Kira is a Tendermint-based network that aims to support dApps which will be truly permissionless, decentralized, cross-chain & secure, all while tokens being tradable through liquid staking with scalability & economic efficiency. The first module to demonstrate Kira’s capabilities will be the Interchain Exchange dApp.

Kira Network is designed to secure and power DeFi applications by utilizing the real, intrinsic value of any digital asset at stake, such as cryptocurrencies, stablecoins, digital fiat, or even NFT’s. Kira provides liquidity to staked assets through staking derivatives which at the same time can be used with any DeFi application in a trustless manner. Kira Network itself is a hub providing and incubating DeFi products such as the Interchain Exchange Protocol (IXP) and the Initial Validator Offering (IVO), where investors do not spend their money but delegate their assets to mine new tokens and maintain full liquidity of their capital. All while earning fees & block rewards.

We’ll examine these parts of Kira:

- Team

- Kira Core / Kira Network / Interchain Exchange Protocol (IXP)

- Initial Validator Offerings (IVOs) — Decentralized Crowdfunding

- MBPoS Consensus (Multi-bonded Proof of Stake)

- Fair & Democratic Governance Model

- Token Utility & Tokenomics

In a few words…

What is Kira?

Kira was initially conceptualized as a decentralized cross-chain exchange based on the Cosmos network in 2018. They were building DeFi even before DeFi was invented as a term. Their idea of locking tokens to mine a new currency can now be seen in many “agricultural revolution 2.0” Uniswap DeFi food tokens in the form of yield farming & AMM pools. What Kira is doing differently is that the more assets staked in the network the more the security increases, while also making the locked assets liquid by minting a new token (staking derivative) that can be traded in the form of sBTC, sETH, etc.

It also offers a completely community-governed (by validators & delegators) cross-chain DEX which users own and profit from the fees while enabling the easy listing of any asset. The governance is carried through a smartly created code-of-conduct that prevents the creation of an oligarchic plutocracy (rich people don’t hold all the weight of votes) and empowers decisions to be made in a truly democratic way.

Each network operator (validator) has equal voting power and an equal chance to propose new blocks.

What’s also really interesting is that unlike existing DEXes the whole infrastructure of the exchange can be hosted in a fully decentralized and censorship-resistant way. It allows asset exchange to occur in a true P2P fashion, without a requirement for any middleman, thus virtually eliminating potential downtime.

The 2 founders, Milana and Mateusz, were previously advisors of Sentinel, another project of the Cosmos ecosystem.

Team — Founders

(Info from Kira’s Wolf AMA)

"My name is Milana Valmont, I grew up in LA but moved to NYC to study economics and psychology at Fordham University. After graduating I have worked in corporate finance for a couple of years as a private equity analyst. I became involved with the crypto ecosystem first as an investor in early 2017 and later the same year I joined Binance exchange as a community volunteer.

After that, I have worked as a project manager for Adcoin.com and was an adviser to Sentinel. In 2018 I went to Tel Aviv to join Knoks platform as head of Strategy, and by mid-2019 I dedicated my full attention to Kira as CEO. I’ve known Mateusz since 2017."

"My name is Mateusz, Kira’s CTO (Chief Technology Officer).

I am an electronics engineer, worked as an R&D developer for Barclays Bank, then as lead infra engineer for US-based Settle Finance then as product manager for the crypto exchange in Switzerland called Bity, shortly after that we started Kira with Milana.

I have been in crypto since late 2011 about which I learned from Reddit, started by mining BTC on my GPU until that stopped being profitable. I was always obsessed with algorithmic trading and switched from automations in MT4 and old day markets to a new obsession with crypto and Kraken API in 2013 : ) the next two years had a lot of ups and downs and a lot of Dogecoins mined.

In 2016/2017 it became clear to me that PoS and cross-chain is the only way forward which made me heavily invest my time into the Cosmos and Polkadot ecosystem. Both me and Milana were advisors for a dVPN project in Cosmos called Sentinel, we got to know each other after DevCon 4 IRL and decided to do something new and exciting that the crypto space needs — Kira."

