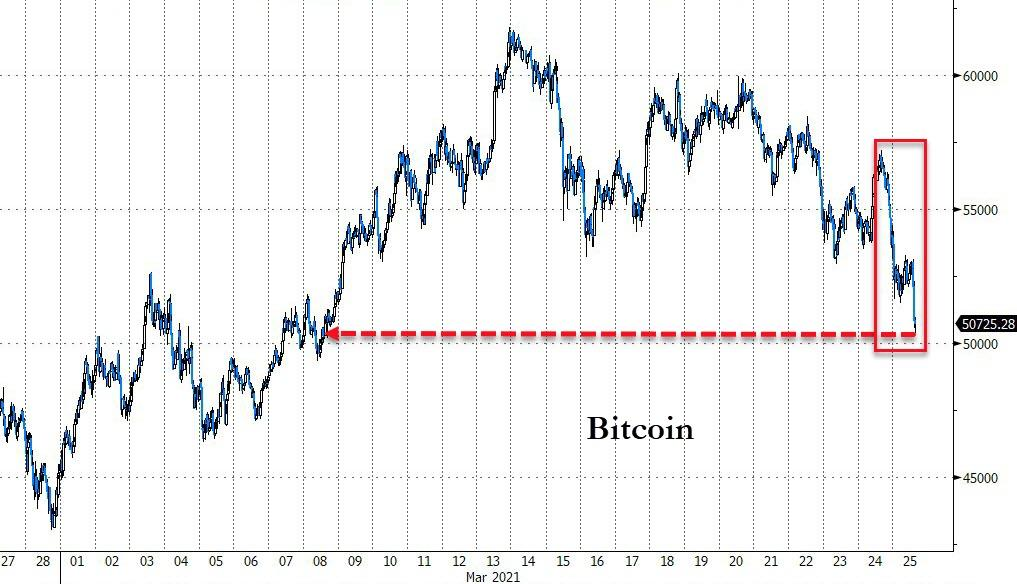

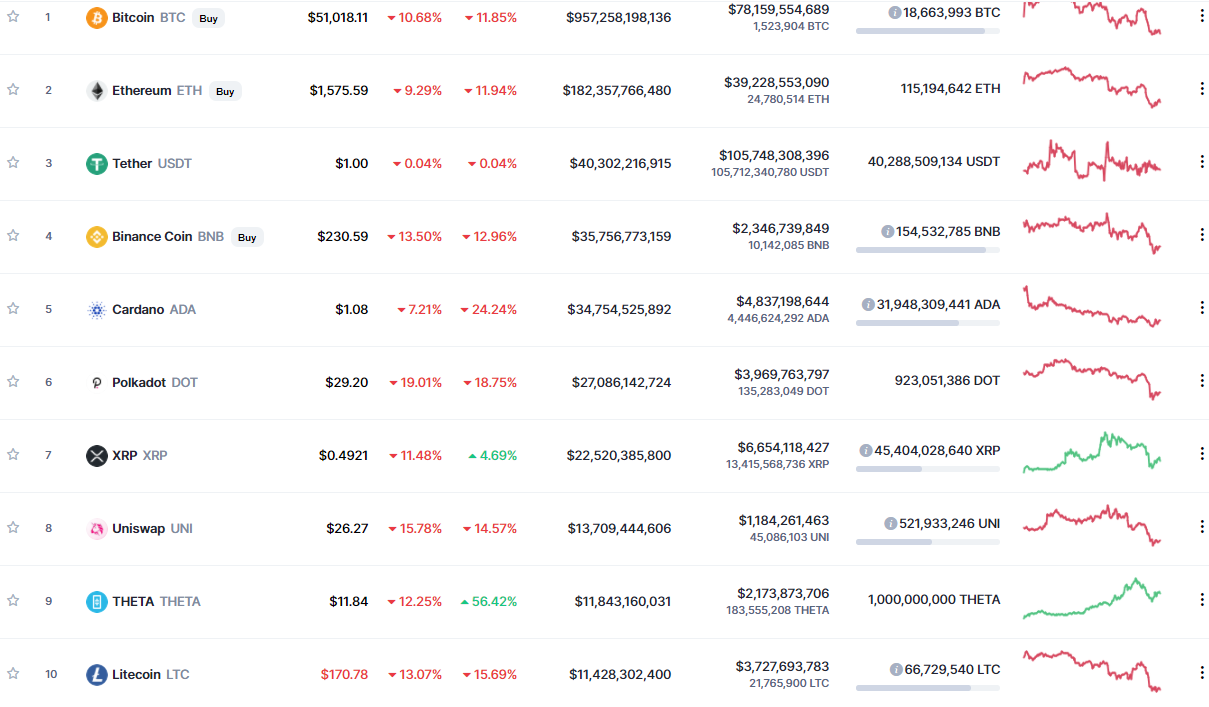

Cryptos Are Crashing Amid Bitcoin 'Ban' Fears & Record Options Expiration

https://www.zerohedge.com/crypto/cryptos-are-crashing-amid-bitcoin-ban-fears-record-options-expiration

source: Bloomberg

N00bs - The end is nigh!

Veterans - woo-hoo

Seem's reasonable since "Visa, Morgan Stanley, and JPMorgan are some of the latest big names to get involved."

Anyone who has been involved with crypto specifically BTC has a better idea of how this play's out. I hear a lot of projections and predictions. The most prevalent and trustworthy analysis I am starting to take on is the 4 year cycle. This includes BTC halvening.

The bitcoin halving explained:

"On the Bitcoin Blockchain, each block contains transactions from global bitcoin users that need to be verified as non-double-spent so they can be go through and be logged on the blockchain ledger. Miners use computer programs and hardware to compete in solving a cryptographic puzzle to ‘win’ the block, thus receiving a reward in newly minted bitcoin.

But at every 210,000 blocks, the Bitcoin Network experiences a scheduled “bitcoin halving”. What this means is that the amount of bitcoin reward to a miner for each block is halved, or cut in half.

Since the first block was mined in 2009, the halves have been initiated about every four years, with the third halving due May 12th of 2020".

https://hedgetrade.com/bitcoin-halving-chart-complete-guide/

Alright so if we go by this view when is the time to 'exit' and re-accumulate (if you so decide? Well if you want to subscribe to this view this chart was published February 2019! The projections are almost uncanny and we can see that from this chart BTC (and of course alt's) have a real chance to continue to go nuts!

Just under USD $175,000 for a single Bitcorn! Imagine what this will do to the alt's. Now experienced traders dump their corn and start to accumulate which looks a few months before 2022. The question is if all experienced BTC trader's know this; can we expect a dump some time before that?

