ICYMI: we had a weekend launch of PolyCUB V2 - we've been working on this release for months and it includes vexPOLYCUB, Governance UI, PolyCUB Improvement Proposal System (PIPs) and of course, the Multi-Token Bridge (pHBD, pHIVE, pSPS, pLEO).

The launch of PolyCUB V2 signifies the convergence of quite a few mechanics that we've been working hard on. In this post, we'll focus on vexPOLYCUB.

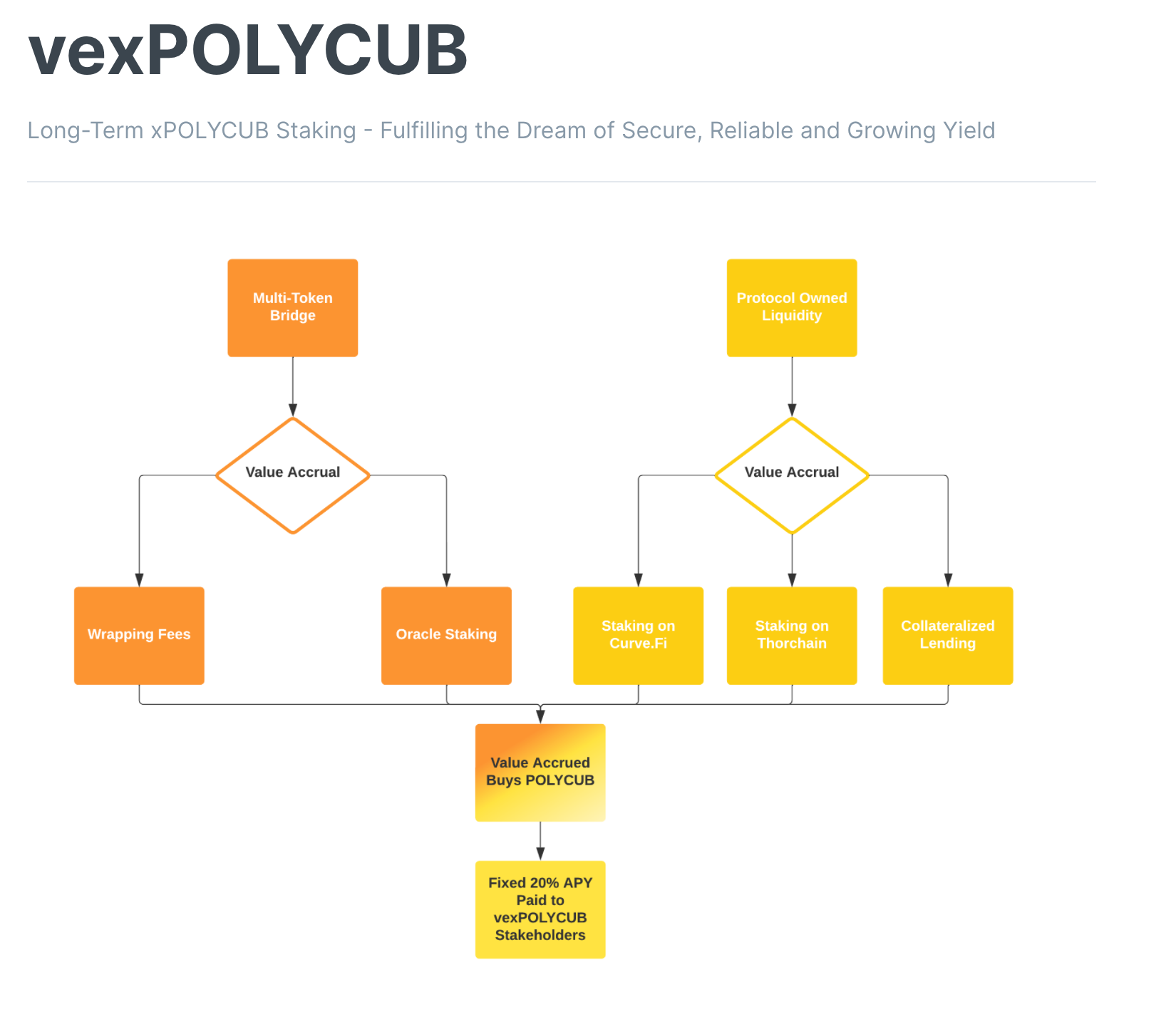

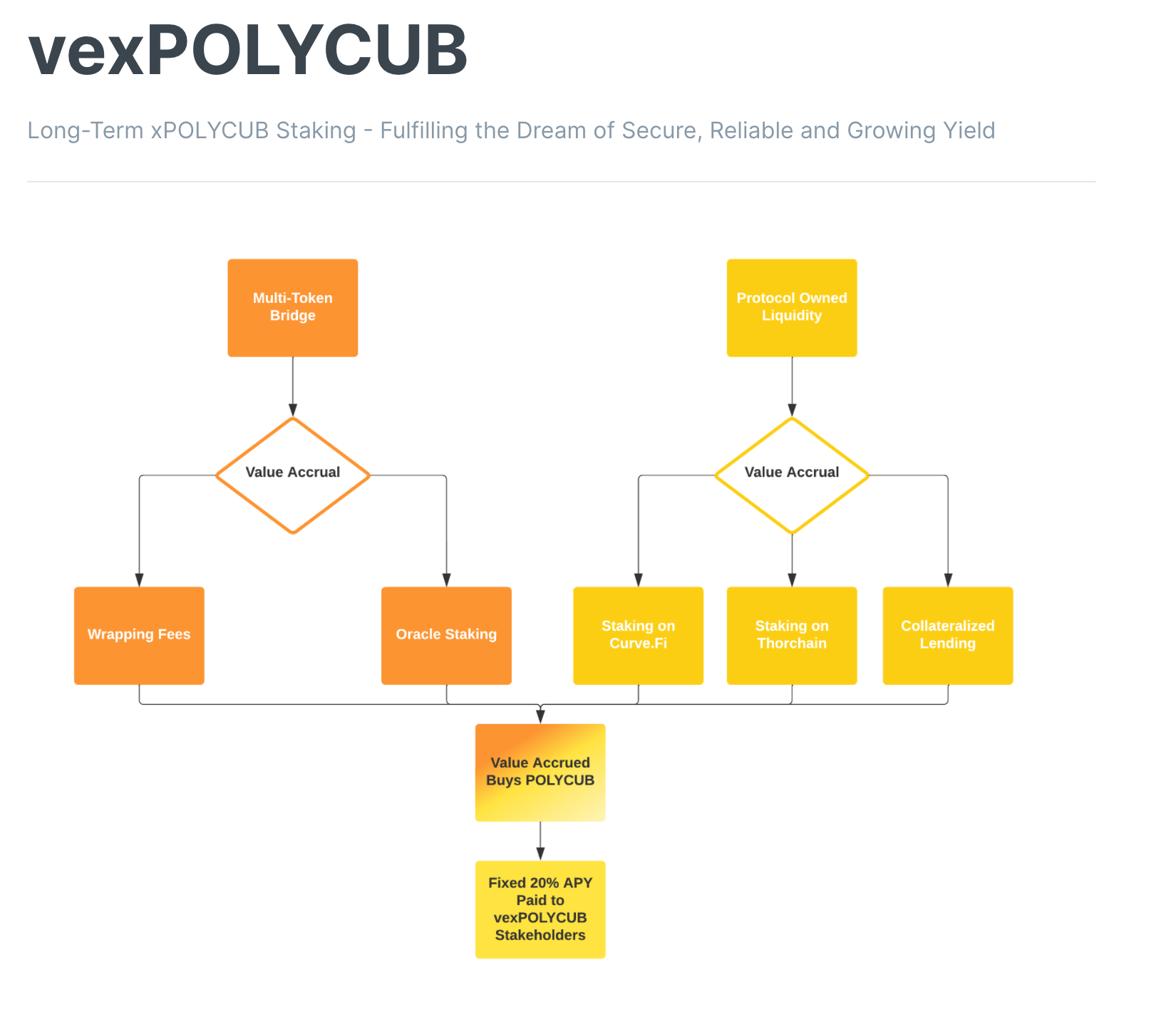

The goal of the vexPOLYCUB vault is to create a singular vault that fulfills the mission statement of PolyCUB - generate safe, reliable and growing yield for our Web3 community. By buying POLYCUB and staking it into xPOLYCUB and then locking it as vexPOLYCUB, you're signaling long-term support of the platform along with amplified Governance Power to govern what happens in the PolyCUB DAO. In return, this vault generates the most safe, reliable and growing yield on the entire platform: a 20% fixed interest APY on your POLYCUB stake... forever!

Just 48 hours have passed since vexPOLYCUB went live. You can now stake your xPOLYCUB into vexPOLYCUB - which stands for Voting Escrow xPOLYCUB.

In short, vexPOLYCUB is a 2 year lockup on your xPOLYCUB. In exchange for locking your xPOLYCUB for 2 years, you gain two core features:

- 20% fixed interest annual yield (more on this below)

- 3x Governance Power

40% of the xPOLYCUB Supply Has Been Locked for 2 Years

As of this writing - just 48 hours into the launch - 40% of the total circulating xPOLYCUB has been locked for 2 years.

This is incredibly bullish. The xPOLYCUB vault holds the vast majority of the POLYCUB circulating - 5.2M POLYCUB at the time of this writing.