Ethan Frey used to be the Lead Developer of Regen Network (Tendermint-based project), he’s the founder of CosmWasmCosmWasm and Confio, the technology that brings smart contracts to Cosmos.

Kira Core — Network — Protocol & Interchain Exchange

Kira Protocol is a set of tools designed by the Kira Core team to secure the Kira Network and induce value into its native staking asset KEX (Kira Token).

Kira Core: The corporate company building the Kira Network, just like Tendermint is building Cosmos or Parity — Polkadot.

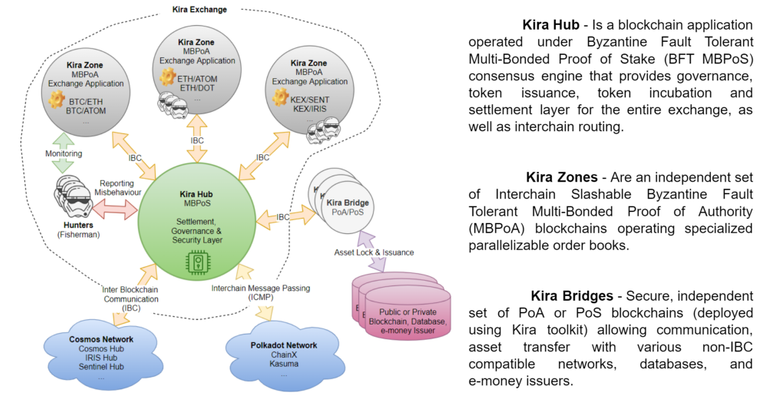

Kira Network: The blockchain where Kira Protocol (the DeFi application) will be deployed.

Interchain Exchange: The module that will be embedded into Kira Protocol so users can stake and trade their assets directly there. It’s a native part of the Kira network, it’s a sharded order book that provides permissionless market access to any token in the interchain. IXP will be the first Kira DeFi dApp.

The purpose of the Kira Network is to become a cryptocurrency ecosystem incubator and over time become its number one security layer. The economy of the Kira Network is designed to bring value into the system. Network operators (Validators) are incentivized from fees paid by the users of the native dApps deployed on the Kira Network, such as the Interchain Exchange and the Initial Delegator Offering modules.

Kira Protocol is a layer built on top of Web3 / Interchain SDKs such as Persistence, Cosmos SDK, and Substrate (Polkadot, Ethereum 2.0) that can be later reused by other interchain projects and cascade its evolution. Kira Core team will also provide a crowdfunding platform to enable more ecosystem projects to build upon its protocol and further contribute to its growth (Initial Delegator Offering’s).

Interchain Exchange Protocol (IXP) — Cross-chain DEX

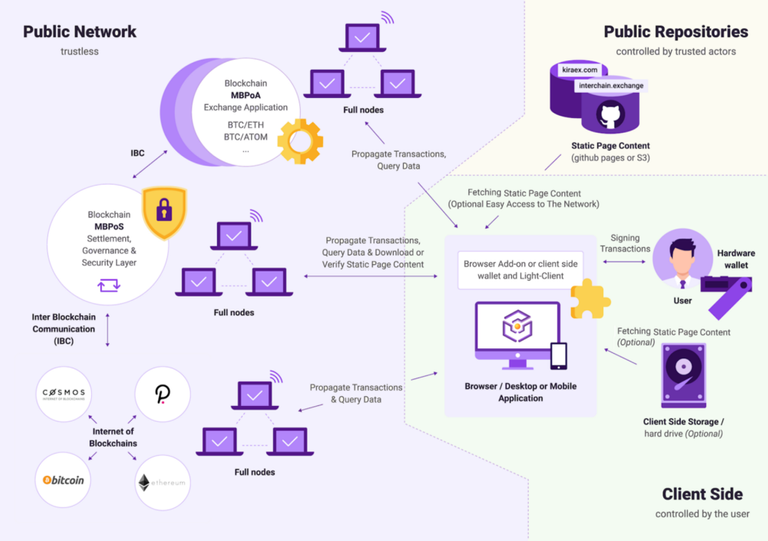

Kira Interchain Exchange Protocol (IXP) is a scalable (sharded), trustless and decentralized DEX module enabling delegators to maintain incentives while staking and simultaneously benefiting from market access. Users can deposit and exchange their assets trustlessly over interchain protocols, such as Cosmos IBC and Polkadot XCMP.

