Is the price of Hive driven by Bitcoin?

I have been writing a series of posts using Granger Causality Testing to determine what factors can contribute to predicting the price of Hive.

In this series I have examined the relationship of the Hive price with Splinterlands activity, Hive posts and comments as well as power ups and power downs. However so far I have ignored an elephant in the room, that is the undeniably strong relationship that nearly every crypto token appears to have with Bitcoin. Indeed @crrdlx mentioned this point in the Hive General price and trading chat group.

In this post I will examine the relationship between the prices of Bitcoin and Hive, and determine if either has any predictive value towards the other.

Correlation

The analysis I have done so far is based on Granger Tests, which rather than just looking at the direct relationship between two variables over time, is attempting to determine if one variable has any predictive value (or "Granger causality") towards another. This predictive value involves a separation of time, ie. "lags". I am using lag measured in days but in the crypto space most of the relationship between two tokens is likely to be found in a much shorter timeframe - hours, minutes or near instant.

For this immediate relationship, we only have to look at the correlation between two tokens. That can be done easily enough in Excel, but even more easily with a tool available online: https://cryptowat.ch/correlations

The above tool very easily allows you to identify the correlation between pretty much any crypto tokens, over periods from 24 hours to 1 year. You can see above that the correlation between the price of Hive and the price of Bitcoin is a statistically significant 0.45, which going by the rule of thumb provided by Boston University would be considered a "moderate" correlation. This shows a relationship, and the immediate correlation is likely the bulk of the relationship between Hive and BTC prices. Granger Causality then shows us what predictive value is involved in the 'lagging' part of the relationship.

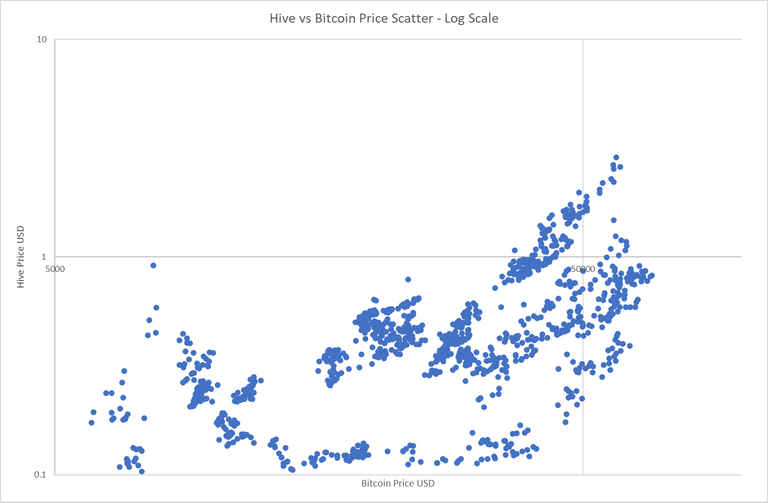

We can see the correlation in a log scale scatter chart below. The correlation of Hive price to BTC price since the fork in March 2020 is 0.596, ie. moderate, but just under the threshold to be considered "strong". Note that the axes in this chart do not start at 0.

Causation (of the Granger kind)