The total circualting supply of POLYCUB is 6.7M. This means that xPOLYCUB holds 77.6% of all POLYCUB that exists... 77.6%!

With 40% of that vault getting locked for 2 years, we can now examine how much POLYCUB is illiquid - since anyone in the vexPOLYCUB vault will have to wait for the unlock cooldown in order to unstake from vexPOLYCUB:

- 40% of total xPOLYCUB is staked in vexPOLYCUB

- 91,932.243 xPOLYCUB staked in vexPOLYCUB

- 91,932.243 xPOLYCUB = 2,117,567.285 locked for 2 years

- Current value of vexPOLYCUB stake = $350,000 USD

Is 20% Fixed Interest Bullish for POLYCUB?

After seeing the collapse of Terra LUNA, some people have come to question the ideals surrounding a 20% fixed interest rate - as that is what initially brought LUNA and UST so much adoption but also became part of their downfall as all that UST liquidity got locked up in Anchor and depleted their reserves.

In a comment on the release post, @bitcoinflood asked the following question:

This is a great question and one that we should address - is a fixed 20% APR going to be the downfall of POLYCUB?

Now that there is $350k in the vexPOLYCUB vault, that means that $5,833.33 USD needs to be distributed to the vexPOLYCUB contract each month.

If the price of POLYCUB rises, then so does this $5800 figure... what happens if more xPOLYCUB gets staked? How will the protocol handle this? Will the reserves run out? Will inflation go up?

The answer is simple: the greater the $ value of this vault, the more bullish POLYCUB becomes.

More $ in vexPOLYCUB = More Buybacks of POLYCUB

I'm extremely excited about how we designed the vexPOLYCUB vault. Essentially, the 20% fixed yield is entirely paid for through Multi-Token Bridge Revenue + Protocol Owned Liquidity Yield.

MTB is generating over $4,000 per month solely from wrapping fees and oracle staking (not including internal arbitrage).

This combined with PoL revenue means that we have an extreme surplus of revenue compounding in the PoL treasury each month. Up until now, we've allowed that PoL to continually compound.

With the release of vexPOLYCUB, the contract is now taking a % of that revenue and autonomously buying POLYCUB to distribute to vexPOLYCUB holders.

The Counterpoint

The argument against the vexPOLYCUB 20% fixed yield is that it can ruin the platform. The counterpoint is that the more yield (in $ terms) that needs to be paid to vexPOLYCUB holders, the greater the monthly buybacks of POLYCUB.

If this yield was paid through inflation, then it could easily wreck the platform. The more $$ that gets staked, the more inflation that needs to come to pay a fixed % yield - this is what happened to Anchor.

However, vexPOLYCUB is built different. It's not paying 20% through inflation. It's paying 20% through buybacks.

As POLYCUB holders, we should want to see the $$ value of the vexPOLYCUB vault grow immensely overtime as this simply means that the protocol needs to purchase more and more POLYCUB each month.

$5800 Per Month

As of this writing, there is $350k staked in vexPOLYCUB. As we mentioned, this means that $5800 worth of POLYCUB will need to be autonomously bought by the Protocol to pay yield to vexPOLYCUB this month.

That $5800 (and all POLYCUB buybacks) are then deposited into the vexPOLYCUB contract. This also means that $5800 worth of POLYCUB is removed from the liquid circulating supply, put into xPOLYCUB and then staked into the vexPOLYCUB contract - locking it for the entirety of the unlock period (~2 years).

We've now created what is essentially a "sink" for the POLYCUB token where every month, the protocol is buying tokens on the open market and making them illiquid by staking them to the vexPOLYCUB contract.