Kira aims to establish itself both as a primary settlement layer within the Internet of Blockchains (IoB), and as a focal point for interchain commerce, by providing scalable order-books, OTC and a range of future decentralized finance (DeFi) applications that will be developed by our community and evolved via governance.

The main utility of the Kira Exchange module is to provide full liquidity (through staking derivatives) to all assets at stake while enabling traders (and KEX holders) to benefit from block rewards and network fees.

Accessibility Freedom — Completely Decentralized

Users of modern CEXes, also some DExes too, sometimes experience lag / cannot access exchanges during peak activity. This can result in bad UX, monetary loss, and opportunity cost. Additionally, operators are frequently forced to apply KYC identification of customers for compliance purposes.

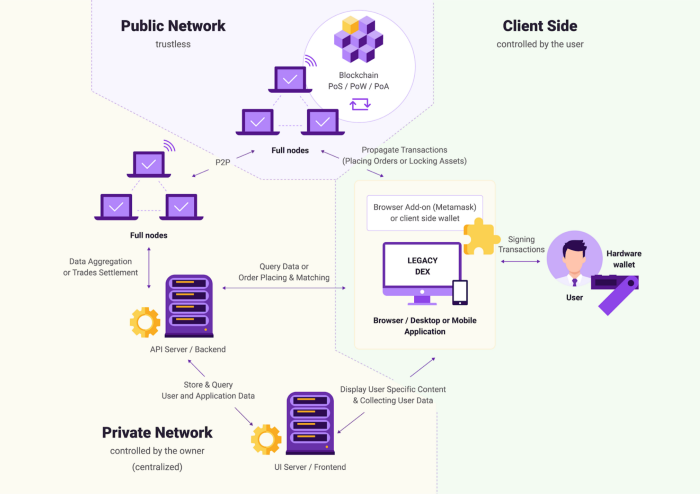

Most of the blockchain-connected application architectures utilize backend gateways e.g. APIs for the purpose of the blockchain state aggregation or processing, most often operated by a single, centralized entity. This offers some benefits but can also result in limited access in certain situations.

Notice that there’s a centralized part in existing DEXes:

Kira Protocol offers a completely decentralized trading experience. Because the trading or any other dApp UI is delivered trustlessly over the decentralized network itself, Kira (like Bitcoin) puts itself beyond jurisdictions and enables peer-to-peer asset exchange with full anonymity. No KYC is ever required and users retain full and exclusive custody of their funds.

The scalable decentralized applications (dApps) of the future demand highly reliable gateways to the internet of blockchains that users can depend upon, even in extreme circumstances. Today, the majority of centralized (and even decentralized) exchanges hinge upon the availability of backend services, via which users’ requests are proxied in order to trade. Not only does this architecture threaten application availability when the system is stressed, attacked, censored, or down for maintenance, but it also exposes users to a multitude of threats, even in the presence of security best practices such as multi-factor authentication. Not your keys — not your coins.

