Yesterday, bitcoin's price continued to decline, and today it has dropped north of 3%.

At the time of this writing, it was trading around $54,500, according to CoinGecko.

Currently, we think the outlook is turning grim for bitcoin and if buyers don't show up soon, a significant drop might occur.

Still, bitcoin's price traded within the predicted range (blue).

Our reasoning is also supported by the Volume Profile Visible Range (VPVR) on the left of the above chart, which shows BTC/USD is reaching a dangerous zone, below $52,000, where buy orders are scarce.

However, bullish news continues across the crypto space. In a recent Forbes article, Billy Bambrough spoke to Pankaj Balani, chief executive of the Singapore-based Delta bitcoin and cryptocurrency exchange, who said that "The expiry data suggests a bullish outlook", referring to "Bitcoin options contracts worth around 100,000 bitcoin, or almost $6 billion at today's prices", that "will expire on Friday, according to data from cryptocurrency analytics provider Bybt."

However, bullish news continues across the crypto space. In a recent Forbes article, Billy Bambrough spoke to Pankaj Balani, chief executive of the Singapore-based Delta bitcoin and cryptocurrency exchange. Balani suggested that a high number of bitcoin contracts expiring this Friday points to a bullish outlook for the coin.

Hence, we think investors and traders should take advantage of the ongoing correction and add bitcoin to their portfolios. However, all those thinking of entering a long position should trade with care. Low volumes usually point to incoming volatility.

We remain bullish on BTC/USD as long as:

- BTC/USD remains above its 20-day MMA (red), 50-day MMA (green), and 200-day MMA (blue).

- BTC/USD doesn't drop below $52,000.

- BTC/USD daily volume goes above its 21-day Modified Moving Average soon.

What Do Traders Think?

This week's first tweet comes from The Wolf Of All Streets (Scott Melker), whose Twitter describes him as an investor, podcaster, and author of The Wolf Den Newsletter.

In his post, Melker shared a weekly chart of bitcoin's price and wrote that

"When that candle is at the top, it is more of a "hanging man" and leans more bearish than bullish," pointing to the fact that there's a high chance bitcoin's price may drop further. He points to $42,000 as a possible short-term target for bitcoin's price. He added that "until the next candle closes,"

it could just be vaporware.

Given the current bearish outlook and as bitcoin's price fell below $58,000, we think this scenario increases the chances of actually playing out.

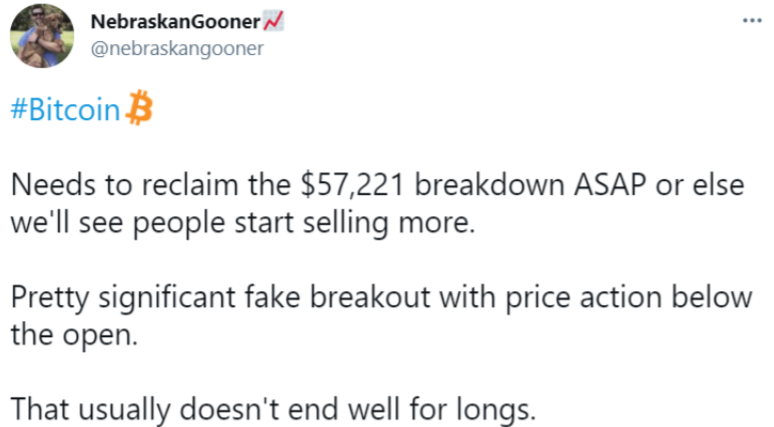

The following post comes from NebraskanGooner, whose Twitter profile describes him as the founder of LVL, a bitcoin exchange, and owner of Elevate Trading.

He wrote that bitcoin

"Needs to reclaim the $57,221 breakdown ASAP or else we'll see people start selling more."

Essentially, his post builds on Melker’s. The trader also thinks that bitcoin can't go above $57,000 and find support at this price range, the likelihood it drops increases.

Just yesterday, a significant number of long positions were liquidated, which indicates choppiness. We advise care.

The following tweet comes from Mayne, whose Twitter profile describes him as someone who has been trading both forex and cryptocurrency since 2013.

Mayne shared a 30-minute chart of bitcoin's price and added Fibonacci retracement levels.

According to Investopedia,

"Fibonacci retracements are popular tools that traders can use to draw support lines, identify resistance levels, place stop-loss orders, and set target prices."

The interval the trader was looking to accumulate was between $56,162 and $56,395. He identified a possible drop towards $55,300 and wrote that

"If we lose this current low, I'm aiming for $52k."

Essentially, Mayne is also pointing to a possible drop towards $52,000 if bitcoin cannot hold $57,000.

The last post of the day comes from Crypto Rand, a cryptocurrency trader and investor.

In his post, Rand shared a 12-hour chart of bitcoin’s price and added two lines, one showing support at the bottom and another resistance at the top.

Unlike most traders, Crypto Rand remains bullish on bitcoin’s short-term price action and thinks there’s a chance the price will skyrocket towards $68,000.

We think the longer bitcoin consolidates, the more powerful the next move will be. Hence, we believe that if bitcoin can hold between $56,000 and $57,000 during the next few days, there’s a chance for a massive upswing soon after.

Bitcoin Price Prediction

At the time of this writing, bitcoin's price is trading close to $54,500 according to CoinGecko.

Bitcoin's price has declined around 3% since yesterday, but we think the long-term bullish trend remains intact. However, volume is falling, which may indicate a massive swing is coming. If the price continues to decline, we'll be forced to update our worldview since it may be indicating a further drop towards $52,000 is about to take place.

Adding to that, a significant number of traders are now strongly considering the possibility bitcoin's price will face another correction before picking up the pace again.

How do we think the price will trade today? As shown in the above chart, we believe that bitcoin could top a little over $59,000 in the next few days, as long as buyers return to space. Still, it's improbable bitcoin's price suddenly shifts its ongoing correction.

On the other hand, we don't expect the cryptocurrency to drop much below $52,000. If it fails to hold that level, then we think a drop towards $48,000 could play out.

To finalize, the VPVR shows a high number of buy orders between $46,500 and $50,000.

It also indicates that there are almost no sellers left above $62,000, which means that when bitcoin breaks above its prior record price and enters price discovery mode, it should hit $70,000 in no time.