Stablecoins are cryptocurrencies created as an alternative to usability against market volatility, digital currencies that have their value tied to a certain asset with a more predictable price, for example, USD, Euro, gold, silver, oil, among others.

Because volatility of more than 10% is still common when it comes to cryptocurrencies, stable currencies have emerged and have been gaining ground as an option for transactions between users and investors.

The big difference that makes them interesting is not the possibility of appreciation, but rather because they enable agility and more predictability of prices for transactions, without the risk of a sudden change in price during an operation, thus providing protection in times of high volatility. Some have parity in FIAT currency, and must have an equal or greater amount of this asset to guarantee its issuance. Others have parity in commodities and some are backed by other cryptocurrencies, using their own mechanisms to keep the value stable. They vary in the format of your governance (some are centralized and others are decentralized) and also in the way you keep your prices stable. But the ultimate goal is the same: to provide fast, efficient, inexpensive transactions in a stable price environment, far from the volatility of crypto.

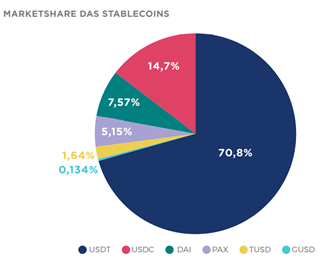

The potential size has attracted the attention of Central Banks, which are running experiments with the first versions of CBDCs (Central Bank Digital Currency). Let's understand the mechanisms they use, get to know the stablecoins with the greatest market share and some details about them.

FIAT COLATERIZATION

Tokens that are supposed to maintain a 1: 1 ratio to money held in bank accounts: TrueUSD (TUSD), USDCoin (USDC), Tether (USDT), Gemini (gUSD) among others. To issue these stablecoins, companies need to put an equivalent amount of money in fiat currency (FIAT), such as the Dollar, Real, Yen, Euro in real bank accounts.

COLATERIZATION WITH CRYPTOACTIVES

Here we have other cryptocurrencies as ballast, they are usually supported by a “basket” of them. This serves for a better distribution of risk, since the risk of volatility is less with a group of cryptocurrencies instead of a single one, thus better absorbing the price fluctuations of the assets included in this basket. Example: DAI

COLATERIZATION WITH COMMODITIES

They have their guarantee in commodities, the most common being gold, but they can also be backed by oil, real estate or baskets of various precious metals. Stable commodity-backed currencies are pegged to a 1: 1 ratio with their reserve assets, so a currency is usually worth a predetermined unit of its referenced commodity (for example, an ounce of gold or a barrel of oil). The applicable merchandise is often kept with a third party who stores and regulates these assets in the reserve.

ALGORITHMIC STABLECOINS

This type is still little known. Here, stablecoin is programmed by smartcontracts that perform the function of a central bank, monitoring the supply and demand of the asset. Smartcontract is responsible for buying coins in circulation when prices are very low and issuing new ones when prices are getting very high, maintaining the balance of the equation, consequently maintaining the stability of the asset. Example: Reserve (RSV), Land (LUNA).

The digital and programmable nature based on blockchain gives stablecoins many advantages for users than the traditional system, but as with everything that involves the market it is important to know the favorable and unfavorable points of the assets:

FAVORABLE POINTS: Payments without borders, low rates, faster transactions, Transparency, very low volatility.

POINTS AGAINST: Centralization in most of them, Dependence on traditional financial markets, Not regulated.

Stablecoins offer more advantages when compared to traditional fiat currencies, as they combine the advantages of using blockchain technology, such as security, processing speed and privacy, with the price stability of traditional assets. In addition, it is an alternative for those who want to transition between the volatility of cryptocurrencies and the stability of fiat currency, without actually having to switch to FIAT. They represent an important innovation for the crypto world, providing the bridge between different markets and providing price stability.

On the other hand, confidence in most of these currencies depends on several factors, which are not under our control and reside in the hands of a third party.

A bias totally against what Satoshi Nakamoto idealized with the creation of Bitcoin, the elimination of intermediaries in the process.

So if you are choosing a stablecoin of your preference, opt for those that have a more decentralized model as possible.

Posted Using LeoFinance Beta

Downvoted, because your active spamming link to this post. Learn the good behavior the hard way

Posted Using LeoFinance Beta

Dude where did I spam? Are you crazy? I'm just trying to get my texts out there, so that more people can see. Thus, this platform will not gain adoption, stay with your mediocrity.

Posted Using LeoFinance Beta

Yehh correct, this sounds like Hives HBD, but not exactly because instead of being backed by a basket of its own coins, it is backed by Hive. He he, cool stuff...

Posted Using LeoFinance Beta