Permissionless Token Listing — An Exchange Owned by the Users

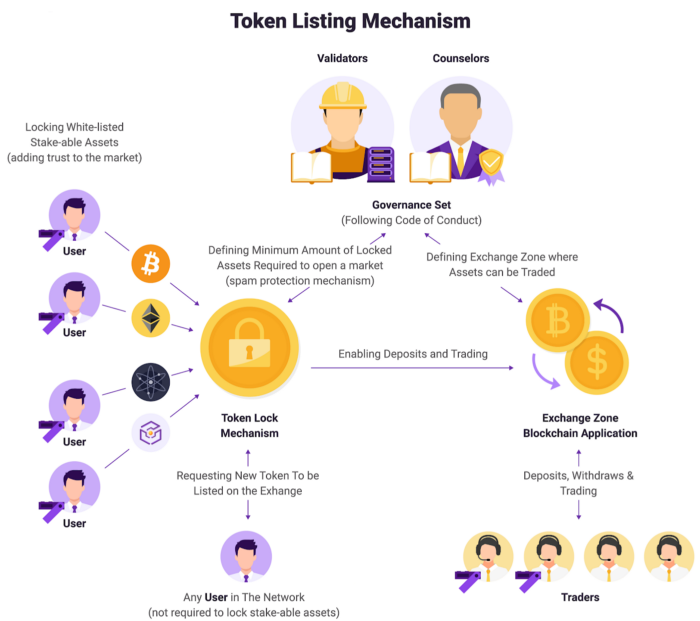

Kira Exchange Protocol enables a simple and permissionless process in which new tokens can be listed in a matter of minutes. This is taking the opposite approach of centralized exchanges where all decisions about token listings and management are made by the owners who also profit from the fees.

An exchange truly owned by its users:

- In order to list a new token, there has to be a minimum amount of whitelisted tokens locked, in order to enable the trading of the new asset.

- The amount which has to be locked is defined by the governance.

- Users are able to collectively lock assets, meaning that it’s not up to one person whether a token is traded or not.

- If the amount of locked assets is not met, or if the assets are unlocked, the trading of that token will be stopped within a predefined time period.

With Kira Exchange Protocol, a transparent consensus of operators, users, and elected council members helps not to only optimize exchange operations by actively adjusting parameters that steer the economy but also adds a second layer of security in the form of activity monitoring, insurance, and governance managed validator slashing on top of the underlying protocol. The governance set can thus not only control the economy but also help prevent fraud and reimburse users in case of potential application faults, unforeseen events, or malicious acts.

The “smart slashing” ensures that bonded tokens are safe in case of accidental validator faults. This is made possible by depositing the slashed assets to the community pool rather than destroying them. This helps remove frequently offline validators from the set, rather than punishing delegators for staking their assets.

Scalability-dApp Sharding

Kira Exchange Protocol consists of many independent, interconnected shards called zones where various cryptocurrencies can be traded in a fully parallelizable manner to achieve centralized exchange experience and transaction throughput while maintaining a decentralized exchange level of asset security. Users remain in full control of their assets even if they’re originating from various different blockchains.

Liquidity

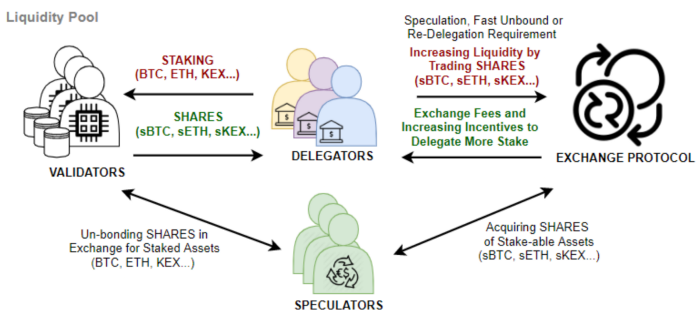

Kira Exchange Protocol liquidity is induced by enabling transfers of the stake-able assets in the form of staking derivatives.

For example, by staking BTC, a staking derivative sBTC would be issued to the staker, and while the BTC would remain illiquid and slashable, a sBTC could be freely transferable and tradable. If the BTC were to be slashed due to validator misbehavior, a sBTC derivative would be able to claim only a portion of the BTC it is representing.

In other words, Kira Exchange Protocol allows the users to earn passive income from the block rewards (KEX inflation) and network fees (such as transaction fees and exchange fees) by staking their BTC, ETH, ATOM, DOT, e-Fiat, tokenized commodities, and other tokens while maintaining the ability to trade and realize the value of their assets at stake.

Staking Derivative Assets — sToken

Staking Derivative assets are necessary to provide liquidity of the assets someone stakes. Without them the ups and downs in the market could cause panic and force people to undelegate — thus decrease security of the network.

Derivatives give you the ability to trade one type of staked token for another e.g. sBTC for sUSDC so you can continue claiming rewards from the network operations with no exposure to the market volatility.

Supported tokens will be all coins in Cosmos initially, and later on Polkadot once they finish the work on the XCMP.

Launch tokens on Kira.

