You want to evaluate the cryptocurrencies that you have not disposed of during the bear season. There are stake and farm pools in the central and/or decentralized exchanges where you trade. Until the bull season comes, your cryptocurrencies can provide passive income. But the two terms you come across may confuse you. APR and APY…

APR (Annual Percentage Rate)

APY (Annual Percentage Yield)

I would like to examine these two concepts and share what I have learned with you.

If you're ready, let's start …

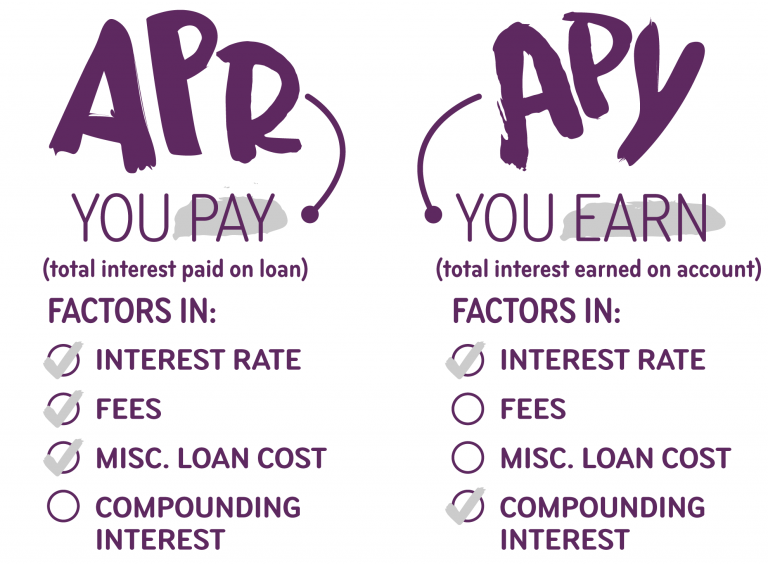

What is APR (Annual Percentage Rate) … ? APR stands for simple interest. In other words, it means the annual interest to be paid or the annual simple interest you will earn. Generally, a high APR rate is not good for borrowers. In terms of borrowing, the APR shows the annual interest rate you pay on credit cards, loans, and other debt. It includes both the interest rate on the loan borrowed and the fee charged by the lender.

APR = Periodic Rate x Number of Periods in a Year

What is APY (Percentage of Return Per Year) … ? Usually, investment companies advertise the APY they pay to attract investors. This is because they know that they will earn more from long-term services such as individual retirement and savings accounts. Unlike the APR, the frequency with which the APY is charged also takes into account the effects of interest rates during the year.

APY = (1 + Periodic Rate)Number of periods – 1

Things to know about APR and APY

APR represents the annual rate used to make money or borrow money.

The more frequent the compounds of interest, the greater the difference between APR and APY.

APY takes compound interest into account, but APR does not.

Compound interest differs from simple interest in the result that the daily interest rate is multiplied by the number of days between payments.

Generally, a high APY is in favor of the investor, but there are also daily, weekly and monthly displays on asset management platforms. In APY, the monthly interest rate is added up every month.

Investment companies often advertise APY, while lenders prefer to advertise APR.

What is the Difference Between APR and APY … ?

The main difference between APR and APY is that APY contains compound interest. APR is simple interest.

You have 1000 USDC. You have options in APR and APY rates.

Option A: Let's assume 10% APR if you lock your USDC for one year.

Option B: Let's assume 10% APY if you lock your USDC for a year.

Results:

Option-A: 110 USDT is refunded.

Option-B: 110.51 USDT is refunded.

Option B is higher because APY determines the new interest rate to be applied by adding the earnings paid in previous periods in order.

My Last Words; While obtaining passive income from the cryptocurrencies in your hand, you should examine the APY and APR rates, and look at the rates of the platform you will trade. Especially when farm ponds are first opened, they can have very high APR and APY rates. This may subside in a few hours. Therefore, do not dream of thinking that you will always get the same rate. If you cannot follow them, you should prefer fixed rate platforms with locks. I use BiSwap, PancakeSwap, …

Posted Using LeoFinance Beta