In recent days, cryptocurrency experts and youtubers on social media channels have started to talk about the fact that the bull season is coming or is very close. There is even talk of which tokens will be flares. So is Taurus season here? What could be the situation now and in the near future… ?

In this article, I would like to share my own thoughts with what I saw and heard.

If you're ready to put up with me, let's get started...

He thinks two factors are important for the start of the bull season...

First; I see effects such as basic indicators, the mobilization of social media, the announcement of news about important developments from projects, the search for alternatives to assets in the fiat financial system. This is OK …

So where are we technically ... ? To speak of this, we need to look at the indicators … The important thing for me is the indicator that the uptrend has started …

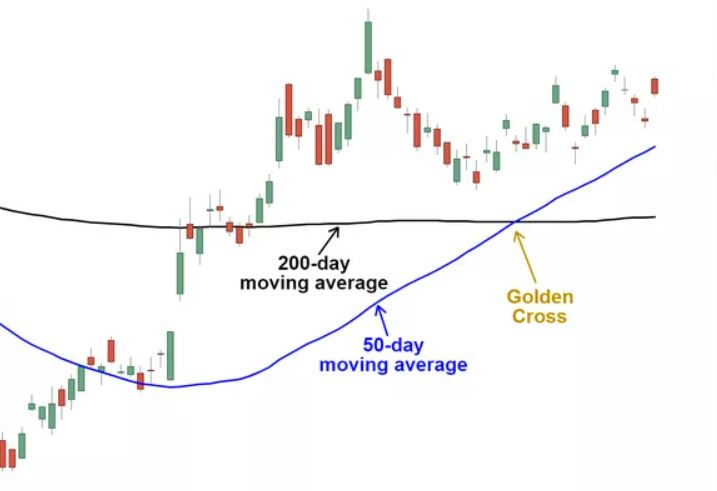

Golden Cross…

Let's first look at what the Golden Cross is...

Golden Cross is a chart pattern where a relatively short-term moving average crosses above a long-term moving average. A golden cross is a bullish pattern that consists of a cross that breaks the short-term moving average (such as the 50-day moving average) of a cryptocurrency, or the resistance of its long-term moving average (such as the 200-day moving average). As long-term indicators carry more weight, the Golden Cross signals a bull market on the horizon and should be supported by high trading volumes.

The Golden Cross consists of three stages ...

First stage; A downtrend should eventually bottom out as sales run out.

In the second stage; The shorter moving average creates a crossover across the larger moving average to trigger a breakout and confirmation of a trend reversal.

In the third and final stage; It is an ongoing uptrend to follow higher prices.

The most commonly used moving averages are the 50-period and the 200-period moving average. The period represents a specific time increment. In general, longer timeframes tend to create stronger permanent breaks.

All indicators are "lagged" and no indicator can accurately predict the future. Often, an observed golden cross produces a false signal. Despite its apparent predictive power in predicting previous major bull markets, golden crosses also do not occur regularly. Therefore, the golden cross should always be confirmed with other signals and indicators before starting a trade.

Ok so far … What about the flagships of the cryptocurrency markets, Bitcoin and Ethereum … ?

Why is this important; Cryptocurrency markets work in cycles … First Bitcoin, then Ethereum, then altcoins …

BTC Price Chart

ETH Price Chart

BTC and ETH, the downtrend was broken to the upside, a Golden cross was formed.

My Last Words; If there are no serious crashes like Terra and Ftx in the cryptocurrency markets, we can start to celebrate the arrival of the bull season. I'm starting to see a lot of altcoin Golden Cross signal formations... I have only one question mark in my mind... The SEC seems obsessed with stablecoins and Binance. A negative situation that may arise from this may extend the bear season … It is useful to follow the markets closely …

As I always say; Listen to everyone, decide for yourself...

Good Luck My Friends…

Posted Using LeoFinance Beta

Agree with you that most probably the bottom for BTC and ETH is in. Altcoins recovering too with some beeing already in a bull market again (e.g. MATIC).