The USA's money printer is going Brrr, it has been for a long time now, but since 2020, it has printed around 40% more currency, something that still hasn't had real consequences - yeah, inflation in the us is around 7% YTD but that's just the beginning, or so they say.

The price of consumer goods is up, but they are still affordable everywhere in the first world; there is an economic crisis in the third world - like Mexico, where I am based - but we are used to those, in fact this crisis feels just like any other one we've experienced every 2-3 years, nothing to worry about, the rich stay rich, the poor stay poor but there's not civil war threat because the poor can still barely survive, just like they've done since they have a memory.

The Covid measures created a state of economic stagnation and an even more extreme feeling of uncertainty among the average Joe, there has been a hesitancy to spend the small amounts of money people still have on their pockets, in fear of an even stronger crisis - both in the 1st and the 3rd world - that we were all told would happen thanks to Covid.

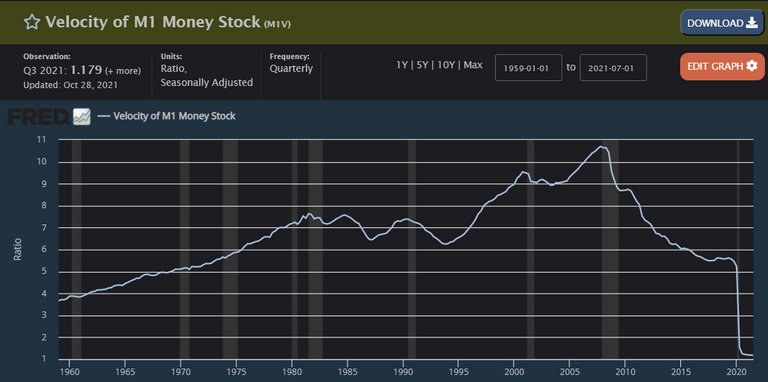

If people spend less money, there is something called velocity, that is basically how much a unit of currency is circulated, the more change of hands a dollar does, the higher the velocity. If any currency has a low velocity, the price of goods takes some time to reflect the currency supply - that's a very simple way of putting it, I'm sure someone with more knowledge can point where I'm oversimplifying for the sake of this post, because this is not a microeconomics post.

Once the velocity of a currency rises, the prices of goods reflect that currency supply faster - this has happened many times in countries like the post WW2 Germany, Argentina, and many African and Latin American countries.

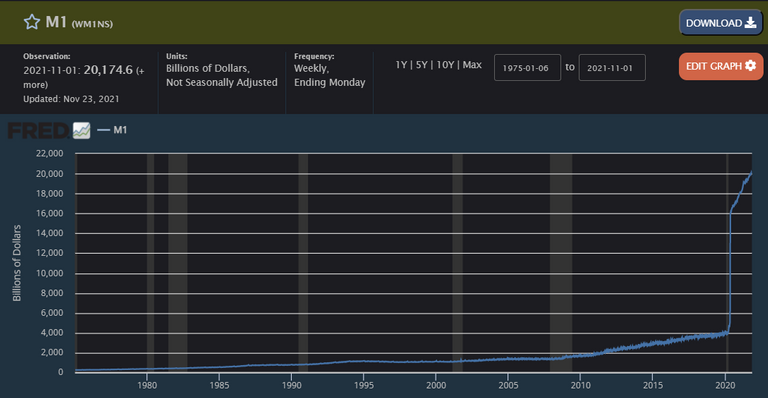

About Money stock, circulation and Velocity

Let's take a dive into how the US dollar has behaved over the past two years, taking into account the money printing that happened in 2020 to stimulate the economy.

M1 consists of is of physical currency and coin, demand deposits, travelers' checks, other checkable deposits, and negotiable order of withdrawal (NOW) accounts.

It is basically the liquid coin running around changing hands.

It went from 4 billions to 20 billion of dollars in just two years. Although these numbers are not trustworthy because in May 2020 they added other metrics thus the vertical climb here doesn't reflect reality, which is why I added the next graph, the one that we really care about.

M2 includes all elements of M1 as well as savings deposits, money market securities, mutual funds, and other time deposits.

M2 is closely watched as an indicator of money supply and future inflation, and as a target of central bank monetary policy. M2 is basically how much money exists as just a number in bank accounts.