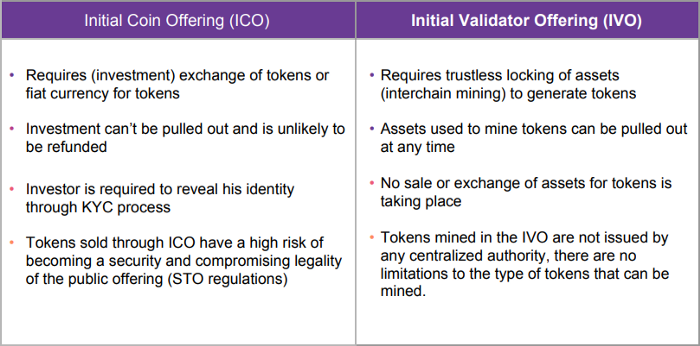

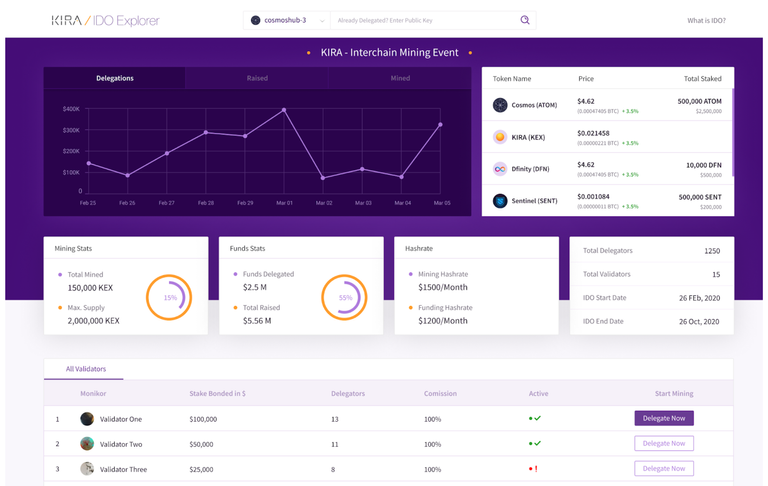

Blockchains such as Cosmos, Polkadot, Dfinity, Ethereum 2.0, Tezos, and others, secured through the process of staking, enable their Validators to earn commission fees from the block and fee rewards. Kira Protocol utilizes staking mechanism for the purpose of crowdfunding, allowing investors to hold full custody over their existing assets while maintaining liquidity and acquiring tokens with the minimal possible risk involved. Initial Delegator Offerings (IDO’s), invented and licensed by JSC Kira Core provide a meaningful, low-risk alternative to Initial Coin Offerings, and other crowdfunding and token distribution mechanisms such as lock-drops.

The main advantage is that investors do not spend their tokens and with MBPoS (Multi-bonded Proof of Stake) they can take part in multiple IVO’s at the same time using the same asset.

With IVO someone can stake safely to the validators he trusts. No one holds custody over his coins and they’re not spent at all. The IVO project gets money directly from the network fees and block rewards — instead of taking it from the users.

Kira Token (KEX) will be one of the first-ever tokens distributed through the IVO process.

Delegators who stake their tokens with KIRA Staking Validator nodes will be able to preview their KEX earnings and state of their delegations in the Kira IVO Explorer tool. There is no need for delegators to disclose their identity, and no registration of the public key will be required to later redeem KEX tokens, making the crowdfunding process incredibly simple and secure for the investor.

How a project can raise funds on Kira:

You need a validator of your own or use an existing validator that would be willing to host it for you. It’s part of the Kira Core (corporate company) business model to deploy IVOs as a service.

Features:

● Automatic, instant, and trustless token distribution

● Staking of any foreign asset thanks to the MBPoS consensus

● Full liquidity of assets at stake thanks to Kira Staking Derivatives

● Issued Tokens can become instantly tradable through the Kira Exchange Protocol

● Lowest possible risks of slashing than in case of any other DeFi product

https://medium.com/kira-core/initial-delegator-offering-ido-b788c83c32d5

Network Consensus: MBPoS (Multi-bonded Proof of Stake)

