Managing my finances is something I had to learn the hard way and right now I won't even say I have a solid grip on my finances but the good thing is that I have years of experience in that aspect and I do learn vital lessons from my mistakes. Many people lack the knowledge on how to manage their finances and they always end up in one debt or the other. One major reason for this is that financial education is something that's not taught in schools, which I would say is quite sad considering how important money is in the world.

School might give you some theories on managing money but we all know that such topics are usually very boring. I'm talking about things like balance sheets, ledgers, and other economic principles for managing finances in your business. Although some of those things do apply to personal finances as well, a lot of useful info is ultimately left out. Two very important things I learned in economics back in secondary school are the scale of preference and the difference between needs and wants.

The scale of preference is basically ranking your wants based on how important they are to you. It's the reason why you will rather use the money you have left to buy a data bundle rather than a new shoe because, at that point, the data bundle ranks higher on your scale of preference (I know it's the other way around for some people). Needs and wants are pretty much self-explanatory; needs are the crucial things you need every day for survival; food, water, and shelter.

Wants on the other hand are things you would like to have but can do without such as a phone (believe me you won't die when you're without your phone for a week), a car, that new handbag you have been saving for, and so on. Knowing the difference between these two is just the tip of the iceberg when it comes to managing personal finances, the rest of the iceberg depends on your level of discipline because, in the end, all the financial knowledge you know won't matter if you lack the discipline. Knowing the difference between needs and wants is crucial for my first tip;

The 50-30-20 rule

Don't worry we are not going back to high school algebra on this one. The 50-30-20 rule is something I learned about a couple of years ago but I didn't use it until last year when I had a sudden boost in my daily income. The 50-30-20 rule is basically a budgeting strategy which states that 50% of your income should be allocated to your needs (food, rent, bills), 30% to your wants (subscriptions, entertainment and hobbies) while 20% goes to savings. Now this is not a hard-coded rule as there are several variations out there and you can adjust it to your taste.

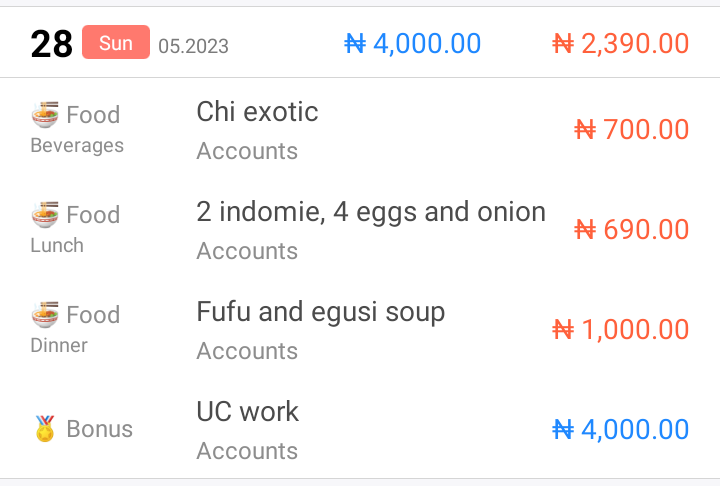

Some people use 60-40-10, and some use 70-20-10, it's up to you which variation you use but the bottom line is that you should have a good budgeting strategy. I learned this last year when I had a side gig that was giving me at least 4000 naira ($4) every day and up to 40,000 naira ($40) sometimes. I noticed that I was spending the money lavishly when the business started and I decided to be more disciplined with the way I spend. So, I downloaded a budgeting app called Money Manager and started keeping track of my daily spending. From each N4000 that comes in daily, I always make sure to save at least N1000.

The N1000 was just a baseline, I sometimes save more than that as you can see in the above picture. The point is that I became more disciplined with my spending when I started seeing where my money went every day and it's mostly food. That actually brings me to my next tip;

Tracking your expenses

For the 50-30-20 rule to actually work, you need to take note of your daily expenses. Create a budget, allocate some of your income to your needs (the essentials) and then save a percentage of your income, the rest can be used to satisfy your wants. That's the strategy I used last year, always making sure I save at least N1000 for every N4000 I made. There are several apps out there that can help you with making a budget and tracking your income but my favorite is Money Manager.

These days, I still track my expenses but I do so mentally because my daily expenses have drastically reduced as compared to when I was still in the university. But since I graduated late last year, I have been living with my parents and I don't have to worry about food and shelter. My major expense every month is an Internet subscription which costs just around $6, then the other expenses are just for snacks and personal care products (deodorants, soap, etc) and these aren't even bought every month. So, the majority of my income is saved, because I want to buy a new phone and laptop later this year.

One last tip I would talk about is buying food items in bulk. Many people don't realize this but buying things in bulk is way cheaper than buying them in small quantities. It might seem expensive at first but when you carefully analyze both methods, you will realize that you will save more when you buy in bulk. Understandably, many people can't really afford to buy food in bulk (especially in Nigeria), hence why they settle for buying in small quantities. I mean, how many families can afford a bag of rice in this economy? But still, that's something you should keep in mind and it's one of the things I learned from my mom.

Thanks for reading

Connect with me on:

Twitter: @kushyzeena

Readcash: @kushyzee

First image: Image by aleksandarlittlewolf on Freepik

Second image: personal screenshot

Third image: Image by storyset on Freepik

Posted Using InLeo Alpha

The 50-30--20 rules sure helps us allocate our income rightly, rather than spend on things we need, save that amount and just go for basic needs, truly, living without them, not my phone though, because it provides the income won't kill us.

The 50-30-20 rule is a great way to ensure we spend wisely. Balancing spending on needs, saving, and giving room for some wants is key. And yes, some things like our phones are essential for work. Thanks for stopping by

Now, this is something worthy of reading,

I never knew a rule like this existed, I have a personal rule I use to budget my salary which is similar to this but mine is based on saving and spending for each month. This is actually interesting. Tracking expenditure might prove difficult cause sometimes one forget to write them down but if a person is dedicated to doing this, it will help them manage the way they spend a lot

Tracking expenditures can indeed be challenging, but dedication and discipline makes a big difference. I don't see it as something that needs to be done all the time, just doing it for 2 to 3 months will give you an idea of where your money goes every month and from there, you no longer need to actively write down your expenses but you will be mentally aware of them. Thanks for stopping by bro

Yeah

Doing it for a long period of them will instill discipline into someone

With some very nice calculations, you have created a complete block on how to arrange financial management in front of us. In fact, our financial management should be such that if we fall into any danger and any problem, we can make use of our money. We have to calculate and conduct our life in such a way that we do not face any problem for money even if we are in danger.

Planning ahead and making informed decisions can help ensure we are financially secure even in tough times. Thanks for stopping by.

We need to increase the financial capability of each and every one of us to make our life very easy

You gave a whole lots of useful tips in this article. I was glued to my phone throughout. I will try and download the Money Manager app and see how it works. Financial management is key to prosperity.

I'm glad you found the tips helpful. Financial management is indeed very important for achieving prosperity. Thanks for stopping by.

You are welcome, friend.