It seems the powers that be in the futures markets aren't happy about silver reaching a new all-time high price. It's amusing it took this long for the COMEX to take action, since it's hard to stop a massive price increase mid-stride. Still, never count them out as desperation and panic kick in and they try to control the market by putting ridiculous trading practices into place. Remember: when you play their game, the house always wins.

(Created with Bing)

(Created with Bing)

I honestly hadn't been following much of the silver news, but that's because I focus on buying physical silver. It was @kerrislravenhill who brought this up in the #silvergoldstackers Discord and posted a video from Silver Dragons on YouTube. I highly recommend watching it.

I personally don't pay much attention to what spot price does, since my local coin store is going to charge me $1.50 over spot for bullion regardless. All that means is any given day I'm able to buy more or less than the last time I purchased.

For those who trade the markets, you're either sweating blood or popping the cork off a champagne bottle to celebrate right now.

Desperate Power Plays

The COMEX is feeling the pressure and wants to maintain control of their cash cow. They don't want people buying physical, so they need to establish control in the price fluctuations. Doing so prevents a massive exodus of investors due to lack of confidence and extreme price volatility. Don't believe me? The futures markets started with gold to control the pricing, and ever since then it's been a game of control for all commodities.

(Source)

(Source)

More Buying Opportunities Coming?

I'm not certain what will happen here. I think we may still see a general upward trend week over week, but I think intraweek we will see a yo-yo effect where COMEX tries to slow the upward price momentum. It's anybody's guess at this point, but it's best not to worry over the price movements.

So What Do We Do?

The solution is simple. If you want to protect your wealth, buy physical gold and silver. The markets can only manipulate prices for so long, but they can't touch your physical holdings. Dollar Cost Averaging is generally considered the best approach, although I personally like to have reserve funds set aside for the occasional large buy when spot price drops substantially.

All we stackers can do is what we've always done: stack to preserve our wealth and leave an inheritance for our kids.

Buy DUO and stake to receive Hive dividends, tip others, have your posts curated, and grow Hive!

https://tribaldex.com/trade/DUO

https://hive-engine.com/trade/DUO

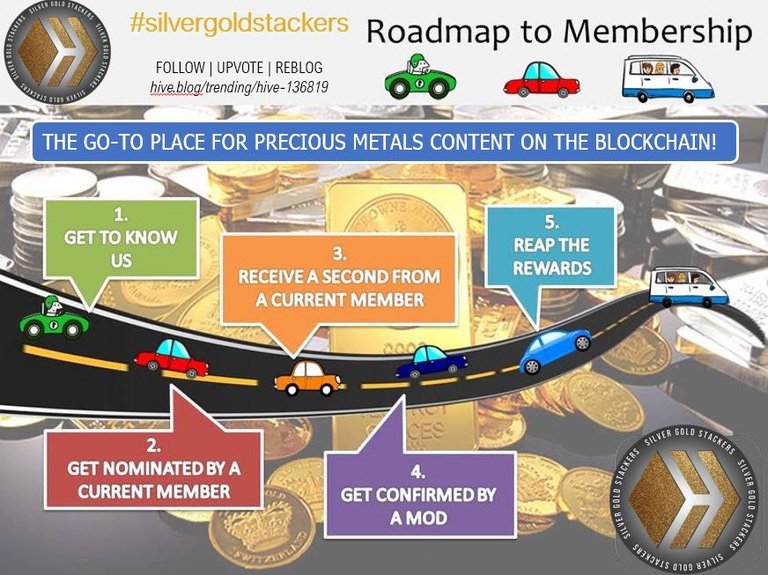

Do you like stacking gold and silver?

Are you new to Hive, or know someone new to Hive, and want help and support?

Have you been on Hive for a while and want to help new Hive members? Join HOC and help us grow Hive and encourage new members!

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

I was near my bullion retailer today, Saturday 13th, and bought 10 random date silver Maple leafs at $90 CAD each. Most people in the small lineup were buying gold and silver. One fellow walked off with 5 RCM 10 oz. bars.

The COMEX is just the theoretical paper price, the physical is the real game. I can play both the Paper and Phys game.

In the words of Keptin @joshuaslane, "Nibble nibble"

!PIMP

They know what's real and what's not. It'll be interesting to see what prices look like about this time next year.

!BBH

!PIZZA

!PIMP

!ALIVE

$PIZZA slices delivered:

@bulliontools(2/5) tipped @kerrislravenhill

Please vote for pizza.witness!