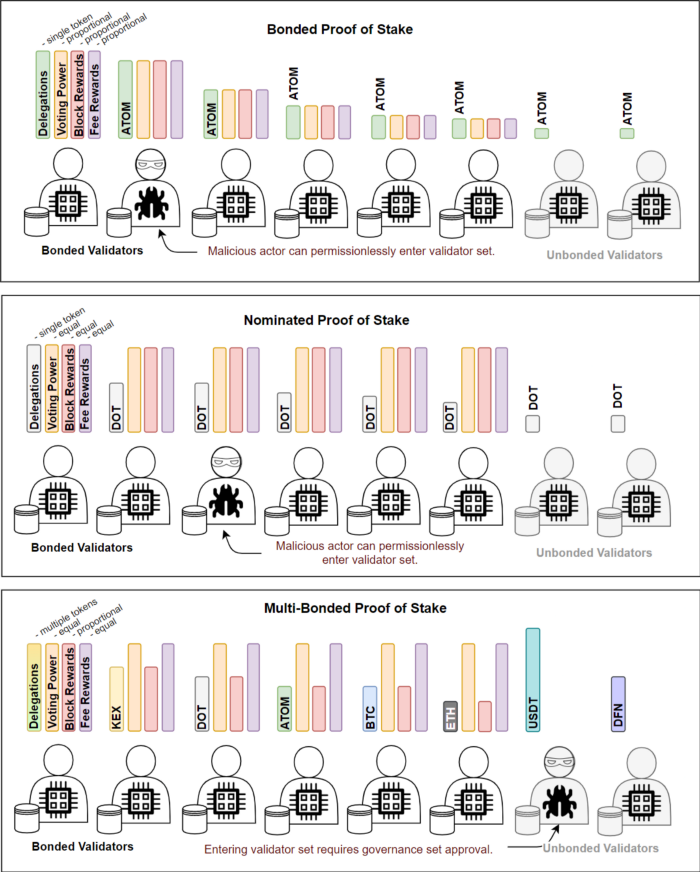

The Multi-Bonded Proof of Stake (MBPoS) is the first consensus to allow long term network decentralization. In contrast to the Proof of Stake where only a single asset can be staked and become centralized over time, a Multi-Bonded Proof of Stake not only allows multiple assets to become stake-able but also enables constant rotation of power in the network and increase of the operators (validators) count. It allows to maintain liquidity of those assets and use them with any DeFi or other dApp deployed on top.

In Kira, each network operator (validator) has equal voting power and an equal chance to propose new blocks. Entering and leaving the validator set is permissioned by the governance which determines its own rules for onboarding new validators.

Nearly every permissionless and decentralized network tends to become more centralized over time. This has happened with regions that have access to cheaper electricity (Proof of Work), or due to cartels accumulating stake-able assets, power, and influence (PoS).

Kira has built-in mechanisms to avoid the centralization of power.

“Kira is a project with the goal to ’Secure the Future of Proof of Stake’ by allowing direct, unstoppable, trust-less, permission-less access to the market to any coin in the interchain ecosystem. It also aims to help the Cosmos Hub recreate the perfect incubation conditions that created a new paradigm during the previous smart contract era, but this time in a sustainable manner thanks to amazing tools like the Cosmos SDK and all the modules around it.”

Staking happens directly on Kira Network to increase the network security — users are incentivized, getting paid, and remain in full control of their funds and to whom they stake them. This is what increases the money flow, liquidity of the exchange protocol, and network activity — therefore block and fee rewards that all stakeholders can claim. A virtuous cycle.

