for Hive.

The hive ecosystem is evolving quite amazingly. Im thinking if i should maybe sell all my splinterlands assets, and invest it all into hive and hbd !

NIce write up and stats, DHF is really a back bone of the hive ecosystem.

Thank you so much for giving us this overview. Quite interesting to see

Great to see this. Valueplan is not a single entity but a large number of individual projects. The Peak Open is similar in its break down although with far fewer projects. Perhaps its best to consider them as categories or label them as such.

Thanks!

Yea, I mentioned on one place in the post that it is a type of an umbrela project, covering more activities .... might add some aditional info, classification ...