Following all the conversations on Ethereums' migration from proof of work to proof of stake consensus protocol and how flash bots are pushing the chain to a central point of control I did some digging around the topic. I got some quick links from @malopie which turned out resourceful for this report.

What we'd be looking at here is a combination of how much influence "flashbots" currently have on the blockchain and what amount of value has been extracted thus far. In future publications, I and @malopie will occasionally present detailed content tagged "MEV Insights" to enlighten the people on here on what is really going on.

Introduction To MEV

To understand how flashbots came into existence, we have to quickly catch up on what MEV means.

MEV is an acronym for "Maximal Extractable Value" which originally was called "Miner Extractable Value" based upon proof of work concept but since Ethereum moved to adopt a proof of stake consensus mechanism, miner was replaced with maximal.

I'll assume you have some knowledge about what is happening with "Tornado cash" as this report is partly being compiled as the result of the sanctioning of tornado cash in the US by the OFAC(Office of Foreign Asset Control).

So what is MEV exactly?

People often talk about what would incentivize miners to keep running those heavy hardwares to verify bitcoin transactions and secure the network after the block rewards halves into nothingness. A similar question is asked with Ethereum, what happens when the "block rewards" become too little to be incentivizing?

MEV is seemly the solution to this.

The whole MEV concept has to do with the hunt for "fees" and miners/validators are known to prioritize transactions with higher fees as though that literally puts more money in their pockets. Across blockchains with underlying fee structures, we see this fight for transaction verification, where in situations of network congestion, miners and validators will filter out "high gas paying transactions" from the mempool to verify.

Validators/miners here refer to individuals running softwares/hardwares called nodes to verify transactions and secure the network while mempool typically is like a storage room where transactions initiated by users stack up and await being picked and added to the chain by miners/validators.

Due to the nature of Ethereum where block rewards are not hard-coded to the network but adjustable via forks initiated by the community, the chances of a long-lasting huge piece of block rewards are not just there. And so, validators result in prioritizing blocks with high fee-paying transactions and while the fee structure of Ethereum will not be fully explained in this content, it is worth noting that it has vast effects on how value can be extracted from the network.

MEV Hunters - Searchers and Flashbots explained

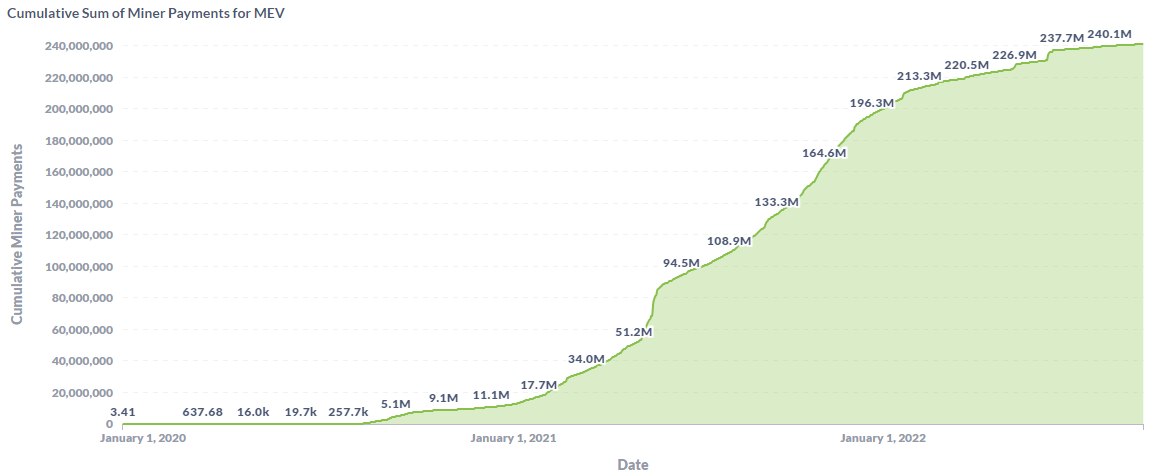

There are practically many layers to what goes on when it comes to maximal extractable value, we will further enrich this content with a future breakdown of each section. But before we proceed, let's take a look at a few charts derived from explore.flashbots.net

Miners' payments for MEV

Cumulative gross payments for MEV

Notice anything different between those two charts? Obviously, there's a huge gap between the "gross profits" and the miners cut for the game so who takes the rest of the pie?

Searchers --> Flashbots

Although the job of adding new blocks to the chain is left to validators, the grouping and ordering of these transactions can be done by just anyone. Searchers are network participants that hunt MEV on the Ethereum blockchain, Flashbots here play the role in extending this job through a more profitable route by keeping it away from the mempool!

Searchers screen for the network for high-paying transactions and forward them to Flashbots and then, flashbot relays these transactions off-chain to a miner to be added to the chain, at the end of the day, the profit is split.

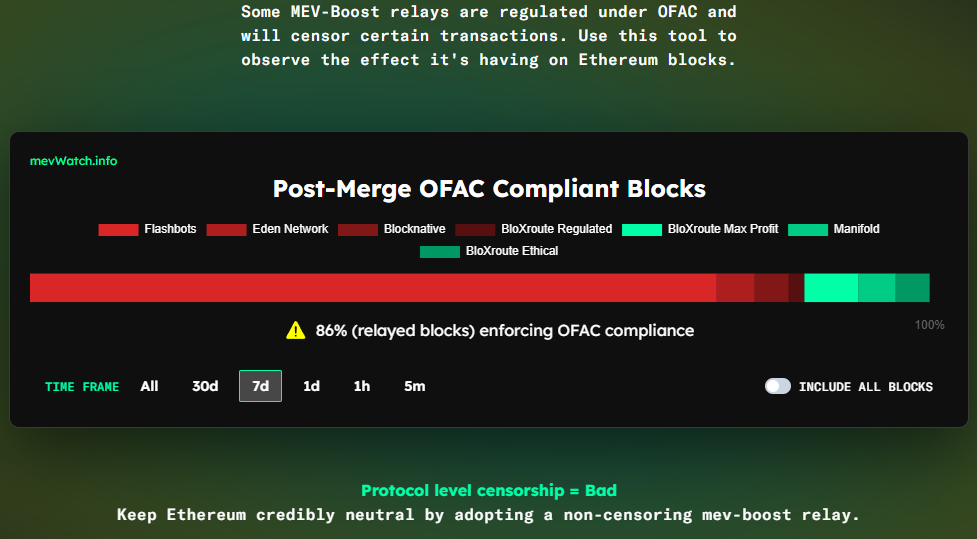

When you look at the header image of this article you'd realize that this is the case of Ethereum today and frankly, the concerns for centralization of block productions keep increasing as earlier today 51% of relay blocks were achieved by flashbots. The reason why this calls for an alarm is that Flashbots are compliant with the OFAC sanction on tornado cash, thus, a huge number of blocks have been ignored as a result. Data from blockchain signinfies that between October 1 and 16 more than 433k transactions on the Ethereum blockchain have failed.

A wrap of August's block activities points to over 1.3 million transactions failing.

The Incentives to be centralized

.png)

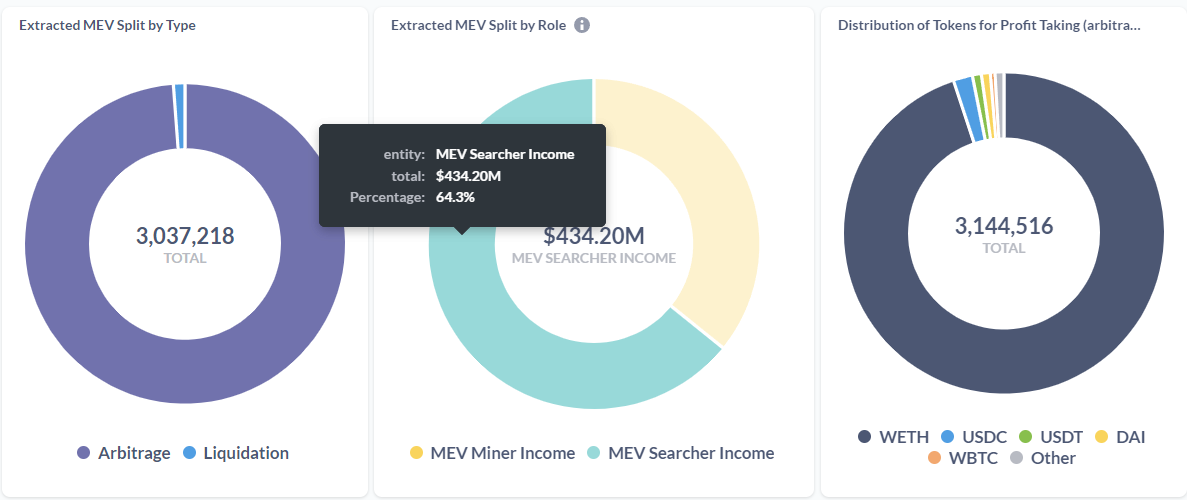

There's no hiding it, Ethereum is highly centralized by these metrics, and all data points to the financial incentives there are to push further centralization. How many companies today can offer their investors a revenue of over $600 million? How many working populations can earn more than 60% of that?

That is how much Searchers earn!

The chart above shows that Searchers earned about 64.3/% of the total sum of over $675 million in MEV, meaning a whooping $434.20M according to explore.flashbots.net, miners only get like 35% and on different occasions this value could be split on a basis of searchers bagging millions while miners reserve a few Ks.

Block production is centralized in the process and a huge amount of value is being mined centrally.

Thank you and please leave a comment, your thoughts matter to me.

contributors: @malopie

Posted Using LeoFinance Beta

nice