DappRadar presents a correlation and regression analysis report where we are analyzing if the social media would help for predicting token price movements. We are taking a closer look at the three tokens: LEND, MKR and CRV.

Key Findings

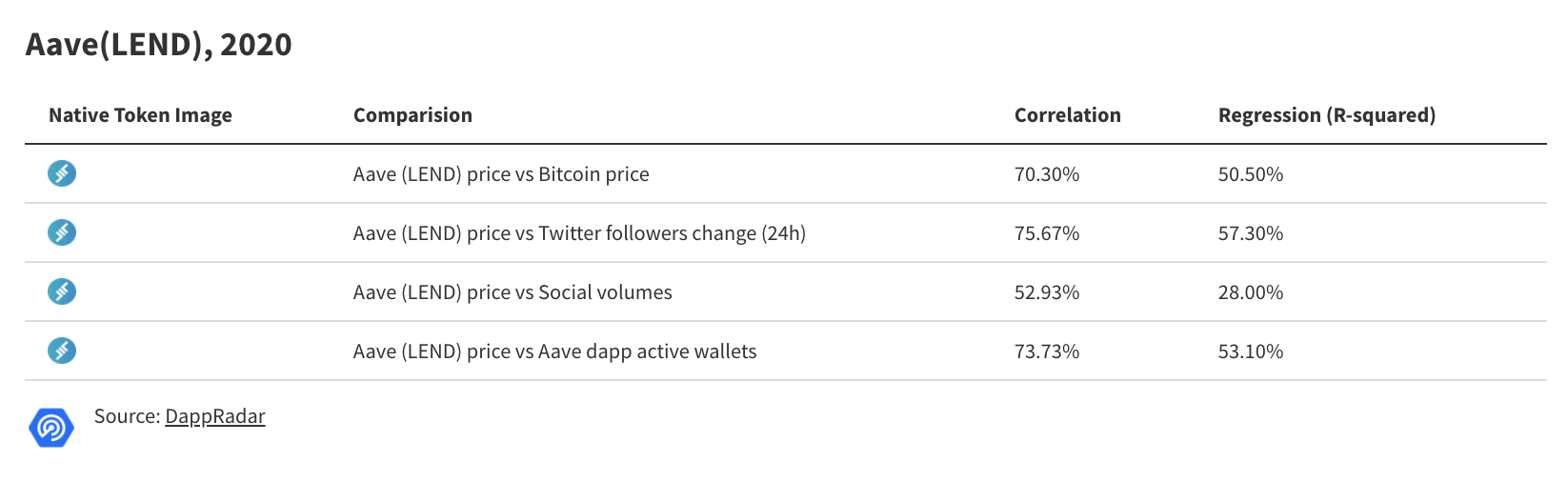

- While Bitcoin proves to be correlating to the price of LEND, Twitter follower and Aave active wallet activity have the strongest correlation.

- MKR price variation is strongly influenced by the price of Bitcoin and the number of Twitter followers.

- Twitter follower change is the most important metric to help understand and predict CRV price movements.

- This analysis proves that social media activity can be a powerful tool for understanding and predicting price movements in DeFi.