In January there were 15.3 Billion USD and right now there are 21.3, this is where most people get the infamous the government printed 40% of the current money in the economy and it happened in under two years! And it is also where the Meme Money printer go Brrr comes from

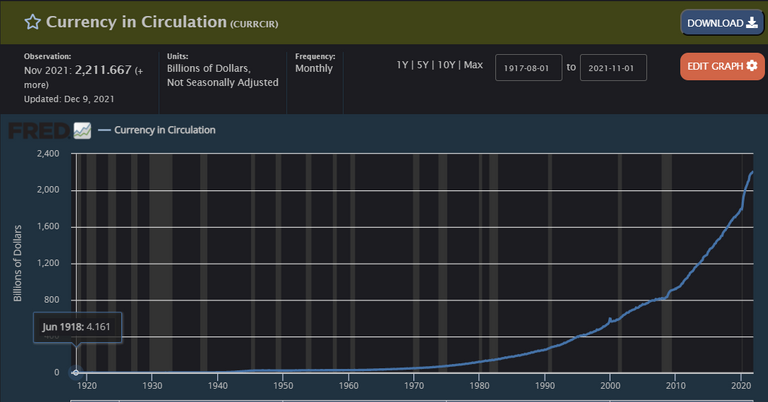

Memes aside, let's check at the interesting part, look at the graph that measures the dollar circulation.

It has only grown 20%, from 1,800 to 2,200 Billions of USD. Where is the other 20%?

If the M2 grew 40%, but circulation only grew 20%, there must be something fishy, right?

People are storing it, they are saving it for when it is not economically irresponsible to buy a pony or when they can travel again - because you know, we can't travel because of the covid restrictions and measures, that were supposed to last two weeks to slow the spread. That money is waiting to be pumped into the economy.

Basic economics: What happens when there is a flood of currency into the market? The market responds. Inflation. And inflation that hasn't happened yet with full force because there is simply too much uncertainty, both your average Joe and your McDonalds manager as well as your mid-size company CEO will not go on a shopping spree, they are saving that money for the eventual rainy days that we've been told will eventually happen thanks to the economic crisis that Covid-19 (not the restrictions, of course) generated.

Here comes the best part, let's take a look at the velocity of both the M1 and M2:

Both show a stagnation point harder than Doge when Elon said it is a shitcoin. Huge dip in the graphic (although it not a dip, this graph doesn't measure a price, just a unit to show how much a unit of currency changes hands).

People aren't spending their money, despite so much printing happening.

Remember what I said at the beginning of the post? A low velocity doesn't allow the market to reflect the actual price of goods.

Now ask yourself, what will happen when the Pandemic is officially over and the governments let people travel freely, spend freely, and there is no uncertainty of what will happen - because the government said so.

Hyperinflation?

I don't think so, but there inflation is at least in the next corner.

Deflation?

Perhaps, maybe before the hyperinflation we will have a deflationary temporary trend before shit hits the fan. This is a theory held by some anti-BTC maxis, that crypto and assets will take a huge dip before the actual bulls come.

All I can say is, there is something brewing, and it will explode once the people start spending again, once the velocity of the USD - and thus, the world currencies - gets on pair with the money printing ratio.

Posted Using LeoFinance Beta

"People are storing it"

Which people? It's not all people but only a few people. The few who hold economic rights and privileges that see money get transferred from the hands of the many into the hands of the few.

Is that money really sitting idle or has it been put into speculative 'investments' already?

Anyone who's got any spare cash and doesn't know about crypto (or think is a scam) and can't buy stock or metals, are pretty much saving it for the rainy days, that's what I meant.

I'm guessing a part of that money has already been cryptonized, but I highly doubt it is the majority.

I've tried to be as ready as possible for several outcomes, of course crypto is a main prep, but also..

Extra food, cash, (vs bank deposits)

It's hard to tell what will happen next.

Posted Using LeoFinance Beta

There are many consptheors that say the financial crisis will be so hard that the less you depend on the government and the system, the better. I think that's an overstatement but still, being prepared as much as we can is the only way to go, whatever the outcome can be.

Money printing went to the moon and it might stay there. With world economy being reshaped to avoid people moving against governments, they will continue to print money.

Posted Using LeoFinance Beta

And the Brr machines will keep going, I wonder if there will be another stimulus by February...

I am ready for it. Or I guess I will be.

I think that until you do not fall into a local hyperinflation, you will never know how unexpected rules may be affected by the inflative wave. And you know: the governement does not like people who are evading and survive the wave. They simply need to rebalance economy. But in the most part of the scenaros, rebalancements goes towards the Default direction. And that is a no-return route.

What if the suspend the accessibility to Cryptos exchanges and cryptos wallets? And what about gold seizure?

Well, let's strengthen our positions so we will be as ready as possible. And probably, already expat in other countries