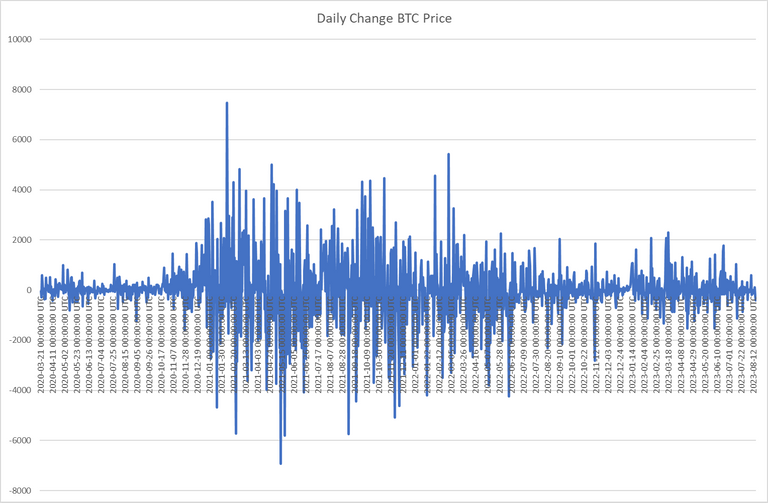

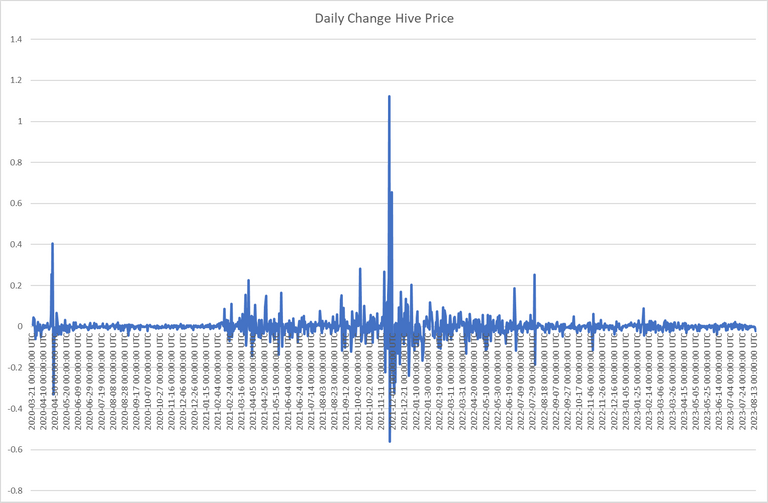

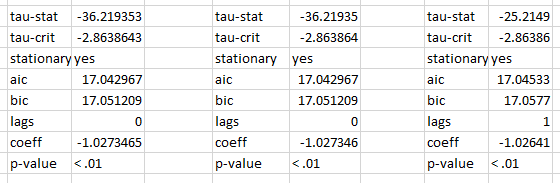

Let's take a look at how changes in the price of Bitcoin can predict changes in the price of Hive and vice-versa. As with previous cases, we need to examine data that is stationary. So we look at the daily changes in price, not the price itself. The charts and Augmented Dickey-Fuller tests below confirm that those datasets are stationary.

Now that the data is confirmed to be stationary, we can proceed with Granger Causality Tests.

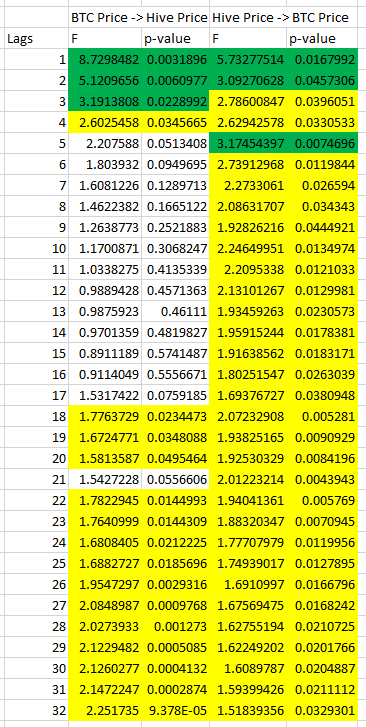

Statistically significant results are highlighted, with the strongest effects (F > 3) highlighted in green.

Conclusions

There has been a moderate to strong relationship between the price of Hive and the price of Bitcoin since the split with Steem. That relationship exists outside of the predictive value described below.

Changes in the price of Bitcoin can predict upcoming changes in the price of Hive. The strongest effect is in the day immediately after a Bitcoin price change, tapering off for the next 3 days. It can also predict changes from 18 to 32 days out.

Changes in the price of Hive can also predict changes in the price of Bitcoin, with the strongest effect in the immediate day, but continuing to have predictive value up to 32 days ahead. It is not as strongly predictive as Bitcoin is of Hive.

I find it surprising that Hive has any predictive value towards Bitcoin at all. Although I have checked my work for errors, it is of course possible that I have a mistake I have not identified. If there is no error here, I would hypothesize that perhaps the price of Hive is an indicator of Korean crypto demand because of the disproportionate volume Hive has on Upbit compared to other tokens. I would be interested if anyone else has a plausible hypothesis.

My statistics and analysis posts take many hours each to research, chart and write, so if you find them valuable and of interest to other Hivers, I appreciate your support in sharing, commenting, and/or upvoting my work. If you're interested in these kinds of stats posts, click the 'follow' button on my profile, or subscribe to the Hive Statistics Community which features daily Hive stats posts from @arcange as well as less regular posts from myself and others.

awesome, great to log in after so long and to see a post from you. I hope you are well

I'm doing great, thanks Paula, long time no see!

I observed this week that Hive adjusted itself to exactly 1/100,000th the cost of Bitcoin, and I remember seeing that back in 2020 and 2021 before of course they had to diverge ... I wondered if there were something going on with the correlation, and, indeed ... wow ... good info here!

ADDENDUM: I don't have any data, per se, but I do have a memory of 2020 ... Bitcoin arose out of the pushback of what everyday people went through in the financial crisis, and Hive arose out of a community pushing back after the powers-that-were betrayed and stole from it. That was the narrative... so it may also be that there is an overlap of the types of people that invest in both Hive and Bitcoin.

The market's head falls on top of all the Sikhs as it descends the way we see it. Its great and very helpful post. Thanks for sharing.

I'm starting in this community and your content is amazing, I hope to learn from you