Welcome back dear traders and investors!

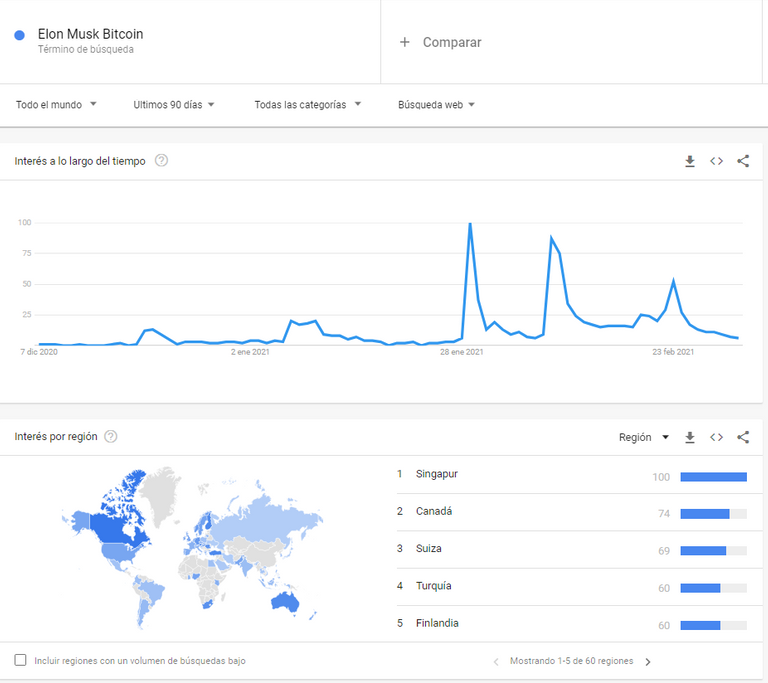

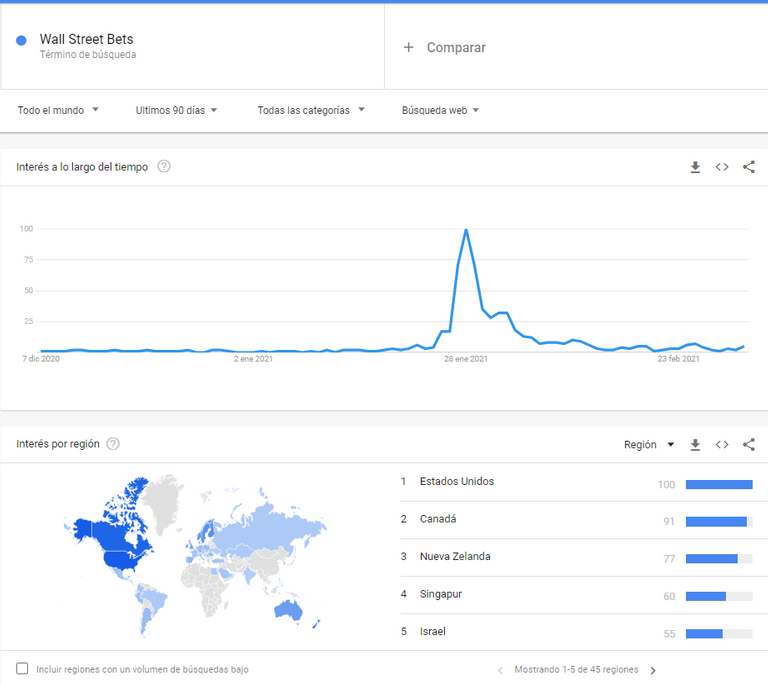

We are again at a key moment between information and technology; In this post today I wanted to take up part two of an article that -in my opinion- is always necessary for fundamental analysis, entitled "Bitcoin is a Momentous News". With it, it is intended to illustrate in tacit, real and trustworthy samples the searches of key topics such as: Bitcoin - Cryptocurrency - Blockchain - Elon Musk Bitcoin. Offering as a result the search indexes and international statistics, leaving an interpretive prism in our mind of how the world is working based on searches on this topic.