Perhaps! This year and last year has thrown us multiple black swan events. Even halvenings and cycles can be disrupted. At this time and for now I view the current trading action and price discovery on track. We have heard before 2021 that institutions are getting in. ETF's are being created, Banning the CORN!

It's been said before, it's been done before. I am currently holding, and even if I miss the top of this BULL market, it may be a painful few years before there is traction again. Of course there are other swan's that will emerge. Quantum computing can crack these encryptions; but it is still years away. Like any experienced Bitcoin / alt-coin trader knows; always take some profit along the way!

Posted Using LeoFinance Beta

hey relax guy!

yeah for many that follows crypto we know there's a load options for the month expiring, happens, no big deal.

Posted Using LeoFinance Beta

So we can buy lot more up when BTC gets 200 K 👌👌👌👌👌👌👌

How incredibly short our memories tend to be. Maybe I mean our attention span! Either way it is amazing that people can so quickly forget the institutional investment announcement of the previous day and quickly FUD because some options are expiring. How many times have options expired in the past and there was never even a blip. People are fickle. I'd like to say it would be nice to shake out some of these weak hands, but thinking back to the last bull run the weak hands will always be around I think.

Posted Using LeoFinance Beta

weak hands indeed

Posted Using LeoFinance Beta

I am sure that a lot of people would sell BTC based on this theory but the firm believers are going to hold.

Specially when a lot of tech and financial giants are joining the game.

I have some coins I am looking at but the best for me that I entered is #1inch I think it is Best opportunity to buy it.

Posted Using LeoFinance Beta

They fell hard.

Posted Using LeoFinance Beta