In another post, here, I wrote about to what extent is a good idea to put Ethereum tokens to stake for the ETH 2.0 protocol. I was undecided, as I think most of us. While the rewards are good (5-20%), the waiting time is enourmous, maybe 2 years.

Finally I came to a solution, around one month ago, and the solution was to stack a part of my Ether tokens with Binance. Why Binance? Because I trust them more and more, I believe is one of the most safe place to go ETH 2.0. What happens is that for each ETH you send to the stacking pool, you receive an BETH which stands for Binance Ethereum, and the latter is a representative token, indicating how much Eth you have the right to redeem (one day or the other). Deposits and withdrawals of this synthetic token are already enabled, because one will be supposed to use it for DeFi apps. If I've understood it right, trading of this token will also be launched soon.

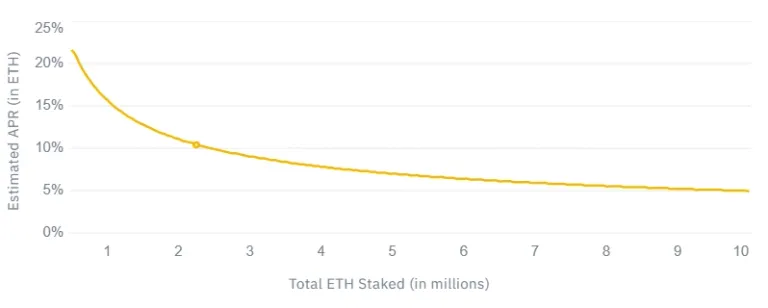

Rewards from stacking arrives directly on your spot wallet account, in the form of more BETH, DAILY! The amount received is, of course, proportional to your stacked amount, with a variable APY depending on the total number of ETH tokens stacked at the ETH2.0 adress, in the way described well by the following picture, captured from Binance's site.

So, currently, there are a bit more than 2 millions ETH tokens stacked worldwide, and so the the APR is around 10%. I've saw that number goind down since the first day I've stacked, because of course nobody can withdraw their tokens from the stacking adress, and so the total number of ETH stacked can only increase ( for now), and the APR decrease.

I'm "afraid" of when we'll reach 10 millions ETH and "just" 5% APR -.-"

So, let's come to the numbers:

On the 16 December, I've stacked 0.2379 (ok, not impressive)

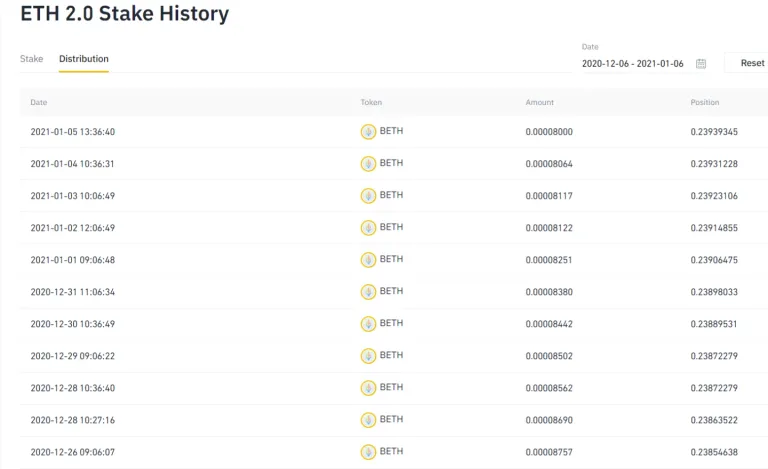

And here a screenshot of the daily rewards of the past days:

As you can notice, the rewards are getting smaller each day, for the reason I told you before. As a rough estimate, let's devide 0.00008 (the past day reward) by the yesterday position, 0.2393... and then multiply by 365... we get around 12% APR!

That's good, very good. Since I'm mostly a trader than a simple hodler, This was for me an hard decision to make. But I don't regret it ( I hope I will not in the future eheheh).

So, for now, those ETH-2.0 rewards on Binance had been smooth and satisfactory :-) This is to remove a bit of the mistery behind it.

If you don't have an account at Binance, please register with my referral link https://www.binancezh.com/en/register?ref=WUCIXS9J , to have a 10% fee kickback, forever! Thank you

Thank you really much for reading my post! Have a nice day,

Ariman

Posted Using LeoFinance Beta

Thanks for this post information. I too have written about ETH 2.0 three times at least, but I learn whenever I read someone else's viewpoint, so I appreciate your work. I think your absolutely right that the two year stacking period means a steady drop in the rate of return. However one question...

What do you think will happen to rewards when mainchain and 2.0 chain merge and all those rewards previously paid to the miners go instead to stackers and node runners on 2.0?

Thank you for your appreciation :-)

Good question, and that is actually what pushed me to stake, the hope of getting the huge amount people spend in eth fees for dapps stuff. Of course this is still not the reality; and at a first glance I was wrong about it, since I believed that they would have been part of the rewards since the beginning ahahah

But the sad news is that network fees will be way lower than today, maybe we can compensate with a much larger community of users? Who knows :-)

Posted Using LeoFinance Beta