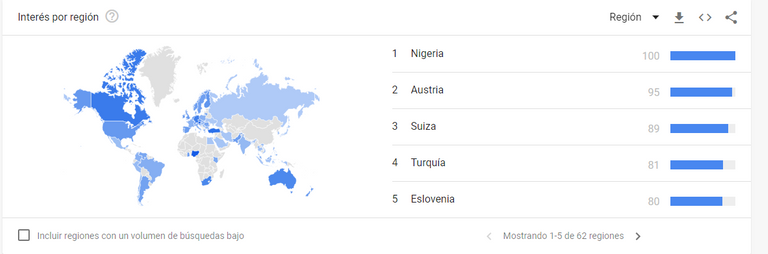

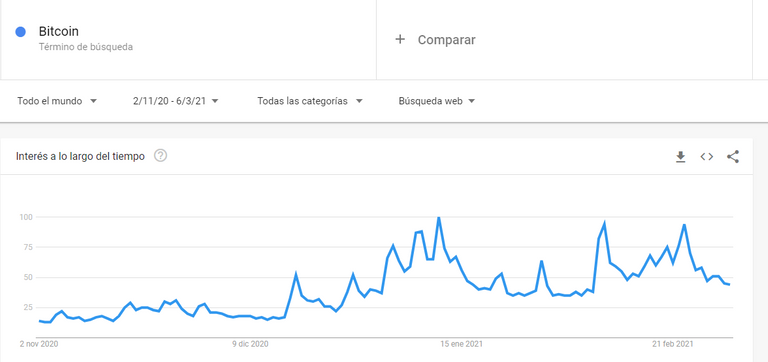

Google Trends - Tag: Bitcoin Epitaph:

The fundamentalist study of Bitcoin in considerations of the experts has always been related to its search index, this shows us that the hikes are in themselves an invisible collaboration and information flow of large scale or global impact, leaving traces of growth in research and graphs of past-present interest. These metrics are in detail quantitative in representation and are the perfect example of geopolitics, the international point of view and the elites or nations that top the list of countries with the most confidence or economy today.

Unlike the last article that I will subscribe to later, I will take the initiative to include a greater number of countries and related search indexes, as well as specific tags that are completely relevant when discussing prospective views. Every good connoisseur of cryptocurrencies should know that:

Bitcoin = Blockchain Bitcoin = Cryptocurrency Cryptocurrency = Blockchain Tony Stark = Elon Musk (Joke) We will start the study from November 2, the peak moment of the upward trend, when the world would never suspect everything that would come in the coming weeks of change, growth and upward trend.

Postscript:

It should be noted that the graphs of each country are dissimilar to each other, they all carry their own nature of search and participate in the general international graph. But it is an impossible task to compare the graphs with the naked eye, since we would have to add psychological, economic, sociological, institutional, public and cultural factors.

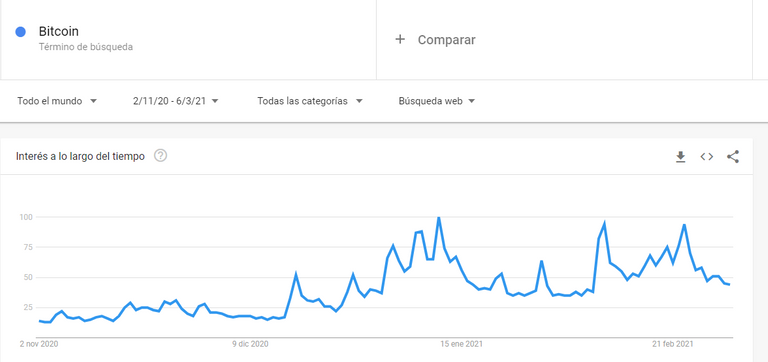

ALL THE WORLD - 02 NOVEMBER 2020 - ACTUALLY 2021 (START OF THE UPTREND)

We can visualize a stepped graph, very similar to the ones we see when trading, this indicates summative, that is, a healthy growth of international search in collaboration with the transit and research of related information. The graph together has rises of the informative nature, translating as news of great impact, days of news value and controversial stages or processes of Bitcoin.