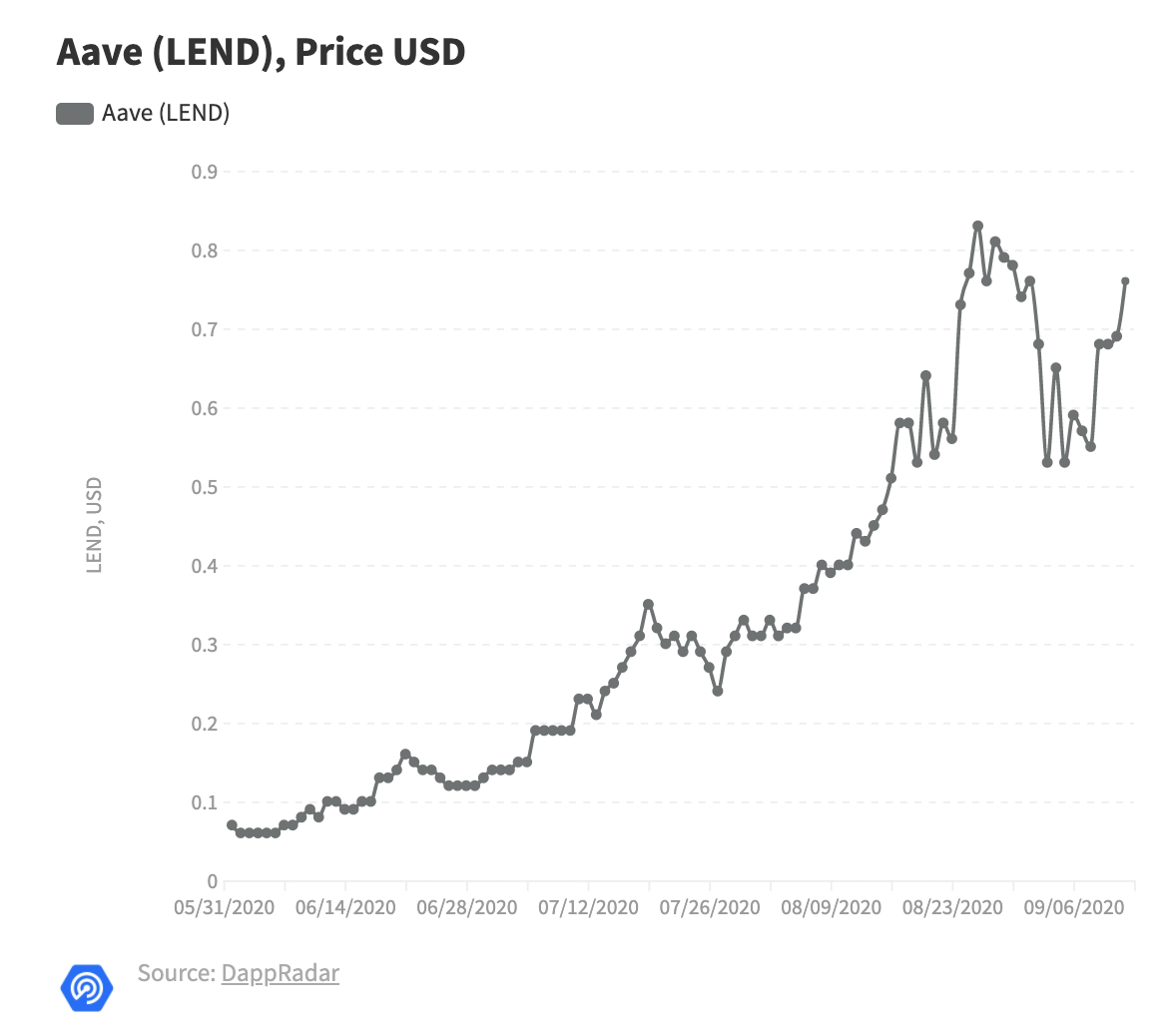

Aave (LEND)

Twitter followers change has the biggest impact on token price

After running the correlation and regression analysis on the provided metrics, we observe that all four metrics have a positive correlation to Aave’s (LEND) price. While one metric’s correlations are way stronger than the others.

Twitter followers together with active wallet changes have the strongest correlation 75.5% and 73.3% accordingly. After running the regression analysis, it could be confirmed that Twitter and active wallets also have the strongest impact on the token price too.

While Bitcoin also shows strong results on correlation and regression, the connection is comparatively weaker.

While running the regression analysis for Twitter followers and active wallets, the results were impressive. Indicating that 75.9% of LEND price fluctuation is majorly impacted by the two metrics.

This shows that Twitter followers together with active wallet changes can to a degree explain the price movements of LEND.

Read what effect, social media has on tokens' (MKR and CRV) prices.