Hello Readers,

I hope all of you are doing well in life and also enjoying the pump in the crypto market. $BTC is currently leading the way and has already touched its all-time high at $96k and currently trading for almost near $97k. Analysts are anticipating it can reach and even cross $100k following this uptrend. While many of the top alt-coins are already moving upwards, some are still behind but I am almost sure that the alt-coin uptrend has only started and will bring a big bang this time while breaking all the previous records like Bitcoin. But noticeably, things have changed a lot with the crypto realm, as not only individuals but also big companies are starting to recognize crypto as an asset class and investing large sums in this sector, causing further boom. In one of my previous posts, I have already talked about one such company Blackrock who is aggressively investing in Bitcoin, and in today’s post, I am going to talk about another such institution that is getting its skin into this game. So, if you are interested, let’s jump right in without any further ado.

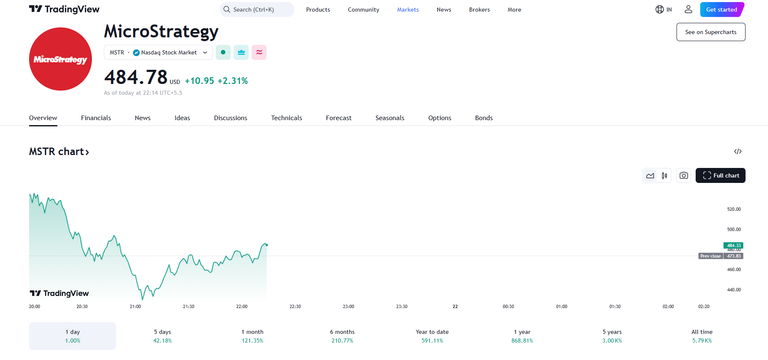

Besides Blackrock, if there is one other company that stands out as a champion of Bitcoin, it is MicroStrategy. If you have been in the crypto world for a while, you must have heard this name. Basically, Microstrategy is an American development company that deals in BI (business intelligence), mobile, and cloud-based services. Microstrategy is also a publicly traded firm and this company was led by founder and executive chairman Michael Saylor in 1989 along with Sanju Bansal and Thomas Spahr. What’s interesting about this company is that it holds its securities widely in the form of Bitcoins. Just recently, Microstrategy has acquired its position among the top 100 companies that are publicly listed in the US and its price has also gone through a sharp upward spike with a 97.66% growth within just the last 30 days and is currently being traded for 432.97$ per share. Recently on November 18, 2024, MicroStrategy announced a bold move as the company is planning to raise a whopping amount of $1.75 billion by offering convertible notes to its investors. They have also acquired another batch of 51,780 BTC for around $4.6 Billion USD at a price of $88.62k USD per Bitcoin. The goal behind this gigantic move is to buy and hold even more Bitcoin. But why is this company so bullish on Bitcoin and accumulating aggressively, let’s find out.

Why Bitcoin?

The current valuation in the form of Bitcoins that this company holds right now is approximately $30 Billion USD and they currently hold around 331,200 Bitcoins, as per data published in fortune.com on 20th November 2024. The founder Michael Saylor strongly believes that Bitcoin is currently the best way to protect value over a long time period, especially in the current world where economic uncertainty has become the new normal. He seems pretty confident that Bitcoin, with its fixed supply and an ever-growing demand and adoption, offers stability and growth potential that traditional currencies and investments can not match in today’s time.

For Saylor and MicroStrategy, holding Bitcoin is not just an experiment for them anymore - it is a financial strategy, as they have already accumulated over 331,200 BTC as I said above. Obviously, it is worth billions of dollars of investments and it seems they are not just stopping there.

How They are Doing It

MicroStrategy is raising money through what is called senior convertible notes. It can be stated as a type of loan that can be converted into cash or shares in the future. Investors who buy these convertible notes are actually lending money to MicroStrategy, with the promise of either repayment or a share in the future and probably with food returns.

Here is what’s interesting

- The notes would not have any kind of regular interest payments. Instead, they will mature in December 2029.

- Starting in 2026, MicroStrategy may start redeeming some of these notes if they want.

- The raised money will go mainly towards buying more Bitcoin and also for general corporate purposes.

By using this strategy, MicroStrategy is taking an enormous step on its belief that Bitcoin’s value will rise significantly over time.

What’s the Big Picture?

MicroStrategy’s approach clearly highlights how some companies see Bitcoin and cryptocurrency as a whole as more than just a speculative investment. For them, it is a new foundation for their financial future. By continuously acquiring Bitcoin, MicroStrategy is preparing for a world where digital currencies could become the new normal. This particular commitment sends a powerful message that Bitcoin is neither just a token of gambling anymore, nor a wild toy for tech enthusiasts or a risky path for retail investors, it has now become a serious asset like Gold that even large companies are starting to leverage for long-term growth.

Why It Matters to You

This giant leap from MicroStrategy and their strategy to invest early in crypto could influence other big and small businesses and investors to take Bitcoin and Cryptocurrency more seriously. If more companies follow their lead, it could boost Bitcoin’s value and stability, solidifying its place in the global financial system.

So, whether you are a Bitcoin enthusiast, a curious observer, a maximalist, or someone just curious and starting to explore cryptocurrency, this great move is a reminder of the growing importance of digital assets. It is not just a trend anymore, it is a groundbreaking shift in how we think about money and value worldwide.

Information Source

I hope you liked reading my post about Microstrategy and its aggressive investment in Bitcoin. Let me know your thoughts and opinions regarding this topic in the comment section below and I will be seeing you all in my next post.

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 10.00% vote for delegating HP / holding IUC tokens.