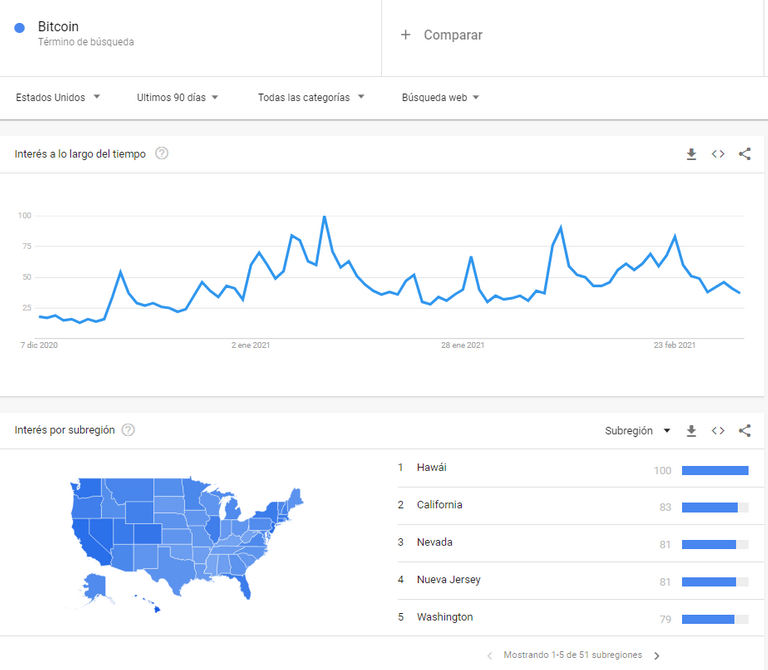

USA: Last 90 days (3 months)

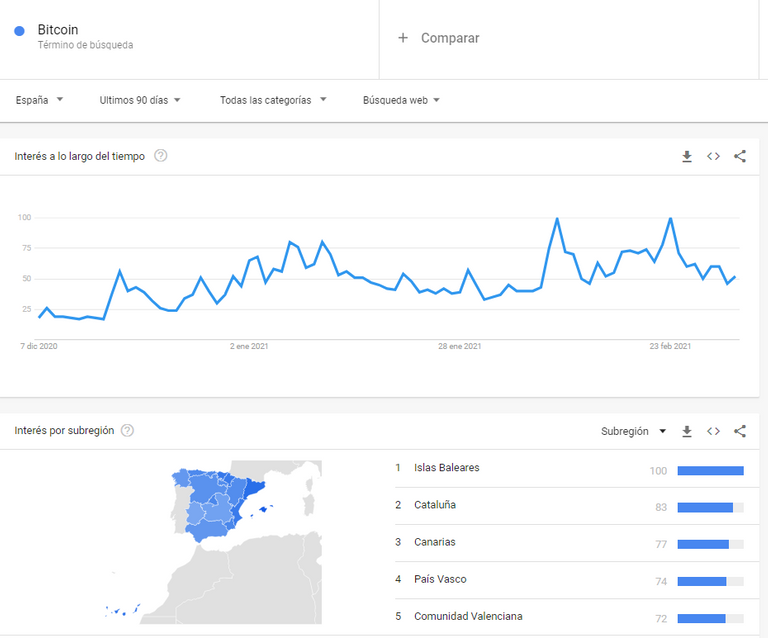

SPAIN: Last 90 days (3 months)

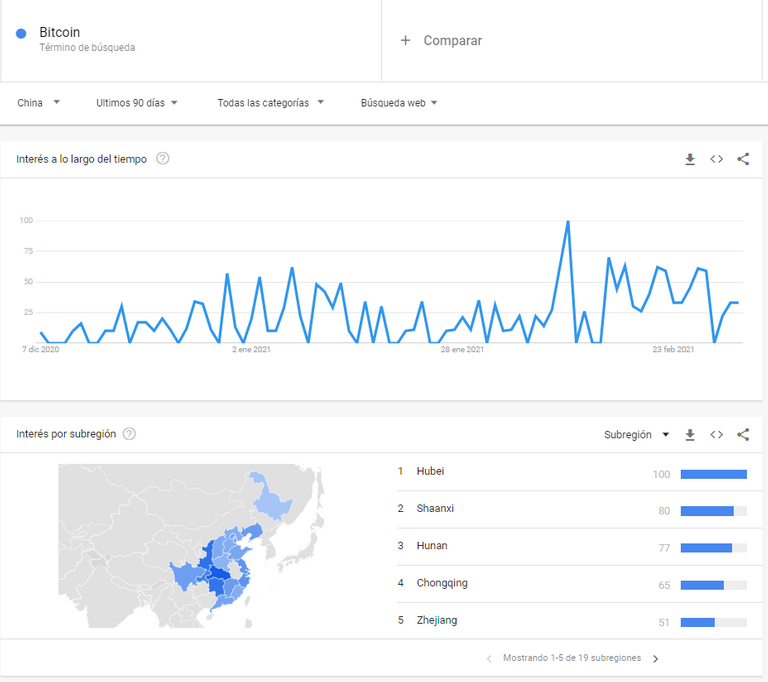

CHINA: Last 90 days (3 months)