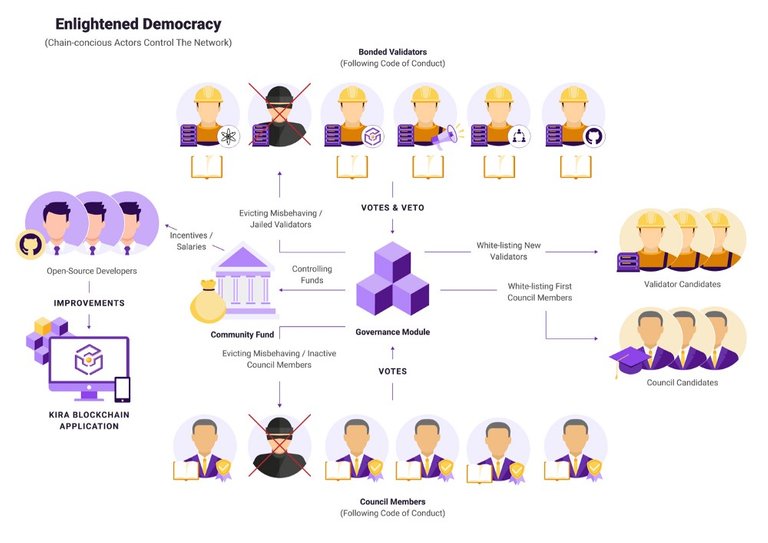

Fair Governance

Kira’s Governance model is really interesting. The system design seems well-thought-out and allows for fairness and democratic procedures to permeate the network, rather than giving all the voting power to rich individuals.

“The Kira Governance System is the core of all network operations and is bootstrapped through an evolutionary process aimed at continuously increasing its efficiency and decentralization without dependency on the wealth or stake distribution.”

Wealth status is no longer the only determining factor when judging candidacy. This eliminates vulnerabilities of plutocratic governance models where hoarding more coins simply implies holding more power but not necessarily being a responsible or rational actor.

“The governance will be an evolution from a Technocracy to the concept we call Enlightened Democracy. The latter is a governance system controlled by chain-conscious actors who by majority are not validators — not only technocrats.” — Asmodat, Kira CTO

Being part of the community will be definitely one of the most important criteria. The security of the governance model is established as the result of three evolutionary steps to form a multicameral governance set:

Code of Conduct

The Code of Conduct (SLA) is a mutually-agreed set of self-organization rules by the community that defines how the network should operate. It enables control over all economic aspects of the network such as freedom to control community pool tokens, interest rates for staking foreign tokens, or inflation rate within certain safety thresholds. It also has a set of guidelines, such as expected and not expected behavior of network actors, a protocol for upgrades and security threats, etc.

It is through these Code of Conduct guidelines that Kira Network can amass & organize hundreds, or thousands of network operators, providing them with the means to cooperate in a clear, transparent, and verifiable manner. Through the brilliance of all its active members, a first truly decentralized and secure Proof of Stake network can not only be brought to life but also continuously and efficiently operate.

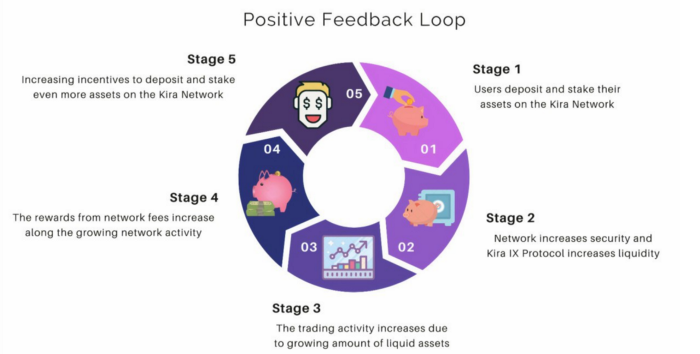

Total Assets Locked (TVL)

Users deposit and stake their assets ➜

The security and liquidity of Kira increases ➜

The trading and network activity increases ➜

That generates more rewards from the network fees ➜

And creates more incentives to users to stake even more assets ➜

And the cycle just repeats itself over and over 🔁

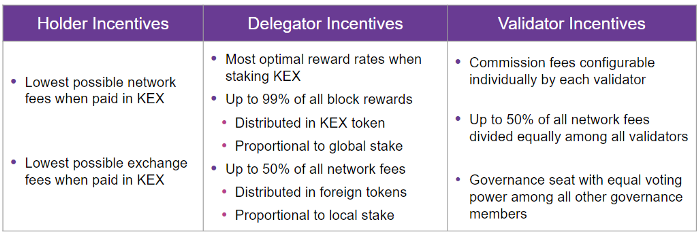

Token Utility

Kira Token (KEX) is a native staking asset of the Kira Network. Staking KEX is the most efficient way of claiming revenues from the block and fee rewards on the Kira Network. Kira’s native token KEX is used as the base denomination currency for all other foreign assets (BTC, ETH, ATOM, DOT, etc…) which can be used to stake as well as pay network fees.

