I don't do much trading in crypto, because I'm not good at it, but I do follow crypto prices day and night and I kind of have some indicators that work well and always tell me the truth about the direction BTC and other types of assets might head to. You can't rely 100% on them but they're quite useful imo.

The two that I want to point at are the RSI and the fear and greed index. I can't seem to be able to open the first one on tradingview, but the fear and greed index is definitely pointing at the market's sentiment to be on the extreme greed territory right now. What does that mean?

From what I noticed, and am not the only one keeping my eyes on this index, usually extreme greed indicators precede some sort of pullbacks/corrections, while extreme fear is definitely a buying opportunity indicator. It's all that simple that I even ask myself why the hell am I not trading based on these simple to use indicators.

Don't know if you have noticed it, but the BTC's price is already under $15,000, after getting close to $16,000 recently and my lucky guess is that it will dump to as low as $14,000 or even a bit under. Does that mean that the bull market is over? Hell no, we just started the uptrend, but it's obviously BTC won't moon in days or weeks once it starts its bull market, and it needs some resting periods over time.

It showed already that it doesn't care too much who the president of the US is, but it still needed to correct and my take is that it will take a few days or weeks till this correction will end and the extreme greed will cool down. Money have definitely entered the market big time and it's probably clear by now for most of you that financial institutions are leading this rally. It was about time, right.

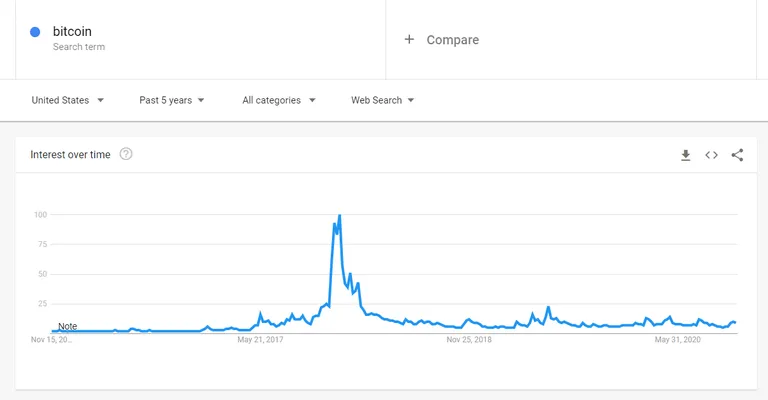

If you check the google trends for the search term bitcoin, you'll see that despite the recent strong rallies, the chart has barely moved, leading towards the judgment that plebs are not in control anymore, and that this is nothing similar with 2017 bull market when retail investors drove the prices up, worth mentioning being the ICO boom which in my opinion was a strong catalyst for many shitcoins 20-30x in one year or less during those times.

2020 is the year when the long awaited financial institutions such as Grayscale, PayPal and others, have taken control over the Bitcoin boat and they're definitely not in for a quick buck profit on Bitoin. Those guys know how to do money, have for sure done their research and are anticipating large revenues for them and their clients investments.

That doesn't mean that plebs aren't buying BTC as well, according to this report only in the US the number of crypto ATMs have doubled from 2019, with a total of 9242 ATMs at the moment. Canada is also a world top five country by the number of ATMs available in the country, and even my modest home country Romania has more than doubled its total of crypto ATMs in the last year.

Bottom line, my take is that according to the fear and greed index, which currently screams extreme greed, we will see a pullback for the price of BTC short term, and it was kind of expected to happen after these strong rallies, but it will not last long, so be careful with your trades that you're not left on the sidelines/stablecoins.

Have a great day folks and see you to the next one.

Thanks for attention,

Adrian

Posted Using LeoFinance Beta

I am horrible at trading too. I basically just move what I need to between tokens at the first price I can find. I know I am costing myself a lot of money by doing that. Actually, I take that back. The amounts of crypto I am working with are so small it isn't as big of a deal as it probably seems. I am really kicking myself for not buying more BTC back in March when it was in the $3k range!

Posted Using LeoFinance Beta

Don't. That's a completely counterproductive thing to do. You or anybody else could not possibly have known what the cryptocurrency market was going to do.

Posted Using LeoFinance Beta

Fair point!

I know it doesn't seem likely, but it could pull back if some stupid exchange gets hacked. Got dry powder?

Posted Using LeoFinance Beta

You're not alone regretting not buying BTC in March...

Posted Using LeoFinance Beta

I was actually expecting it to dump under 14k at least I can buy little, I'm not really a trader, the technical aspects is something I'm not really up to the task. BTC moon is steadily becoming a thing but the the drop back is even an added advantage

Posted Using LeoFinance Beta

Have a look at this indicator once in a while. It sure gives a bit of perspective on where the market is heading.

Posted Using LeoFinance Beta

@acesontop, Bitcoin Market is driven by Extreme emotions, and in my opinion Extreme emotions because of it's Decentralised Nature. Stay blessed.

Emotions often beat all the charts in the world.

Posted Using LeoFinance Beta

Sounds true.

For sure

Posted Using LeoFinance Beta

Yes.

I'm hoping for only a minor bump before the charge upward continues!

Posted Using LeoFinance Beta

We'll see about that. It's extreme greed territory.

Posted Using LeoFinance Beta

Consistently profitable trading is extremely difficult. It's best for amateurs to only make one trade per coin per four years.

Posted Using LeoFinance Beta

Yea, hard to nail great trades that often

Posted Using LeoFinance Beta

I'm tellin ya, there is a lot to this fear and greed trading. I would have sold everything if I was into stocks today.

Posted Using LeoFinance Beta

Do you use this indicator?

Posted Using LeoFinance Beta

Just in my head, I just know when things are overvalued there is a blow-off top and when things look bad they will get worse, then I buy at a discount compared to the cash value.

Posted Using LeoFinance Beta

Great strategy.

Posted Using LeoFinance Beta

Thanks for the tip about the indicators - where are these found? Is there a dedicated website with them on or an app or something else?

Ah, you described me so well haha! But I'm just sticking to my gameplan at the moment with daily micro-purchases of BTC and keeping some cash to catch the corrections, which are inevitable, it can't keep going up all the time!

Posted Using LeoFinance Beta

Search fear and greed on google and look for RSI at indicators on tradingview.

Posted Using LeoFinance Beta

Thanks a lot, think I'll be doing this more often!

Posted Using LeoFinance Beta

It's free to use :)

Posted Using LeoFinance Beta