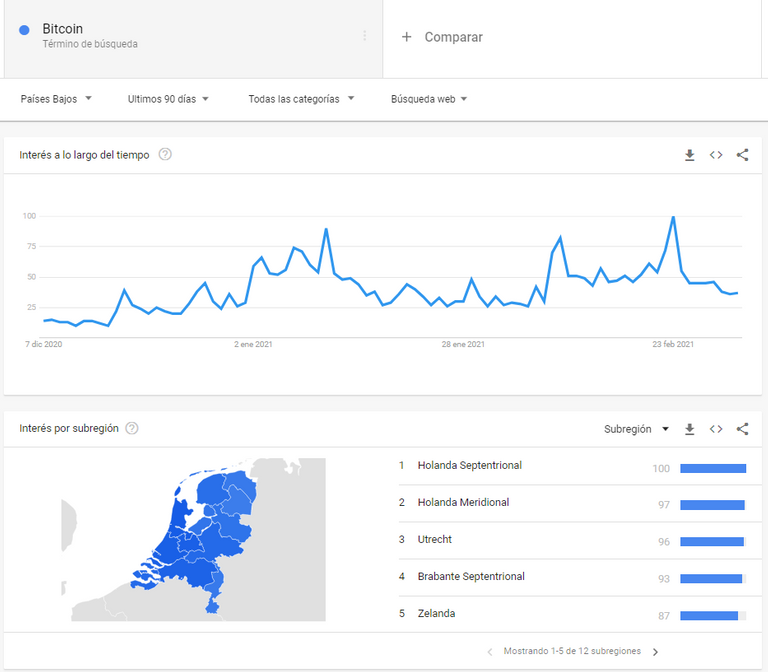

NETHERLANDS: Last 90 days (3 months)

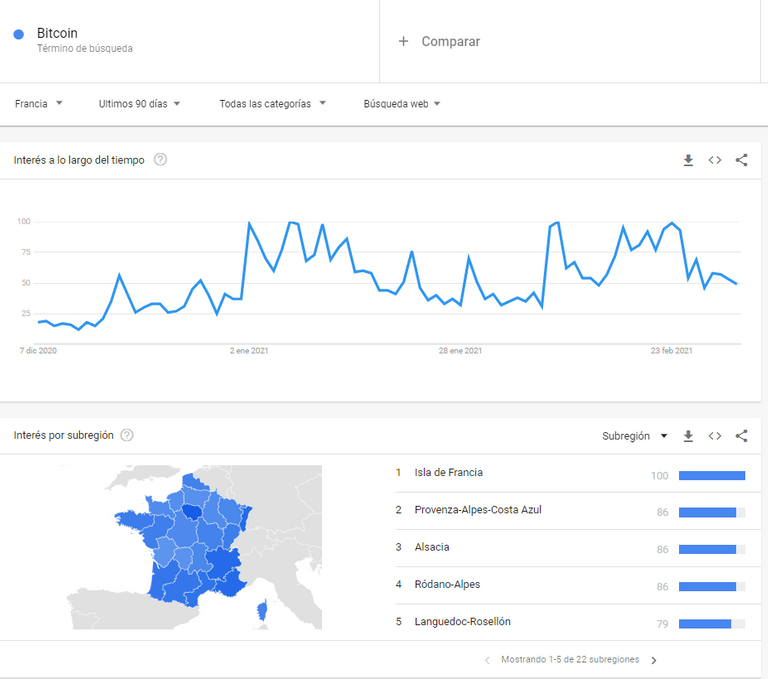

FRANCE: Last 90 days (3 months)

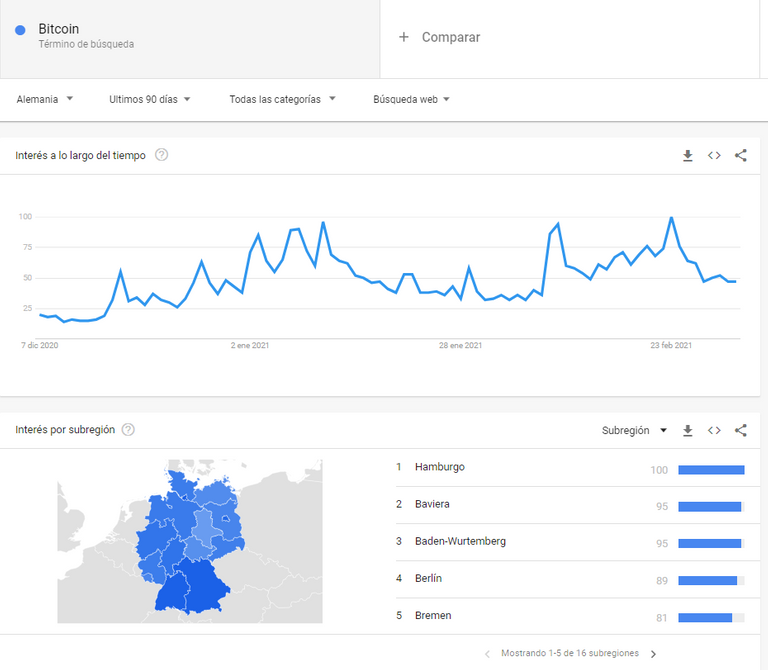

GERMANY: Last 90 days (3 months)

