The Gold/Silver ratio fell from 90 to 84 just this month. Does that mean anything?

The historical ratio was between 8 and 12. Will we see a return to these ratios?

Is gold the real investors PM? And silver, just an industrial metal?

If silver is an industrial metal, will its price actually start following actual manufacturing needs/demand?

What the bleep is going on with precious metals?

Gold's price is a complete lie

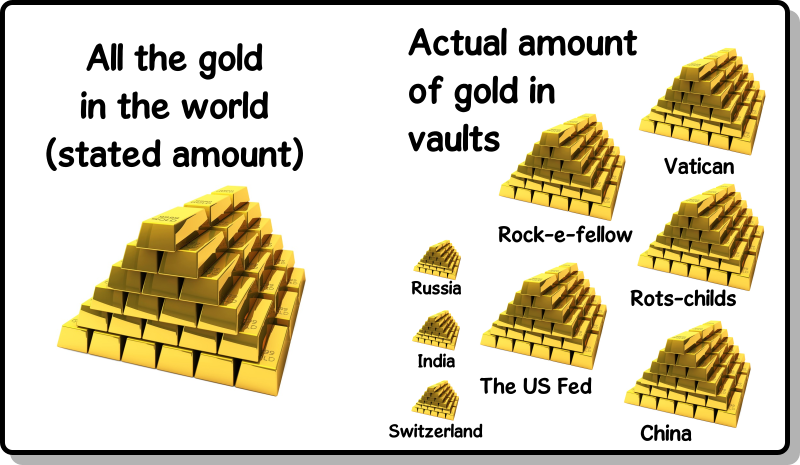

First, there is tons more gold in vaults than is touted as "all the gold in the world". Conservative, honest estimates are 10x.

There are piles under rots-childs estates. Who knows where the Ft. Knox gold is. Where did Tanaka's gold go? Have they secretly mined the Grand Canyon? Gold is mined, cast into bars, and then, pretty much, are put into vaults to never see the light of day.

Second, whenever you hear of some person buying tons of gold, the rumors are that they paid 2x-5x what the comex spot price was. So, the spot price that we buy piddly 1 ounce coins for, is not the real price of gold.

Third, central banks have put gold back on the #1 asset list, and they need to have it to continue functioning. So, they are doing what they can to acquire it. And acquire it without making waves and sending the price skyrocketing.

So, what is gold's actual price right now? Somewhere between $0 and $10,000 an ounce.

Gold is actually so common, that it is only rare because people at the top horde it and don't let anyone know the real quantity. (like DeBeers)

Gold's value, if you take the outstanding fiat, and convert it back to a gold backing, then its value is (was) $10,000.

What is silver's actual price?

We don't know.

More silver is used each year than is mined each year.

More silver is traded on the COMEX each day than is mined each year.

Where is the extra silver coming from?

There are speculations, but that is all. A huge shell game is being played.

It could turn out that there is lots of mining unaccounted for. (Like from Mexico, or Native Americans)

It could turn out that the use numbers are wrong.

It could turn out that we have a teensy tiny amount of silver excess left, and suddenly the real supply and demand will show, and the price will double in a day.

Many people say that silver is the most undervalued element on the planet.

And, i forsee a lot more essential uses for silver coming with electronic inventions.

So, it is way undervalued.

Gold vs Silver

The problem with comparing these two is they have two different time lines, and two very different use cases.

Gold will go way up in price as banks collapse and central banks talk about/enact gold backed currencies. If we make it to this state where the banks still have control, and the fiat is really dying, then gold will be brought on the scene, and we will probably have $10k gold overnight. (that is a lot of ifs) It is also possible that the banks just DIE. No one values or trusts any of the central banks, and gold will become commodity that there is way too much of, and few buyers.

Silver is extremely valuable as an industrial metal. And if another big industry use is discovered, it will be even more valuable. If it is found that we were just selling reserves to cover the missing supply from mines, then all of a sudden, silver will jump up in price until more mines can come online.

Gold is a monetary metal. And as such, is tied to the monetary system, and what happens to them.

Silver is an industrial metal (everything electronic), and is also used as an monetary metal. So, its price is really dependent on real demand from real manufacturing.

So, which one is better? The one whose future actually happens.

The fiat money / central bank ponzi scheme is coming to an end. This will see the price of gold going up, just from the retail investors. (and i believe central bank buying) This will probably continue over the next few years. Then it will depend on how much "Gold" solutions vs how many "Crypto" solutions are enacted, and how they work out. I guess you could say that gold's price will be the inverse of XRP's price.

The timeline of silver is based on how long they can keep the silver flowing. There are signs that the manipulators are getting desperate. (going around and buying up excess silver with deep pockets) When this collapses, the price of silver will go up a dollar a day, then five dollars a day. And if more demand, either industrial (new tech) or monetary (we start using silver coins) than silver will become extremely valuable. Probably so valuable that the monetary use will be dropped.

So, i expect gold's price to double or triple, and then go slowly down.

And i expect silver's price to 10x - 50x, and stay there until more mining comes online, and we get some kind of balance between production and usage. Of course, the buying and selling of monetary silver will make this have a lot more fluctuations, but it will still level out.

Overall, i expect to see gold/silver ratio to go up to 150-200, and then down to ½.

But, i am often wrong about timing. I think the banks should have crashed and died already.

No one knows how things will go as the the trust in the fiat currency comes crashing down its just we know it will come to an end, just prepare as best you can and hope for the best. Some Central banks are fleeing to gold and more countries will do the same. By the time the public begins to flee to gold only to find it too expensive before going to silver as a cheaper alternative. That is when silver will become a monetary metal rather than just an industrial commodity.

This is a problem of two timelines.

I believe in your flee to gold.

However, silver, there is not enough of it for industrial and monetary usage.

and so, if the gold happens first, we may see $100 gold 1oz coin, and a $1 silver 1oz coin.

(gold/silver ratio going 100 to 1)

But, if the industrial supply runs out first, then silver will be on a trend where it is more expensive than gold. So, the second part of flee into gold doesn't happen. It will just be seeing how we can make small pieces of gold manageable.

Industrial demand for silver is expected to continue to outstrip supply as much as 100 to 200 million oz. According to the Silver Institute but critics from a rival organization Silver Academy claims that the silver Institute's figures do not include Military and Areo space use, so the gap can be much wider the claimed.