As is already well known, the Bitcoin protocol is suited for one simple thing, that are transactions and moving coins around. It has a maximum cap of 21M coins, and a system that involves miners writing transactions, nodes reading data, developers and users submitting transaction requests to miners. The system design has successfully endured the test of time and has been very successful till now.

What Bitcoin doesn’t have, and that is by design, are smart contracts and all the other things coming with it, enabling DeFi, tokens, NFTs, etc.

With the rise of the smart contract chains like Ethereum, Solana etc. and the introduction of DeFi a demand for a Bitcoin token representation on these chains has emerged. This demand comes from the need of simple trading Bitcoin on chain, to the more complicated stuff like lending using BTC as collateral and more.

In the last period we are seeing a new trend introducing Bitcoin yielding tokens, where the wrapped version of Bitcoin is a yield bearing token similar like the staked ETH tokens, stETH or Solana JitoSOL.

The most important thing to have in mind about these Bitcoin derivatives is that they are not actual Bitcoin. A token on the Ethereum network or any other network is not Bitcoin. It is a representation of Bitcoin with a promise to keep a 1:1 value. Usually, the way this works is some entity is establishing a vault on the Bitcoin chain where they keep the native Bitcoin and for every Bitcoin put in that vault/s they mint the wrapper on the other chain. It’s basically a service provided by a third party and it has an inherent additional risk from the third party.

With this said lets take a look at the tokens list. Here it is:

- WBTC

- cbBTC

- LBTC

- SolvBTC

- eBTC

- tBTC

There are more but these are the biggest one and represent most of the industry.

WBTC

WBTC is a wrapped Bitcoin on the Ethereum network. How does this work? Well, there is a centralized entity, a company that users sends Bitcoin to, they locked into a wallet and mint WBTC on the Ethereum network. Because crypto is transparent, users can see both of the wallets for the native BTC on the Bitcoin network and WBTC on the Ethereum network at any time and make sure the balances matches.

WBTC allows users to use Bitcoin in defi protocols like AAVE and MakerDAO. In most cases WBTC is provided as colateral and then users borrow against it. It’s a beautiful thing as long as you manage your position and don’t overleverage and get liquidated. The company that was managing WBTC up until last year was BitGo situated in the US. Since last year they have partnered with BitGlobal, a Honkong/Singapure company under the umbrella of Justin Sun. This has caused controversy and soon after Coinbase launched their Bitcoin wrapper cbBTC.

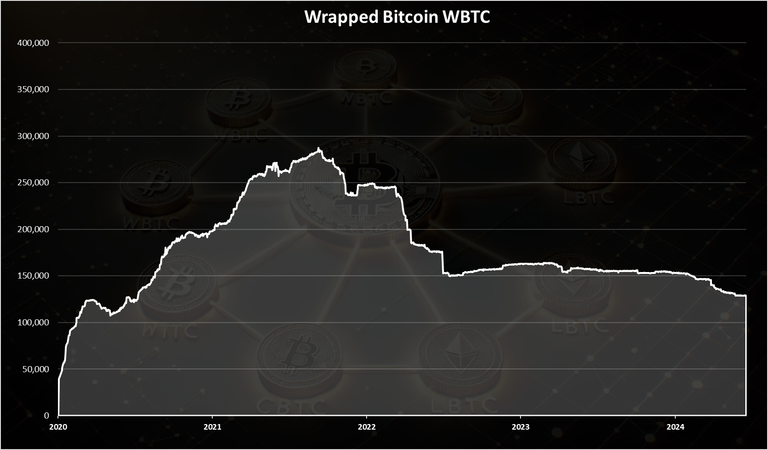

Here is the chart.

Note that the chart above is in Bitcoin dominated units, not USD. It represent how much Bitcoins are being wrapped on Ethereum.

As we can see there has been a high growth of the amount of WBTC in the previous bull run. Starting from 2020, till 2022, the a amount of BTC, wrapped on ETH has kept growing and reached ATH of 285k in May 2022. At the time at those prices the market cap was around 10B. Towards the end of 2022 the amount of WBTC dropped to around 150k and has stayed around those levels up last year. In the last months we are seeing further drop in the amount of BTC under WBTC and the numbers are now at 128k. This might be related to the rebranding and the new emerging competition for wrapped Bitcoin.

Coinbase cbBTC

Following the offshore move from BitGo and the partnership with BitGlobal, Coinbase took a step forward and announced their version of wrapped Bitcoin, cbBTC, starting from September 2024. In this case the custodian for the Bitcoins is Coinbase. They are acting as a bridge between Bitcoin and the other smart contracts chains. A totally centralized solution.

Here is the chart for cbBTC:

We can see that starting from September 2024 the amount of cbBTC started growing and is constantly in an uptrend. At the moment Coinbase is custodian of 25k wrapped Bitcoin in the form of cbBTC, or around 2.5 billion USD.

Lombard Staked LBTC

Another version of the Bitcoin wrappers, but this time with a twist. It provides yield.

Lombard Staked BTC (LBTC) is a liquid staking token developed by Lombard, enabling Bitcoin holders to stake their BTC through the Babylon protocol while retaining liquidity for participation in decentralized finance (DeFi) applications. Each LBTC token is backed 1:1 by Bitcoin, allowing users to earn staking yields without compromising their BTC's security or value. This integration transforms Bitcoin from a static store of value into a productive asset within the DeFi ecosystem

The Babylon protocol is an L2 chain for Bitcoin that tries to bridge Bitcoin to EVM chains and DeFi.

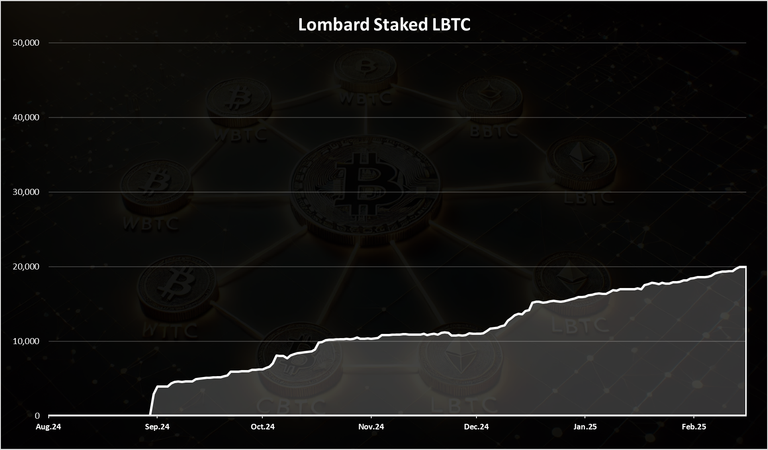

Here is the chart for LBTC.

As we can see this chart has also an uptrend! A total of 20k BTC now in this wrapped, close to two billion USD.

Solv Protocol SolvBTC

Another protocol that is providing cross chain service for Bitcoin, eneablaing integration with multiple chains, like Ethereum and the other EVMs like Base, Arbitrum, next BSC, Avalanche, etc. Furthermore it provides yield in the process.

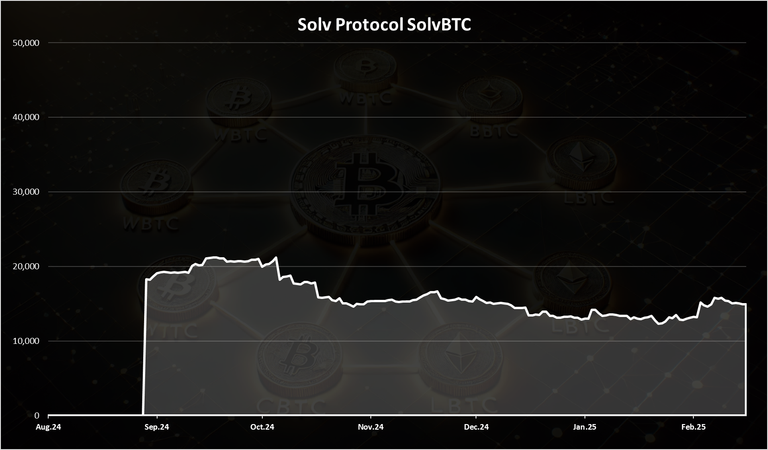

Here is the chart for SolvBTC.

SolvBTC has been hovering in the range of 15k to 20k Bitcoins in the last period. This is still a significant market cap and is in the billion dollars club.

