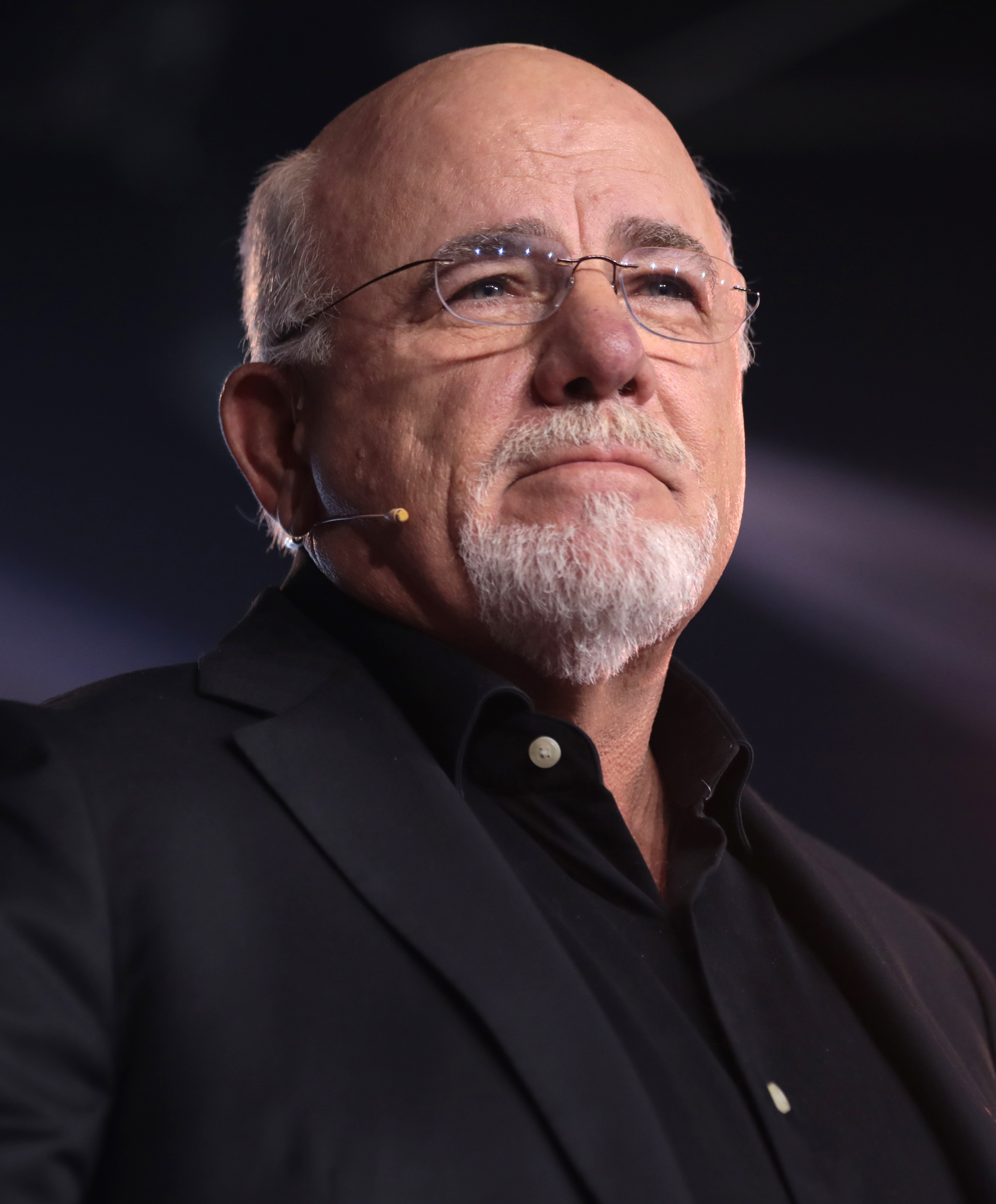

I've been following Dave Ramsey for a long while now and I could almost agree with everything he says, because he really knows what he's talking about.

I came across one of his videos where he explains the 7 baby steps toward financial security and wealth, and they go as follows:

-1) Save up a thousand dollars

-2) Get out of debt using the snowball method (by that he means pay off everything apart from your house, so things like your credit car debt, a car loan, etc)

The snowball method mainly focuses on paying off debts from smallest to largest regardless of interest rates, as it just focuses on building momentum and achieving small wins like a snowball rolling downhill.

-3) Save 3-6 months of expenses for a fully funded emergency fund.

-4) Invest 15% of your household income into retirement.

-5) Start saving for kids' college

-6) Pay off your house

-7) Step number he says: "Nothing left to do now but become very wealthy and outrageously generous.

Dave Ramsey claims that this is the plan 10 million people used to straighten out.

I believe it's a super plausible plan and while it's not easy, it's simple. Meaning that it's not complex, not difficult to understand or memorize, however it takes notable effort to be executed. The good part is; the results are certain!

Good afternoon @anassharkawwy. It is recommended to read the community posting rules so that your articles can be postulable. Thank you for your attention.