Well that escalated rather quickly. I have been writing for weeks that the precious metals have been trading within a very tight range.

I have also stated that from tight ranges come BIG MOVES.

I have repeated that "CAUTION" is the word of the day.

Gold broke the range in stunning fashion getting as low as $1858 per ounce.

Silver is outpacing gold in the selloff.

You have been warned!

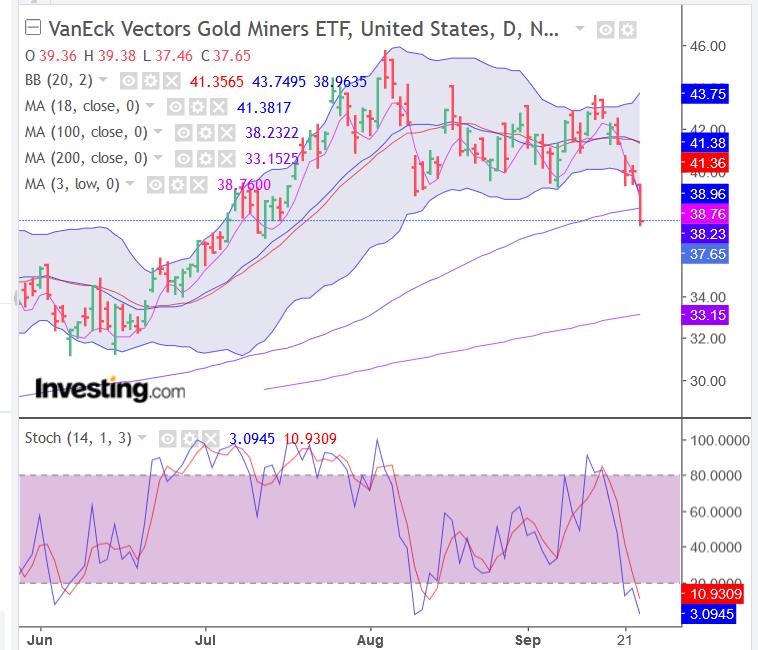

GDX, the miners, broke way below the Lower Bollinger Bands and sliced through the 100 day moving average.

The stochastic is now in OVERSOLD territory. Just remember that a market can remain oversold longer than you can remain solvent!

I have linked an article by Rambus which goes into greater detail of what he thinks is happening in the market. https://rambus1.com/2020/09/21/markets-update-268/

Caution remains the word of the day!

Peace out and stack on!

So what changed? WW3 break out? A new Covid-20? or another JP Morgan Paper dumps?

The "time" changed. Time and Price are always intertwined. "To everything there is a season."

I made a reply to @dfinney two weeks ago:

https://hive.blog/hive-136819/@dfinney/qgd6c7

"Barring a run away market to the upside, I think mid to late October might provide an opportunity to fulfill your wish list. When I look at the silver chart, I can see a possible run up to around to $28.50 between now and September 15th. After that either more sideways or a nice drop."

On September 16th Gold posted its most recent HIGH at $1983.80 (right on the upper Bollinger Band) and silver posted its recent HIGH on September 15th (right on "time" I might add) at $27.87 per ounce. After that we got some more sideways action (for 3 days) followed by a "nice drop".

Most people do not believe that Time and Price are so strongly correlated therefore seek other explanations for why the market "turns". The markets do not HAVE to turn, at certain "times" and "prices" but when time and price do come together there is a HIGH PROBABILITY that a "turn" will occur.

If Gold and Silver did not "turn" on or around September 15th, then there would have been a HIGH PROBABILITY of a "runaway market to the upside".

When am I looking for the next "turn" in the market?

October 9th through October 16th provides the next primary "time" for a potential "turn" in the market. The "secondary" periods run slightly before and slightly after these dates.

No one knows the future but everyone knows the difference between Summer and Winter.

Pandemic Lump sum payment coming Woo hoo!

Been setting aside some cash now that my Emergency reserves are back to normal!

I know, I will buy more and make it bottom. I alone tanked this market because I bought a couple of ounces!

Posted Using LeoFinance

We need to make a chart of you! I too have the "gift" of buying high and selling low.

You are the Market Maker!

Thanks for sharing the report, Handofzara. The best time to be holding Precious Metals may be when people understand how much fiat currency is chasing so little Precious Metals. Even grams will look huge.

You received an upvote of 38% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!