Kira governance is tasked with controlling the inflation rate of the KEX token and defining the revenue share of all tokens in the network. For that reason, staking KEX can maintain its utility and remains the most efficient way of accessing incentives from the block and fee rewards. Governance of the network has full ability to control the economy (inflation, interest rates) and can define any other suitable model for ensuring long term operations of the network.

The token can also be used to create staking derivatives — sTokens.

Revenue Model

The Kira Foundation will own 20% of all KEX and stake them to Kira Core validator, the rewards are then distributed to Kira Core JSC equity holders in proportion to the number of shares they have.

Kira Core will also operate IVO’s as a service for other projects and utilize foundation tokens to help other projects raise their funding goals while benefiting from new exposure to new tokens and commission fees.

The long term goal of Kira Core is also to provide R&D (research & development) as a service to the projects that will deploy IVOs and expand the interchain and Kira ecosystem.

Roadmap

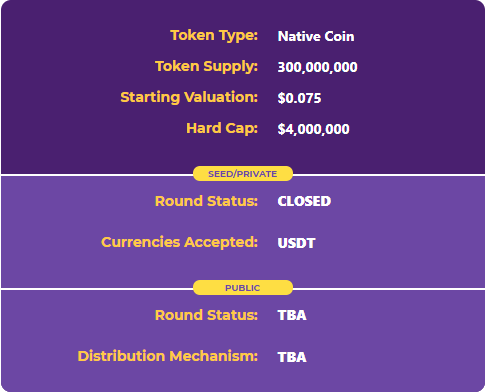

Token Sale & Supply

Hard cap: $4M

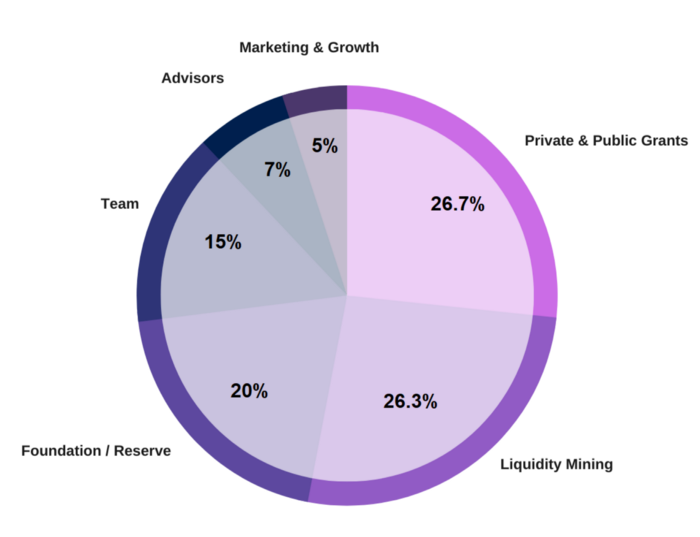

The total initial token supply will be 300 million KEX.

- 20% of it will be permanently staked by the foundation and is not intended to never enter the market

- 15% team

- 7% advisors

- 25%+ seed, private & public rounds

- …and the rest is community + liquidity/reserve.

The seed & private sales claimed a total of $3.6M. $400k was raised in Public sale.

Initially, the ERC20 version of the token will be released, later on, with the token swap, the token vesting allocation will start. The token vesting will last 17 months for seed & private round investors, while advisors’ tokens vesting will take place throughout the months 18–36 after the launch.

The team’s budget is reserved for three years to ensure they can deliver a self-sustaining network within that time before the community fully takes over.

Kira is based in Prague, most of the devs are in the EU and Singapore.

Join my free Telegram to stay updated with the latest news from Kira and other crypto projects: t.me/AkatsukiCryptoFA

Follow me on Twitter.

Kira Network Links

Website: https://kiracore.com

Telegram: https://t.me/kirainterex & https://t.me/KiraAnnouncements

Github: https://github.com/kiracore

Twitter: https://twitter.com/kira_core

Whitepaper: https://wp.kira.network

Congratulations @nagato-dharma! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 20 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: