The value layer of the Internet, this is what the Polygon Blockchain network is called, but it is more commonly known as a layer 2 blockchain solution, designed primarily to solve the flaws of the Ethereum blockchain.

What are these flaws of Ethereum?

Some say high fees, some say centralization, but how many crypto blockchains currently are truly decentralized? That's right, very few, so best believe that Ethereum isn't one and surely a layer 2 blockchain solution cannot solve that.

But let's not just make guesses, let's take a look at what Polygon was actually built for.

Glancing through the first few lines of its whitepaper, I see the mention of two things "scalability and user-experience", judging this by the flaws we looked at above, we can say that both centralization and high fees can affect the scalability of a network and its user experience.

The next few lines talks about the crippling effects observed when networks experience a surge in user activities, this comes closely after the whitepaper talked about the flaws most blockchains have which is the inability to onboard or attract the masses and when some manage to attract a few, the practically get stuck, can't scale due to one thing or the other.

As such, the Polygon Blockchain was born to build on the already established Ethereum popularity, I mean, talk about the most used blockchain by both users and developers, of course Binance Smart Chain is closely competing at current times, but let's not give CZ a shine here.

The everyone's marketing ploy

It's no news that not all crypto projects give a shit about what crypto was envisioned to solve, it's just freaking gold mine so why care? Just exploit the shit and head to the next, someone say AI!!!

So, polygon was launched with idea to better the "decentralized applications" ecosystem by combating the problems faced by most DApps and we'll be looking at these problems and judging the solutions put forth by Polygon.

Slow Transactions

Yikes, this is a bit tricky but here's a highly secured and decentralized coin to keep your mouth shut.

Yeah, maximalists will probably frown at that mockery, but it's true nonetheless, bitcoin is quite the blockchain when it comes to security but 10 minutes? Tracy's boyfriend should have cummed like 8 minutes earlier. Any Tracy in the house? My sincere apologies darling :)

But you get the point, 10 minutes shucks and is no way fit for mass adoption, so despite being a pretty shiny coin, bit-10-fucking-minutes had to be replaced for mass adoption, oh, we were supposed to be talking about Ethereum, yes, my bad, well, numerous sources claims that on average, it takes 15 seconds to 5 minutes for transactions on Ethereum to get processed, so it pretty still sucks.

What was Polygon proposing?

The Matic Network solves this problem by using a high throughput blockchain with consensus provided by a selected set of Block Producers, chosen for every checkpoint by a set of Stakers. It then uses a Proof Of Stake layer to validate the blocks and publish periodic proofs (merkle roots) of the blocks produced by the Block Producers to the Ethereum mainchain. This helps in achieving high level of decentralization while maintaining an extremely fast (< 2 seconds) block confirmation times.

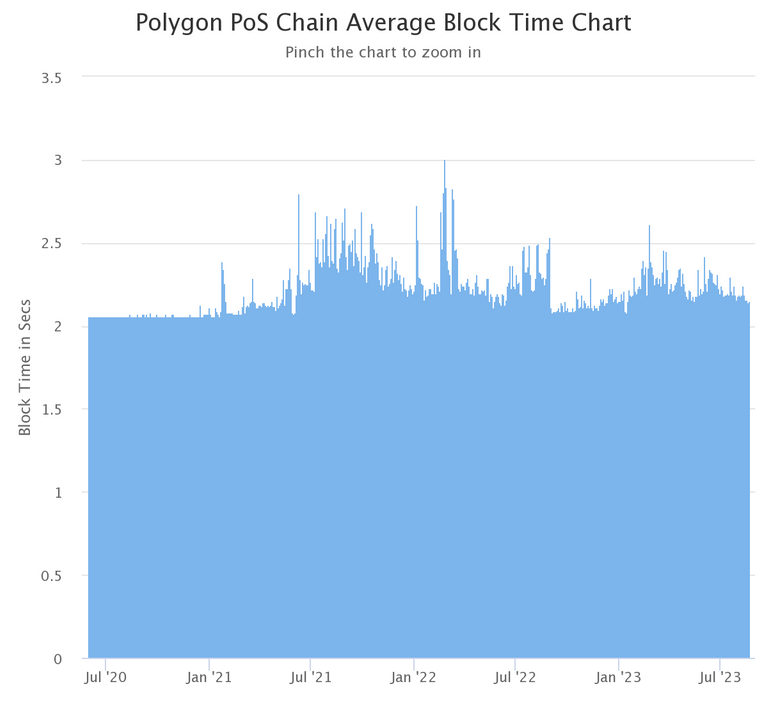

I don't know how that helps achieve decentralization when you're still relying on Ethereum for finality but that's not my problem right now, we just care about that figure "<2 seconds" for now.

The sign "<" means "less than" I believe, math majors? Anyone? Come on guys, don't leave me hanging.

Anyways let's look at some stats

Judging from the chart, the blockchain sure as hell didn't take 5 minutes to process a transaction but it mostly didn't take less than 2 seconds either, but the peak from the stats here shows a little above 3 secs and that was in February 23, 2022.

So if we're to trust this data from Polygonscan, then the network delivered transactions at a relatively high speed.

Low Transactions Throughput

Remember that rant about mass adoption and most blockchains including Ethereum not being equiped for it?

Yeah, it is related to how small the number of transactions that can be processed per block is. Due to the design of these blockchains, blocks need to be kept relatively small, so that typically means less transactions but Polygon claims to solve this problem:

The Matic Network solves this problem by using a Block Producer layer to produce the blocks. Block Producers enable the system to produce blocks at a very fast rate. The system ensures decentralization using PoS checkpoints which are pushed to the Mainchain (Ethereum serves as the mainchain for a start).This enables The Matic Network to theoretically achieve up to 65,536 transactions every 2 seconds, so almost 2 million transactions a minute.

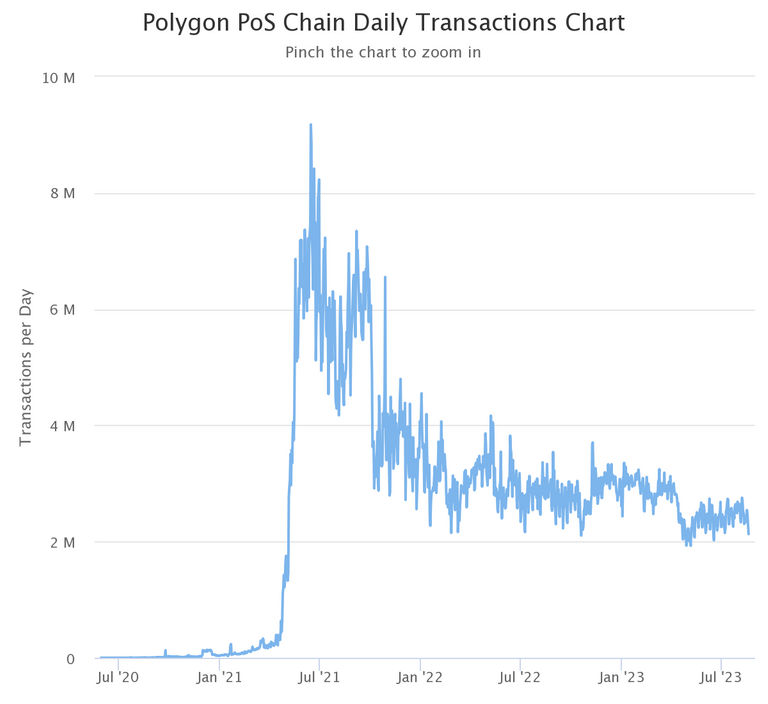

Let's look at some stats

The chart shows that the network has handled way more transactions than the estimated above on the chain and its highest number of transactions ever recorded in a day is over 9 million.

High transactions fees

Yes, the grand daddy of all these madness, the major reason the season is coughing up several layer 2 side chains, fees on Ethereum, the just crazy situation this network has been battling.

Polygon proposed a solution:

The Matic Network enables low cost transactions through achieving economies of scale by doing a large number of transactions on the Block Producer layer which ensures low cost, and then subsequently batching the proofs of the Matic blocks using the Merkle root of the blocks to a highly decentralized mainchain (for ex. Ethereum) using a decentralized layer of PoS Stakers.

In summary, the network basically boxes up several transactions and posts to the Ethereum blockchain as 1, get it? By doing this, the fees are drastically reduced.

It's nothing that fancy, it's available on most layer 1 blockchains and other side chains, an off-chain protocol collects several transactions, turn into one and forwards to the main chain, I believe that's what the lightning network does, and most if not all layer 2 blockchains to Ethereum.

I believe the phrase "Block Producer layer" is another way of saying "Sequencer" for those familiar with Optimism and its network design they are all practically centralized.

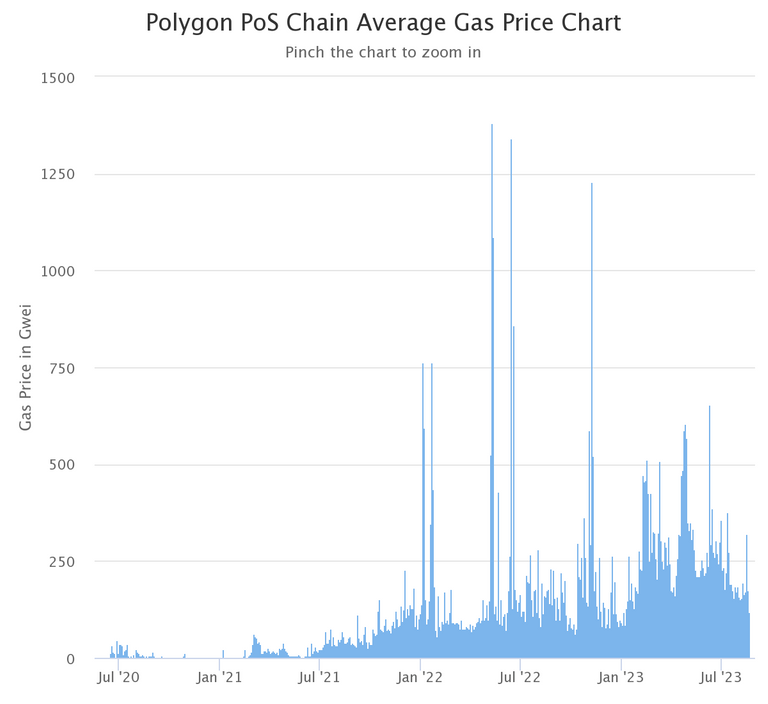

Let's look at some stats

Looking at the chart, the average transaction fee or gas price as commonly called within the Ethereum ecosystem stays under 250 Gwei which is like 0.00000025 ETH, barely anything you'd notice if stolen at current ETH price of $1,671.

Now there are several other proposed solutions the Polygon Blockchain came with and all can be seen and examined from their whitepaper but the primary ones are the ones discussed above.

I noticed something throughout the whitepaper, the Polygon developers did not explicitly call out Ethereum's centralization, or that of any other blockchain as something they wanted to solve, in fact, there praised it saying:

The Matic Network uses a dual strategy of Proof of Stake at the checkpointing layer and Block Producers at the block producer layer to achieve faster blocktimes while ensuring a high degree of decentralization by achieving finality on the main chains using the checkpoints and fraud proof mechanisms.

Through this mechanism, The Matic Network achieves high transcation speed with a high degree of decentralization and finality on Mainchain. In the first version which has Ethereum only as the base chain, Ethereum root contract enforces solvency and finality through header block(checkpoints) very efficiently.

Well, maybe because Polygon was launched even before the move from PoW to Proof of Stake carried out by the Ethereum blockchain, but who cares, it was always clear from the token supply that things were screwed but they moved anyways.

So, looking at these numbers, polygon has solved most of the problems it was designed to, they didn't explicitly say they would solve the centralization problems, that would be impossible as a side chain because you're literally relying on the main chain(Ethereum) for transaction finality.

Is Matic a good investment?

I don't know, this is not investment advice.

Posted Using LeoFinance Alpha