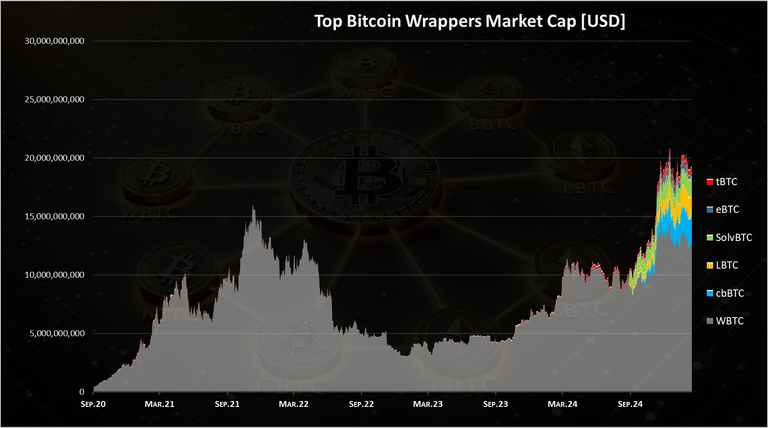

Cumulative Chart for the Top Bitcoin Wrappers

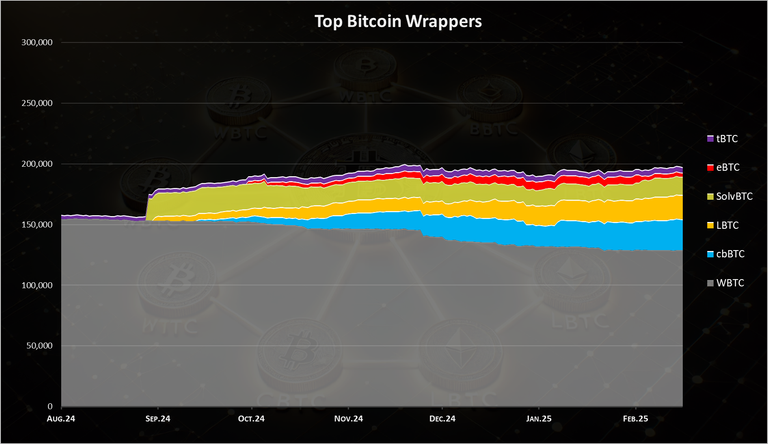

When we add all the above together, plus some smaller ones like eBTC, tBTC we get this chart.

This is a long term chart, starting from 2020, when the only dominant player was WBTC. But we can see since last year, 2024 the competition has heated up significantly and more options for Bitcoin wrappers have emerged. But even with all the new options the previous ATH for Bitcoin wrappers has not yet been reached. We are now at 200k BTC in these instruments, while the previous ATH in BTC was at 285k.

When we zoom in, we get this:

Here we can see more clearly how the WBTC dominance is going down and more other options have emerged. cbBTC is the leader of those, but LBTC and SolvBTC are also significant players.

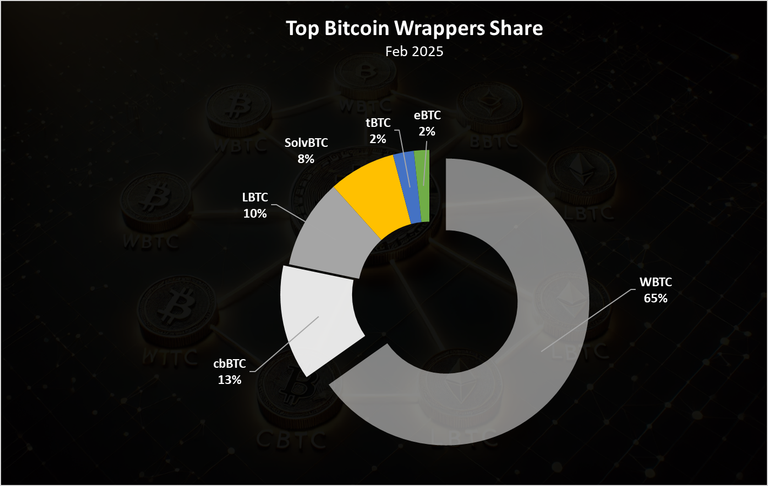

Top Bitcoin Wrappers Share

The current share of the Bitcoin wrappers looks like this.

WBTC is still dominant with 65%, but far from the only dominant player where it was just a year ago. cbBTC has 13% share, followed by LBTC with 10%.

At the end the market cap for the bitcoin wrappers in USD:

When we look in USD dollars we have now an ATH in market cap for the bitcoin wrappers with close to 20B market cap combined. The previous ATH in dollar units was around 15B. Note that in BTC this is not the case and the preivous ATH of 285k is not yet reached, but becouse of the price increase of BTC we are now at ATH in USD dollars.

Overall, we can see quite a development in the Bitcoin wrapper space. The need for Bitcoin DeFi is obvious and users are searching for yield. This of course comes at additional risk, and everyone should be very cautious when using these products. For sure do not put all your BTC in any of them. My guess is that as time goes on we will see more and more BTC derivatives that will try to add more functionality and financial instruments to Bitcoin.

All the best

@dalz

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

And soon it seems hive will be in the btc wrapping game with upcoming VSC release.

Yea that is step in that direction

ahhhh, the wrapped stuff. I always picture a candy that is wrapped.. :P

Quite close :)

I think when the yield looks decent or good enough then the risks are always damned, seems like what's happening with memes nowadays.

Debating yield is always interesting. Long term probably there will be a lot of instruments providing btc yield.

Indeed. I guess it's probably going to be one of those evolutions of crypto

Does this implies to the prices getting high each time btc is high? With the different stable coins implemented will this affect the use of these babies btc