Governance

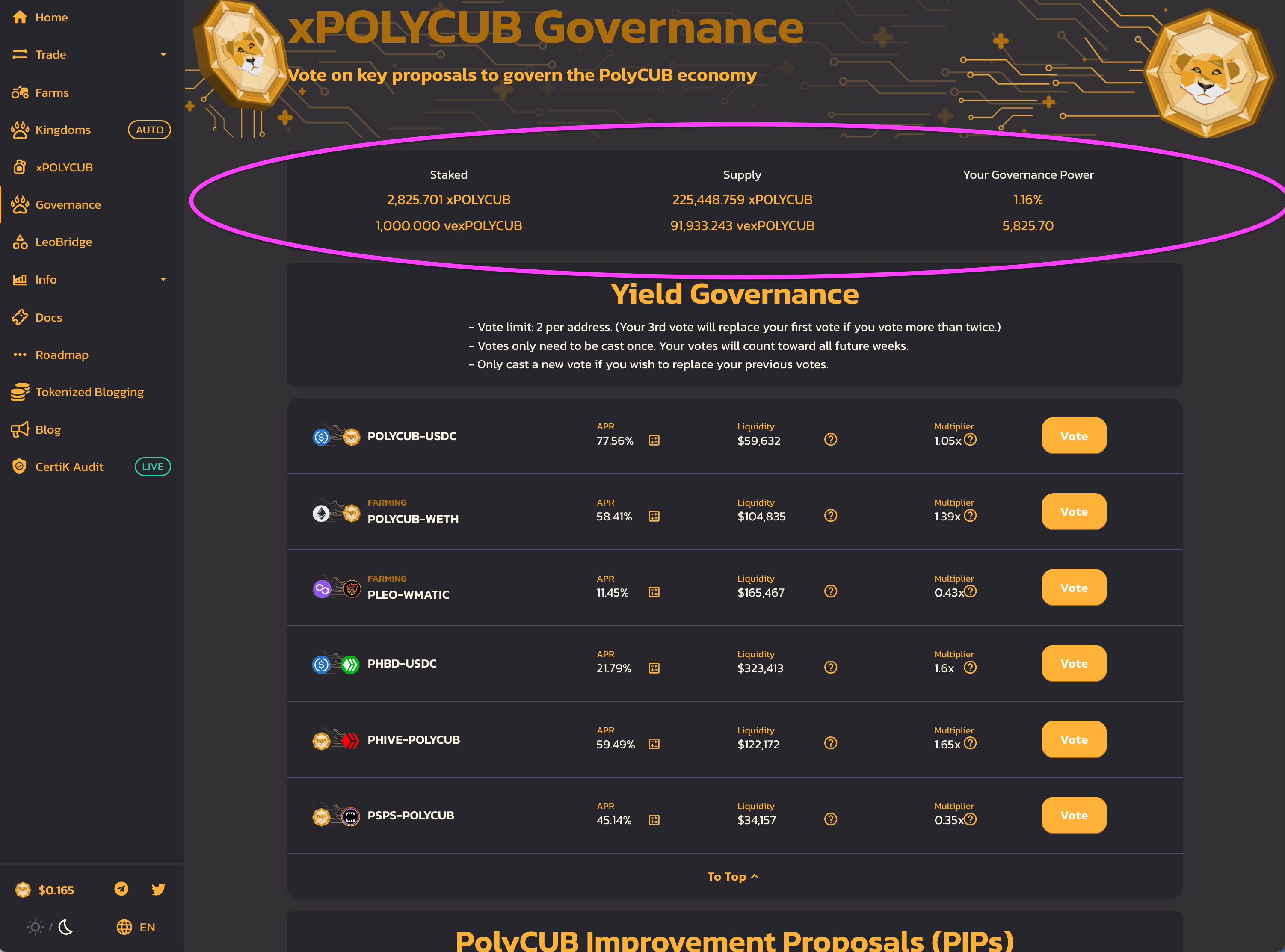

Governance is the core utility of PolyCUB. The platform is based around an idea to generate long-term, sustainable, reliable and growing yield for our Web3 ecosystem.

With this idea, we've released the POLYCUB DAO. The governance of our platform and how it moves forward is in the hands of all xPOLYCUB and vexPOLYCUB stakeholders.

vexPOLYCUB stakeholders have a 3x amplifier on their Governance Power which can be seen on the https://polycub.com/governance page.

PIP2 & PIP3

PIP2 is already live. It asks our userbase to vote on increasing the MTB wrapping fee from 0.25% to 0.35% or 0.50%.

Whichever receives the most votes will go into effect on July 23rd (voting ends July 22nd).

After PIP2 is completed, we'll release PIP3, PIP4, PIP5, etc. etc.

There are a lot of POLYCUB Improvement Proposals lined up, so get ready to vote.

Additionally, weekly yield governance is in effect. Make sure you go and cast your votes (re-cast your votes if you voted before the UI went live, as we cleared out the DAO and reset all votes with this release).

PIP3 will be a governance vote to add a pHBD-POLYCUB vault. This could have a significantly positive impact on MTB revenues - which ultimately buyback POLYCUB and distribute to vexPOLYCUB holders.

Our Mission

Our mission is to build one of the first DeFi platforms with truly sustainable, reliable and growing yield. This is not a mission that we can tackle alone.

We're building the technology as fast as we can. How that technology gets utilized to generate revenue for the protocol, stake into long-term lockups like vexPOLYCUB, get more TVL and capital pooled on the platform and ultimately buyback more POLYCUB each month is up to the community.

Let's build this together, 🦁s! Stake your HBD and HIVE across the MTB and help bolster the monthly revenue!

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

Polygon HBD (pHBD): https://wleo.io/hbd

Polygon HIVE (pHIVE): https://wleo.io/hive

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

LEO Wrapping Bridge: https://wleo.io

Posted Using LeoFinance Beta