Story of 2008 Crisis

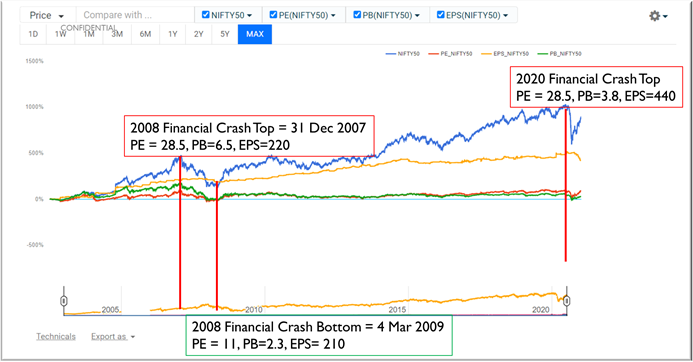

Most recent crash that global markets have seen was in 2008. Indian Market (NIFTY) saw its crash from 6300 to 2600, a crash of 58%, over a period of 14 months. The good part was EPS only declined by 4.5% over that period and so enabling the market to rise quickly. Still Market recovered to its crash level only by Oct 2010 i.e. almost in three years.

What is possible in covid-2020 crisis

It is not a rocket science to say that current crisis, due to global corona pandemic, are many magnitude bigger than 2008 crisis. Knowing that there is no way that market can come back to the pre-corona level in less than 3 years. So the bottom won't reach that quickly. It will take at least 1-2 years to play out for final bottom to reach. And bottom will be much deeper than in last crisis, percent wise, as EPS has already declined by 13% and we are nowhere close to complete manifestation of pandemic driven economic collapse in activity. There is huge EPS collapse on the way for next 2-3 quarters.

And as EPS decline picks pace - the valuation models will start cracking. They won't support high PE. A PE of more than 10 is unreasonable and unhealthy when EPS is declining. What would be bottom EPS -is anybody's guess.

My gut feeling says bottom EPS would be somewhere ~200-300. With PE of 10 - Nifty index bottom value could be in the range of 2000-3000 (0.5gm gold).

These numbers are assuming there is no depreciation of INR. But that would be an unreasonable assumption. So Index in INR could trade higher, compensation for currency devaluation, but in gold terms it would be trading around 0.5gm near the bottom of this cycle.

I will update on this post in October Ist week when all the results for Q1'2020 become available.

Comments and feedback is always welcome.

Well`put....