ALL THE WORLD: Last 90 days (3 months)

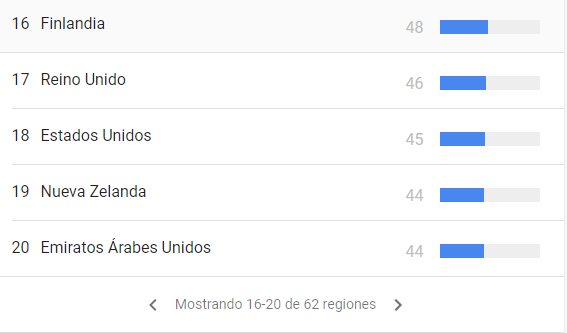

List of countries (UPDATED)

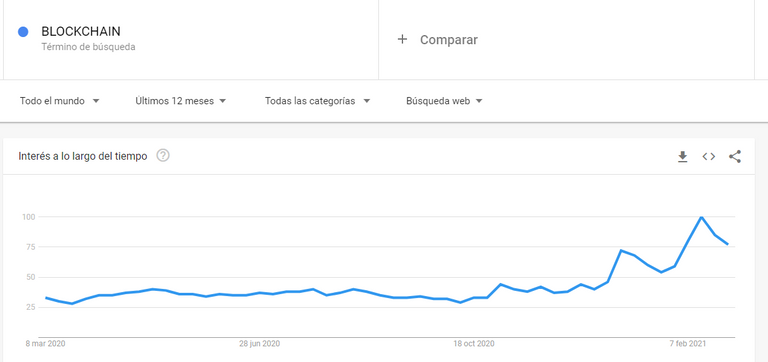

BLOCKCHAIN: Last 12 months

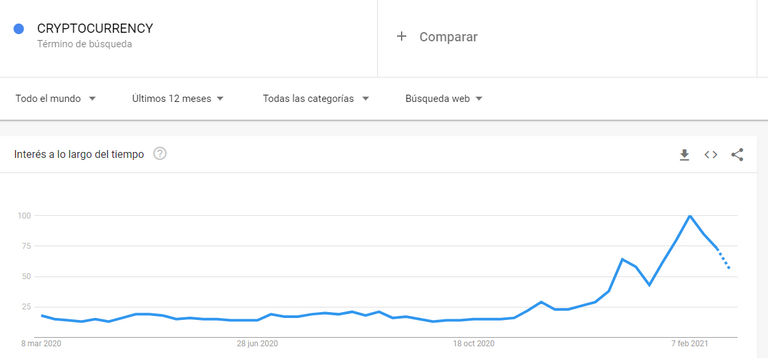

CRYPTOCURRENCY: Last 12 months

EXTRA: Last 90 days (3 months)

The problem:

Materially there is no problem to detail, in reality, there are quite a few. The first, which has been maintained since the first article I wrote months ago, is that the search indexes have not yet shown more research support for countries with better public or political relations; that is, Bitcoin, Blockchain, Cryptocurrency is still a massive interest for many people and governments, not all act with the best will or philanthropy, on the contrary, it is they who obfuscate the concept of this technology leading dark and malicious dyes to the true use legitimate and trustworthy.

Another problem that should be mentioned is the speed with which the interest of the researchers disappears in the face of their search, it can be noted that not everyone manages to get what they are really looking for, or simply what they are looking for is not achieved as a plausible idea because example: "How do I mine my first Bitcoin with a computer?" "How to win in Bitcoin" are questions that honestly do not give a positive aspect to what is needed in public or institutional opinion.

The third problem would be centered on the shape and volume of the graphs, establishing a comparison by the way in which they rise, fall, and remain, we could say that: "when the Bitcoin rises is when they look for it the most" and "when the Bitcoin goes down, is forgotten in the past or what it once was"

All statistics were truly justified and belong to Google Trends

You can review the statistics through the following link: https://trends.google.es/trends/explore?q=Bitcoin

Without further ado, I say goodbye thanking you again for reading, if you like the Socratic debate on cryptocurrencies, do not hesitate, write a comment! 😜✌

Just remember:

If you want to support my content and my analysis or articles, you can do it through my wallet

BTC donations: 19xUQN6SNKJGMYJGc25Hs6g832YHdx8A4u

All content is original and belongs to @abelardobravoh

Posted Using LeoFinance Beta